PwC Africa: Withdrawal From Nine Countries Explained

Table of Contents

Reasons Behind PwC's Africa Withdrawal

Several intertwined factors contributed to PwC's decision to withdraw from nine African nations. These factors can be broadly categorized into financial performance challenges, a strategic realignment focusing on core markets, and persistent regulatory and operational hurdles.

Financial Performance and Market Challenges

PwC's performance in the affected African countries likely fell below expectations, prompting the strategic withdrawal. Several contributing elements include:

- Declining profitability in specific markets: Certain regions may have experienced a consistent decline in profitability, rendering continued operation unsustainable. This could be due to intense competition or lower-than-anticipated client demand.

- Increased competition from local and international firms: The African market is increasingly competitive, with both local and international firms vying for market share. This competitive pressure might have squeezed PwC's profit margins.

- Economic instability affecting client demand: Economic downturns or political instability in some regions could have significantly impacted client demand for PwC's services, leading to reduced revenue.

- Difficulty attracting and retaining top talent: Attracting and retaining skilled professionals in certain African markets can be challenging, potentially hindering operational efficiency and service delivery. Competition for skilled professionals in these regions is fierce.

Strategic Realignment and Focus on Core Markets

PwC's decision aligns with a broader global strategy emphasizing consolidation and a focus on key, high-growth markets. This often entails:

- Consolidation of resources in key strategic locations: By withdrawing from less profitable regions, PwC can reinvest resources into areas with greater potential for growth and return on investment.

- Focus on higher-growth sectors within Africa: This may involve a shift towards sectors experiencing rapid expansion in certain African countries, allowing for greater profitability and market penetration.

- Investment in technology and digital transformation: This realignment might involve shifting resources towards technological advancements and digital transformation initiatives in priority markets.

- Shifting focus to larger, more established markets: PwC's strategic realignment could reflect a prioritization of larger, more mature markets within Africa, where the potential for returns is higher.

Regulatory and Operational Challenges

Navigating the regulatory and operational landscapes in some African countries presents significant challenges, contributing to the withdrawal. These challenges include:

- Stringent regulatory environments in certain countries: Complex and sometimes inconsistent regulatory frameworks in some nations can hinder operational efficiency and compliance.

- Challenges in navigating complex local regulations: The complexities of complying with various local regulations, including tax laws and accounting standards, can be substantial and costly.

- Infrastructure limitations affecting operational efficiency: Inadequate infrastructure, such as unreliable internet access or power supply, can significantly impact operational efficiency and service delivery.

- Political and social instability impacting business operations: Political unrest or social instability can create significant uncertainty and risk, making sustainable operations challenging.

Impact of the Withdrawal on PwC's Clients and Employees

PwC's withdrawal has direct implications for both its clients and employees in the affected African countries.

Client Implications

The departure leaves existing clients facing a period of transition and potential disruption:

- Potential disruption to ongoing audit and advisory services: Clients may experience disruptions to existing services as PwC transitions its responsibilities.

- Need for clients to find alternative service providers: Clients must now identify and transition to alternative professional services providers, potentially incurring additional costs and time delays.

- Potential impact on business continuity and operations: The change in service providers could temporarily impact business continuity and operations, requiring careful planning and management.

- Increased costs associated with switching providers: Transitioning to new service providers can be expensive, involving additional fees, contract negotiations, and potentially higher service charges.

Employee Implications

The withdrawal directly affects PwC's employees in the affected regions:

- Potential job losses and redundancy packages: PwC will likely offer redundancy packages and support to affected employees.

- Support and relocation options for affected employees: The firm may offer support to employees seeking alternative employment within or outside PwC.

- Opportunities for redeployment within other PwC offices: Some employees may have opportunities for redeployment within other PwC offices in different locations.

- Potential for retraining and upskilling programs: PwC may offer retraining and upskilling programs to help employees adapt to the changing circumstances.

Future of PwC in Africa

Despite the withdrawal, PwC remains committed to its long-term presence in key African markets. The firm's future strategy will likely involve:

- Continued commitment to key African markets: PwC will continue operations and investments in strategically important African countries.

- Strategic partnerships with local firms: Collaborations with local firms may be explored to maintain a market presence and deliver services in previously served regions.

- Investment in technology and digital solutions for African clients: PwC's focus will likely shift towards technology-driven solutions tailored to the unique needs of African clients.

- Focus on sustainable and responsible business practices in Africa: PwC is expected to prioritize sustainable and responsible business practices as part of its ongoing commitment to the African continent.

Conclusion

The PwC Africa withdrawal, impacting nine countries, signifies a major strategic shift. This decision, born from a complex interplay of financial pressures, strategic realignment, and operational challenges, necessitates a thorough understanding of its implications. While the short-term consequences for clients and employees are significant, PwC's long-term commitment to Africa remains. Further analysis will be crucial to understand the complete ramifications of this decision and its impact on the broader African business landscape. For ongoing updates and deeper analysis on the complexities of the PwC Africa withdrawal, continue your research and stay informed on related developments.

