Pre-Tariff Shock: Japan's Economic Contraction In Q1

Table of Contents

Impact of Global Slowdown on Japanese Exports

The global economic slowdown significantly impacted Japan's export-oriented economy. Weakening global demand and disruptions to supply chains played crucial roles in the Q1 contraction.

Weakening Global Demand

A decline in global demand, particularly for Japanese electronics and automobiles, severely hampered export performance.

- Exports to the United States, a key trading partner, decreased by 5% in Q1, largely due to reduced consumer spending and a slowdown in the tech sector.

- Similarly, exports to China fell by 7%, reflecting a slowdown in the Chinese economy and reduced demand for Japanese machinery and components.

- European Union exports also experienced a decline of 3%, reflecting the broader weakness in the European economy. This impacted various sectors, from automotive to electronics manufacturing, significantly contributing to Japan's economic contraction.

Supply Chain Disruptions

Global supply chain disruptions further exacerbated the situation, hindering Japanese production and exports.

- The ongoing semiconductor shortage continued to constrain production across several key industries, particularly automobiles and electronics, impacting both domestic and international sales.

- Logistical bottlenecks, including port congestion and freight shortages, added to the challenges, leading to delays and increased costs.

- These disruptions directly contributed to a 4% drop in industrial production during Q1, significantly impacting the nation's GDP.

Domestic Factors Contributing to the Contraction

Beyond external pressures, several domestic factors also contributed to Japan's economic contraction in Q1.

Weak Consumer Spending

Subdued consumer spending significantly dampened economic activity. Several factors contributed to this weakness:

- Rising inflation, driven by increased energy and food prices, eroded consumer purchasing power, leading to reduced spending on discretionary items.

- Stagnant wages further constrained consumer spending, as households struggled to keep pace with rising living costs.

- Uncertainty about the future, fueled by geopolitical risks and economic volatility, also negatively impacted consumer confidence, as reflected in the declining consumer confidence index, which fell to its lowest point in three years. This led to a significant drop in retail sales and weakened the service sector.

Impact of Rising Energy Prices

Japan's heavy reliance on energy imports made it particularly vulnerable to rising global energy prices.

- The country's high dependence on imported oil and natural gas exposed its economy to volatility in international energy markets.

- Energy price inflation contributed significantly to overall inflation, squeezing household budgets and corporate profits. Energy price increases were approximately 15% year-on-year.

- This led to reduced corporate investment and a dampening effect on overall economic activity.

