Pre-Q2 Earnings: Apple Stock Underperforms

Table of Contents

Factors Contributing to Apple Stock Underperformance Before Q2 Earnings

Several interconnected factors contributed to the underperformance of Apple stock before its Q2 earnings announcement. These factors highlight the complexities influencing even the most established tech giants.

Weakening Consumer Demand

Globally, smartphone sales have shown signs of slowing, directly impacting Apple's revenue projections. This weakening consumer demand is a significant contributor to the "Pre-Q2 Earnings: Apple Stock Underperforms" narrative.

- Decreased iPhone sales: Reports suggest a decline in iPhone sales compared to previous quarters, indicating a potential saturation of the market or a shift in consumer preferences.

- Competition from Android manufacturers: Intense competition from Android manufacturers offering increasingly sophisticated and affordable alternatives is putting pressure on Apple's market share.

- Macroeconomic factors impacting consumer spending: Global inflation, rising interest rates, and overall economic uncertainty have led to decreased consumer spending on discretionary items like smartphones, impacting Apple's sales. For instance, a recent report from [Source: reputable financial news outlet] indicated a [Specific percentage]% drop in consumer electronics spending in [Specific region].

Supply Chain Disruptions

Apple, like many other tech companies, continues to grapple with significant supply chain disruptions. These disruptions have impacted production levels and contributed to the "Pre-Q2 Earnings: Apple Stock Underperforms" situation.

- Manufacturing delays: Lockdowns and logistical challenges in key manufacturing regions have led to delays in the production and delivery of Apple products.

- Component shortages: A shortage of essential components, including semiconductors and specialized materials, has constrained Apple's ability to meet demand.

- Rising transportation costs: Increased freight costs and shipping delays further exacerbate the challenges faced by Apple's supply chain, impacting profitability. These costs directly affect the final price of products and limit the company’s profit margins.

Investor Sentiment and Market Volatility

The overall market environment played a crucial role in the pre-Q2 Apple stock underperformance. Investor sentiment and market volatility significantly influenced the Apple stock price.

- Rising interest rates: The Federal Reserve's policy of raising interest rates to combat inflation has dampened investor enthusiasm for riskier assets, including technology stocks like Apple.

- Inflation concerns: Persistent inflation erodes purchasing power and increases uncertainty about future economic growth, impacting investor confidence.

- General market uncertainty: Geopolitical instability and other global uncertainties further contribute to market volatility and influence investor decisions regarding Apple stock. The uncertainty surrounding [mention specific geopolitical event] added to the negative sentiment.

Analysis of Pre-Q2 Earnings Expectations and Actual Results

Analyzing the pre-Q2 earnings expectations and comparing them to the actual results provides a clearer picture of Apple's performance.

Analyst Predictions vs. Reality

Analysts' predictions for Apple's Q2 earnings varied, but generally reflected expectations of moderate growth. However, the actual results revealed a different story.

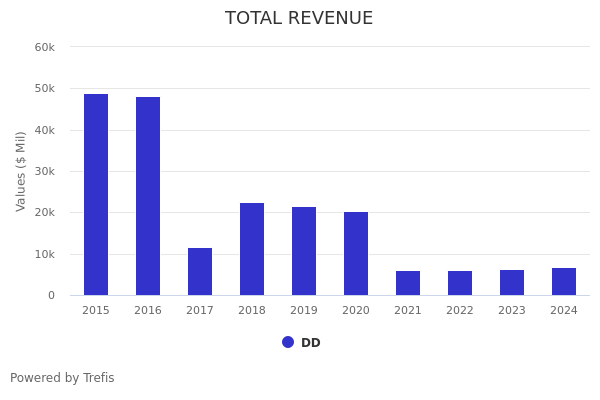

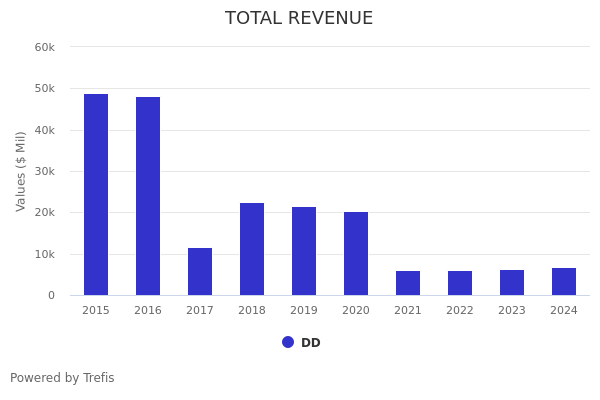

- Key financial metrics (revenue, earnings per share, etc.): [Insert actual figures for revenue and earnings per share and compare them to the average analyst predictions]. The discrepancy between the predicted and actual figures highlights the challenges Apple faced during the quarter.