Featured Posts

-

Jeff Goldblum Checks His Own Oscars Photos The Internets Hilarious Response

Apr 29, 2025

Jeff Goldblum Checks His Own Oscars Photos The Internets Hilarious Response

Apr 29, 2025 -

Cassidy Hutchinson Key Witness Details Plans For Memoir Release

Apr 29, 2025

Cassidy Hutchinson Key Witness Details Plans For Memoir Release

Apr 29, 2025 -

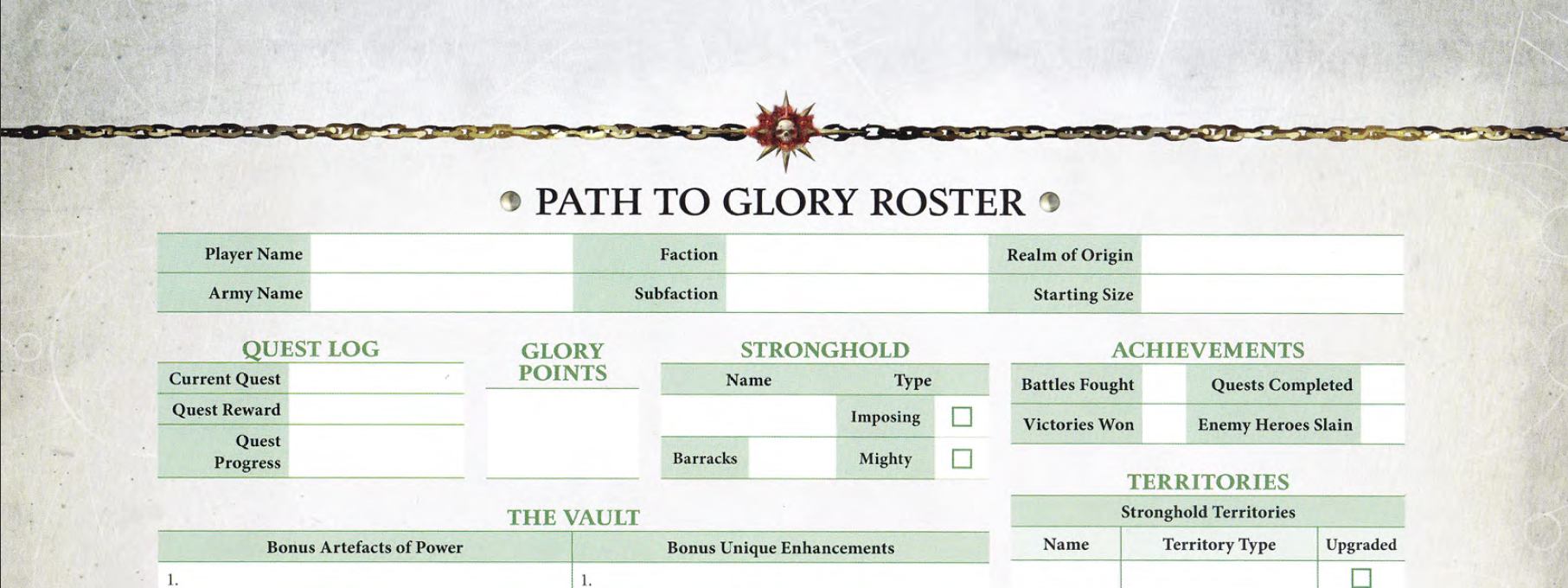

Helmeyers Path To Blaugrana Glory

Apr 29, 2025

Helmeyers Path To Blaugrana Glory

Apr 29, 2025 -

Taxe 2025 Anunturi Si Modificari Importante Conferinta Pw C Romania

Apr 29, 2025

Taxe 2025 Anunturi Si Modificari Importante Conferinta Pw C Romania

Apr 29, 2025 -

Study Reveals Increased Adhd Rates In Adults With Autism And Intellectual Disability

Apr 29, 2025

Study Reveals Increased Adhd Rates In Adults With Autism And Intellectual Disability

Apr 29, 2025

Latest Posts

-

Prof Iva Khristova Nyama Opasnost Ot Nova Gripna Vlna

Apr 29, 2025

Prof Iva Khristova Nyama Opasnost Ot Nova Gripna Vlna

Apr 29, 2025 -

Na Sveti Valentin Kontsert S Uchastieto Na Dscheryata Na Iva Ekimova

Apr 29, 2025

Na Sveti Valentin Kontsert S Uchastieto Na Dscheryata Na Iva Ekimova

Apr 29, 2025 -

Sveti Valentin Iva Ekimova I Kontsertt Na Dscherya Y

Apr 29, 2025

Sveti Valentin Iva Ekimova I Kontsertt Na Dscherya Y

Apr 29, 2025 -

Aktualno Prof Iva Khristova Za Gripnata Epidemiya

Apr 29, 2025

Aktualno Prof Iva Khristova Za Gripnata Epidemiya

Apr 29, 2025 -

Prof Iva Khristova Za Gripa Nyama Vtora Vlna

Apr 29, 2025

Prof Iva Khristova Za Gripa Nyama Vtora Vlna

Apr 29, 2025