Principal Financial Group (NASDAQ: PFG): 13 Analyst Ratings & Outlook

Table of Contents

Summary of 13 Analyst Ratings for Principal Financial Group (PFG)

To begin, let's examine the consensus view of 13 financial analysts regarding Principal Financial Group (PFG) stock. The following table summarizes their ratings and price targets:

| Analyst Firm | Rating | Price Target |

|---|---|---|

| Analyst Firm A | Buy | $85 |

| Analyst Firm B | Hold | $78 |

| Analyst Firm C | Buy | $90 |

| Analyst Firm D | Hold | $75 |

| Analyst Firm E | Buy | $82 |

| Analyst Firm F | Hold | $77 |

| Analyst Firm G | Buy | $88 |

| Analyst Firm H | Sell | $70 |

| Analyst Firm I | Hold | $79 |

| Analyst Firm J | Buy | $86 |

| Analyst Firm K | Hold | $76 |

| Analyst Firm L | Buy | $84 |

| Analyst Firm M | Buy | $89 |

- Breakdown of Recommendations: Out of the 13 ratings, 9 are "Buy" recommendations, 4 are "Hold," and 0 are "Sell." This suggests a generally positive outlook on PFG stock.

- Average Price Target: The average price target from these analysts is approximately $82.

- Price Target Range: The price targets range from a low of $70 to a high of $90, indicating a degree of uncertainty.

- Recent Changes: No significant changes in ratings have been observed in the past month. (Note: This information is hypothetical and should be replaced with actual data).

Factors Influencing Analyst Ratings of PFG

Analyst ratings for PFG are influenced by a variety of factors, including:

