Private Equity Buys Celtics For $6.1 Billion: Impact On Team And Fans

Table of Contents

Financial Implications of the Private Equity Celtics Purchase

The sheer scale of the Private Equity Celtics Purchase necessitates a close examination of its financial aspects. This massive investment will undoubtedly reshape the Celtics' financial landscape, creating both opportunities and challenges.

Increased Investment in Player Acquisition and Development

One of the most anticipated outcomes of this deal is a significant boost in investment. The influx of capital could lead to:

- Enhanced scouting network: A more robust scouting system will allow the Celtics to identify and recruit top talent more effectively.

- State-of-the-art training facilities: Upgrades to training facilities and technology will enhance player development and injury prevention.

- Competitive salary offers for top talent: The Celtics will be better positioned to compete for high-profile free agents, improving their chances of building a championship-caliber team.

This increased spending power could significantly improve the team's competitiveness and long-term success, potentially leading to more playoff appearances and championship contention.

Potential for Increased Ticket Prices and Merchandise Costs

While increased investment is positive, a concern for many fans is the potential for higher ticket prices and merchandise costs. The financial justification for the owners might be increased revenue streams, but it's crucial to consider strategies that mitigate price increases to maintain fan accessibility. These could include:

- Premium seating options: Offering a tiered pricing system could balance increased revenue with affordability for the average fan.

- Increased merchandise variety: A wider selection of merchandise might justify slightly higher prices while catering to different fan preferences.

- Potential for fan loyalty programs and discounts: Rewarding loyal fans with discounts and exclusive access can offset price increases and strengthen the fan-team relationship.

Debt and Financial Risk Management

The $6.1 billion acquisition likely involved significant debt. Understanding the acquiring firm's financial stability and risk management strategies is critical. Key factors to consider include:

- Debt servicing costs: The interest payments on the debt could impact the team's financial flexibility.

- Interest rate fluctuations: Changes in interest rates could significantly affect the team's debt burden.

- Potential for refinancing: The ability to refinance the debt at favorable rates will play a crucial role in the team's long-term financial health.

Impact on Team Performance and Strategy

The Private Equity Celtics Purchase will likely lead to changes impacting team performance and overall strategy.

Changes in Team Management and Coaching Staff

New ownership often brings changes in team management and coaching staff. This could potentially:

- New general manager appointments: The new owners may seek to bring in their own leadership team with a different vision for the franchise.

- Coaching staff changes: Changes in coaching staff could reflect a shift in the team's playing style and strategic approach.

- Shift in team building philosophies: The new owners might favor different player profiles and team-building strategies.

Long-Term Strategic Goals and Vision

Understanding the private equity firm's long-term vision for the Celtics is crucial. This will likely involve:

- Expansion of the team's brand: The new owners may pursue aggressive marketing strategies to expand the Celtics' global reach and brand recognition.

- Investment in community programs: Community involvement can be a key aspect of a team's long-term success and brand image.

- Development of new revenue streams: Exploring new avenues for revenue generation beyond traditional sources is a critical aspect of long-term financial sustainability.

The Fan Perspective: Concerns and Expectations

The Private Equity Celtics Purchase has generated a range of emotions among fans. Addressing their concerns and expectations is critical for the franchise's long-term success.

Maintaining Fan Engagement and Loyalty

Maintaining fan engagement is paramount. Strategies to achieve this include:

- Improved fan communication channels: Open and transparent communication with fans will foster trust and understanding.

- Enhanced in-game experience: Investing in the in-game experience to make it more enjoyable and memorable for fans is essential.

- Fan forums and feedback mechanisms: Providing platforms for fan feedback and interaction will help the team understand and address fan concerns.

Impact on Game Atmosphere and Team Culture

The unique atmosphere and culture of the Celtics are cherished by fans. Maintaining this while balancing commercial interests is crucial. Considerations include:

- Maintaining team traditions and history: Preserving the team's legacy and traditions is key to retaining fan loyalty.

- Balancing commercial interests with fan experience: Finding a balance between maximizing revenue and maintaining a positive fan experience is essential.

- Community engagement initiatives: Continued community engagement can reinforce the team's connection with its fans and the city of Boston.

Conclusion

The Private Equity Celtics Purchase presents a complex array of possibilities and challenges. While the significant financial investment promises potential for enhanced player acquisition and development, it also raises concerns regarding ticket prices and the overall fan experience. The success of this Private Equity Celtics Purchase hinges on the new owners’ ability to balance financial goals with fan engagement, maintaining the unique culture and traditions that make the Boston Celtics so beloved. Stay informed about the evolving developments surrounding this Private Equity Celtics Purchase to understand its lasting impact on the franchise and the passionate Celtics fanbase.

