ProShares' XRP ETFs: Details On The New Non-Spot Offerings

Table of Contents

Understanding ProShares' Non-Spot XRP ETF Strategy

A crucial distinction exists between spot and non-spot ETFs. A spot ETF directly holds the underlying asset (in this case, XRP), mirroring its price movements. A non-spot ETF, however, invests in instruments related to XRP, such as futures contracts or other XRP-linked securities. This approach often leads to a quicker approval process, bypassing some of the regulatory hurdles associated with directly holding cryptocurrencies.

This strategic difference presents both advantages and disadvantages. While a non-spot approach might offer quicker access to the XRP market through a regulated ETF investment, it could also lead to tracking differences – meaning the ETF's price might not perfectly match XRP's price. This discrepancy arises because the ETF's value is tied to the performance of its underlying assets, not XRP itself.

- Potential Underlying Assets: ProShares' non-spot XRP ETF might hold XRP futures contracts, options, or other financial instruments that derive their value from XRP's price.

- Comparison to Existing Non-Spot ETFs: While not directly comparable to existing non-spot cryptocurrency ETFs (if any), this strategy allows for a comparison in terms of risk/reward profiles and regulatory compliance.

- Risk/Reward Profile: Non-spot XRP ETFs likely carry a different risk profile than spot ETFs. Investors need to consider the potential for tracking error and the impact of market volatility on the underlying derivative instruments.

Regulatory Landscape and SEC Approval for ProShares' XRP ETF

The regulatory landscape surrounding cryptocurrency ETFs, especially in the US, is complex and constantly evolving. The SEC's scrutiny of spot cryptocurrency ETFs stems from concerns about market manipulation, custody, and investor protection. Non-spot ETFs, however, might face fewer regulatory barriers as they don't directly hold the cryptocurrency.

The likelihood of approval for ProShares' non-spot XRP ETF hinges on the SEC's assessment of the ETF's proposed structure and risk mitigation measures. A crucial factor will be whether the SEC deems the underlying assets sufficiently regulated and transparent. The approval timeline remains uncertain, subject to ongoing regulatory reviews.

- Recent SEC Decisions: Examining past SEC decisions regarding cryptocurrency ETF applications provides insights into the agency's current thinking and potential criteria for approval.

- Legal Challenges and Precedents: Any legal challenges or successful precedents related to cryptocurrency ETFs could influence the approval process for ProShares' offering.

- Future Regulatory Changes: Changes in cryptocurrency regulation could significantly impact the performance and viability of the ETF.

Investment Implications and Strategies for ProShares' XRP ETF

Investing in ProShares' non-spot XRP ETF offers several potential advantages: diversification of a portfolio, convenient exposure to XRP's price movements, and regulated access to a potentially high-growth asset class. However, risks remain. The volatility of the cryptocurrency market and the regulatory uncertainty surrounding crypto assets could significantly impact the ETF's performance.

Investors should carefully assess their risk tolerance before investing. The ETF's suitability depends on individual investment goals and overall portfolio strategy.

- Risk Assessment: Consider factors such as investment horizon, risk tolerance, and overall portfolio diversification when determining the appropriate allocation to the ProShares XRP ETF.

- Asset Allocation: Incorporate the ETF strategically within a broader portfolio based on a well-defined asset allocation strategy.

- Comparison with Other XRP Investment Options: Weigh the advantages and disadvantages of investing in the ETF compared to directly purchasing XRP or using other XRP-related investment products.

Comparing ProShares' XRP ETF to Competitors

While ProShares' offering might be a first-mover advantage in some specific markets, a direct comparison to other existing or anticipated XRP ETFs depends on the competitive landscape. Key factors for comparison include expense ratios, underlying assets, investment strategies (spot vs. non-spot), and overall investment approach.

A detailed comparative table would be beneficial for investors to analyze fees and risk-return profiles side by side.

- Fee Structure Comparison: Analyze expense ratios and trading fees to determine the overall cost-effectiveness of investing in ProShares' ETF versus its competitors.

- Investment Strategy Comparison: Assess the differences between spot and non-spot strategies, focusing on the potential implications for tracking error and risk.

- Advantages and Disadvantages: Weigh the benefits and drawbacks of each ETF relative to an investor's individual needs and preferences.

Conclusion: Investing in the Future with ProShares' XRP ETFs

ProShares' non-spot XRP ETF presents a potentially revolutionary approach to XRP investment, offering regulated access through a familiar ETF structure. While the non-spot strategy might present some tracking differences compared to a direct spot investment, it also promises a smoother regulatory path to market. Potential investors must carefully assess the associated risks, including market volatility and regulatory uncertainty.

To make informed investment decisions, conduct thorough research, consider seeking advice from a qualified financial advisor, and understand the nuances of non-spot ETF investments. The ProShares XRP ETF, along with other non-spot XRP ETFs and cryptocurrency ETF investments, will undoubtedly shape the future of cryptocurrency investing. Learn more today and consider adding this innovative investment vehicle to your diversified portfolio.