- Comparison of expectations and reality: [Analyze the specific areas where Apple underperformed or exceeded expectations]. For example, while iPhone sales might have been weaker than predicted, services revenue could have shown more resilience.

- Reasons for discrepancies: The discrepancies between predictions and reality can be largely attributed to the factors discussed above: weakening consumer demand, supply chain disruptions, and overall market uncertainty.

Impact on Apple's Future Projections

The Q2 earnings results have implications for Apple's future financial outlook and its long-term growth trajectory.

- Revised guidance: Apple likely revised its guidance for future quarters based on the Q2 performance, reflecting the current market challenges.

- Potential changes in strategy: The company might adjust its strategies to address weakening demand, improve supply chain efficiency, or explore new growth avenues.

- Long-term growth predictions: The long-term growth predictions for Apple will depend on its ability to navigate the current challenges and capitalize on future opportunities.

Strategies for Investors Following Pre-Q2 Earnings Report

Navigating the market after the Q2 earnings announcement requires a careful assessment of risk and reward.

Assessing Risk and Reward

Investors need to evaluate the risks and potential rewards associated with Apple stock in the current market environment.

- Short-term vs. long-term investment strategies: Short-term investors might adopt a more cautious approach, while long-term investors might see this as a buying opportunity, depending on their risk tolerance and investment horizon.

- Diversification: Diversifying investments across different asset classes is crucial to mitigate risk.

- Risk tolerance: Investors should carefully consider their risk tolerance before making any investment decisions.

Actionable Steps for Investors

Based on the current market situation, investors can consider several actionable steps.

- Hold, buy, or sell recommendations: The decision to hold, buy, or sell Apple stock depends on individual investor profiles, risk tolerance, and investment goals. A thorough understanding of the company's financial health and future prospects is crucial.

- Importance of thorough research and consulting a financial advisor: Before making any investment decisions, investors should conduct thorough research and, if necessary, consult with a qualified financial advisor.

Conclusion: Pre-Q2 Earnings: Apple Stock Underperforms – What's Next?

The pre-Q2 earnings report revealed a period of underperformance for Apple stock, largely driven by weakening consumer demand, ongoing supply chain disruptions, and general market volatility. These challenges highlight the interconnected nature of macroeconomic factors and their influence on even the most successful companies. While the short-term outlook may be uncertain, Apple’s long-term prospects remain strong, contingent on the company successfully navigating these challenges.

Key Takeaways: The underperformance underscores the importance of understanding macroeconomic factors and their impact on individual stock performance. Supply chain vulnerabilities and changing consumer behavior remain key considerations for investors.

Future Outlook: Apple's future trajectory will depend on its ability to adapt to changing market dynamics, strengthen its supply chain, and potentially innovate to stimulate demand. Close monitoring of consumer sentiment and economic indicators will be crucial.

Call to Action: Stay informed about Apple's performance and continue monitoring "Pre-Q2 Earnings: Apple Stock Underperforms" and related news for making informed investment decisions. Consider consulting financial news sources and analyst reports for in-depth analysis before making any investment choices related to Apple stock or similar tech investments.

