Protecting Your Credit Score From Late Student Loan Payments

Table of Contents

Understanding the Impact of Late Student Loan Payments on Your Credit Score

Late student loan payments can severely impact your credit score, making it harder to secure loans, rent an apartment, or even get a job in the future. Understanding the mechanics of this impact is the first step towards protecting your financial health.

How Late Payments are Reported

Late payments are reported to the three major credit bureaus – Equifax, Experian, and TransUnion – significantly impacting your creditworthiness.

- Negative impact on credit score: A late payment can result in a substantial drop in your FICO score, potentially hundreds of points.

- Length of time negative mark remains: This negative mark typically stays on your report for seven years from the date of delinquency.

- Potential for collection agencies: Repeated late payments can lead to your debt being sold to collections agencies, further damaging your credit.

The FICO scoring model, widely used by lenders, heavily weighs payment history. Even one late payment can significantly reduce your credit score, making it more difficult and expensive to borrow money in the future.

The Severity of Delinquency

The length of time your payment is overdue directly correlates with the severity of the negative impact.

- 30-day delinquency: While less severe than longer delinquencies, a 30-day late payment still negatively impacts your credit score.

- 60-day delinquency: This signifies a more serious problem, leading to a more substantial drop in your credit score.

- 90+ day delinquency: A 90-day or longer delinquency is a serious credit issue. It can lead to wage garnishment, making it extremely difficult to obtain new credit. Lenders view this as a high risk.

Different lenders have varying thresholds for accepting applicants with a history of delinquencies. A 30-day late payment might be overlooked by some, while a 90+ day delinquency will likely be a deal-breaker for most.

Proactive Strategies to Avoid Late Student Loan Payments

Preventing late payments is far easier than repairing the damage they cause. Proactive strategies are key to protecting your credit score.

Budgeting and Financial Planning

Creating a realistic budget is paramount. This involves:

- Tracking income and expenses: Use budgeting apps, spreadsheets, or even a simple notebook to monitor your finances.

- Prioritizing loan payments: Make student loan payments a top priority in your budget.

- Using budgeting apps or spreadsheets: Tools like Mint, YNAB (You Need A Budget), or even a simple Excel spreadsheet can assist in tracking and managing your finances.

Effective financial planning includes anticipating unexpected expenses and building an emergency fund to cover unforeseen circumstances that could otherwise jeopardize your ability to make on-time payments.

Automating Loan Payments

Automating your loan payments removes the risk of human error.

- Reduced risk of missed payments: Automatic payments ensure consistent, on-time payments.

- Convenience: It simplifies your financial management.

- Potential for interest rate reductions: Some lenders offer interest rate reductions for enrolling in auto-pay.

You can typically set up automatic payments through your loan servicer's website or by linking your bank account.

Exploring Repayment Options

Several repayment plans can help manage student loan debt.

- Income-driven repayment (IDR) plans: IBR, PAYE, REPAYE, and income-based repayment plans adjust your monthly payment based on your income and family size.

- Loan consolidation: Combining multiple loans into one can simplify payments.

- Deferment and forbearance: These options temporarily postpone payments but may have implications for your credit score, so it's crucial to understand the terms and conditions before opting for them.

Choosing the right repayment plan depends on your individual financial circumstances.

Communicating with Your Loan Servicer

Open communication is crucial.

- Discussing financial hardship: If you face unexpected financial difficulties, contact your loan servicer immediately.

- Exploring repayment options: They can help you find a suitable repayment plan.

- Negotiating payment plans: They may be able to work with you to create a more manageable payment schedule.

Don't wait until you're significantly behind on payments to reach out; proactive communication is key.

Repairing Your Credit Score After a Late Payment

Even with the best intentions, late payments can happen. Here's how to repair the damage.

Monitoring Your Credit Report

Regularly reviewing your credit report is essential.

- Utilizing free credit report services (AnnualCreditReport.com): Check your reports from all three bureaus annually for free.

- Reviewing reports for errors: Errors can negatively impact your score, and you can dispute them.

