Private Credit Jobs: 5 Key Do's And Don'ts For Success

Table of Contents

<p><b>Meta Description:</b> Land your dream private credit job! Learn the 5 crucial dos and don'ts for navigating the competitive private credit industry and maximizing your career potential. Discover essential skills and strategies for success.</p>

<p>Breaking into the lucrative world of private credit jobs requires more than just a strong resume. This competitive field demands a specific skill set and understanding of the industry's unique nuances. This article outlines five key "dos" and "don'ts" to help you stand out from the competition and achieve success in your private credit career. Whether you're a recent graduate or a seasoned professional looking to transition, understanding these crucial elements will significantly boost your chances.</p>

<h2>Do's for Private Credit Job Success</h2>

<h3>1. Develop In-Demand Skills</h3>

<p>The private credit industry demands a robust skillset. To stand out, you need to master several key areas:</p> <ul> <li><b>Master financial modeling and valuation techniques:</b> Become proficient in Discounted Cash Flow (DCF) analysis, leveraged buyout (LBO) modeling, and other valuation methodologies crucial for assessing investment opportunities. Practice building sophisticated financial models and understand their limitations.</li> <li><b>Become proficient in credit analysis and underwriting:</b> Learn how to assess credit risk, analyze financial statements, and perform thorough due diligence. Understanding credit scoring, covenants, and risk mitigation strategies is essential.</li> <li><b>Develop strong knowledge of legal and regulatory frameworks:</b> Familiarity with relevant laws and regulations governing private credit transactions is crucial. This includes understanding compliance requirements and best practices.</li> <li><b>Build expertise in specific sectors within private credit:</b> Focusing on a niche, such as real estate private credit, healthcare private credit, or infrastructure private credit, can give you a competitive edge. Developing sector-specific expertise demonstrates a deeper understanding of the market.</li> <li><b>Enhance your understanding of portfolio management and risk assessment:</b> Learn how to manage a portfolio of private credit investments, including diversification strategies, risk monitoring, and performance measurement.</li> </ul>

<h3>2. Network Strategically</h3>

<p>Networking is paramount in the private credit world. Building relationships is key to uncovering hidden opportunities and gaining valuable insights.</p> <ul> <li><b>Attend industry conferences and events:</b> These events offer excellent networking opportunities to connect with professionals and learn about industry trends.</li> <li><b>Join relevant professional organizations:</b> Organizations like the CFA Institute provide access to networking events, educational resources, and industry leaders.</li> <li><b>Leverage LinkedIn:</b> Use LinkedIn to connect with professionals in private credit, follow industry influencers, and participate in relevant discussions.</li> <li><b>Informational interviews are key:</b> Research firms and individuals you admire, and reach out for informational interviews to learn more about their experiences and the industry.</li> <li><b>Build relationships with professors and alumni:</b> Leverage your academic network to connect with professionals in the field.</li> </ul>

<h3>3. Craft a Compelling Resume and Cover Letter</h3>

<p>Your resume and cover letter are your first impression. They must effectively showcase your skills and experience.</p> <ul> <li><b>Tailor your resume and cover letter:</b> Customize your materials for each specific job application, highlighting the skills and experience most relevant to the position.</li> <li><b>Highlight relevant experience and quantify your achievements:</b> Use numbers and data to demonstrate the impact of your work. For example, instead of saying "Improved efficiency," say "Improved efficiency by 15%." </li> <li><b>Use keywords relevant to private credit jobs:</b> Incorporate keywords like "credit underwriting," "debt financing," "leveraged buyouts," "distressed debt," and "private equity" to optimize your application for Applicant Tracking Systems (ATS).</li> <li><b>Showcase your analytical and problem-solving abilities:</b> Highlight your ability to analyze complex data, identify trends, and solve problems.</li> <li><b>Emphasize any experience in financial modeling or investment analysis:</b> Demonstrate your proficiency in building financial models and conducting investment analysis.</li> </ul>