Featured Posts

-

Arsenal Psg Macini Sifresiz Canli Izlemenin Yollari

May 08, 2025

Arsenal Psg Macini Sifresiz Canli Izlemenin Yollari

May 08, 2025 -

Contest From Hell First Trailer For Dystopian Horror Movie

May 08, 2025

Contest From Hell First Trailer For Dystopian Horror Movie

May 08, 2025 -

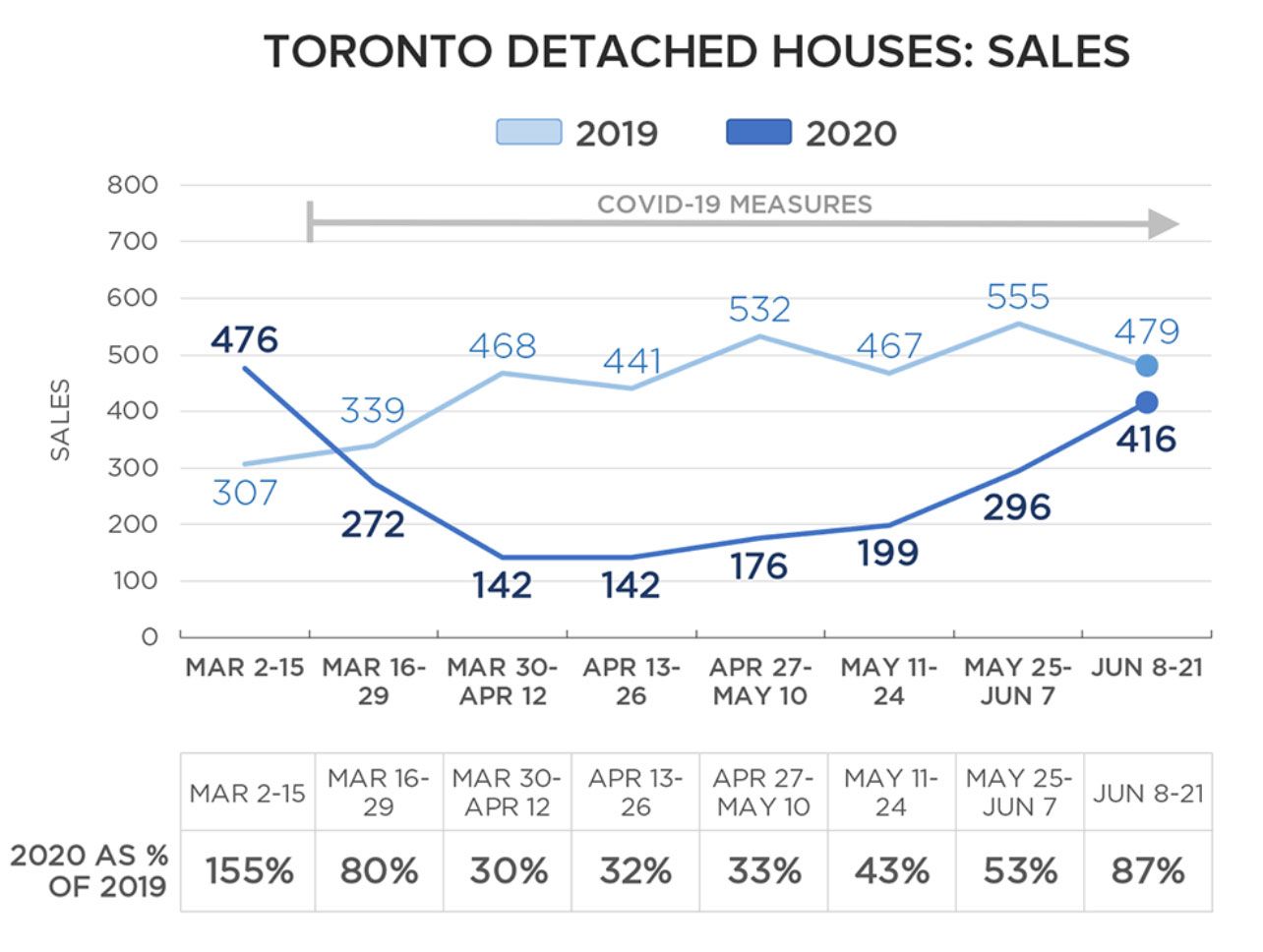

Sharp Decline In Toronto Home Sales 23 Year Over Year Drop 4 Price Reduction

May 08, 2025

Sharp Decline In Toronto Home Sales 23 Year Over Year Drop 4 Price Reduction

May 08, 2025 -

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Expert Prediction

May 08, 2025 -

Luis Enrique Ben Pastrim Te Psg 5 Yje Largohen

May 08, 2025

Luis Enrique Ben Pastrim Te Psg 5 Yje Largohen

May 08, 2025