Pound Gains As Traders Reduce Expectations Of BOE Interest Rate Cuts

Table of Contents

Reduced Expectations for BOE Rate Cuts

The decreased anticipation of BOE interest rate cuts stems from several key factors influencing the UK's economic outlook and the central bank's monetary policy. These factors suggest a potentially more resilient UK economy than previously predicted.

-

Improved UK Economic Data: Recent economic indicators have painted a more positive picture. Stronger-than-expected GDP growth figures, coupled with a decline in unemployment rates, point towards a healthier economic trajectory. This improved performance reduces the pressure on the BOE to stimulate the economy through further interest rate reductions.

-

Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential easing of inflationary pressures. While specific numbers will vary depending on the release date, a downward trend in inflation, even if gradual, decreases the likelihood of the BOE needing to take drastic measures like further rate cuts to curb rising prices.

-

Shift in Market Sentiment Towards a More Hawkish BOE Stance: The market's perception of the BOE has shifted. A "hawkish" stance refers to a central bank that prioritizes controlling inflation even at the risk of slower economic growth. This shift indicates a reduced expectation of further rate cuts, contributing directly to the Pound's recent gains. This sentiment is influenced by recent pronouncements from BOE officials, suggesting a more cautious approach to future monetary policy decisions.

-

Analysis of Recent BOE Statements and Pronouncements: Careful analysis of the Bank of England's recent communications – including minutes from monetary policy committee meetings and public statements by key officials – reveals a nuanced approach. While acknowledging ongoing economic challenges, the emphasis seems to be shifting away from immediate rate cut expectations, bolstering the Pound's value.

Impact on the Pound (GBP)

The reduced expectation of BOE rate cuts has had a tangible effect on the GBP exchange rate, strengthening the Pound against major currencies.

-

Pound's Appreciation Against Other Major Currencies: The GBP has appreciated against the US dollar (USD), the Euro (EUR), and other major currencies. For example, (Insert specific percentage changes and currency pairs if available at the time of writing, e.g., "The GBP/USD exchange rate has risen by X%, while the GBP/EUR has increased by Y%"). This appreciation reflects the increased confidence in the UK economy and its currency.

-

Implications for UK Exporters and Importers: A stronger Pound makes UK exports more expensive for foreign buyers, potentially impacting export volumes. Conversely, it makes imports cheaper for UK businesses and consumers. This dual effect needs careful consideration for businesses operating internationally.

-

Impact on Foreign Investment into the UK: A stronger Pound can make the UK a less attractive destination for foreign investment, as the return on investment (in GBP terms) is potentially lower for foreign investors. However, a stable and strengthening currency can also attract long-term investors seeking lower risk.

-

Potential Risks and Uncertainties Associated with the Pound's Recent Gains: While the current upward trend is positive, it's crucial to remember that currency markets are inherently volatile. Unexpected economic shocks or shifts in BOE policy could reverse the recent gains, leading to potential losses for those heavily invested in Sterling.

Implications for Traders and Investors

The changing market landscape presents both opportunities and challenges for forex traders and investors. Adapting strategies is crucial to navigate this evolving environment.

-

Adjusting Trading Strategies in Light of Reduced Rate Cut Expectations: Traders who previously held positions anticipating further BOE rate cuts may need to reassess their strategies. This might involve adjusting positions, hedging risks, or exploring alternative trading opportunities.

-

Re-evaluating Investment Portfolios and Asset Allocation: Investors need to re-evaluate their portfolios in light of the Pound's strengthening. This might involve adjusting the allocation between GBP-denominated assets and other currencies to optimize returns and mitigate risks.

-

Opportunities and Challenges Presented by the Shifting Market Dynamics: The shift in market sentiment creates both opportunities and challenges. Traders can potentially profit from the Pound's strength, but careful risk management is crucial to avoid losses if the trend reverses.

-

The Importance of Risk Management in Navigating Currency Fluctuations: Given the inherent volatility of currency markets, effective risk management is paramount. This includes diversifying investments, employing stop-loss orders, and carefully monitoring market developments.

Conclusion

The Pound's recent gains are predominantly driven by reduced market expectations of further BOE interest rate cuts. Improving UK economic data, easing inflation concerns, and a shift towards a more hawkish BOE stance have contributed to this positive trend. This has significant implications for traders and investors, necessitating adjustments to trading strategies and investment portfolios. It's crucial to stay informed about the latest developments in BOE monetary policy and economic indicators to navigate the evolving market conditions effectively. Stay informed about the latest developments in BOE monetary policy and adjust your Pound Sterling trading strategies to capitalize on the evolving market conditions. Understanding the nuances of GBP trading and the factors influencing the Pound is key to successful navigation of the forex market.