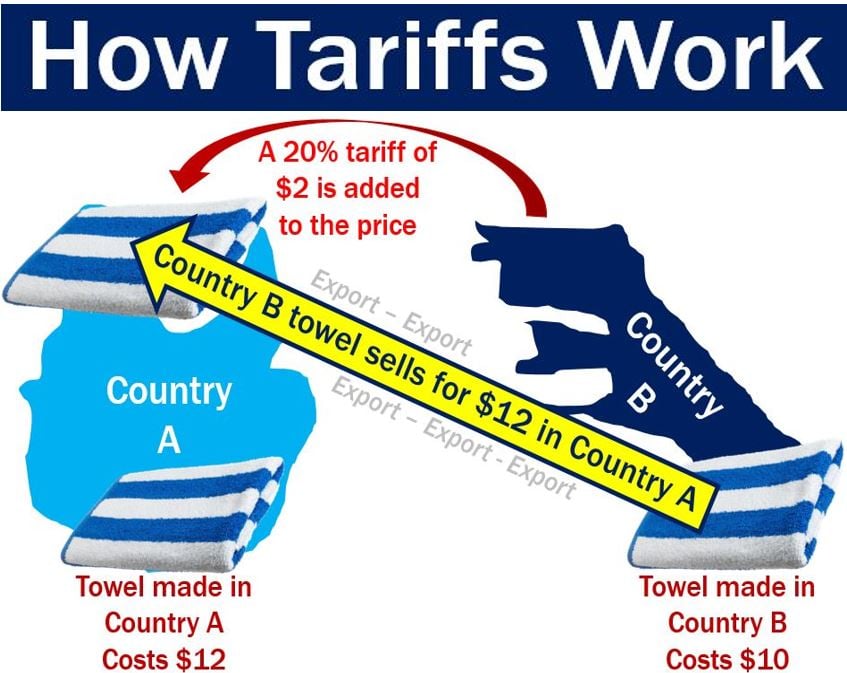

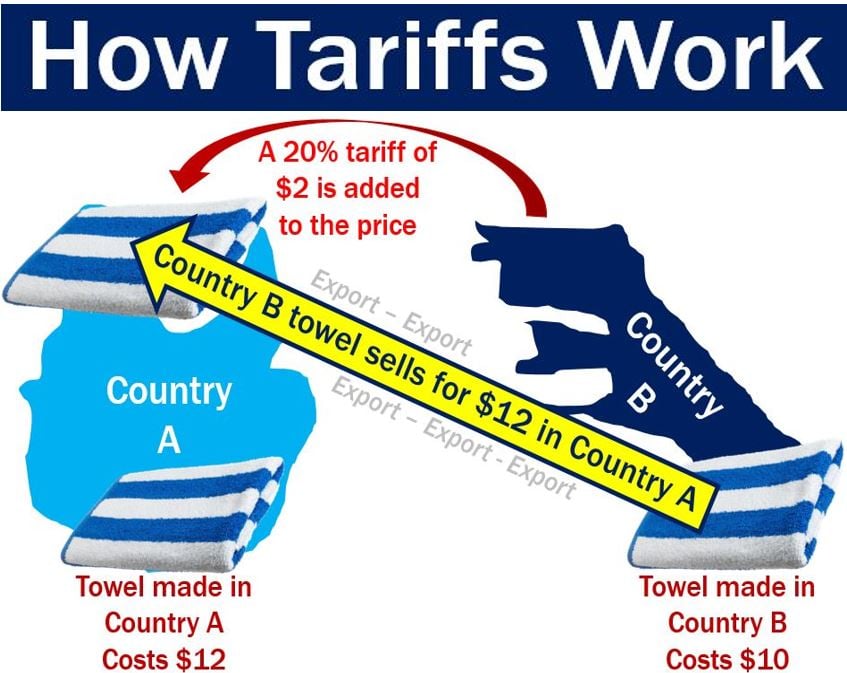

The Looming Threat of Tariffs

The potential impact of future tariffs adds another layer of uncertainty to Japan's economic outlook.

Potential Tariff Impacts

The possibility of increased trade protectionism poses a significant risk to the Japanese economy.

- Sectors heavily reliant on exports, such as automobiles and electronics, would be particularly vulnerable to retaliatory tariffs imposed by other countries.

- Increased tariffs could disrupt supply chains and further reduce global demand for Japanese goods, potentially triggering a more substantial economic downturn.

- Experts warn that the economic fallout could be severe, potentially leading to job losses and decreased economic growth.

Government Response and Mitigation Strategies

The Japanese government has implemented several measures to address the economic slowdown and mitigate the potential impact of future tariffs.

- Stimulus packages aimed at boosting consumer spending and supporting businesses are currently being considered.

- The government is also exploring strategies to diversify trade relationships and reduce reliance on specific trading partners.

- Policy adjustments focused on enhancing supply chain resilience and promoting domestic production are also being discussed. The effectiveness of these measures remains to be seen.

Conclusion

Japan's Q1 economic contraction highlights the vulnerability of its export-oriented economy to global headwinds, domestic challenges, and the looming threat of tariffs. The interplay between weakening global demand, supply chain disruptions, weak consumer spending, and rising energy prices created a perfect storm, resulting in a significant economic downturn. The potential for further economic contraction due to increased trade protectionism is a serious concern. Understanding Japan's economic contraction is crucial for navigating the complexities of the global economy. To stay updated on this evolving situation, further research into "Japan economic forecast," "Japan trade relations," and "impact of tariffs on Japan" is recommended. The severity of Japan's economic contraction demands close attention to its potential long-term consequences.

Featured Posts

-

Jackbit The Best Bitcoin Casino For 2025 A Comprehensive Guide

May 17, 2025

Jackbit The Best Bitcoin Casino For 2025 A Comprehensive Guide

May 17, 2025 -

Crew Chief Admits Wrong Call Cost Detroit Pistons Game Against Knicks

May 17, 2025

Crew Chief Admits Wrong Call Cost Detroit Pistons Game Against Knicks

May 17, 2025 -

Thibodeaus Job On The Line Brunson Offers Insight

May 17, 2025

Thibodeaus Job On The Line Brunson Offers Insight

May 17, 2025 -

Warner Bros Pictures At Cinema Con 2025 Film Announcements And More

May 17, 2025

Warner Bros Pictures At Cinema Con 2025 Film Announcements And More

May 17, 2025 -

Brunsons Podcast Perkins Call For Cancellation

May 17, 2025

Brunsons Podcast Perkins Call For Cancellation

May 17, 2025

Latest Posts

-

Fortnite Cowboy Bebop Giveaway A Limited Time Offer

May 17, 2025

Fortnite Cowboy Bebop Giveaway A Limited Time Offer

May 17, 2025 -

Secure Your Free Cowboy Bebop Fortnite Items Event Ending Soon

May 17, 2025

Secure Your Free Cowboy Bebop Fortnite Items Event Ending Soon

May 17, 2025 -

Fortnite Offers Free Cowboy Bebop Cosmetics Timed Event

May 17, 2025

Fortnite Offers Free Cowboy Bebop Cosmetics Timed Event

May 17, 2025 -

Fortnite Cowboy Bebop Collaboration Free Items Available For A Short Time

May 17, 2025

Fortnite Cowboy Bebop Collaboration Free Items Available For A Short Time

May 17, 2025 -

Get The Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Details

May 17, 2025

Get The Fortnite Cowboy Bebop Skins Faye Valentine And Spike Spiegel Bundle Price Details

May 17, 2025