Private Credit Stress: Early Warning Signs And Market Implications

Table of Contents

Identifying Early Warning Signs of Private Credit Stress

The private credit market, while offering attractive returns, is not immune to periods of stress. Recognizing the early warning signs is paramount for proactive risk management. Several key indicators point towards potential trouble.

Rising Defaults and Delinquencies

Increasing default rates across various private credit sectors serve as a significant red flag. Direct lending, mezzanine financing, and distressed debt are particularly vulnerable. Monitoring delinquency trends is crucial, as they often precede defaults. A sharp increase in late payments signals potential problems with borrower repayment capacity.

- Increased late payments on loans: A noticeable rise in the percentage of borrowers failing to make timely payments.

- Higher-than-average default rates in specific sectors: Certain industries might be more susceptible to economic downturns, leading to higher default rates within those sectors of the private credit market.

- Difficulty in refinancing existing debt: Borrowers struggling to secure new financing to replace maturing loans indicate underlying financial weakness.

Reliable data from credit rating agencies and market research firms should be consulted to track these trends effectively. A significant uptick in these indicators warrants close scrutiny.

Deteriorating Credit Metrics of Borrowers

A decline in the creditworthiness of borrowers is another critical warning sign. This manifests in several ways:

- Declining EBITDA margins: Shrinking profit margins indicate reduced profitability and a weakening ability to service debt.

- Increased leverage and debt levels: High debt-to-equity ratios point to excessive borrowing, increasing vulnerability to economic shocks.

- Negative cash flow trends: Consistent negative cash flow indicates an inability to generate sufficient cash to meet debt obligations.

- Rising interest coverage ratios: A declining ability to cover interest payments with operating income signifies increasing financial strain.

Covenant breaches, where borrowers violate the terms of their loan agreements, are further indicators of financial distress and should trigger immediate attention. Regular monitoring of borrower credit scores and ratings is essential to identify deteriorating credit metrics early.

Reduced Liquidity in the Private Credit Market

Decreased liquidity is a major concern, reflecting reduced investor appetite and lower fundraising activity. This translates into several observable market changes:

- Decreased availability of new credit: Borrowers may find it harder to secure new loans, increasing their financial vulnerability.

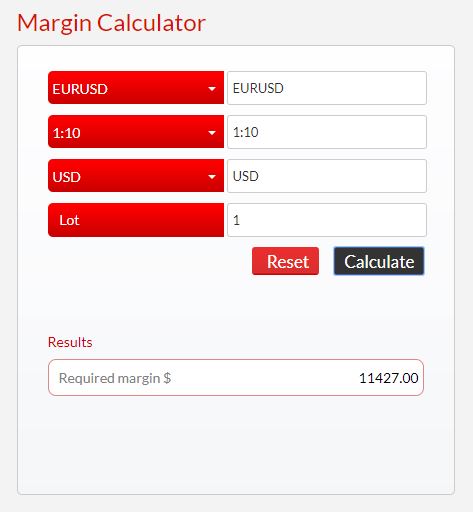

- Higher borrowing costs: Increased risk premiums lead to higher interest rates for borrowers, exacerbating their financial difficulties.

- Increased difficulty in exiting investments: Investors may face challenges selling their private credit holdings, leading to illiquidity.

Macroeconomic factors and regulatory changes also contribute to reduced liquidity. Understanding these broader market forces is crucial for interpreting liquidity trends within the private credit market.

Market Implications of Private Credit Stress

The consequences of private credit stress extend far beyond the private credit market itself, impacting the broader financial system and the real economy.

Contagion Effect on Other Financial Markets

Stress in the private credit market can trigger a contagion effect, spreading to other asset classes:

- Increased volatility in stock and bond markets: Concerns about private credit defaults can spill over into public markets, increasing market uncertainty and volatility.

- Potential for credit rating downgrades: Widespread defaults could lead to credit rating downgrades for various financial institutions and corporations, increasing borrowing costs.

- Reduced investor confidence: Market uncertainty can lead to a decline in investor confidence across different asset classes.

This interconnectedness highlights the systemic risk associated with private credit stress.

Impact on Economic Growth

The impact on businesses reliant on private credit financing is significant:

- Reduced business investment: Higher borrowing costs and reduced credit availability can stifle business investment and hinder economic growth.

- Slower economic growth: Reduced investment and business activity can lead to a slowdown in overall economic growth.

- Increased unemployment: Economic downturns can result in job losses and increased unemployment.

Opportunities for Investors

While private credit stress presents risks, it also creates opportunities for specialized investors:

- Potential for higher returns in distressed debt investments: Investors with expertise in distressed debt can profit from acquiring assets at discounted prices.

- Opportunities for strategic acquisitions of financially troubled companies: Companies facing financial difficulties may become attractive acquisition targets for strategic buyers.

However, careful due diligence and robust risk management are crucial for navigating these opportunities successfully.

Conclusion

Monitoring for signs of private credit stress is critical for navigating the current economic landscape. Understanding the early warning signs, such as rising defaults, deteriorating credit metrics, and reduced liquidity, allows investors and businesses to proactively manage risk and identify potential opportunities. By closely tracking these indicators and their broader market implications, stakeholders can make informed decisions and mitigate the potential impact of private credit stress. Stay informed about potential shifts in the private credit market and actively manage your exposure to private credit risk. Remember, understanding private credit stress and its various manifestations is key to sound financial planning and investment strategies.

Featured Posts

-

Hhs Investigation Into Debunked Autism Vaccine Link Draws Criticism

Apr 27, 2025

Hhs Investigation Into Debunked Autism Vaccine Link Draws Criticism

Apr 27, 2025 -

Blue Origins Rocket Launch Subsystem Issue Causes Delay

Apr 27, 2025

Blue Origins Rocket Launch Subsystem Issue Causes Delay

Apr 27, 2025 -

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025

Bencics Stylish Abu Dhabi Open Victory

Apr 27, 2025 -

Canadas Calculated Wait Assessing Leverage In Us Trade Talks

Apr 27, 2025

Canadas Calculated Wait Assessing Leverage In Us Trade Talks

Apr 27, 2025 -

La Campanada De Indian Wells Una Favorita Fuera De La Competicion

Apr 27, 2025

La Campanada De Indian Wells Una Favorita Fuera De La Competicion

Apr 27, 2025

Latest Posts

-

Pirates Defeat Yankees In Extra Innings With Walk Off

Apr 28, 2025

Pirates Defeat Yankees In Extra Innings With Walk Off

Apr 28, 2025 -

Walk Off Win For Pirates Against Yankees

Apr 28, 2025

Walk Off Win For Pirates Against Yankees

Apr 28, 2025 -

Pirates Edge Yankees After Extra Innings Battle

Apr 28, 2025

Pirates Edge Yankees After Extra Innings Battle

Apr 28, 2025 -

Yankees Lose Heartbreaker To Pirates On Walk Off Hit

Apr 28, 2025

Yankees Lose Heartbreaker To Pirates On Walk Off Hit

Apr 28, 2025 -

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025

Pirates Win Walk Off Thriller Against Yankees In Extras

Apr 28, 2025