Posthaste: The Looming Crisis In The World's Largest Bond Market

Table of Contents

Unprecedented Levels of Debt and Rising Interest Rates

The Debt Bomb

The global accumulation of government and corporate debt has reached staggering levels. Decades of low interest rates fueled borrowing, creating a massive debt burden now threatened by rising inflation and interest rates. This "debt bomb" poses a significant risk to global financial stability.

- Examples of high-debt nations: Several developed and developing economies are grappling with unsustainable debt-to-GDP ratios, including Italy, Greece, and many emerging markets. The challenge of servicing this debt is dramatically increasing.

- Rising interest rates impact debt servicing: As central banks raise interest rates to combat inflation, the cost of servicing existing debt balloons, squeezing government budgets and corporate profitability.

- Potential for sovereign debt defaults: The risk of sovereign debt defaults is rising, potentially triggering a cascade of financial crises and impacting global markets. This potential for defaults adds another layer of complexity to the already precarious situation.

The Impact of Inflation

Persistent inflation is a major catalyst in the current bond market turmoil. Inflation erodes the value of fixed-income investments, putting downward pressure on bond prices.

- Inverse relationship between bond prices and interest rates: When interest rates rise, bond prices fall, and vice versa. This inverse relationship is a fundamental principle of bond investing, and the current situation exemplifies it perfectly.

- Flight to safety vs. riskier assets: Investors are faced with difficult decisions: remain in bonds, accepting lower returns, or shift to higher-yielding but riskier assets. This is influencing the behaviour of the world's largest bond market.

- Impact on central bank policies: Central banks are caught in a difficult balancing act, needing to control inflation without triggering a debt crisis through overly aggressive interest rate hikes. Their responses significantly impact the world's largest bond market.

Diminishing Liquidity and Market Volatility

Reduced Trading Activity

Liquidity in the bond market, the ease with which bonds can be bought and sold, has significantly diminished. This makes it more difficult to manage risk and execute trades efficiently.

- Reasons for decreased trading activity: Increased regulation, the shift away from traditional trading desks towards electronic platforms, and the concentration of bond holdings among a smaller number of large investors have contributed to the liquidity crunch. This affects everyone involved in the world's largest bond market.

- The role of high-frequency trading: While high-frequency trading initially aimed to enhance liquidity, its role in amplifying volatility is now a source of concern.

- Implications for market stability: Reduced liquidity increases the risk of price volatility and makes it harder for investors to exit positions quickly, potentially exacerbating market instability.

Increased Market Volatility

Bond prices are exhibiting greater volatility, reflecting the uncertainties surrounding inflation, interest rates, and economic growth.

- Factors contributing to increased volatility: Geopolitical risks, unexpected economic data releases, and changes in central bank policy all contribute to this increased uncertainty and volatility.

- Impact on investor confidence: Increased volatility erodes investor confidence, leading to a potential sell-off in the bond market.

- Potential for cascading effects: A sharp decline in bond prices in the world's largest bond market could trigger a broader financial crisis, impacting other asset classes and the global economy.

The Role of Central Banks and Government Intervention

Central Bank Responses

Central banks globally are navigating a delicate path, trying to tame inflation while avoiding a debt crisis.

- Quantitative easing (QE): While previously used to stimulate economies, QE is less effective in the current inflationary environment and potentially contributes to the debt burden.

- Interest rate hikes: Interest rate increases aim to control inflation but also increase the cost of borrowing and debt servicing. It's a crucial aspect of managing the world's largest bond market.

- Other potential interventions: Central banks might explore other measures to enhance market liquidity and support financial stability.

Government Policies and Regulations

Government policies play a crucial role in mitigating the potential crisis.

- Fiscal stimulus: Government spending can support economic growth but also adds to the overall debt burden.

- Debt restructuring: Debt restructuring might be necessary for some countries to avoid defaults, but this is a complex and politically challenging process.

- Regulatory changes: Regulatory reforms could aim to improve market transparency, liquidity, and risk management. This might involve changes to the world's largest bond market regulations.

