Pressure Tactics: Taiwan Regulator Scrutinizes ETF Sales Practices

Table of Contents

Allegations of Aggressive Sales Techniques

Recent allegations against several financial institutions involved in ETF sales in Taiwan have raised serious concerns about ethical conduct and investor protection. The core accusations revolve around aggressive sales tactics that prioritized profits over client suitability. These practices undermine investor confidence and threaten the integrity of the Taiwanese financial market.

-

Misrepresentation of ETF risk profiles: Several reports suggest that some institutions downplayed the inherent risks associated with certain ETFs, misleading investors about potential losses. This is a serious breach of fiduciary duty.

-

Unsuitable recommendations for specific investor profiles: Allegations include recommending high-risk ETFs to conservative investors who were not adequately informed of the potential downsides. This highlights a failure to conduct proper due diligence and understand client needs.

-

High-pressure sales tactics targeting vulnerable investors: Reports suggest that vulnerable investors, such as the elderly or those with limited financial literacy, were specifically targeted with aggressive sales techniques, exploiting their lack of knowledge.

-

Lack of transparency regarding fees and commissions: The lack of clear and upfront disclosure about fees and commissions associated with ETF purchases is another major concern. This opacity makes it difficult for investors to make informed decisions.

-

Use of misleading marketing materials: Marketing materials used to promote ETFs are also under scrutiny, with allegations of exaggerating returns and minimizing risk. These deceptive practices violate securities regulations and erode investor trust.

These reported incidents, if proven, could lead to significant legal ramifications under Taiwanese securities laws, potentially including hefty fines and license revocations. The specifics of the ongoing investigations remain confidential in many cases, but the potential for significant penalties underscores the severity of the alleged misconduct in these aggressive ETF sales practices.

The Regulatory Response and Investigation

The Taiwanese financial regulator, [Insert Name of Regulatory Body], has responded swiftly to these allegations, launching formal investigations into several financial institutions implicated in the scandal. This proactive approach demonstrates a commitment to safeguarding investor interests.

-

Formal investigations launched into specific firms: Multiple investigations are underway, focusing on specific instances of alleged misconduct and the firms involved.

-

Increased scrutiny of ETF prospectuses and marketing materials: The regulator is meticulously examining the marketing materials and prospectuses related to the ETFs in question, seeking evidence of misrepresentation or misleading information.

-

Potential penalties for non-compliance, including fines and licensing suspensions: The potential penalties are substantial, serving as a strong deterrent against future misconduct related to ETF sales in Taiwan.

-

Public statements released by the regulator regarding the investigation: The regulator has issued public statements acknowledging the investigation and reiterating its commitment to ensuring fair and transparent market practices.

-

Calls for increased investor protection measures: The scandal has fueled calls for stronger investor protection measures, including improved financial literacy programs and more robust regulatory oversight. This focus on investor protection is crucial for restoring confidence in the market.

Impact on Investor Confidence and Market Stability

The allegations of unethical ETF sales practices in Taiwan have had a demonstrable impact on investor confidence. The potential consequences extend beyond individual investors, affecting the stability of the broader market.

-

Potential decline in ETF investments due to lack of trust: The scandal could lead to a decline in ETF investments as investors become hesitant to trust financial institutions.

-

Increased market volatility in the short term: The uncertainty surrounding the investigation and its outcomes could cause short-term market volatility.

-

Long-term effects on the development of the Taiwanese ETF industry: If the issues are not addressed effectively, the long-term development of the Taiwanese ETF industry could be significantly hampered.

-

Impact on foreign investor confidence: The scandal could also negatively impact the confidence of foreign investors in the Taiwanese market.

The economic repercussions of this scandal require a multi-pronged approach to rebuild trust. This includes swift and decisive action by the regulator, improved transparency from financial institutions, and enhanced investor education programs. Addressing the issue of investor confidence in Taiwan is crucial for restoring stability and fostering long-term growth.

