Pre-May 5th Palantir Stock Analysis: What Wall Street Thinks

Table of Contents

Wall Street Analyst Ratings and Price Targets

The consensus among major Wall Street analysts regarding Palantir's stock is mixed, reflecting the inherent complexities of evaluating a company with a rapidly evolving business model. While some analysts maintain a bullish outlook, others express caution. Let's examine the current landscape:

| Analyst Firm | Rating | Price Target | Rationale |

|---|---|---|---|

| Goldman Sachs | Buy | $20 | Strong government contract pipeline, potential for commercial market expansion. |

| Morgan Stanley | Hold | $15 | Concerns about profitability and competition in the data analytics market. |

| JPMorgan Chase & Co. | Buy | $18 | Positive outlook driven by strong revenue growth and increasing customer adoption. |

| Bank of America | Neutral | $16 | Uncertain macroeconomic environment and potential impact on government spending. |

-

Bullish Ratings: Goldman Sachs and JPMorgan Chase & Co. see strong potential for Palantir, citing robust government contract wins and growth in the commercial sector as key drivers. Their Palantir stock forecast is optimistic.

-

Bearish Ratings: Morgan Stanley and Bank of America express more cautious views, highlighting concerns around profitability, competition, and macroeconomic headwinds.

-

Average Price Target: Based on the above, the average price target is approximately $17.25.

-

Range of Price Targets: The price targets range from a low of $15 to a high of $20, demonstrating the significant variance in analyst opinions regarding Palantir's future valuation.

Key Factors Influencing Palantir Stock Performance Pre-May 5th

Several key factors will significantly impact Palantir stock performance before May 5th. These include macroeconomic conditions, Palantir's financial performance, competitive pressures, and technological advancements.

-

Macroeconomic Factors: Rising interest rates and persistent inflation pose challenges for high-growth tech companies like Palantir. These factors can impact investor sentiment and affect the overall market environment, impacting Palantir revenue growth.

-

Financial Performance: Investors will scrutinize Palantir's upcoming earnings report, paying close attention to Palantir revenue, Palantir earnings, and Palantir profitability. Strong revenue growth, coupled with improving profitability and positive cash flow, would bolster investor confidence.

-

Competitive Landscape: Palantir operates in a competitive market, facing pressure from established players and emerging startups in the data analytics and government contracting sectors. The company's ability to maintain its competitive edge through innovation will be crucial.

-

Key Bullet Points:

- Government Contracts: Securing new substantial government contracts can significantly boost Palantir's stock price.

- Competition: Increased competition from companies like Snowflake and Databricks presents a challenge.

- Innovation: Palantir's ability to continuously innovate and adapt to changing market needs is crucial for long-term success.

- Risks and Challenges: Potential regulatory hurdles, cybersecurity risks, and dependence on government contracts are key challenges facing Palantir.

Investor Sentiment and Trading Volume

Analyzing investor sentiment is crucial for understanding the market's perception of Palantir. High trading volume, coupled with positive social media sentiment, suggests strong investor confidence. Conversely, high short interest could indicate a bearish outlook.

-

Social Media Sentiment: Tracking social media mentions of Palantir can provide a glimpse into public opinion. Analyzing the overall tone – positive, negative, or neutral – can be informative.

-

Options Activity: Increased options trading volume may indicate heightened speculative activity and volatility.

-

Short Interest: High short interest can potentially trigger short squeezes, leading to rapid price increases, but it also signals that many investors are betting against the stock.

-

News Events: Major news announcements, such as new contracts, partnerships, or regulatory changes, can significantly influence Palantir stock price fluctuations and investor sentiment.

Conclusion: Making Informed Decisions About Palantir Stock

Wall Street's outlook on Palantir stock before May 5th is mixed, with analysts expressing a range of opinions. Factors like macroeconomic conditions, financial performance, and competitive dynamics play a crucial role in shaping the stock's trajectory. Before making any investment decisions, remember to perform your own thorough due diligence. Consider all available information, including analyst ratings, financial reports, and market trends.

Stay informed about the latest developments regarding Palantir stock and continue to monitor the market for further updates on Palantir investment opportunities. Remember that this analysis is for informational purposes only and does not constitute financial advice. Conduct thorough research and consider consulting a financial advisor before making any investment decisions related to Palantir stock trading or Palantir stock investing. Always carefully assess the Palantir stock outlook before committing capital.

Featured Posts

-

Ferrari Dq Scare Prompts Jeremy Clarksons F1 Intervention Plan

May 09, 2025

Ferrari Dq Scare Prompts Jeremy Clarksons F1 Intervention Plan

May 09, 2025 -

Bitcoin Madenciliginin Sonu Yaklasirken Gelecek Ne Getiriyor

May 09, 2025

Bitcoin Madenciliginin Sonu Yaklasirken Gelecek Ne Getiriyor

May 09, 2025 -

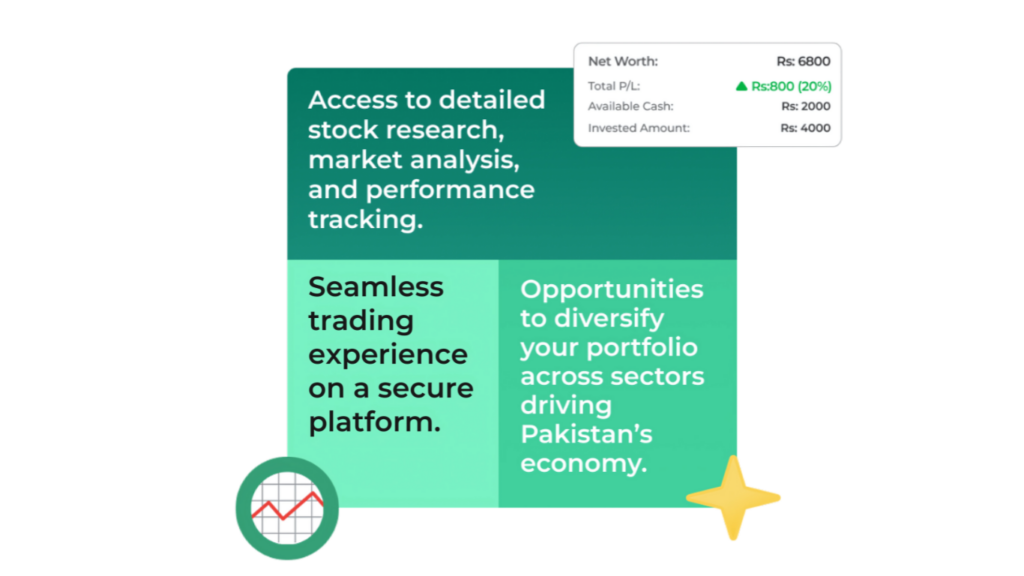

Accessible Stock Trading Jazz Cash And K Trade Make It A Reality

May 09, 2025

Accessible Stock Trading Jazz Cash And K Trade Make It A Reality

May 09, 2025 -

Municipales Dijon 2026 L Enjeu Ecologique

May 09, 2025

Municipales Dijon 2026 L Enjeu Ecologique

May 09, 2025 -

Mc Cann Parents Granted Police Protection Amid Stalking Fears At Upcoming Vigil

May 09, 2025

Mc Cann Parents Granted Police Protection Amid Stalking Fears At Upcoming Vigil

May 09, 2025