Private Credit Investment: Invesco And Barings Open Doors For Everyday Investors

Table of Contents

Invesco's Approach to Private Credit Investment

Invesco, a global investment management firm, offers a range of private credit investment strategies designed to provide diversified exposure to this asset class. Their approach incorporates both direct lending and fund-of-funds strategies, allowing for a balanced portfolio.

-

Invesco's Private Credit Offerings and Strategies: Invesco leverages its extensive network and expertise to identify attractive private credit opportunities across various sectors and geographies. They offer diverse strategies, including direct lending to middle-market companies and investments in private credit funds managed by other reputable firms. This diversified approach helps mitigate risk.

-

Investment Approach: Invesco's private credit investments focus on providing senior secured debt, which generally carries lower risk compared to other forms of private debt. Their team rigorously assesses the creditworthiness of borrowers and structures investments to protect against potential defaults.

-

Risk-Return Profile: While private credit investments generally offer the potential for higher returns than traditional fixed-income investments, they also carry inherent risks. Invesco's strategies aim to balance risk and return by focusing on high-quality borrowers and employing robust risk management practices.

-

Specific Invesco Funds: Invesco offers access to private credit through various funds and investment vehicles, some of which may be available to everyday investors with lower minimum investment thresholds. It's crucial to check the specific requirements and suitability for your personal circumstances.

-

Benefits of Diversification: Investing in Invesco's private credit offerings allows for diversification beyond traditional public market investments, potentially reducing overall portfolio volatility.

Barings' Strategy in the Private Credit Market

Barings, another prominent global investment firm, also plays a significant role in the private credit market. They employ a focused strategy targeting specific segments within the private debt landscape.

-

Barings' Private Credit Investment Strategy: Barings focuses on generating attractive risk-adjusted returns by carefully selecting private credit investments across various market segments. Their expertise lies in identifying opportunities in middle-market lending and other niche areas of the private debt market.

-

Types of Private Credit Investments: Barings' private credit portfolio includes senior secured loans, subordinated debt, and other credit instruments. They carefully analyze the financial health and prospects of borrowers before committing capital.

-

Risk Management Framework: Barings employs a rigorous risk management framework to assess and mitigate potential risks associated with private credit investments. This includes comprehensive due diligence, ongoing monitoring of borrowers, and stress testing of their portfolio.

-

Potential Benefits and Drawbacks: The potential benefits include higher yields and reduced correlation with public markets. However, it is important to understand that private credit investments are illiquid and may have longer lock-up periods than traditional investments.

-

Innovative Approaches: Barings continuously seeks innovative approaches to private credit investing, including leveraging technology and data analytics to improve their investment process and risk management.

The Advantages of Private Credit Investments for Everyday Investors

Private credit investments offer several compelling advantages for everyday investors seeking to enhance their portfolio returns and diversify their holdings.

-

Potential for Higher Returns: Private credit often provides the potential for higher returns compared to traditional fixed-income investments such as government bonds or highly-rated corporate bonds, due to the higher risk profile.

-

Reduced Correlation with Public Markets: Private credit investments typically exhibit low correlation with public equity and bond markets, making them a valuable tool for portfolio diversification and risk management.

-

Opportunities for Income Generation: Private credit investments generate income through regular interest payments, contributing to a steady stream of cash flow for investors.

-

Risks and Mitigation: Like any investment, private credit carries risks, including the potential for default by borrowers. However, these risks can be mitigated through careful selection of investments and diversification across different borrowers and sectors.

-

Due Diligence and Professional Advice: Thorough due diligence and, if necessary, seeking professional financial advice are crucial before investing in private credit to ensure it aligns with your individual risk tolerance and investment goals.

Accessibility and Investment Vehicles

Accessing private credit investments may seem daunting, but several vehicles make it increasingly accessible to everyday investors:

-

Mutual Funds and ETFs: Many mutual funds and ETFs provide exposure to private credit through investments in underlying private credit funds. These offer greater accessibility with lower minimum investment requirements compared to direct investments.

-

Separately Managed Accounts: High-net-worth individuals may access private credit through separately managed accounts, offering tailored portfolios based on their risk profiles and objectives. However, minimum investment requirements tend to be substantially higher than mutual funds or ETFs.

-

Fees and Minimum Investments: Fees and minimum investment amounts vary depending on the chosen investment vehicle. It's essential to compare fees and requirements before making an investment decision.

Conclusion

Invesco and Barings are leading the charge in making private credit investment more accessible to a wider range of investors. By understanding their strategies and the potential benefits of this asset class, everyday investors can explore opportunities to diversify their portfolios and potentially enhance returns. However, it's crucial to remember that private credit investments come with risks, and thorough due diligence and potentially professional financial advice are essential.

Ready to explore the world of private credit investment? Research Invesco and Barings' offerings and consider how private credit might complement your investment strategy. Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

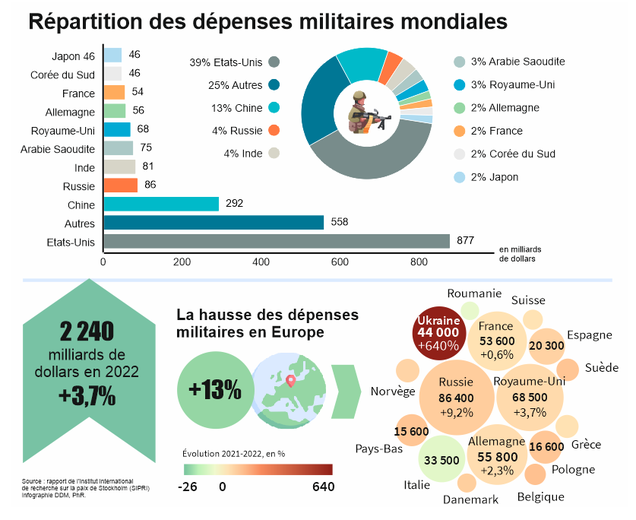

John Plassard Sur Les Depenses Militaires Usa Et Russie Face A Face

Apr 23, 2025

John Plassard Sur Les Depenses Militaires Usa Et Russie Face A Face

Apr 23, 2025 -

Skubals 7 Inning Shutout A Masterclass Against The Brewers

Apr 23, 2025

Skubals 7 Inning Shutout A Masterclass Against The Brewers

Apr 23, 2025 -

Brewers Humiliate Athletics In Historic Win

Apr 23, 2025

Brewers Humiliate Athletics In Historic Win

Apr 23, 2025 -

Chto Mozhno I Nelzya Delat V Chistiy Ponedelnik 3 Marta 2025 Goda

Apr 23, 2025

Chto Mozhno I Nelzya Delat V Chistiy Ponedelnik 3 Marta 2025 Goda

Apr 23, 2025 -

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025

Yankees Opening Day Win A Winning Formula Against Brewers

Apr 23, 2025