Future Implications for ETF Sales and Regulation

The outcome of this investigation will likely lead to significant changes in both ETF sales practices and regulatory oversight in Taiwan. These changes are essential for preventing similar scandals and strengthening investor protection.

-

Strengthening of regulatory guidelines for ETF sales: Expect to see more stringent guidelines governing the sale of ETFs, focusing on suitability, transparency, and ethical conduct.

-

Increased transparency requirements for financial institutions: Financial institutions will likely face stricter transparency requirements, including clearer disclosure of fees, commissions, and potential risks.

-

Implementation of stricter penalties for misconduct: The penalties for non-compliance are expected to become more severe, acting as a greater deterrent against unethical practices.

-

Enhanced investor education programs to promote informed investment decisions: More robust investor education programs are vital to empower investors to make informed decisions and protect themselves from manipulative sales tactics.

-

Potential changes to the licensing and certification requirements for ETF sales professionals: The licensing and certification process for ETF sales professionals might undergo changes to ensure higher standards of competence and ethical conduct.

The future of the Taiwanese ETF market will depend on the effectiveness of these reforms. Stronger ETF regulation in Taiwan, coupled with increased investor awareness, is crucial for restoring confidence and facilitating sustainable growth in this important sector.

Conclusion:

This investigation into alleged pressure tactics in ETF sales practices in Taiwan highlights the critical need for ethical and transparent conduct within the financial industry. The regulator's response underscores its commitment to protecting investors and maintaining the stability of the market. The outcome of this scrutiny will significantly shape the future of ETF sales and regulations in Taiwan. Moving forward, increased investor awareness of responsible ETF investment strategies and further strengthening of regulatory oversight surrounding ETF sales practices in Taiwan are essential. It’s crucial for investors to remain vigilant and report any suspected unethical sales practices to the appropriate authorities.

