Protect Yourself: Spotting And Avoiding Fake Steven Bartlett Investment Videos

Table of Contents

Red Flags: Identifying Fake Steven Bartlett Investment Videos

Many fraudulent videos deceptively claim endorsement or affiliation with Steven Bartlett. Learning to spot the red flags is crucial to protecting yourself from these investment scams.

Low-Quality Production and Editing

Professional videos from legitimate sources typically boast high production values. Fake investment videos, however, often exhibit telltale signs of amateur production.

- Grainy footage: Poor video quality is a significant warning sign.

- Inconsistent lighting: Amateurish lighting suggests a lack of professional production.

- Unprofessional voiceovers: Listen for awkward pauses, poor audio quality, or unnatural-sounding narration.

- Jump cuts and jarring transitions: Poor editing is another common characteristic of low-quality, fraudulent videos.

These indicators of low-quality video and poor editing should immediately raise concerns about the video's authenticity. Remember, a legitimate investment opportunity wouldn't be presented in such a shoddy manner.

Unrealistic Promises and Guaranteed Returns

Legitimate investments carry inherent risk. No reputable investment advisor will guarantee specific returns. Be wary of any video promising exceptionally high returns in a short timeframe.

- "Double your money in a week": This is a classic sign of a high-yield investment program (HYIP), almost always a scam.

- "Risk-free investment": All investments involve some degree of risk. Claims of a risk-free investment are inherently dishonest.

- Extremely high percentage returns: Unusually high returns are a major red flag indicative of a fraudulent investment scheme.

These unrealistic promises and guaranteed returns are common tactics used in investment scams to lure unsuspecting victims.

Suspicious URLs and Domains

Always examine the URL and domain name linked within the video. Fake Steven Bartlett investment videos often direct viewers to websites with suspicious characteristics.

- Misspellings: Slight variations in spelling (e.g., "StevnBartlett") are common in phishing attempts.

- Unusual top-level domains: Be wary of domains ending in .xyz, .tk, or other less common extensions, rather than .com or .org.

- Generic domain names: Lack of a specific and branded domain name is another warning sign.

Investigating these suspicious URLs and domains before clicking any links is paramount in avoiding phishing websites.

Lack of Transparency and Contact Information

Legitimate investment opportunities provide clear and readily accessible contact information. A lack of transparency should be viewed with extreme caution.

- Absence of contact details: No email address, phone number, or physical address is a major red flag.

- Unclear terms and conditions: Vague or missing terms and conditions often indicate a lack of legitimacy.

- Absence of an official company registration: Check if the company is registered and legitimate within its stated jurisdiction.

This lack of transparency and readily available contact details is a common tactic used in creating a scam alert situation.

Pressure Tactics and Urgency

Scammers frequently employ high-pressure tactics to coerce viewers into immediate decisions without proper due diligence.

- "Limited-time offer": This sense of urgency is designed to bypass critical thinking.

- "Act now before it's too late": This is a classic pressure tactic used in investment fraud.

- Aggressive sales pitches: An overly persuasive and aggressive sales pitch should be a warning sign.

These high-pressure sales tactics and urgency tactics are designed to bypass rational decision-making processes.

Where to Find Legitimate Information About Steven Bartlett's Investments

To avoid fake Steven Bartlett investment videos, always seek information from credible sources.

Official Website and Social Media

Verify any investment information only through Steven Bartlett's official website and verified social media profiles. Look for official announcements and press releases.

Reputable Financial News Sources

Consult reputable financial news outlets for legitimate investment opportunities and reviews. Avoid relying solely on information presented in online videos.

Financial Advisors

Before making any investment decisions, consult with a qualified financial advisor who can provide personalized guidance based on your financial situation.

Conclusion

Protecting yourself from fake Steven Bartlett investment videos requires vigilance and critical thinking. By understanding the red flags discussed and seeking information from credible sources, you can significantly reduce your risk of falling prey to these fraudulent schemes. Remember to carefully scrutinize any online investment offers claiming to be affiliated with Steven Bartlett. Learn to spot fake Steven Bartlett investment videos and avoid fake Steven Bartlett investment videos to safeguard your financial well-being. Always perform your due diligence and seek professional financial advice before investing in any opportunity.

