PwC Exits Nine African Nations: Implications And Future Outlook

Table of Contents

Reasons Behind PwC's Exit from Nine African Nations

PwC's official statements cite a strategic realignment of its global operations as the primary reason for its departure from nine African nations. However, a deeper analysis reveals a more nuanced picture. While the firm hasn't explicitly detailed the specific challenges in each affected nation, several factors likely contributed to this decision.

These factors likely include a complex interplay of market dynamics, regulatory hurdles, and internal strategic shifts. Market-related issues, such as decreased profitability in specific markets due to intense competition or economic downturns, undoubtedly played a role. Furthermore, increasing regulatory burdens and compliance costs, particularly in nations with evolving regulatory frameworks, may have made operations unsustainable.

Additionally, challenges related to talent acquisition and retention within these markets, potentially due to skills shortages or competition from other firms, might have added pressure. The decision also likely involved a cost-benefit analysis, with PwC strategically refocusing resources on other, more profitable markets with greater growth potential. Finally, potential risks associated with operating in politically unstable regions with high levels of corruption or uncertainty could have influenced the decision.

- Decreased profitability in specific markets. Lower revenue streams compared to operational costs may have rendered certain markets unprofitable.

- Increased regulatory burdens and compliance costs. Stringent regulations and complex compliance requirements may have increased operational costs.

- Challenges related to talent acquisition and retention. Difficulties in attracting and retaining skilled professionals could have impacted service delivery.

- Strategic refocusing of resources on other, more profitable markets. A global realignment of priorities may have prioritized certain markets over others.

- Potential risks associated with operating in politically unstable regions. Political instability and associated risks could have influenced the decision to withdraw.

Implications for Businesses Operating in the Affected Nations

PwC's withdrawal significantly impacts businesses operating within the nine affected African nations. The immediate consequence is reduced access to auditing services and financial advice from a globally recognized and established firm. Finding reputable alternative auditing firms might present challenges, particularly in regions with limited local capacity. This could lead to increased costs in procuring auditing services, potential delays in financial reporting, and difficulties in meeting regulatory compliance deadlines.

The impact extends beyond immediate operational challenges. The departure could negatively influence investor confidence and foreign direct investment (FDI) in these regions. International investors might perceive a higher risk profile, leading to decreased investment flows, hindering economic growth.

- Increased costs of finding alternative audit providers. Securing comparable services from other firms might involve higher fees and potential compromises in service quality.

- Potential delays in financial reporting and regulatory compliance. Finding and onboarding a new auditor may lead to delays in completing financial statements and fulfilling reporting obligations.

- Reduced access to specialized financial services. PwC’s withdrawal might limit access to specialized services like forensic accounting or tax advisory.

- Decreased investor confidence in affected markets. The perception of increased risk associated with the absence of a global player might deter potential investors.

- Potential difficulties in securing loans and financing. Auditing reports from reputable firms are crucial for securing loans and financing from banks and financial institutions.

Impact on the Overall Economic Landscape of Affected Nations

PwC's exit has broader implications for the economic landscape of the affected nations. The potential for decreased transparency and accountability in financial reporting is a significant concern. The absence of a major player like PwC may increase the risk of financial irregularities and fraud, particularly in markets with weaker regulatory frameworks.

This lack of transparency could further deter foreign investors and negatively impact economic growth and development. The affected countries might also face increased scrutiny from international bodies concerned about financial stability and regulatory compliance. Credit ratings might be negatively impacted, raising borrowing costs for governments and businesses alike. This situation will put pressure on local audit firms to meet the increased demand, requiring significant capacity building and investment. Strengthening regulatory oversight becomes crucial to fill the gap left by PwC's withdrawal.

- Increased risk of financial irregularities and fraud. The absence of a strong audit presence could create opportunities for unethical practices.

- Reduced attractiveness to foreign investors. A perceived increase in risk could reduce foreign investment, hindering economic growth.

- Potential for negative impact on credit ratings. A decline in financial transparency could negatively affect sovereign and corporate credit ratings.

- Increased pressure on local audit firms to meet increased demand. Local audit firms will need to adapt and expand to accommodate the increased workload.

- Need for regulatory bodies to strengthen oversight. Strengthening regulatory frameworks and enforcement is crucial to maintaining financial stability.

Future Outlook for Auditing and Financial Services in Africa

While PwC's departure presents significant challenges, it also presents opportunities for other auditing firms to expand into the vacated markets. This will increase competition within the industry, potentially benefiting businesses by offering a wider range of choices and potentially more competitive pricing.

However, the long-term success of the African auditing sector relies on the development of local audit capacity and expertise. Investing in training, education, and the creation of a skilled workforce is crucial for building a sustainable and resilient auditing sector. Furthermore, technological advancements, such as the use of data analytics and artificial intelligence in auditing, can significantly transform the sector and improve efficiency and accuracy.

- Increased competition among remaining audit firms. Other firms will compete to fill the gap left by PwC, potentially leading to more competitive pricing and service offerings.

