Potential US Debt Crisis: August Deadline And Treasury's Warning

Table of Contents

The Looming August Deadline and its Significance

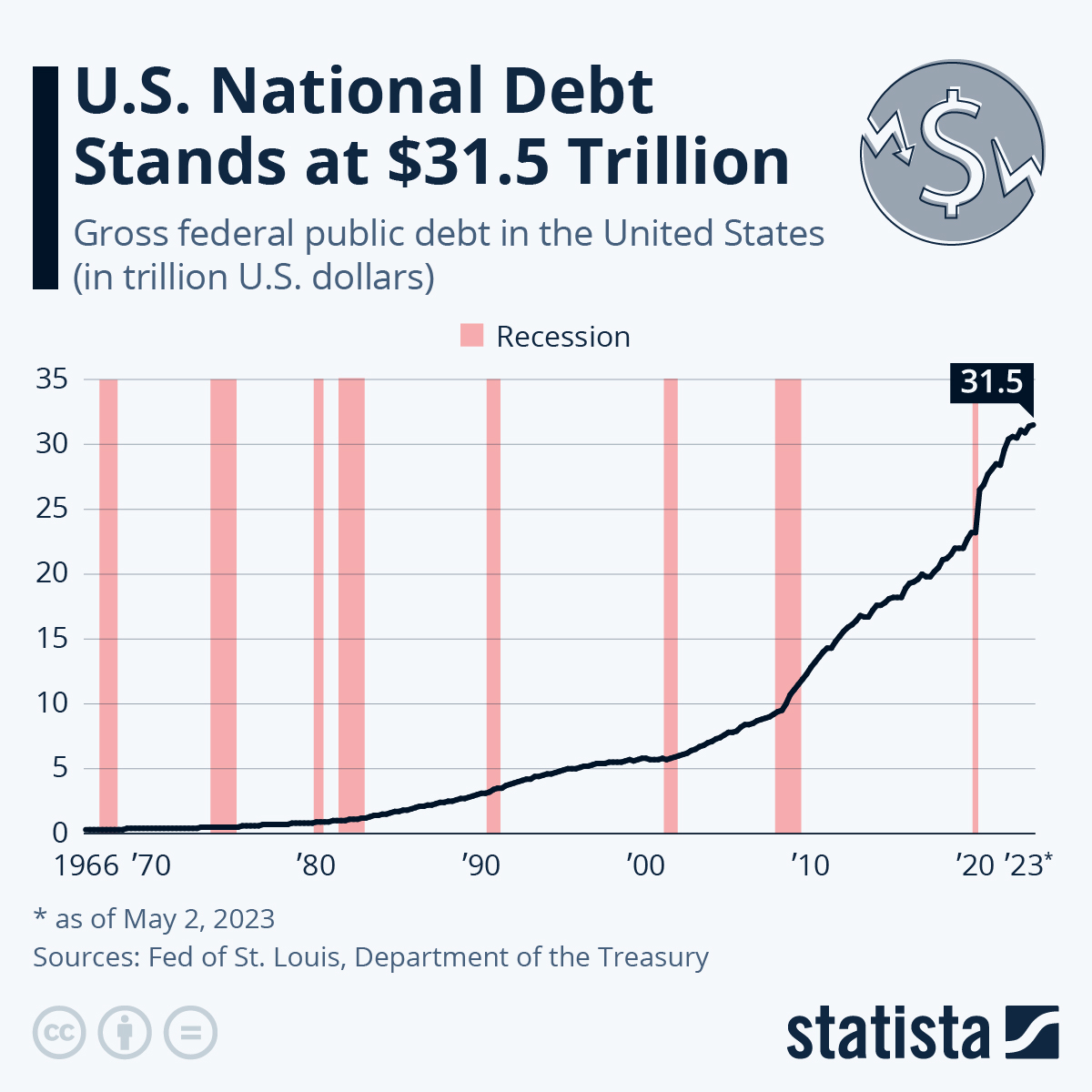

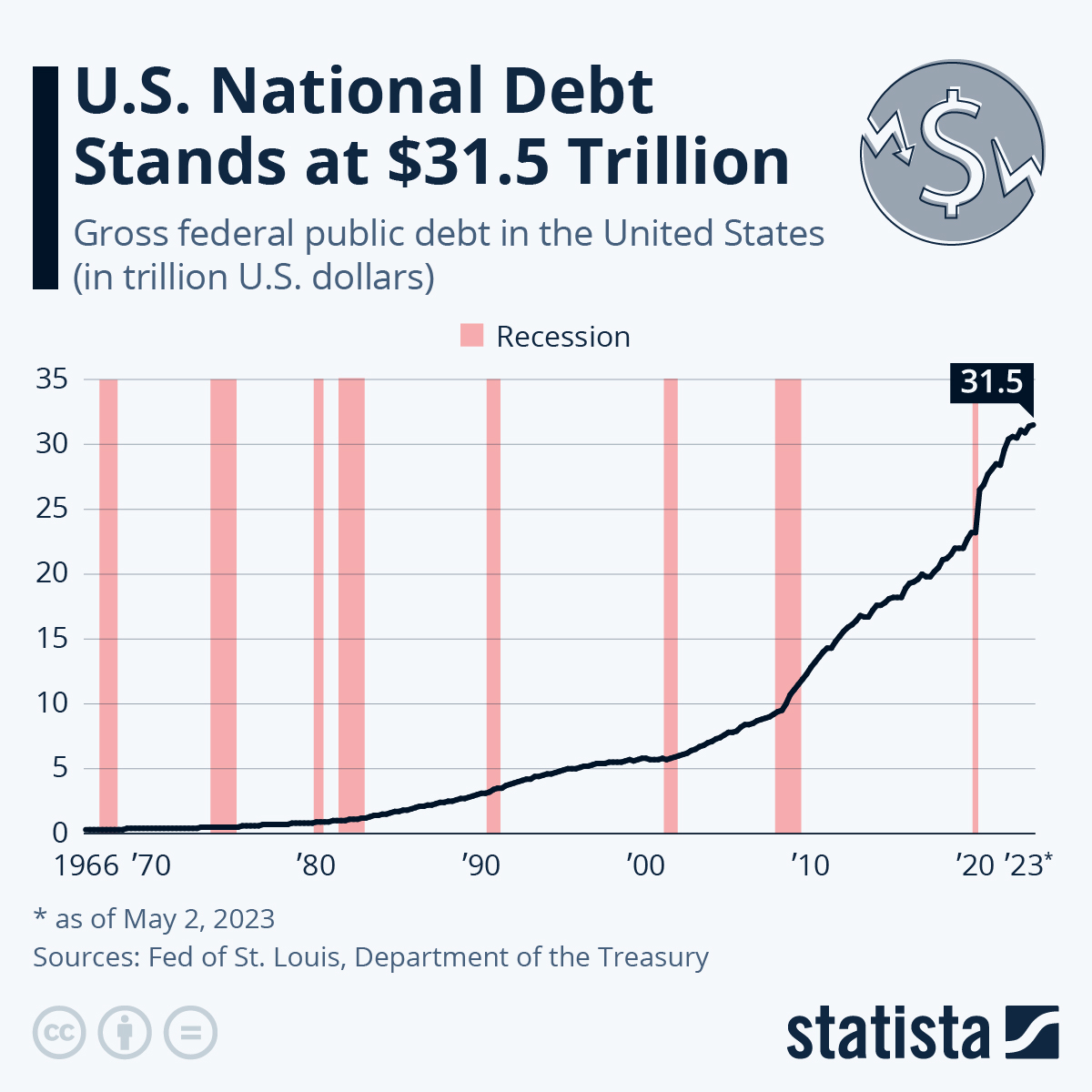

The US debt ceiling is a legal limit on the total amount of money the US government can borrow. This limit is set by Congress and has been raised numerous times throughout history to accommodate the nation's borrowing needs. However, reaching the debt ceiling without a corresponding increase creates a significant financial challenge. August 2024 is shaping up to be a critical deadline because the Treasury Department has warned that it may exhaust its extraordinary measures to avoid exceeding the debt limit around this time.

Why is August so critical? Failure to raise the debt ceiling before this point could lead to several severe consequences:

- Specific date(s) mentioned by Treasury: While the exact date remains fluid and dependent on various factors like tax revenues, the Treasury Department has indicated that it may run out of available cash sometime in early August. This date is subject to change based on economic conditions.

- Consequences of not raising the debt ceiling: A failure to raise the debt ceiling could result in a partial or complete government shutdown. More critically, it could lead to a default on US debt obligations—a catastrophic event with far-reaching global implications. The government would be unable to meet its financial commitments, potentially impacting Social Security payments, military salaries, and other essential services.

