Pound Strengthens As Traders Reduce Expectations Of Bank Of England Rate Cuts

Table of Contents

Reduced Expectations of BoE Rate Cuts

The primary catalyst for the Pound's recent rally is the diminished expectation of further Bank of England interest rate cuts. This shift in market sentiment is based on two key factors: easing inflation and robust economic indicators.

Impact of Inflation Data

Recent inflation figures, although still elevated, are showing signs of moderation. This easing of inflationary pressure reduces the perceived need for the BoE to aggressively cut interest rates to stimulate the economy.

- Lower-than-expected inflation readings: Several recent reports have indicated that inflation is cooling more quickly than previously anticipated, providing some relief for policymakers.

- Market analysts revising downward their rate cut predictions: Financial analysts and economists are now forecasting fewer, or less aggressive, rate cuts from the BoE than they were just a few weeks ago. This revised outlook is directly contributing to the increased demand for the Pound Sterling.

- Impact of government fiscal policy on inflation: Government efforts to control spending and manage public debt are also perceived as playing a role in tempering inflationary pressures, further reducing the pressure for rate cuts.

Strengthening Economic Indicators

Beyond inflation, positive economic data is also bolstering confidence in the UK economy and consequently, the Pound. Improved employment figures, robust retail sales, and growth in key sectors all point towards a healthier economic outlook.

- Positive growth in key economic sectors: The services sector, a major component of the UK economy, is showing signs of continued growth, providing further support for the Pound.

- Improved labor market conditions: Strong employment figures indicate a resilient labor market, suggesting the economy is capable of weathering potential headwinds.

- Increased consumer spending: Robust retail sales data suggests strong consumer confidence, indicating a healthy level of domestic demand within the UK economy.

Impact on GBP Exchange Rates

The reduced expectation of BoE rate cuts has had a direct and substantial impact on GBP exchange rates. The Pound has demonstrated significant gains against both the US dollar and the euro.