- Disputing inaccuracies: The process involves contacting the credit bureaus and providing evidence of the error.

Addressing any errors promptly is critical for maintaining an accurate credit history.

Building Positive Credit History

Rebuilding your credit takes time and consistent effort.

- Consistent on-time payments: Make all future payments on time.

- Maintaining low credit utilization: Keep your credit card balances low.

- Avoiding new credit applications: Multiple applications can temporarily lower your score.

Rebuilding your credit score is a marathon, not a sprint. Consistent positive behavior over time will gradually improve your score.

Conclusion

Protecting your credit score from the negative impact of late student loan payments requires proactive planning and consistent effort. By understanding the consequences of delinquency, implementing effective budgeting strategies, exploring available repayment options, and maintaining open communication with your loan servicer, you can significantly reduce the risk of harming your credit. Regularly monitoring your credit report and taking steps to rebuild your credit if necessary are also crucial components of long-term financial well-being. Don't let late student loan payments derail your financial future; take control and protect your credit score today!

Featured Posts

-

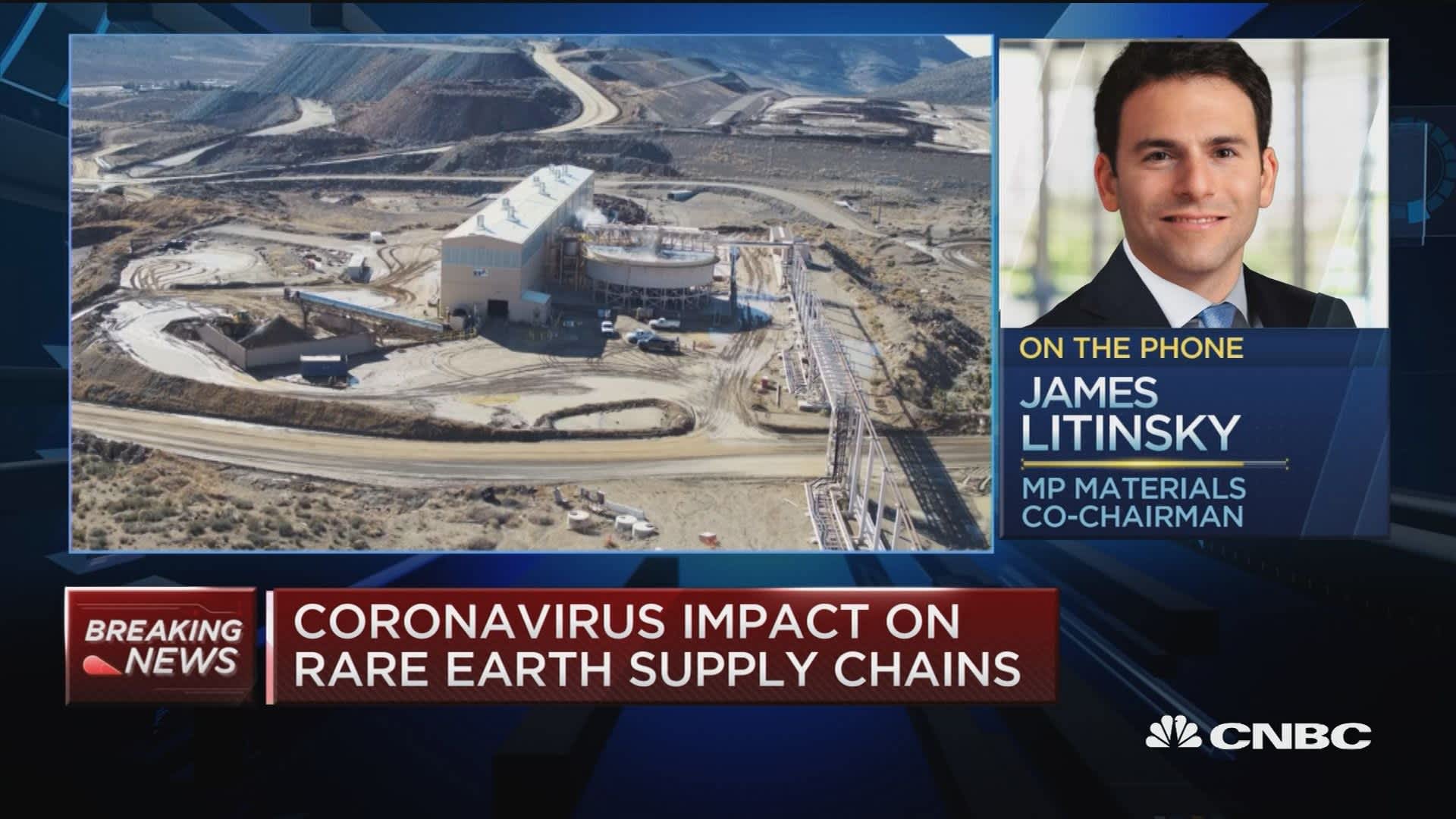

The Looming Cold War Over Rare Earth Element Supply Chains

May 17, 2025

The Looming Cold War Over Rare Earth Element Supply Chains

May 17, 2025 -

St Johns Basketball Success Earns Praise From New York Knicks Head Coach Thibodeau

May 17, 2025

St Johns Basketball Success Earns Praise From New York Knicks Head Coach Thibodeau