Featured Posts

-

Australian Trans Influencer Shatters Record Addressing Doubts And Scrutiny

May 22, 2025

Australian Trans Influencer Shatters Record Addressing Doubts And Scrutiny

May 22, 2025 -

Streamers Making Money The Rise Of Creator Economics And Its Impact On Consumers

May 22, 2025

Streamers Making Money The Rise Of Creator Economics And Its Impact On Consumers

May 22, 2025 -

Transferz Innovatief Digitaal Platform Krijgt Financiering Van Abn Amro

May 22, 2025

Transferz Innovatief Digitaal Platform Krijgt Financiering Van Abn Amro

May 22, 2025 -

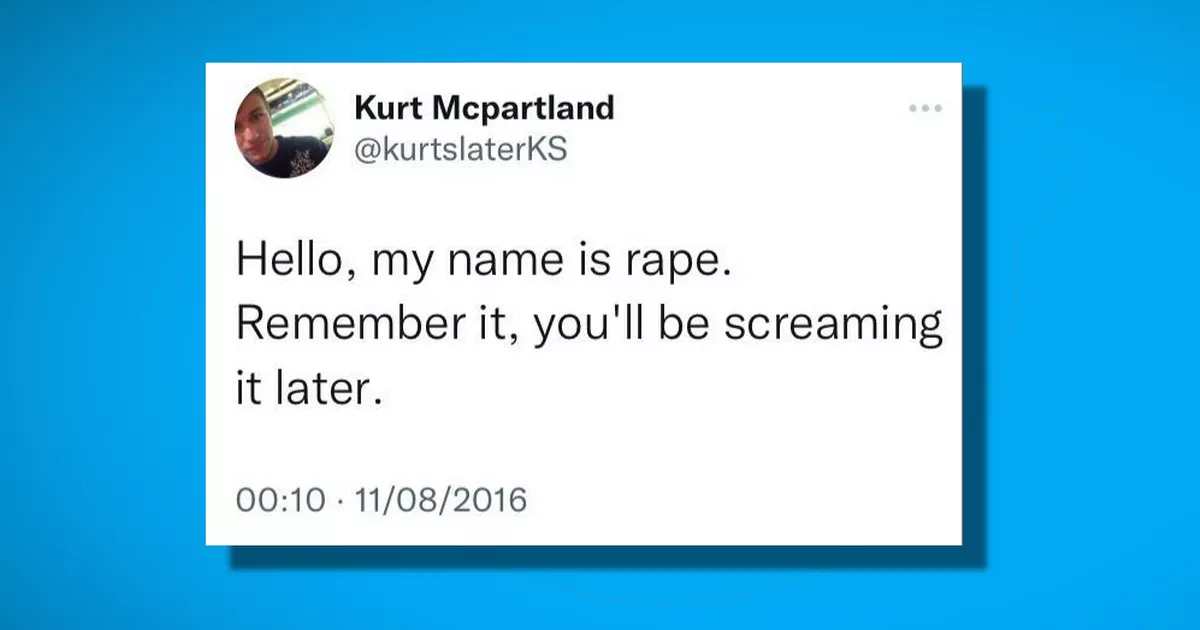

Sentence Appeal Following Racial Hatred Tweet By Ex Tory Councillors Wife

May 22, 2025

Sentence Appeal Following Racial Hatred Tweet By Ex Tory Councillors Wife

May 22, 2025 -

Australian Foot Crossing Record Smashed By William Goodge

May 22, 2025

Australian Foot Crossing Record Smashed By William Goodge

May 22, 2025

Latest Posts

-

Unexpected Zebra Mussel Discovery On Casper Boat Lift

May 22, 2025

Unexpected Zebra Mussel Discovery On Casper Boat Lift

May 22, 2025 -

Zebra Mussel Problem Casper Resident Discovers Large Infestation On Boat Lift

May 22, 2025

Zebra Mussel Problem Casper Resident Discovers Large Infestation On Boat Lift

May 22, 2025 -

Massive Zebra Mussel Infestation Found On Private Casper Boat Lift

May 22, 2025

Massive Zebra Mussel Infestation Found On Private Casper Boat Lift

May 22, 2025 -

Zebra Mussel Infestation Discovered On Casper Boat Lift

May 22, 2025

Zebra Mussel Infestation Discovered On Casper Boat Lift

May 22, 2025 -

Wildlife Rescue A Uw Documentary On The Pronghorns Winter Struggle And Recovery

May 22, 2025

Wildlife Rescue A Uw Documentary On The Pronghorns Winter Struggle And Recovery

May 22, 2025