Potential Sale Of Chip Tester UTAC By Chinese Buyout Firm

Table of Contents

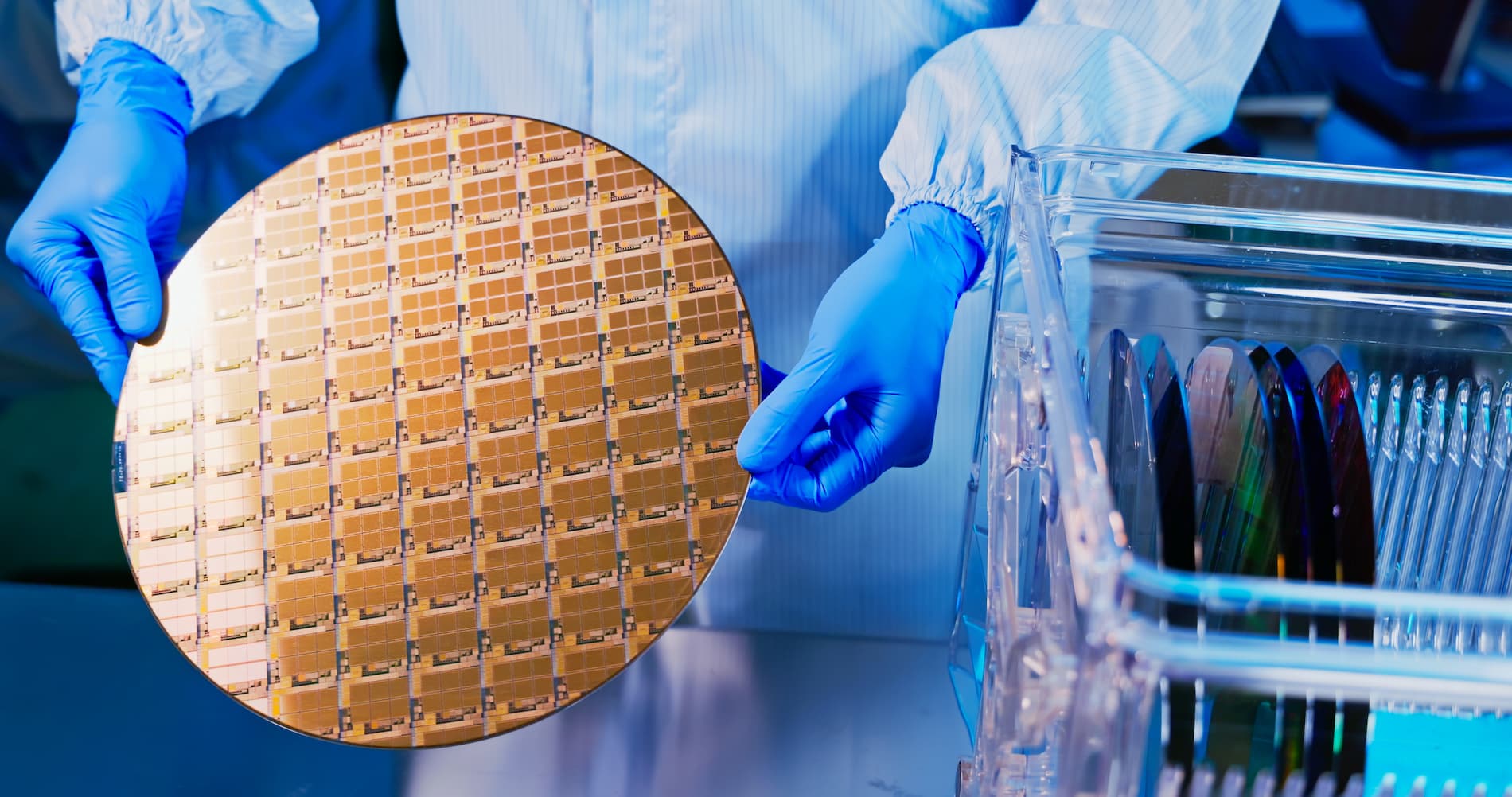

UTAC's Significance in the Semiconductor Landscape

UTAC holds a prominent position within the complex semiconductor ecosystem. Understanding its role is crucial to grasping the implications of this potential acquisition.

Market Position and Technological Capabilities

UTAC boasts a substantial market share, particularly in the crucial arena of advanced node testing. Its specialized technologies set it apart from competitors.

- Specific types of chips tested: UTAC's expertise extends to high-performance computing chips, vital for data centers and artificial intelligence (AI) applications, as well as cutting-edge AI chips themselves. They also test memory chips and other crucial components.

- Market leadership in specific segments: UTAC holds a commanding lead in testing advanced 5nm and 3nm chips, a segment experiencing explosive growth.

