Proposed Tax Hike Targets Harvard And Yale's Billions In Endowments

Table of Contents

The Details of the Proposed Tax Hike

A proposed tax hike aims to levy a significant tax on the massive endowments held by elite universities, primarily targeting institutions like Harvard and Yale. While the exact details may vary depending on the final legislation, the core concept involves imposing a percentage-based tax on a portion of these endowments' assets. This isn't just about Harvard and Yale; other universities with similarly substantial endowments would likely also be affected.

- Tax rate percentage: Proposals range from a few percentage points to potentially much higher rates, depending on the size of the endowment and specific legislative proposals. Some advocate for a progressive tax structure, with higher rates applied to larger endowments.

- Targeted asset types: The tax would likely target a broad range of assets held within the endowment, including stocks, bonds, real estate holdings, and other investments. The precise definition of "taxable assets" will be crucial in the final legislation.

- Proposed use of funds: The revenue generated from this proposed endowment tax is intended to be used for various public benefit purposes. Proposed uses include significantly increasing financial aid for underprivileged students across the country, bolstering underfunded public education systems, and investing in critical social programs.

- Legislative sponsors and their rationale: The sponsors of these proposals typically emphasize the need to address wealth inequality and ensure greater equity in access to higher education. They argue that these massive endowments represent a significant underutilized resource that could dramatically improve societal well-being.

Arguments in Favor of the Proposed Tax Hike

Proponents of the proposed tax on university endowments argue that it's a necessary step towards addressing growing wealth inequality and promoting greater access to higher education. The sheer size of these endowments, accumulated over centuries, raises ethical questions about their societal responsibility.

- The ethical implications of vast wealth disparities: The immense wealth held by these institutions contrasts sharply with the financial struggles faced by many prospective students and the underfunding of public education. A tax on these endowments could help rectify this imbalance.

- The potential for increased financial aid and scholarships: A significant portion of the revenue generated could be directly channeled into need-based financial aid programs, making higher education more accessible to students from low-income backgrounds. This could lead to a more diverse and equitable student population at these universities and beyond.

- Addressing the underfunding of public education systems: Public schools in many areas are chronically underfunded, impacting the quality of education and opportunities available to students. Funds from the endowment tax could significantly alleviate these budgetary constraints, improving educational outcomes for a wider population.

- Examples of how the tax revenue could improve social programs: Beyond financial aid and public education, the revenue could be used to fund vital social programs addressing issues such as affordable housing, healthcare access, and community development.

Counterarguments Against the Proposed Tax Hike

Opponents of the proposed tax raise concerns about potential negative consequences for university research, endowment management, and legal challenges to the legislation.

- Impact on university research funding and innovation: Critics argue that reducing endowment assets could severely curtail funding for crucial research initiatives, impacting scientific advancements and technological innovation. This could harm the long-term competitiveness of American universities globally.

- The potential for endowment divestment and economic repercussions: The tax could incentivize universities to divest from certain assets or relocate funds, potentially impacting local economies and investment markets. Such actions could have far-reaching and unforeseen economic consequences.

- Concerns about the legal precedent and potential for broader implications: There are concerns that setting a precedent of taxing endowments could have broad implications for other non-profit organizations and potentially lead to further taxation of charitable assets.

- Arguments regarding the autonomy of private institutions: Some argue that the government should not interfere with the internal financial management of private institutions, regardless of the size of their endowments. They argue for the autonomy of these organizations to allocate their resources as they see fit.

The Potential Impact on Harvard and Yale

Harvard and Yale, with their massive endowments exceeding tens of billions of dollars, would be significantly affected by this proposed endowment tax. The impact extends beyond simple financial losses; it could reshape their admissions policies and financial aid distributions.

- Harvard's endowment size and its current allocation: Harvard's substantial endowment supports various initiatives, including research, financial aid, and infrastructure. A significant tax could drastically alter these allocations, forcing prioritization and potential cuts in certain areas.