<h3>4. Ace the Interview Process</h3>

<p>The interview process is crucial. Preparation is key to success.</p> <ul> <li><b>Prepare for behavioral questions, technical questions, and case studies:</b> Practice answering common interview questions and prepare for technical questions related to financial modeling, credit analysis, and private credit markets. Practice case studies to demonstrate your problem-solving skills.</li> <li><b>Practice your answers and showcase your knowledge:</b> Rehearse your answers to common questions and demonstrate a deep understanding of the private credit market.</li> <li><b>Demonstrate your understanding of financial statements and credit risk:</b> Be prepared to discuss your understanding of financial statement analysis and credit risk assessment methodologies.</li> <li><b>Research the firm and interviewer beforehand:</b> Show your genuine interest by researching the firm's investment strategy, recent transactions, and the interviewer's background.</li> <li><b>Ask insightful questions:</b> Prepare thoughtful questions to demonstrate your interest and engagement.</li> </ul>

<h3>5. Continuously Learn and Adapt</h3>

<p>The private credit landscape is constantly evolving. Continuous learning is essential for staying ahead of the curve.</p> <ul> <li><b>Stay updated on market trends and regulatory changes:</b> Follow industry news, read publications, and attend webinars to stay informed about the latest developments.</li> <li><b>Pursue relevant certifications:</b> Consider obtaining certifications such as the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) designations to enhance your credibility.</li> <li><b>Read industry publications and follow key influencers:</b> Stay informed by reading industry publications, following key influencers on social media, and attending industry events.</li> <li><b>Attend webinars and workshops:</b> Enhance your skills by participating in webinars and workshops focused on private credit topics.</li> <li><b>Embrace lifelong learning:</b> Stay competitive by continuously seeking opportunities to expand your knowledge and skills.</li> </ul>

<h2>Don'ts for Private Credit Job Success</h2>

<h3>1. Neglect Networking</h3>

<p>Don't underestimate the power of networking. It's often the key to unlocking unadvertised opportunities and gaining valuable industry insights. Actively cultivate relationships within the private credit community.</p>

<h3>2. Submit Generic Applications</h3>

<p>Don't submit generic resumes and cover letters. Each application should be tailored to the specific requirements and culture of the target firm. Generic applications often get overlooked.</p>

<h3>3. Underprepare for Interviews</h3>

<p>Don't go into interviews unprepared. Thorough preparation, including practicing answers to common questions and researching the firm and interviewer, significantly increases your chances of success. Private credit interviews often involve detailed technical questions.</p>

<h3>4. Ignore Industry News</h3>

<p>Don't become complacent. Staying informed about market trends, regulatory changes, and economic factors is crucial for success in the dynamic private credit industry.</p>

<h3>5. Underestimate the Importance of Soft Skills</h3>

<p>Don't overlook the importance of communication, teamwork, and problem-solving skills. These soft skills are crucial in the collaborative and demanding environment of private credit. Strong interpersonal skills are as valuable as technical expertise.</p>

<h2>Conclusion</h2>

<p>Securing a successful career in private credit jobs requires a strategic approach. By following these "dos" and avoiding the "don'ts," you'll significantly improve your chances of landing your dream job and thriving in this competitive industry. Remember, continuous learning, strategic networking, and a well-crafted application are essential components for success. Develop a strong understanding of financial modeling, credit analysis, and the legal landscape of private credit.</p>

<p><b>Call to Action:</b> Ready to take the next step in your private credit job search? Start by developing your skills, building your network, and crafting a compelling application. Mastering these strategies will set you on the path to a rewarding career in private credit. Begin your journey towards a successful private credit career today!</p>