- Technological advantages over competitors: UTAC's proprietary testing algorithms and advanced hardware provide faster and more accurate testing capabilities, resulting in higher yields for chip manufacturers.

Customer Base and Strategic Partnerships

UTAC's impressive client portfolio includes many industry giants, reinforcing the significance of its potential acquisition.

- Key clients: While confidentiality agreements may prevent specific naming, it is understood that UTAC counts several leading semiconductor manufacturers and fabless chip designers among its clientele.

- Strategic alliances and their impact on the semiconductor supply chain: UTAC's strategic alliances with materials suppliers and equipment manufacturers create a tightly integrated supply chain, making its acquisition even more impactful.

The Chinese Buyout Firm and its Motives

Identifying the Chinese buyout firm and understanding its investment strategy is vital to interpreting the potential UTAC sale.

Identity and Investment Strategy

While the specific firm remains undisclosed at this time (due to ongoing negotiations), it is understood to be a significant player in the Chinese private equity market with a focus on technology acquisitions.

- Company background: The firm has a proven track record of successful investments in various technological sectors, exhibiting a strong appetite for strategic acquisitions.

- Previous acquisitions: Previous acquisitions include companies involved in semiconductor manufacturing equipment, software development, and telecommunications infrastructure.

- Investment focus areas: Their consistent investment in technology, particularly within the semiconductor sector, suggests a long-term strategic vision.

Potential Reasons for Acquiring UTAC

Several strategic motivations might drive the Chinese buyout firm's interest in UTAC.

- Access to advanced technology: Acquiring UTAC would provide immediate access to cutting-edge testing technologies, potentially accelerating the buyer's own technological development.

- Expansion into international markets: UTAC's established international presence offers the buyer a significant advantage in expanding its global reach and market share.

- Strengthening of domestic semiconductor industry: The acquisition aligns with China's ambitious goal of achieving self-sufficiency in semiconductor technology.

- Potential for intellectual property acquisition: UTAC's valuable intellectual property portfolio is an attractive asset for the buyer, enhancing their competitiveness.

Implications and Potential Consequences

The potential acquisition of UTAC has significant implications, both domestically and globally.

Geopolitical Ramifications

The deal raises concerns regarding US-China technological competition and national security.

- Potential data security issues: Concerns exist about potential data breaches and the security of sensitive technological information.

- Concerns about technology transfer: The transfer of advanced testing technologies could enhance the capabilities of China's domestic semiconductor industry.

- Impact on US semiconductor policies: The acquisition could trigger further tightening of US export controls and investment restrictions.

Impact on the Semiconductor Supply Chain

The acquisition could significantly reshape the global semiconductor supply chain.

- Potential for increased market concentration: The acquisition could lead to increased market concentration, potentially reducing competition and affecting pricing.

- Impact on chip availability and cost: Depending on the buyer's strategies, the acquisition could lead to changes in chip availability and pricing for global manufacturers.

- Potential for supply chain disruptions: Integration of UTAC into the buyer's structure might cause temporary supply chain disruptions.

Reactions from Competitors and Regulators

The acquisition is likely to spark reactions from various stakeholders.

- Responses from competitors: Rival chip tester manufacturers might respond with increased investments in R&D or through strategic alliances.

- Potential regulatory hurdles: Regulatory bodies, such as the Committee on Foreign Investment in the United States (CFIUS), may scrutinize the deal and impose conditions or even block the acquisition.

- Likely outcomes of regulatory scrutiny: The outcome will depend on the regulatory review process and the ability of involved parties to address any concerns.

Conclusion

The potential sale of UTAC to a Chinese buyout firm highlights the intensifying rivalry in the global semiconductor industry. This transaction carries substantial implications for technological dominance, national security interests, and the intricate dynamics of global supply chains. The final outcome hinges significantly on regulatory review and the strategic actions of all participants.

Call to Action: Stay informed about developments concerning the potential sale of Chip Tester UTAC and its impact on the semiconductor industry. Follow us for updates on this critical acquisition and other significant news in the sector. Continue reading our articles on Chinese investment in technology and the future of semiconductor testing for a deeper understanding.