Featured Posts

-

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

May 01, 2025

1 050 V Mware Price Hike At And T Details Broadcoms Proposed Increase

May 01, 2025 -

Popular Us Cruise Lines For 2024

May 01, 2025

Popular Us Cruise Lines For 2024

May 01, 2025 -

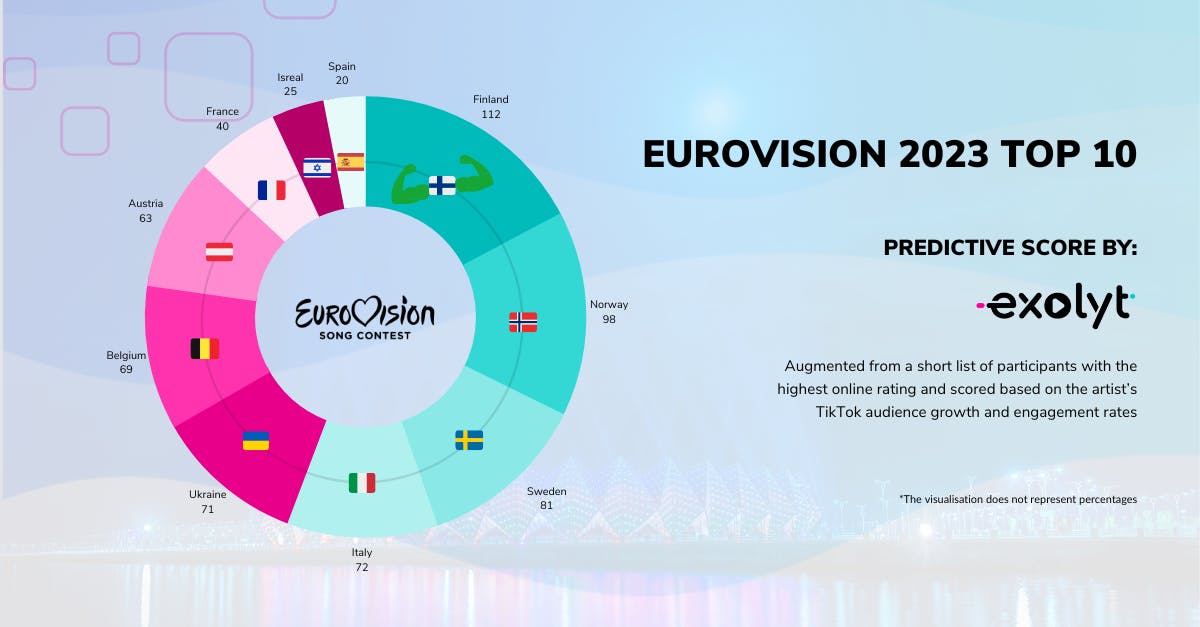

Predicting The Eurovision 2025 Winner Early Contenders

May 01, 2025

Predicting The Eurovision 2025 Winner Early Contenders

May 01, 2025 -

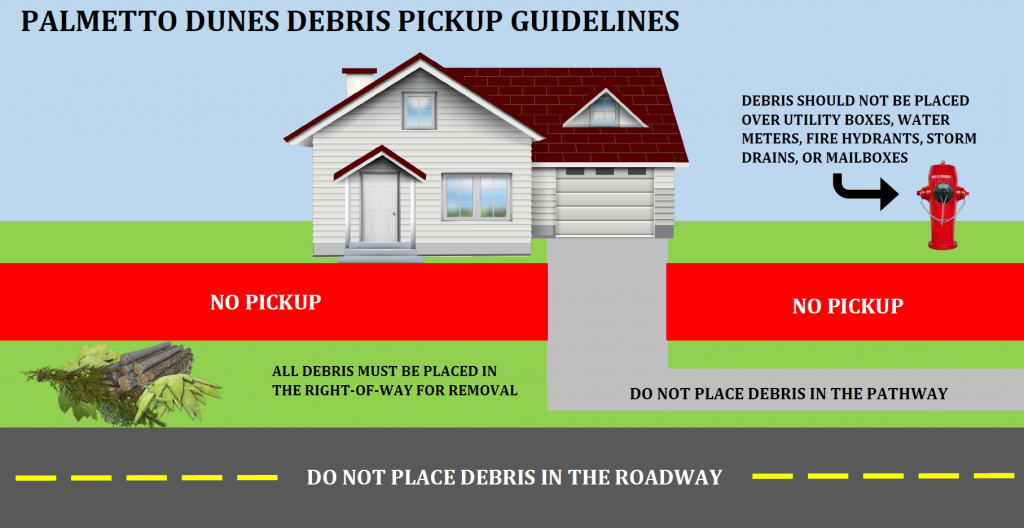

Louisville Residents Submit Your Storm Debris Pickup Request Today

May 01, 2025

Louisville Residents Submit Your Storm Debris Pickup Request Today

May 01, 2025 -

Processo Becciu L Appello Inizia Il 22 Settembre Cosa Aspettarsi

May 01, 2025

Processo Becciu L Appello Inizia Il 22 Settembre Cosa Aspettarsi

May 01, 2025