Featured Posts

-

The Politics Of Grief Trumps Participation In Pope Benedicts Funeral Rites

Apr 27, 2025

The Politics Of Grief Trumps Participation In Pope Benedicts Funeral Rites

Apr 27, 2025 -

Concerns Raised Over Anti Vaccination Advocates Role In Autism Study

Apr 27, 2025

Concerns Raised Over Anti Vaccination Advocates Role In Autism Study

Apr 27, 2025 -

Eliminacion Inesperada En Indian Wells Quien Fue La Favorita Que Cayo

Apr 27, 2025

Eliminacion Inesperada En Indian Wells Quien Fue La Favorita Que Cayo

Apr 27, 2025 -

The Alberta Anomaly How Oil Wealth Shaped Canadian Anti Trump Sentiment

Apr 27, 2025

The Alberta Anomaly How Oil Wealth Shaped Canadian Anti Trump Sentiment

Apr 27, 2025 -

Alberto Ardila Olivares Tu Garantia De Exito En El Futbol

Apr 27, 2025

Alberto Ardila Olivares Tu Garantia De Exito En El Futbol

Apr 27, 2025

Latest Posts

-

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025

Starbucks Union Spurns Companys Guaranteed Raise Proposal

Apr 28, 2025 -

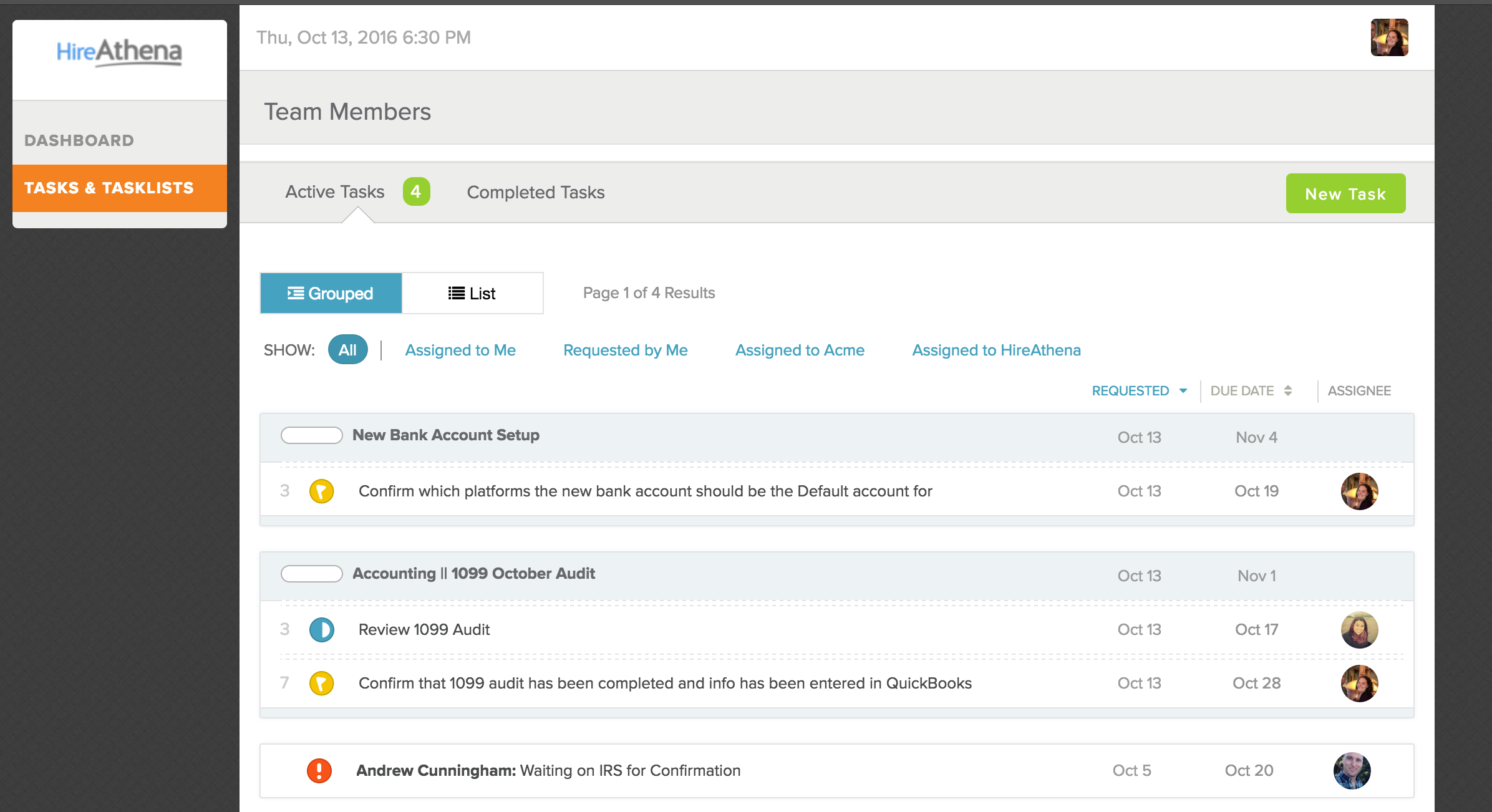

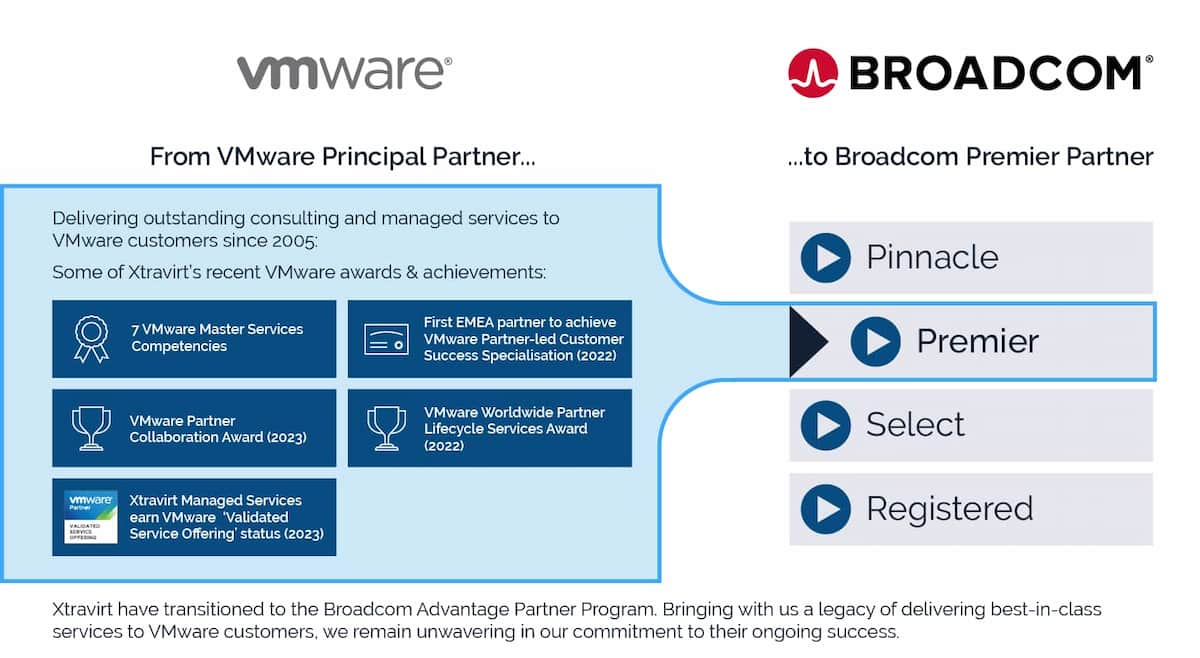

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025

The Broadcom V Mware Deal An Extreme Price Hike Of 1 050 For At And T

Apr 28, 2025 -

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025

At And T Raises Alarm Over Extreme V Mware Price Hike After Broadcom Deal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025