Potential Consequences and Future Outlook

Global Economic Impact

The crisis in the world's largest bond market could have profound global economic consequences.

- Impact on investment: Uncertainty in the bond market discourages investment, hindering economic growth.

- Impact on consumer spending: Rising interest rates and economic uncertainty may reduce consumer spending, further weakening economic activity.

- Potential for global financial instability: A major crisis in the bond market could trigger a global financial crisis, with severe repercussions across multiple sectors.

Opportunities and Challenges

Despite the risks, the crisis also presents opportunities for investors.

- Defensive investment strategies: Investors might shift towards defensive assets like high-quality bonds or government securities.

- Opportunities in distressed debt: Experienced investors might find opportunities in distressed debt, though this carries significant risk.

- Risks to consider: The potential for further losses in the bond market remains significant, and careful risk management is crucial.

Conclusion

The potential for a crisis in the world's largest bond market is real and significant. The combination of unprecedented debt levels, rising interest rates, diminishing liquidity, and increased market volatility creates a precarious situation with potentially devastating global economic consequences. Understanding the dynamics of the world's largest bond market is crucial for informed investment decisions. Stay updated on the latest developments and consult with financial professionals to navigate this evolving landscape. The global bond market, and indeed the global economy, depend on careful management of this complex situation.

Featured Posts

-

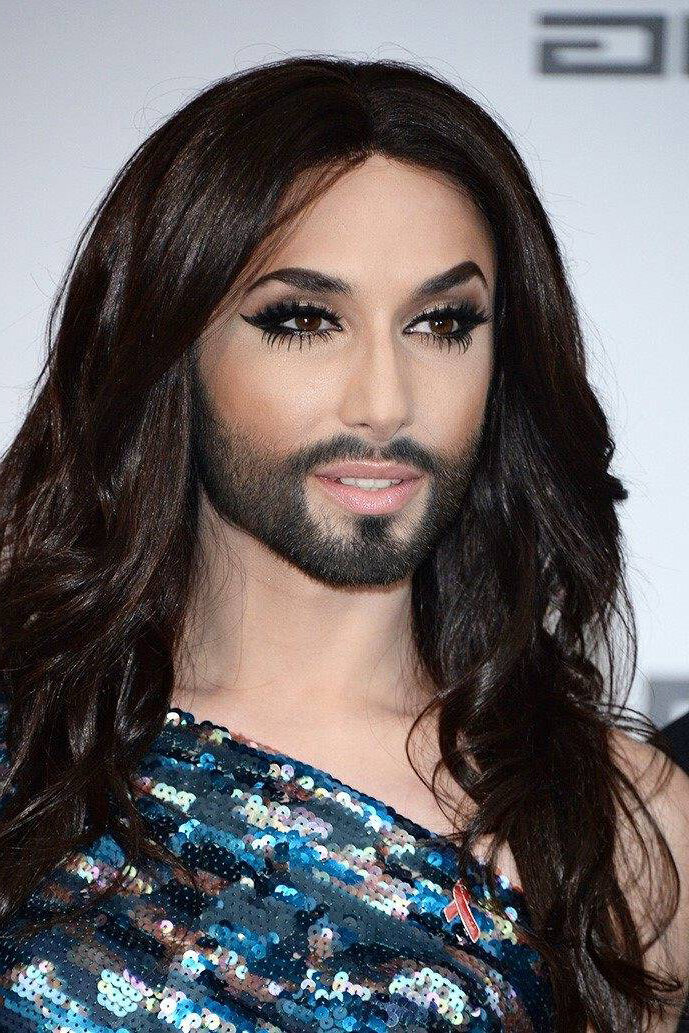

Kak Izglezhda Konchita Vurst Dnes Promeni Sled Evroviziya

May 24, 2025

Kak Izglezhda Konchita Vurst Dnes Promeni Sled Evroviziya

May 24, 2025 -

Kriza V Nemecku Masivne Prepustanie V Najvaecsich Spolocnostiach

May 24, 2025

Kriza V Nemecku Masivne Prepustanie V Najvaecsich Spolocnostiach

May 24, 2025 -

Mengenal Porsche 356 Sejarah Pabrik Zuffenhausen Dan Warisannya

May 24, 2025

Mengenal Porsche 356 Sejarah Pabrik Zuffenhausen Dan Warisannya

May 24, 2025 -

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025

Zapreschenniy Garazh Istoriya Protivostoyaniya Ryazanova I Tsenzury Pri Brezhneve