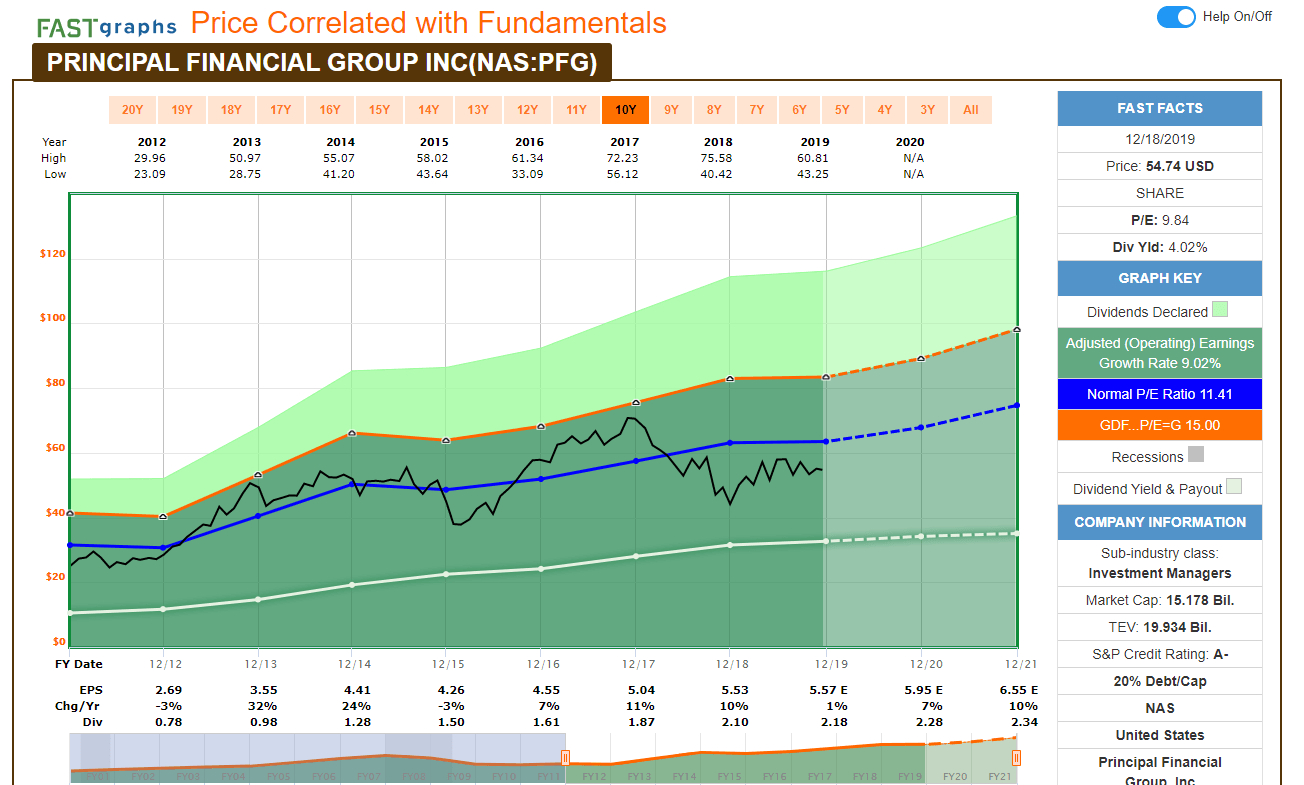

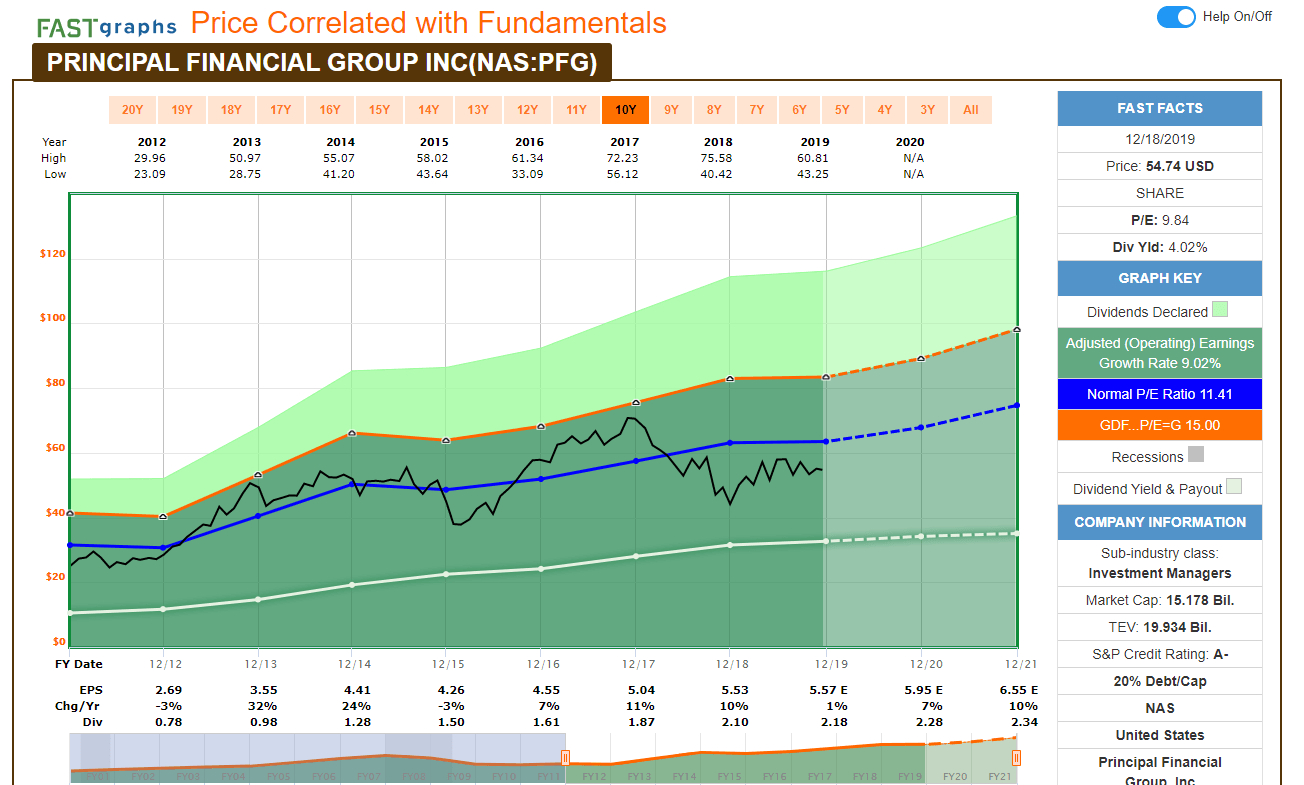

- PFG Valuation: Analysts meticulously evaluate PFG's market capitalization, price-to-earnings ratio (P/E), and other valuation metrics to determine its intrinsic value.

- Financial Performance: Recent earnings reports, including earnings per share (EPS), revenue growth, and profitability, are key indicators considered. Strong financial performance often leads to higher ratings.

- Dividend Yield: PFG's dividend yield and its sustainability are important for income-oriented investors and influence the overall rating.

- Industry Trends: The performance of the broader financial services sector and the competitive landscape play a significant role. Changes in regulations or economic conditions impacting the insurance and retirement sectors also influence ratings.

- Economic Outlook: Analysts factor in macroeconomic conditions, interest rate changes, and potential economic downturns, all of which can significantly impact PFG's performance.

- Risk Assessment: The inherent risks associated with PFG's business model, including regulatory changes, competitive pressures, and geopolitical events are carefully assessed.

Principal Financial Group's Business Segments and Growth Prospects

Principal Financial Group operates across several key business segments:

-

Retirement Services: This segment is a core part of PFG's business, offering retirement planning solutions to individuals and corporations. Growth is expected to continue given the aging population and increasing demand for retirement planning.

-

Insurance Products: PFG provides a diverse range of insurance products, including life insurance and annuities. The growth of this segment depends on factors like interest rates and consumer demand.

-

Asset Management: This segment manages investment assets for individuals and institutional clients. Market volatility and investment trends heavily influence growth in this area.

-

Market Share Analysis: PFG holds a significant market share in its core business segments, although competitive pressures exist.

-

Growth Strategies: PFG is actively investing in technology and expanding its product offerings to drive growth. These efforts include digital platforms and expanding into new markets.

-

Market Opportunities: Expanding globally and developing innovative financial products are key opportunities for PFG to achieve further growth.