Featured Posts

-

Sharks Missing Swimmer And A Body Found On Israeli Beach

Apr 24, 2025

Sharks Missing Swimmer And A Body Found On Israeli Beach

Apr 24, 2025 -

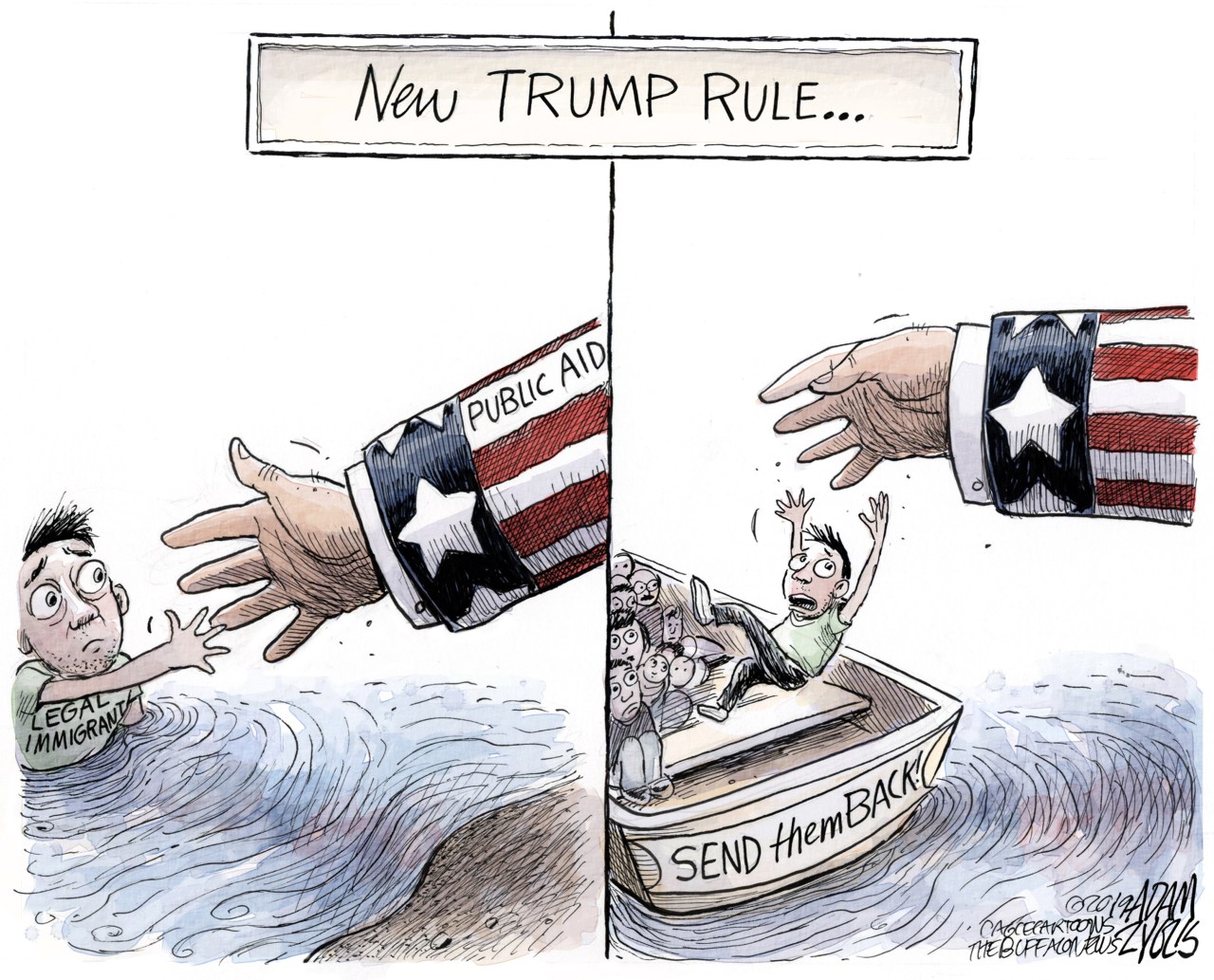

Immigration Crackdown Trump Administrations Policies Under Legal Scrutiny

Apr 24, 2025

Immigration Crackdown Trump Administrations Policies Under Legal Scrutiny

Apr 24, 2025 -

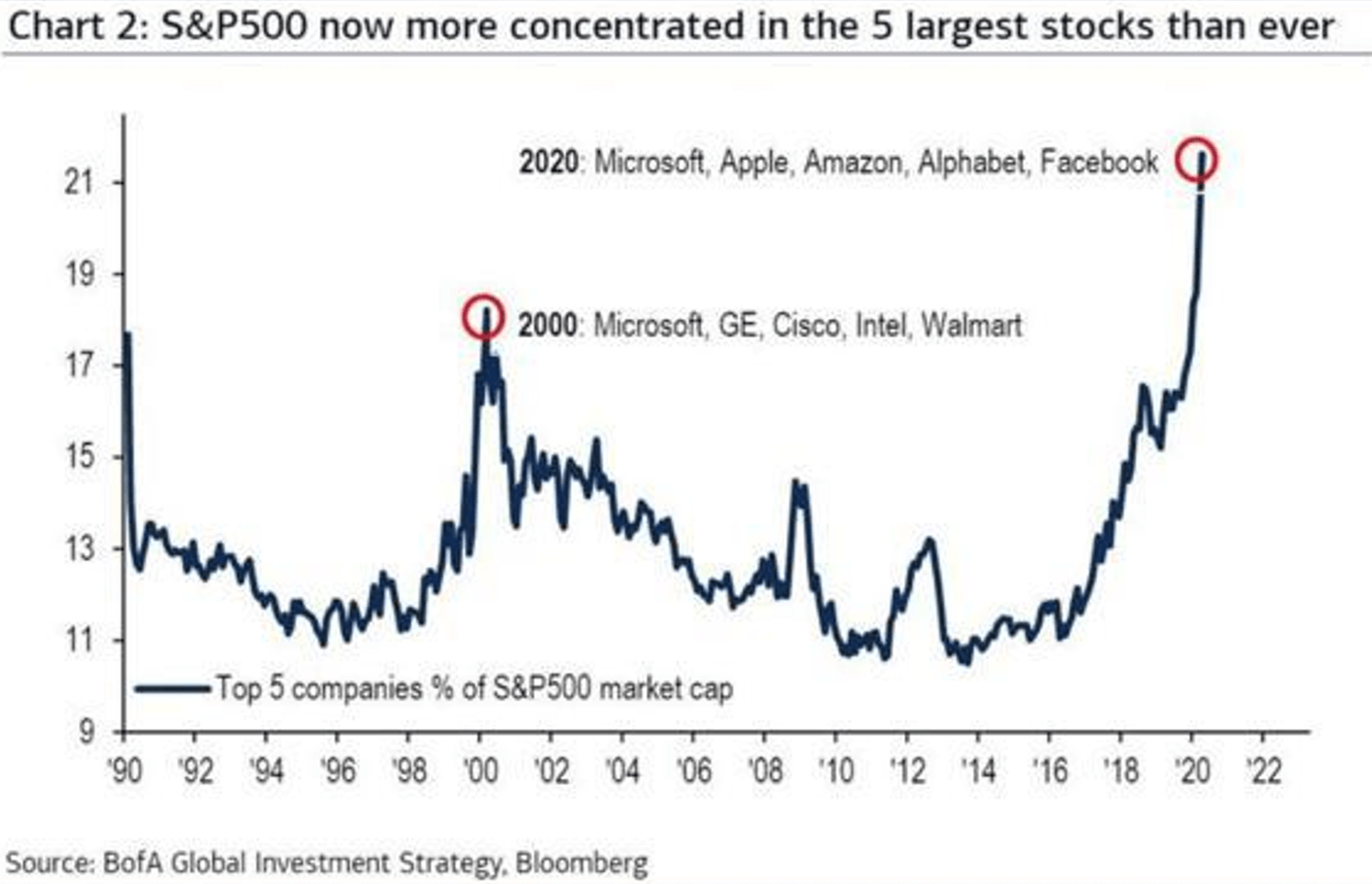

Market Surge Dow Soars Nasdaq And S And P 500 Follow Suit

Apr 24, 2025

Market Surge Dow Soars Nasdaq And S And P 500 Follow Suit

Apr 24, 2025 -

Stock Market Live Dow Nasdaq S And P 500 Gains On Tariff Relief

Apr 24, 2025

Stock Market Live Dow Nasdaq S And P 500 Gains On Tariff Relief

Apr 24, 2025 -

Luxury Car Sales In China Analyzing The Difficulties Faced By Bmw And Porsche

Apr 24, 2025

Luxury Car Sales In China Analyzing The Difficulties Faced By Bmw And Porsche

Apr 24, 2025

Latest Posts

-

The Impact Of Childhood On Payton Pritchards Basketball Journey

May 12, 2025

The Impact Of Childhood On Payton Pritchards Basketball Journey

May 12, 2025 -

Payton Pritchards Breakout Year A Look At His Development And Impact

May 12, 2025

Payton Pritchards Breakout Year A Look At His Development And Impact

May 12, 2025 -

Payton Pritchard How His Upbringing Shaped His Basketball Success

May 12, 2025

Payton Pritchard How His Upbringing Shaped His Basketball Success

May 12, 2025 -

Nba Sixth Man Award Payton Pritchard Honored Va Hero Spotlight

May 12, 2025

Nba Sixth Man Award Payton Pritchard Honored Va Hero Spotlight

May 12, 2025 -

Celtics Unlikely Duo 40 Point Games In A Single Match

May 12, 2025

Celtics Unlikely Duo 40 Point Games In A Single Match

May 12, 2025