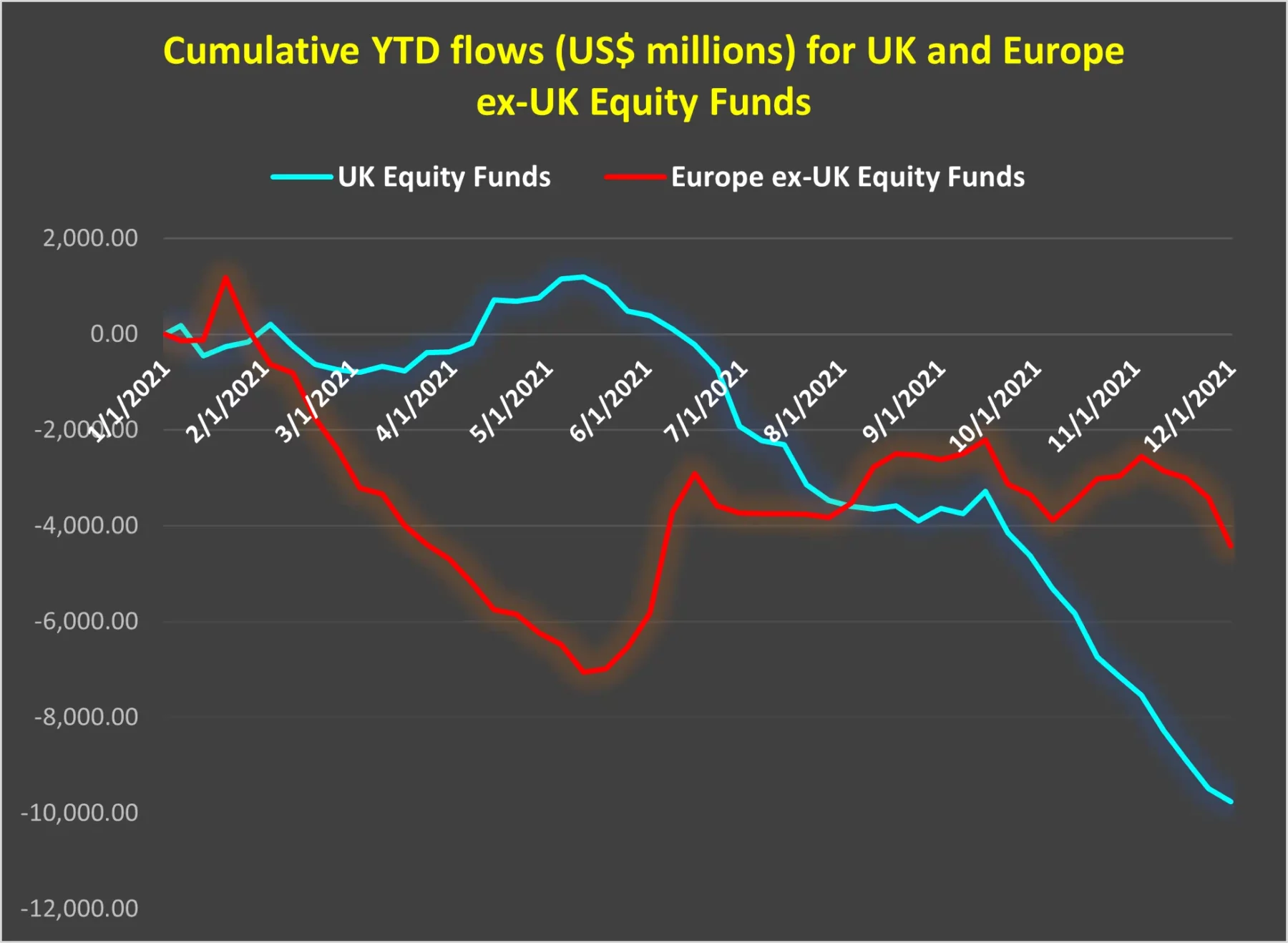

GBP/USD and GBP/EUR Movement

The strengthening of the Pound is clearly visible in the GBP/USD and GBP/EUR exchange rate pairs.

- Analysis of GBP/USD exchange rate fluctuations: The GBP/USD pair has experienced a notable upward trend, reflecting increased investor confidence in the British pound.

- Comparison with GBP/EUR exchange rate performance: Similarly, the GBP/EUR exchange rate has also shown positive movement, highlighting the broad-based strengthening of the Pound against major currencies.

- Technical analysis of chart patterns: Technical analysis of currency charts further supports the positive outlook for the Pound, with indicators suggesting sustained upward momentum.

Implications for UK Businesses

The stronger Pound has significant implications for UK businesses, primarily impacting their import and export activities.

- Impact on import prices: A stronger Pound makes imports cheaper for UK businesses, potentially reducing production costs.

- Effect on export competitiveness: Conversely, a stronger Pound makes UK exports more expensive for international buyers, potentially reducing export competitiveness in global markets.

- Strategies for businesses to manage currency risk: UK businesses need to implement robust strategies to manage currency risk effectively, including hedging techniques to mitigate potential losses from exchange rate fluctuations.

Global Economic Context and its Influence on the Pound

The Pound's performance is not solely determined by domestic factors; the global economic context plays a crucial role.

Global Market Sentiment

Global market sentiment significantly influences the demand for the Pound Sterling. In times of global uncertainty, the Pound, as a major global currency, can sometimes benefit from a "safe-haven" effect.

- Analysis of global economic factors influencing the pound: Geopolitical events and global economic uncertainty can drive investors toward more stable currencies, including the Pound.

- Impact of geopolitical events: Major geopolitical events can impact investor confidence and consequently influence the value of the Pound.

- Comparison with other major currencies: The Pound's performance relative to other major currencies, such as the US dollar and the euro, is often influenced by comparative economic performance and investor sentiment.

Interest Rate Differentials

Interest rate differentials between the UK and other major economies are a key determinant of the Pound's strength.

- Comparison of UK interest rates with those of other countries: The relative attractiveness of UK interest rates compared to those in other countries influences the flow of capital into and out of the UK, directly impacting the value of the Pound.

- The role of interest rate differentials in currency valuation: Higher interest rates generally attract foreign investment, leading to an increased demand for the currency.

- Impact of future interest rate changes: Anticipations regarding future interest rate changes in the UK and other countries also play a significant role in currency valuation.

Conclusion

The recent strengthening of the Pound Sterling is a multifaceted phenomenon resulting from a confluence of factors. Primarily, the reduced expectation of Bank of England rate cuts, fueled by easing inflation and robust economic indicators, has significantly boosted market confidence. This positive sentiment has led to substantial gains against major currencies, creating both opportunities and challenges for UK businesses and the broader economy.

Understanding the complexities of Pound Sterling fluctuations and the Bank of England's monetary policy is crucial for investors and businesses alike. Stay informed about the latest developments regarding the Pound Sterling, Bank of England rate decisions, and the overall economic outlook to effectively manage currency risk and capitalize on potential opportunities in the dynamic forex market. Monitor changes in the GBP exchange rates closely to make informed decisions.

Featured Posts

-

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 25, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 25, 2025 -

Is Sean Penn Me Too Blind His Support Of Woody Allen Under Scrutiny

May 25, 2025

Is Sean Penn Me Too Blind His Support Of Woody Allen Under Scrutiny

May 25, 2025 -

Sejarah Produksi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Produksi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025 -

Apple Stock Below Key Support Ahead Of Q2

May 25, 2025

Apple Stock Below Key Support Ahead Of Q2

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Regarding Venezuelan Deportations

May 25, 2025

Latest Posts

-

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025 -

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025 -

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025 -

Flood Warnings And Advisories For Miami Valley What You Need To Know

May 25, 2025

Flood Warnings And Advisories For Miami Valley What You Need To Know

May 25, 2025 -

Wednesday Coastal Flood Warning Southeast Pa Update

May 25, 2025

Wednesday Coastal Flood Warning Southeast Pa Update

May 25, 2025