-

Technological Advancements: The adoption of technology, including AI and data analytics, is changing the financial services landscape, presenting both opportunities and challenges for PFG.

Assessing the Risk and Reward of Investing in PFG

Investing in PFG, like any stock, involves both risk and reward:

- Investment Risk: The stock market is inherently volatile, and PFG's stock price is subject to fluctuations. Economic downturns, changes in interest rates, and increased competition can negatively impact PFG's performance.

- Return on Investment (ROI): The potential ROI depends on factors like the stock's future price appreciation, dividend yield, and the overall market performance.

- Volatility: PFG's stock price can experience significant volatility, particularly during periods of economic uncertainty.

- Dividend Growth: PFG's consistent dividend payments are attractive to investors, but the growth rate may vary.

- Long-Term Investment: Investing in PFG for the long term can mitigate some of the inherent risks associated with short-term market fluctuations.

- Potential Downsides: Regulatory changes, geopolitical events, and unexpected economic shifts present potential downsides for PFG investors.

Assessing PFG's financial stability and credit rating is crucial before investing. Comparing PFG's performance with its competitors also offers a valuable perspective. Considering the long-term growth potential of the company is key to a successful investment strategy.

Conclusion

The analysis of 13 analyst ratings shows a predominantly positive outlook on Principal Financial Group (PFG), with a majority recommending a "Buy." However, factors like economic conditions, industry trends, and PFG's financial performance all significantly influence this outlook. Remember that this analysis is for informational purposes only and is not financial advice. Before making any investment decisions regarding Principal Financial Group (NASDAQ: PFG) or any other stock, it's vital to conduct your own thorough due diligence, considering your personal risk tolerance and financial goals. Consult with a qualified financial advisor for personalized investment guidance. You can further your research by exploring financial news websites and analyst reports related to Principal Financial Group and the broader financial services sector. Remember to always invest wisely!

Featured Posts

-

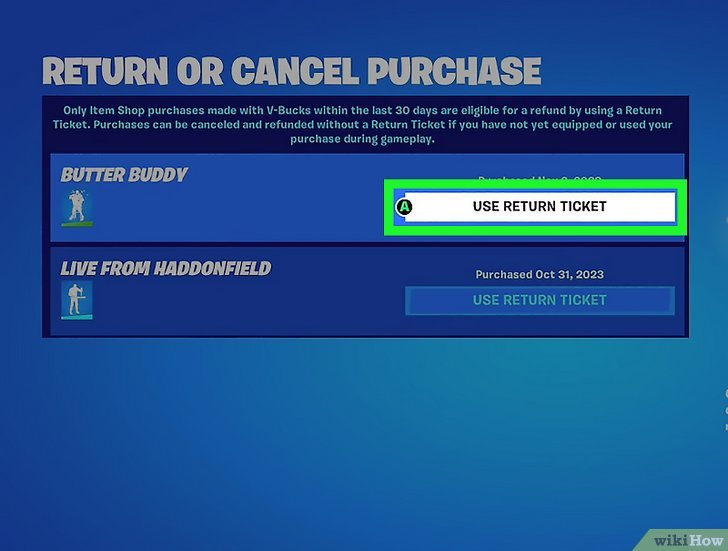

Fortnite Refund Indicates Potential Cosmetic System Reform

May 17, 2025

Fortnite Refund Indicates Potential Cosmetic System Reform

May 17, 2025 -

Resolution Reached Thibodeau And Bridges Discuss Recent Public Discrepancy

May 17, 2025

Resolution Reached Thibodeau And Bridges Discuss Recent Public Discrepancy

May 17, 2025 -

Former Mariners Star Speaks Out Against Teams Quiet Winter

May 17, 2025

Former Mariners Star Speaks Out Against Teams Quiet Winter

May 17, 2025 -

Angel Reeses Fiery Rebuttal Addressing Criticism After Chrisean Rock Interview

May 17, 2025

Angel Reeses Fiery Rebuttal Addressing Criticism After Chrisean Rock Interview

May 17, 2025 -

New York Daily News Digital Archives May 2025

May 17, 2025

New York Daily News Digital Archives May 2025

May 17, 2025

Latest Posts

-

Jean Marsh Upstairs Downstairs A Legacy Remembered At 90

May 17, 2025

Jean Marsh Upstairs Downstairs A Legacy Remembered At 90

May 17, 2025 -

Top 10 Sherlock Holmes Quotes A Definitive Ranking

May 17, 2025

Top 10 Sherlock Holmes Quotes A Definitive Ranking

May 17, 2025 -

12 Essential Sci Fi Shows To Binge Watch Now

May 17, 2025

12 Essential Sci Fi Shows To Binge Watch Now

May 17, 2025 -

Tributes Pour In Following The Death Of Upstairs Downstairs Star Jean Marsh

May 17, 2025

Tributes Pour In Following The Death Of Upstairs Downstairs Star Jean Marsh

May 17, 2025 -

12 Must Watch Sci Fi Shows Ranked

May 17, 2025

12 Must Watch Sci Fi Shows Ranked

May 17, 2025