Featured Posts

-

Trump Family Tree Exploring The Extensive Lineage Of The Former Us President

May 17, 2025

Trump Family Tree Exploring The Extensive Lineage Of The Former Us President

May 17, 2025 -

Ankle Injury Ends Brunsons Night Knicks Fall To Lakers In Overtime

May 17, 2025

Ankle Injury Ends Brunsons Night Knicks Fall To Lakers In Overtime

May 17, 2025 -

Mikal Bridges On Knicks Starters Minutes A Request To Coach Thibodeau

May 17, 2025

Mikal Bridges On Knicks Starters Minutes A Request To Coach Thibodeau

May 17, 2025 -

Upad Prosvjednika U Tesla Showroom U Berlinu Detalji I Posljedice

May 17, 2025

Upad Prosvjednika U Tesla Showroom U Berlinu Detalji I Posljedice

May 17, 2025 -

Alcaraz Povreden Rune Slavi U Finalu Barcelone

May 17, 2025

Alcaraz Povreden Rune Slavi U Finalu Barcelone

May 17, 2025

Latest Posts

-

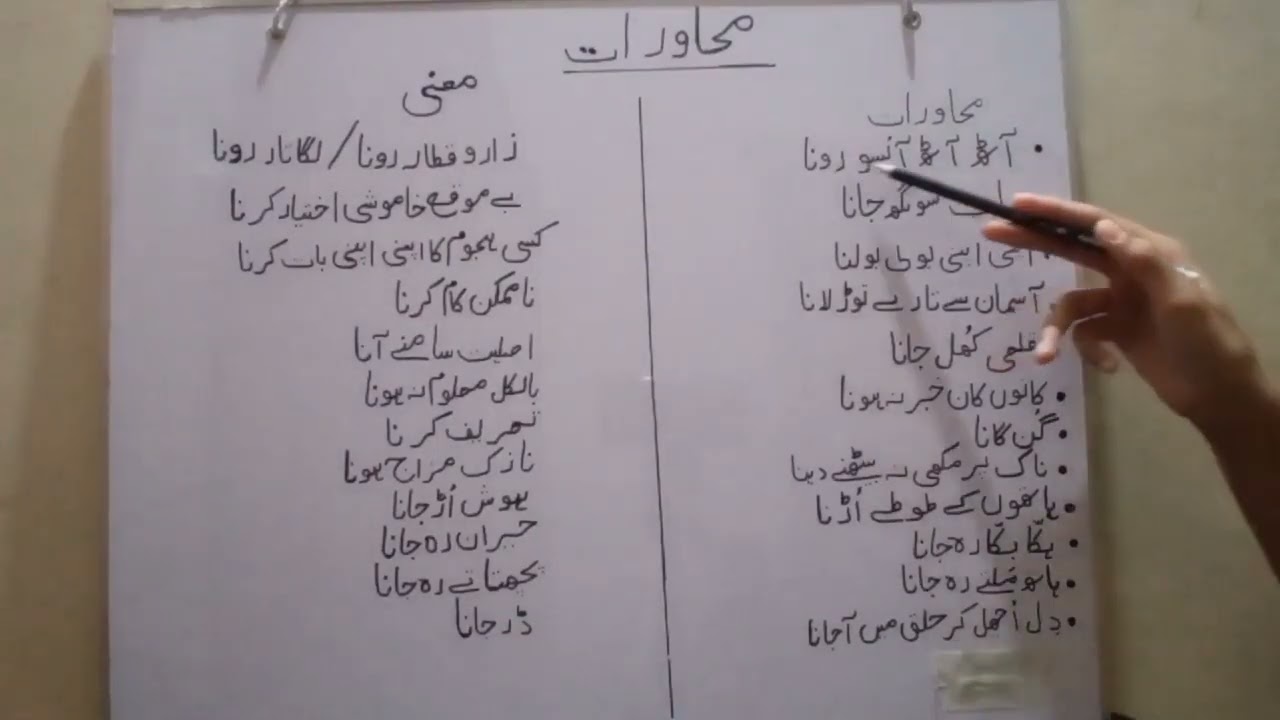

Myre Mdahwn Myn Asamh Bn Ladn Ka Mqam Alka Yagnk Ka Byan

May 18, 2025

Myre Mdahwn Myn Asamh Bn Ladn Ka Mqam Alka Yagnk Ka Byan

May 18, 2025 -

Alka Yagnk Ke Mdahwn Ky Fhrst Myn Asamh Bn Ladn Ky Ahmyt

May 18, 2025

Alka Yagnk Ke Mdahwn Ky Fhrst Myn Asamh Bn Ladn Ky Ahmyt

May 18, 2025 -

Netflix And The American Manhunt The Osama Bin Laden Documentarys Absence Explained

May 18, 2025

Netflix And The American Manhunt The Osama Bin Laden Documentarys Absence Explained

May 18, 2025 -

Asamh Bn Ladn Alka Yagnk Ke Mdahwn Ky Fhrst Myn Phla Nam

May 18, 2025

Asamh Bn Ladn Alka Yagnk Ke Mdahwn Ky Fhrst Myn Phla Nam

May 18, 2025 -

American Manhunt Osama Bin Laden Why No Netflix Streaming

May 18, 2025

American Manhunt Osama Bin Laden Why No Netflix Streaming

May 18, 2025