Prediction: 2 Stocks Poised To Outperform Palantir In 3 Years

Table of Contents

Stock #1: Snowflake (SNOW) – A Deep Dive into its Growth Potential

Snowflake, a cloud-based data warehousing and analytics company, presents a compelling case for outperformance. Its robust growth projections, strong financial fundamentals, and proactive risk mitigation strategies position it favorably against Palantir.

Superior Growth Trajectory

Snowflake's revenue growth has consistently exceeded expectations, driven by strong demand for its cloud-based data platform.

- Projected Annual Recurring Revenue (ARR) Growth: Analysts predict a consistent double-digit ARR growth rate for the next three years, significantly outpacing Palantir's projected growth.

- Market Share Expansion: Snowflake is rapidly expanding its market share in the cloud data warehousing sector, capitalizing on the migration of businesses to cloud-based solutions.

- Competitive Advantages: Snowflake's scalable architecture, ease of use, and strong partnerships provide a significant competitive advantage. Its unique data sharing capabilities are a key differentiator.

Strong Financial Fundamentals

Snowflake exhibits impressive financial health, indicating a solid foundation for sustained growth.

- Profitability: While not yet consistently profitable on a net income basis, Snowflake demonstrates strong operating leverage and is rapidly improving its margins. Its gross margins are significantly higher than Palantir's.

- Cash Flow: Snowflake generates substantial positive free cash flow, providing ample resources for further investment and expansion.

- Positive Analyst Ratings: Many leading analysts have issued buy or outperform ratings on Snowflake stock, reflecting strong confidence in its future prospects.

Addressing Risks and Mitigation Strategies

Like any growth company, Snowflake faces risks. Increased competition and potential economic downturns are key considerations.

- Competition: The cloud data warehousing market is competitive. Snowflake mitigates this risk through continuous innovation, strategic partnerships, and a focus on customer success.

- Economic Downturn: A potential economic slowdown could impact customer spending. Snowflake's scalable model and strong customer relationships help to mitigate this risk.

Stock #2: CrowdStrike (CRWD) – Disrupting the Cybersecurity Landscape

CrowdStrike, a leading cybersecurity company specializing in endpoint protection, is another strong candidate to outperform Palantir. Its disruptive technology, expanding market opportunity, and capable management team contribute to its projected success.

Disruptive Technology and First-Mover Advantage

CrowdStrike's cloud-native platform leverages artificial intelligence (AI) for real-time threat detection and response, providing a significant advantage over traditional security solutions.

- Technological Innovation: CrowdStrike's Falcon platform offers superior threat detection and response capabilities compared to traditional antivirus solutions and many other competitors.

- Market Differentiation: Its cloud-native architecture, AI-driven threat intelligence, and comprehensive suite of security tools provide a compelling value proposition.

- Superiority to Palantir's Offerings: While Palantir offers data analytics solutions that can be applied to cybersecurity, CrowdStrike's specialized focus and leading technology provide a more direct and effective solution.

Expanding Market Opportunity

The cybersecurity market is experiencing significant growth, driven by the increasing frequency and sophistication of cyberattacks.

- Market Size and Growth: The global cybersecurity market is projected to experience robust growth in the coming years, offering substantial opportunities for CrowdStrike.

- Market Share Potential: CrowdStrike is well-positioned to capture significant market share through its innovative technology and strong go-to-market strategy.

- Strategic Acquisitions: CrowdStrike has strategically acquired companies to enhance its platform and expand its capabilities.

Management Team and Execution Capabilities

CrowdStrike boasts a highly experienced and effective management team with a proven track record of success.

- Experienced Leadership: The company's leadership team comprises seasoned executives with extensive experience in the cybersecurity industry.

- Execution Capabilities: CrowdStrike has consistently demonstrated its ability to execute its strategic plan and deliver strong results.

- Industry Recognition: CrowdStrike has received numerous industry awards and recognitions, validating its market leadership.

Comparative Analysis: Snowflake, CrowdStrike, and Palantir

| Metric | Snowflake (SNOW) | CrowdStrike (CRWD) | Palantir (PLTR) |

|---|---|---|---|

| Revenue Growth (YoY) | High Double Digits | High Double Digits | Mid-Single Digits |

| Profit Margins | Improving | Improving | Low |

| Market Cap | High | High | Moderate |

This table highlights the superior revenue growth and profit margin improvement projected for Snowflake and CrowdStrike compared to Palantir.

Conclusion: Investing in Stocks Poised to Outperform Palantir

Based on our analysis, Snowflake and CrowdStrike present compelling investment opportunities with significant potential to outperform Palantir Technologies over the next three years. Both companies demonstrate robust growth trajectories, strong financial fundamentals, and compelling competitive advantages. Their innovative technologies and expanding market opportunities suggest substantial upside potential.

Remember to conduct your own thorough due diligence before making any investment decisions. Consider investing in these stocks poised to outperform Palantir as part of a diversified portfolio. Discover more about these potential Palantir outperformers by researching their respective company websites and consulting reputable financial news sources. This article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Hollywood Shut Down Writers And Actors Strike Impacts Film And Television

May 10, 2025

Hollywood Shut Down Writers And Actors Strike Impacts Film And Television

May 10, 2025 -

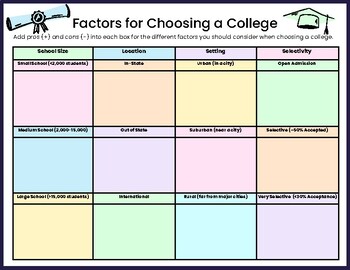

Choosing A College Town Why Consider City Name In Michigan

May 10, 2025

Choosing A College Town Why Consider City Name In Michigan

May 10, 2025 -

Trumps Transgender Military Ban A Comprehensive Overview

May 10, 2025

Trumps Transgender Military Ban A Comprehensive Overview

May 10, 2025 -

Noi Mosdo Kormanyepuelet Letartoztatas Transznemu Jogok Floridaban

May 10, 2025

Noi Mosdo Kormanyepuelet Letartoztatas Transznemu Jogok Floridaban

May 10, 2025 -

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025

Abrz Almdkhnyn Fy Tarykh Krt Alqdm

May 10, 2025