May 17, 2025 -

Melhores Cursos De Ensino Superior 4 Com Nota Maxima Do Mec No Vale

May 17, 2025

Melhores Cursos De Ensino Superior 4 Com Nota Maxima Do Mec No Vale

May 17, 2025 -

Conflict Resolved Tom Thibodeau And Mikal Bridges End Public Dispute

May 17, 2025

Conflict Resolved Tom Thibodeau And Mikal Bridges End Public Dispute

May 17, 2025 -

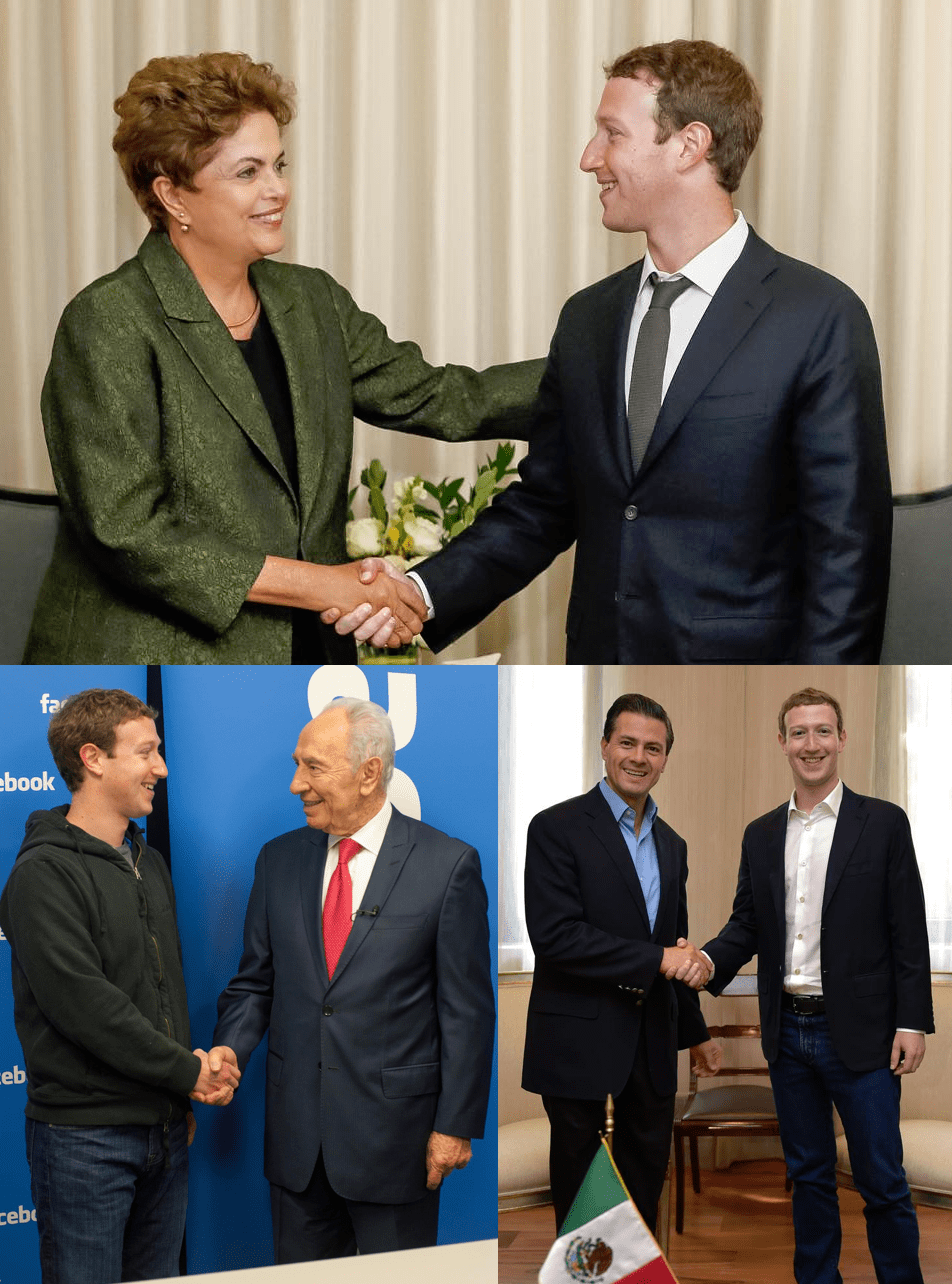

Zuckerbergs Leadership In The Age Of Trump

May 17, 2025

Zuckerbergs Leadership In The Age Of Trump