- Impact on global markets and investor confidence: A US debt default would severely damage the credibility of the US dollar and trigger a global financial crisis. Investor confidence would plummet, leading to market volatility and potentially a significant economic downturn.

Treasury Secretary's Warnings and Proposed Solutions

Treasury Secretary Janet Yellen has repeatedly warned Congress about the impending danger of a US debt crisis, emphasizing the severe economic repercussions of failing to raise the debt ceiling. Her statements have highlighted the potential for irreversible damage to the US economy and its standing in the global financial system.

Proposed solutions involve negotiations between the White House and Congress to reach a bipartisan agreement on raising the debt ceiling. However, these negotiations are often fraught with political gridlock, making a timely resolution uncertain:

- Specific quotes or statements from the Treasury Secretary: Secretary Yellen has consistently stressed the urgency of the situation, using strong language to warn against the catastrophic consequences of a default. Specific quotes should be sourced from official Treasury Department releases and press conferences.

- Summary of proposed solutions: Proposals range from a clean increase in the debt ceiling (raising the limit without any conditions) to more complex deals that might include spending cuts or other budgetary adjustments.

- Analysis of the feasibility and potential drawbacks of each solution: The feasibility of each solution depends largely on the willingness of both parties in Congress to compromise. Drawbacks might include potential damage to the economy from spending cuts or the political implications of negotiating with the opposing party.

Economic Impacts of a US Debt Crisis

A US debt crisis would have devastating economic consequences, both domestically and internationally. The ripple effects would be felt across various sectors, leading to instability and uncertainty:

- Potential impact on consumer spending and business investment: Uncertainty surrounding the government's ability to meet its obligations would likely dampen consumer spending and discourage business investment, hindering economic growth.

- Risks of a recession or economic downturn: A default could trigger a recession or even a deeper economic downturn, leading to job losses, increased poverty, and a decline in the standard of living.

- Effect on the value of the US dollar and global financial markets: The value of the US dollar would likely plummet, impacting global exchange rates and triggering instability in financial markets worldwide. Foreign investors might lose confidence in US assets, leading to capital flight.

Political Ramifications and Congressional Action

The political ramifications of a US debt crisis are significant. The situation underscores the deep partisan divisions within Congress and the challenges of reaching bipartisan consensus on critical fiscal issues.

- Political stances of different parties regarding the debt ceiling: Different political parties often have differing approaches to the debt ceiling, sometimes using it as a bargaining chip in budget negotiations. Understanding these positions is crucial for analyzing the potential for compromise.

- Potential for compromise or continued stalemate: The possibility of a compromise depends on the willingness of both parties to negotiate and find common ground. A continued stalemate could lead to severe economic consequences.

- The influence of special interest groups and lobbying efforts: Special interest groups and lobbying efforts can significantly influence the outcome of debt ceiling negotiations, adding another layer of complexity to the situation.

Conclusion

The potential US debt crisis presents a significant threat to both domestic and global economic stability. The August deadline underscores the urgency of a solution. The Treasury's warnings highlight the severe consequences of inaction. While various solutions have been proposed, the path forward remains uncertain and hinges on political will and effective negotiation. Staying informed about developments regarding the US debt crisis is paramount for every citizen and investor to mitigate potential risks and advocate for responsible fiscal policy. Understanding the potential impacts of a US debt crisis and actively engaging in the political process is crucial to safeguarding the economic future of the United States. Follow the news closely for updates on this critical US debt crisis situation.

Featured Posts

-

Family Demands Justice Following Unprovoked Racist Murder

May 10, 2025

Family Demands Justice Following Unprovoked Racist Murder

May 10, 2025 -

Whoop Under Fire Users Furious Over Unfulfilled Upgrade Offers

May 10, 2025

Whoop Under Fire Users Furious Over Unfulfilled Upgrade Offers

May 10, 2025 -

Exploring The Business Empire Of Samuel Dickson A Canadian Industrialist

May 10, 2025

Exploring The Business Empire Of Samuel Dickson A Canadian Industrialist

May 10, 2025 -

Canadian Sports Fans Where To Spend Your Dollars In Seattle

May 10, 2025

Canadian Sports Fans Where To Spend Your Dollars In Seattle

May 10, 2025 -

Nhl 2024 25 Season Key Storylines To Follow

May 10, 2025

Nhl 2024 25 Season Key Storylines To Follow

May 10, 2025