- Opportunities for local firms to grow and expand. Local firms can capitalize on the increased demand and expand their services and expertise.

- Growth of digital auditing solutions. Technological advancements will help improve efficiency and effectiveness in the auditing process.

- Increased demand for skilled professionals in the sector. Increased activity will create more opportunities for skilled professionals, driving further investment in training.

- Need for investment in training and education. Investing in developing local talent is crucial to build a strong and sustainable auditing sector in Africa.

Conclusion

PwC's departure from nine African nations presents significant challenges and opportunities. While the immediate impact on businesses and economies is uncertain, it highlights the need for greater regulatory oversight, investment in local talent, and adaptation to the evolving landscape of financial services in Africa. The long-term implications of this decision remain to be seen, but it underscores the importance of a robust and diverse auditing sector for sustainable economic development on the continent. Understanding the intricacies of PwC's withdrawal and its repercussions is crucial for businesses and stakeholders alike. Stay informed about developments concerning PwC's exit and the future of auditing in Africa, and consider engaging with industry experts to navigate these changing dynamics.

Featured Posts

-

British Paralympian Sam Ruddock Missing Las Vegas Police Appeal For Witnesses

Apr 29, 2025

British Paralympian Sam Ruddock Missing Las Vegas Police Appeal For Witnesses

Apr 29, 2025 -

How The Uks Legal Definition Of Woman Affects Sex Based Rights For Transgender People

Apr 29, 2025

How The Uks Legal Definition Of Woman Affects Sex Based Rights For Transgender People

Apr 29, 2025 -

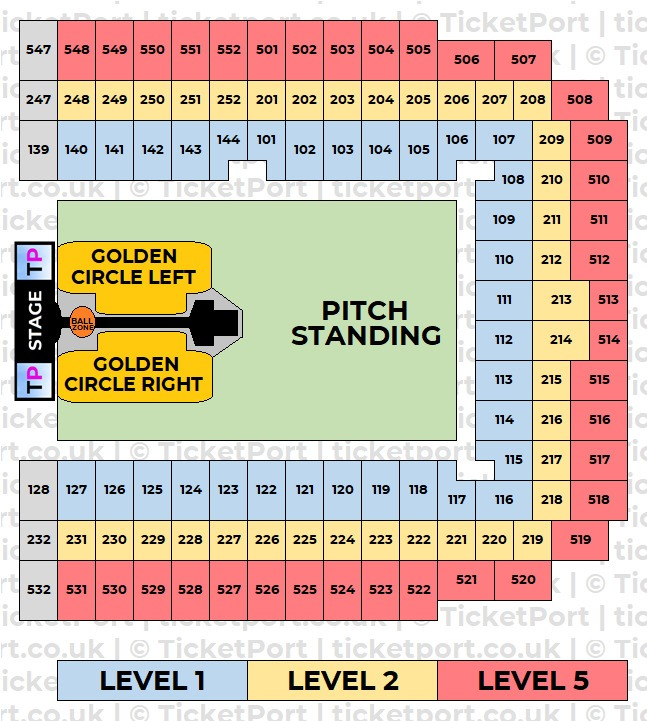

Capital Summertime Ball 2025 Tickets A Step By Step Guide Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 Tickets A Step By Step Guide Braintree And Witham

Apr 29, 2025 -

Does Tik Toks Content Contribute To Self Diagnosing Adhd

Apr 29, 2025

Does Tik Toks Content Contribute To Self Diagnosing Adhd

Apr 29, 2025 -

Jeffrey Goldberg Facing Charges Benny Johnsons Perspective

Apr 29, 2025

Jeffrey Goldberg Facing Charges Benny Johnsons Perspective

Apr 29, 2025

Latest Posts

-

Obnova Konania V Pripade Unosu Studentky Sudna Rozprava V Stredu

Apr 29, 2025

Obnova Konania V Pripade Unosu Studentky Sudna Rozprava V Stredu

Apr 29, 2025 -

Gripniyat Sezon Prof Iva Khristova Za Vliyanieto Na Toploto Vreme

Apr 29, 2025

Gripniyat Sezon Prof Iva Khristova Za Vliyanieto Na Toploto Vreme

Apr 29, 2025 -

Ekspertno Mnenie Prof Iva Khristova Za Gripnata Situatsiya

Apr 29, 2025

Ekspertno Mnenie Prof Iva Khristova Za Gripnata Situatsiya

Apr 29, 2025 -

Prof Iva Khristova Nyama Opasnost Ot Nova Gripna Vlna

Apr 29, 2025

Prof Iva Khristova Nyama Opasnost Ot Nova Gripna Vlna

Apr 29, 2025 -

Na Sveti Valentin Kontsert S Uchastieto Na Dscheryata Na Iva Ekimova

Apr 29, 2025

Na Sveti Valentin Kontsert S Uchastieto Na Dscheryata Na Iva Ekimova

Apr 29, 2025