Featured Posts

-

Scrutiny Of Thames Water Executive Bonuses And The Public Outcry

May 25, 2025

Scrutiny Of Thames Water Executive Bonuses And The Public Outcry

May 25, 2025 -

Ilya Ilich I Ego Gryozy Lyubvi Publikatsiya V Gazete Trud

May 25, 2025

Ilya Ilich I Ego Gryozy Lyubvi Publikatsiya V Gazete Trud

May 25, 2025 -

I Dazi E Il Futuro Della Moda Negli Stati Uniti

May 25, 2025

I Dazi E Il Futuro Della Moda Negli Stati Uniti

May 25, 2025 -

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 25, 2025

Rekordnoe Kolichestvo Svadeb Na Kharkovschine 40 Par Skazali Da

May 25, 2025 -

What Does Elon Musks Recent Activity Mean For Dogecoin

May 25, 2025

What Does Elon Musks Recent Activity Mean For Dogecoin

May 25, 2025

Latest Posts

-

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025 -

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025 -

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025 -

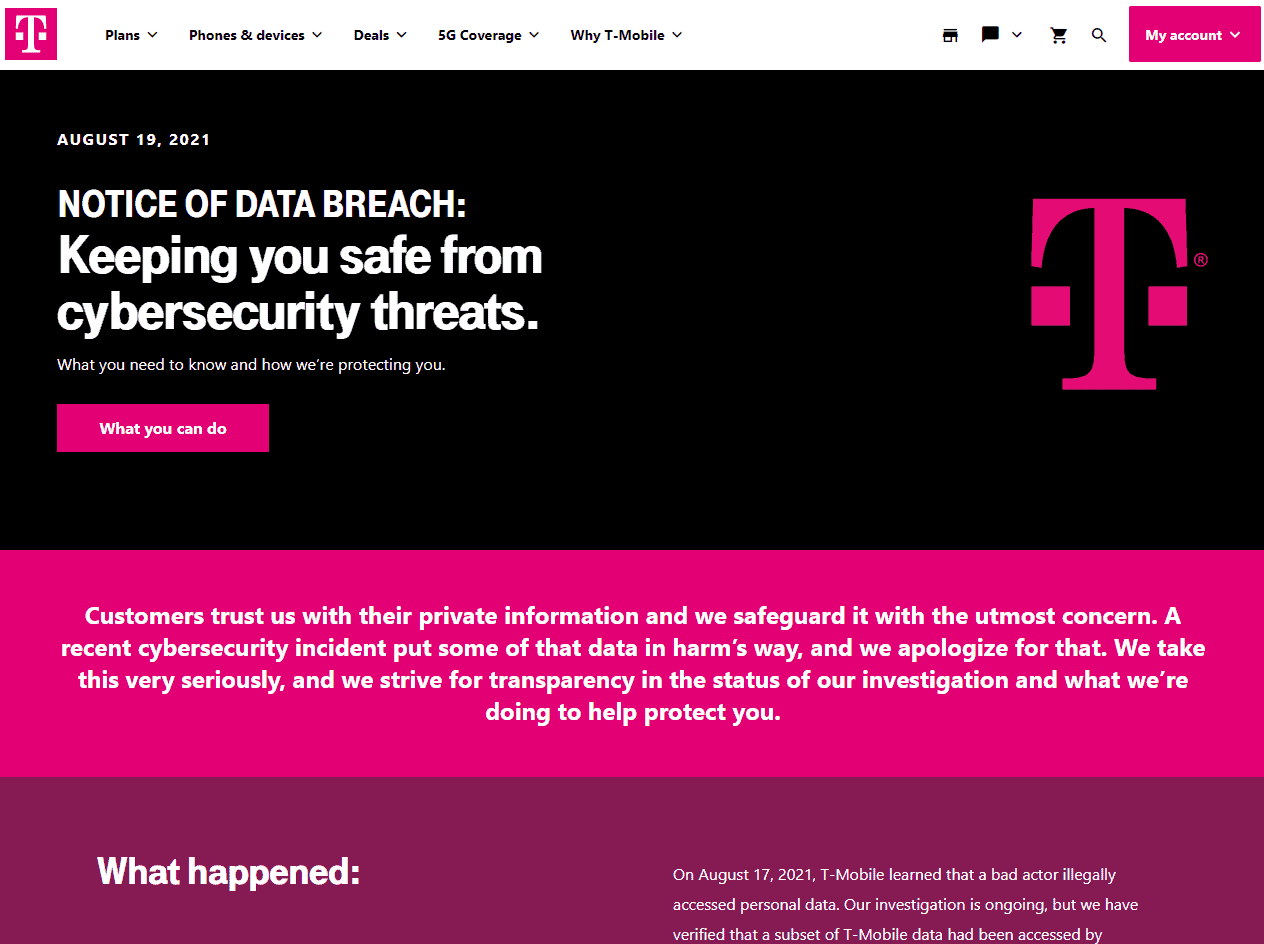

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025