Featured Posts

-

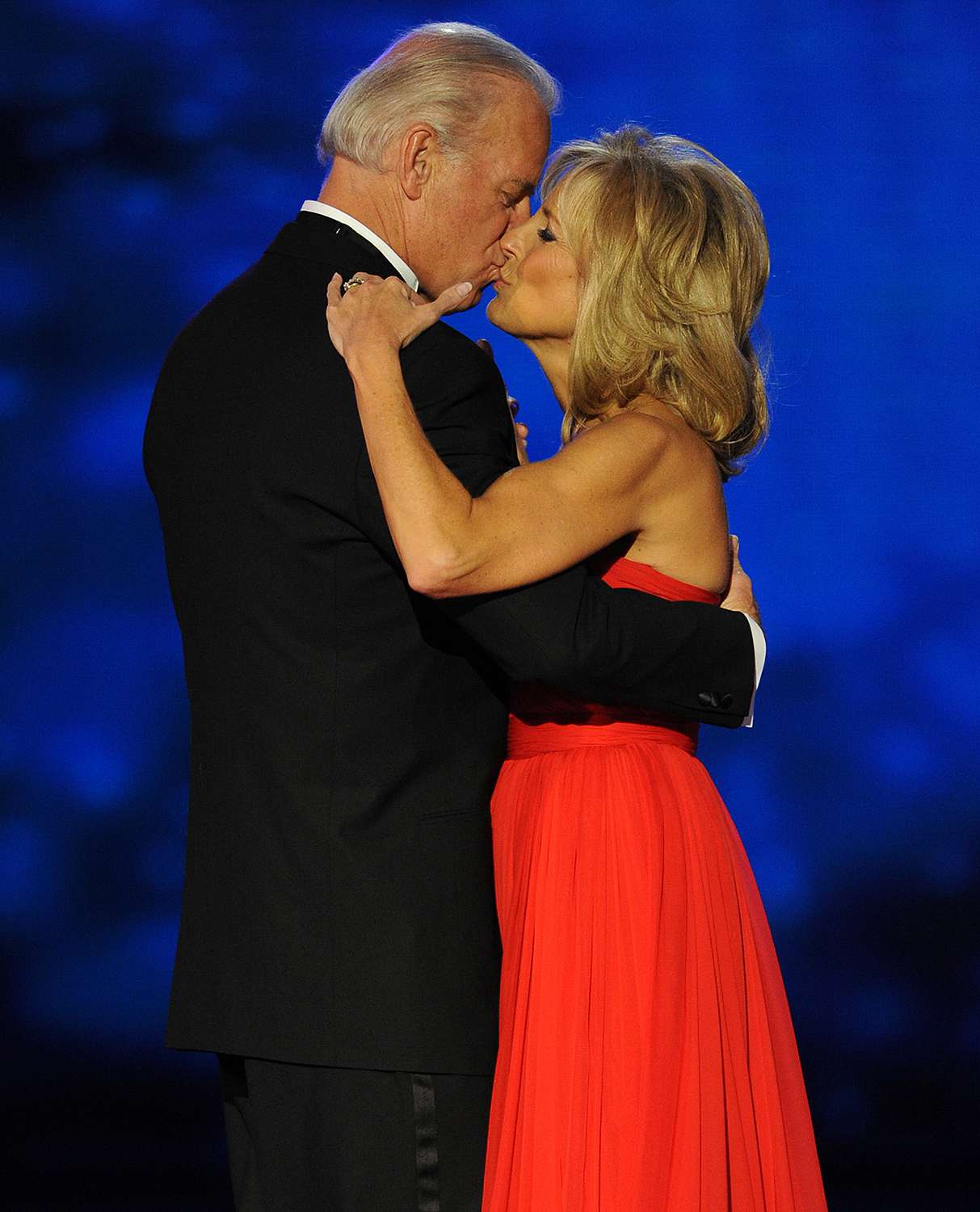

Miss Joe And Jill Biden On The View Full Interview

May 16, 2025

Miss Joe And Jill Biden On The View Full Interview

May 16, 2025 -

Maple Leafs Vs Panthers A Point Earns Leafs Playoff Berth

May 16, 2025

Maple Leafs Vs Panthers A Point Earns Leafs Playoff Berth

May 16, 2025 -

Tom Cruises 1 Debt To Tom Hanks An Unpaid Role And A Lasting Joke

May 16, 2025

Tom Cruises 1 Debt To Tom Hanks An Unpaid Role And A Lasting Joke

May 16, 2025 -

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

May 16, 2025

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

May 16, 2025 -

Wayne Gretzkys Goal Record Tied By Alex Ovechkin Nhl Milestone Reached

May 16, 2025

Wayne Gretzkys Goal Record Tied By Alex Ovechkin Nhl Milestone Reached

May 16, 2025

Latest Posts

-

Analiz Raketnoy Ataki Rf Na Ukrainu Bolee 200 Tseley

May 16, 2025

Analiz Raketnoy Ataki Rf Na Ukrainu Bolee 200 Tseley

May 16, 2025 -

Olimpia Vence A Penarol 2 0 Resumen Completo Del Encuentro

May 16, 2025

Olimpia Vence A Penarol 2 0 Resumen Completo Del Encuentro

May 16, 2025 -

Ataka Rossii Na Ukrainu Posledstviya Massirovannogo Raketnogo Udara

May 16, 2025

Ataka Rossii Na Ukrainu Posledstviya Massirovannogo Raketnogo Udara

May 16, 2025 -

Ukrainskie Goroda Pod Obstrelom Rossiya Zapustila Bolee 200 Raket I Bespilotnikov

May 16, 2025

Ukrainskie Goroda Pod Obstrelom Rossiya Zapustila Bolee 200 Raket I Bespilotnikov

May 16, 2025 -

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 16, 2025

Crystal Palace Vs Nottingham Forest Resultado En Directo Y Resumen

May 16, 2025