May 17, 2025

Latest Posts

-

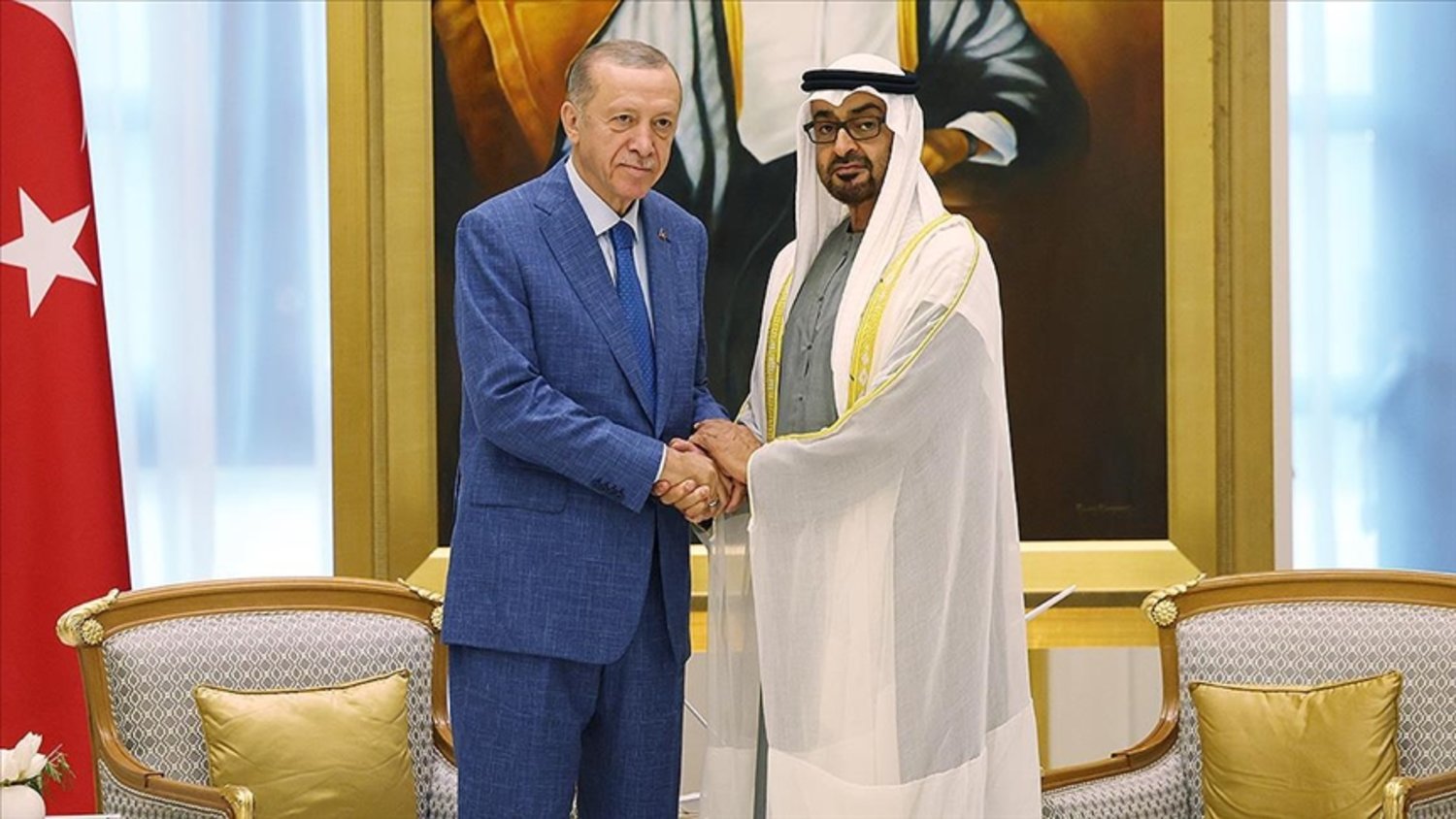

Erdogan Birlesik Arap Emirlikleri Devlet Baskani Telefon Diplomasi

May 17, 2025

Erdogan Birlesik Arap Emirlikleri Devlet Baskani Telefon Diplomasi

May 17, 2025 -

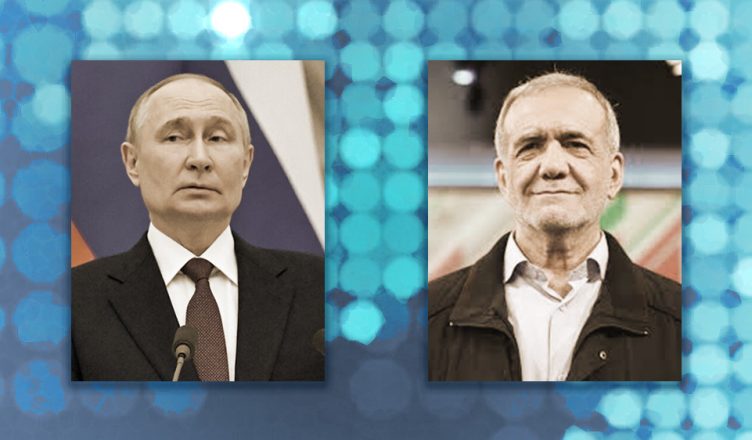

Biseda Telefonike Putin Emiratet E Bashkuara Arabe Cfare U Diskutua

May 17, 2025

Biseda Telefonike Putin Emiratet E Bashkuara Arabe Cfare U Diskutua

May 17, 2025 -

Istrazivanje Ujedinjenih Arapskih Emirata Destinacije I Aktivnosti

May 17, 2025

Istrazivanje Ujedinjenih Arapskih Emirata Destinacije I Aktivnosti

May 17, 2025 -

Putin Dhe Presidenti I Emirateve Te Bashkuara Arabe Zhvillojne Bisedime Telefonike

May 17, 2025

Putin Dhe Presidenti I Emirateve Te Bashkuara Arabe Zhvillojne Bisedime Telefonike

May 17, 2025 -

Cumhurbaskani Erdogan Birlesik Arap Emirlikleri Lideriyle Goeruestue

May 17, 2025

Cumhurbaskani Erdogan Birlesik Arap Emirlikleri Lideriyle Goeruestue

May 17, 2025