- Yale's endowment size and its current financial aid practices: Yale's endowment also plays a crucial role in funding its financial aid programs. A tax could impact its ability to provide generous financial aid packages and may lead to changes in its financial aid distribution policies.

- Projected impact on financial aid and scholarship programs: The most immediate impact could be on financial aid, potentially resulting in reduced aid packages or fewer scholarships available to students. This would impact both current and prospective students.

- Potential changes in admissions policies or student body demographics: To compensate for reduced funds, universities might adjust their admissions policies, potentially impacting student body diversity and accessibility.

Conclusion

The debate surrounding this proposed tax hike on Harvard and Yale's endowments is complex and multifaceted. While proponents highlight the potential for addressing wealth inequality and improving access to higher education, opponents express concerns about the negative consequences for research, innovation, and the autonomy of private institutions. The proposed legislation's details – the tax rate, targeted assets, and use of funds – will ultimately shape its impact. Understanding the arguments for and against this proposed endowment tax is vital for informed participation in the ongoing discussion. The debate over this endowment tax is far from over. Stay informed about the progress of this legislation and engage in the conversation about fair taxation of large endowments. Let your voice be heard on this crucial issue affecting the future of higher education and wealth distribution. Consider the implications of a potential university endowment tax and how taxing university endowments might reshape the landscape of higher education.

Featured Posts

-

Understanding The Nba Draft Lottery Rules And Odds

May 13, 2025

Understanding The Nba Draft Lottery Rules And Odds

May 13, 2025 -

Town City Name Obituaries Saying Goodbye To Our Neighbors

May 13, 2025

Town City Name Obituaries Saying Goodbye To Our Neighbors

May 13, 2025 -

Landman Season 2 Casting News Demi Moores Role And Fan Reactions

May 13, 2025

Landman Season 2 Casting News Demi Moores Role And Fan Reactions

May 13, 2025 -

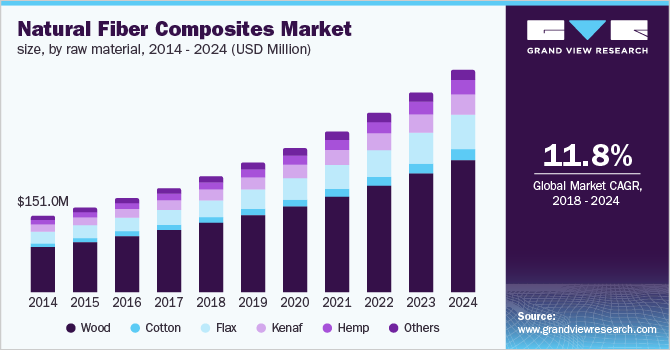

The Future Of Natural Fiber Composites A Global Market Forecast To 2029

May 13, 2025

The Future Of Natural Fiber Composites A Global Market Forecast To 2029

May 13, 2025 -

Three Cars Crash Into Townhouse In Two Years Cnn Video

May 13, 2025

Three Cars Crash Into Townhouse In Two Years Cnn Video

May 13, 2025

Latest Posts

-

Michigan Great Value Product Recall Warning

May 14, 2025

Michigan Great Value Product Recall Warning

May 14, 2025 -

Assessing Manchester Uniteds Transfer Market Prospects

May 14, 2025

Assessing Manchester Uniteds Transfer Market Prospects

May 14, 2025 -

Shark Ninja Pressure Cooker Recall What You Need To Know About Burn Injuries

May 14, 2025

Shark Ninja Pressure Cooker Recall What You Need To Know About Burn Injuries

May 14, 2025 -

Warning Great Value Products Recalled In Michigan

May 14, 2025

Warning Great Value Products Recalled In Michigan

May 14, 2025 -

Manchester Uniteds Strategic Positioning For Summer Signings

May 14, 2025

Manchester Uniteds Strategic Positioning For Summer Signings

May 14, 2025