May 24, 2025 -

Billie Jean King Cup Kazakhstan Scores Victory Against Australia

May 24, 2025

Billie Jean King Cup Kazakhstan Scores Victory Against Australia

May 24, 2025

Latest Posts

-

Get The Answers Nyt Mini Crossword For March 13 2025

May 24, 2025

Get The Answers Nyt Mini Crossword For March 13 2025

May 24, 2025 -

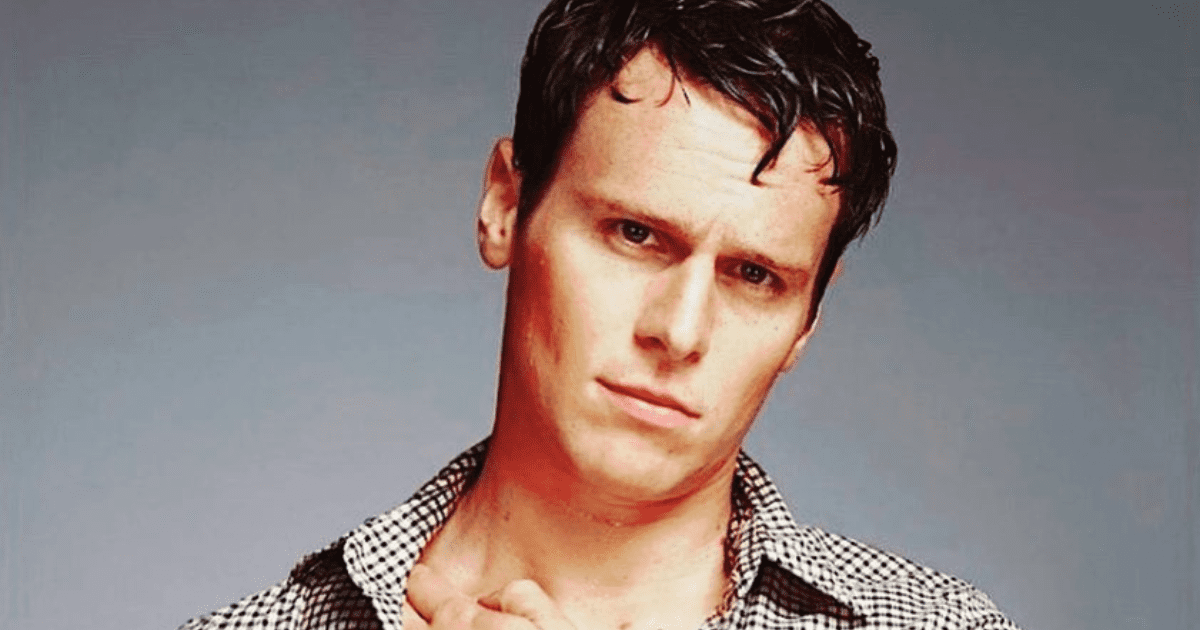

Jonathan Groff On Asexuality Instinct Magazine Interview

May 24, 2025

Jonathan Groff On Asexuality Instinct Magazine Interview

May 24, 2025 -

Jonathan Groffs Past An Open Discussion Of Asexuality

May 24, 2025

Jonathan Groffs Past An Open Discussion Of Asexuality

May 24, 2025 -

Broadway Buzz Jonathan Groffs Performance In Just In Time And His Connection To Bobby Darin

May 24, 2025

Broadway Buzz Jonathan Groffs Performance In Just In Time And His Connection To Bobby Darin

May 24, 2025 -

Jonathan Groff Channels Bobby Darin A Deep Dive Into Just In Time

May 24, 2025

Jonathan Groff Channels Bobby Darin A Deep Dive Into Just In Time

May 24, 2025