PwC Faces One-Year Ban From Saudi Arabia's Public Investment Fund

Table of Contents

H2: Details of the One-Year Ban

The PIF's one-year ban on PwC Saudi Arabia is a significant development in the Kingdom's financial regulatory landscape. The ban prohibits PwC from undertaking any audit, advisory, or other professional services for the PIF for a period of twelve months. While the official statement lacks explicit detail, it's understood the ban encompasses all PIF-related activities across the Kingdom. This suggests a broad scope, impacting various PwC service lines and potentially affecting numerous ongoing projects.

- Specific services prohibited: Audit services, financial advisory, consulting services, and any other services contracted directly with the PIF.

- Geographical scope: Nationwide within Saudi Arabia.

- Key dates and timelines: The exact start and end dates of the ban need further clarification from official sources.

- Summary of official statements: Both PwC and the PIF have released brief statements acknowledging the ban, but neither has yet provided a detailed explanation of the reasons behind it. More detailed information is expected to emerge as the situation unfolds.

H2: Reasons Behind the Ban

The precise reasons for the PIF's decision remain unclear, but speculation points towards potential regulatory violations or failures in fulfilling contractual obligations. While neither party has explicitly stated the cause, industry analysts suggest possible explanations, such as:

- Specific alleged violations or failures: These could relate to audit quality, conflict of interest concerns, or breaches of Saudi Arabian regulatory requirements.

- Timeline of events leading to the ban: Further investigation is needed to determine the exact timeline of events that culminated in the ban. The PIF's decision suggests a serious breach of trust or significant regulatory concern.

- Mention of any ongoing investigations or legal proceedings: Although no formal investigations have been publicly announced, the ban's severity implies the possibility of further scrutiny.

H2: Impact on PwC and the PIF

The ban's implications are far-reaching for both PwC and the PIF. For PwC, the short-term impact includes a substantial loss of revenue from PIF contracts. The long-term consequences could include reputational damage, affecting its ability to secure future government contracts in Saudi Arabia and other markets. For the PIF, the ban may lead to delays in projects, the need to find alternative audit firms, and potential disruption to their investment strategies.

- Potential financial losses for PwC: The loss of PIF contracts represents a significant hit to PwC’s Saudi Arabian revenue stream.

- Damage to PwC’s reputation and credibility: The ban casts a shadow on PwC's reputation for integrity and compliance, particularly concerning its operations in high-profile markets.

- Potential delays or disruptions to PIF projects: The transition to a new audit firm might delay crucial projects and investment decisions.

- Implications for other foreign companies in Saudi Arabia: The ban serves as a reminder of the stringent regulatory environment and the importance of rigorous compliance for foreign companies operating in Saudi Arabia.

H2: Future Outlook and Implications

PwC may explore legal avenues to challenge the ban, but the success of any appeal remains uncertain. The situation also highlights the evolving regulatory landscape in Saudi Arabia, signaling a stricter approach to corporate governance and financial oversight. The long-term effects could encompass shifts in the audit industry within the Kingdom, potentially favoring local firms and prompting regulatory reforms.

- Possible legal challenges by PwC: PwC might initiate legal proceedings to challenge the ban, but the outcome will depend on the specifics of the alleged violations and the Saudi Arabian legal process.

- Expected regulatory changes in Saudi Arabia's financial sector: This incident may trigger a review of existing regulations and an increase in enforcement activities by Saudi Arabian regulators.

- Long-term effects on investor confidence: The ban could negatively impact investor confidence in the Saudi Arabian market, though its impact is likely to depend on the transparency of future investigations and regulatory actions.

- Potential changes in PwC’s Saudi Arabian operations: PwC may adjust its operations and compliance strategies in response to the ban and the overall strengthening of regulatory oversight in the Kingdom.

3. Conclusion

The one-year ban imposed on PwC Saudi Arabia by the Public Investment Fund is a significant event with far-reaching implications. While the precise reasons behind the ban remain partially undisclosed, the severity of the action points to serious concerns regarding regulatory compliance and professional conduct. The incident underscores the challenging regulatory environment in Saudi Arabia and highlights the importance of robust governance for all businesses operating in the Kingdom. The long-term impact on PwC's reputation, the PIF's investment strategies, and the broader Saudi Arabian business climate remains to be seen. Stay updated on the evolving situation surrounding the PwC Saudi Arabia ban and its implications for the Public Investment Fund by following reputable financial news sources.

Featured Posts

-

Funding Cuts Spur International Pursuit Of Us Scientific Talent

Apr 29, 2025

Funding Cuts Spur International Pursuit Of Us Scientific Talent

Apr 29, 2025 -

Adult Adhd Understanding Your Diagnosis And Next Steps

Apr 29, 2025

Adult Adhd Understanding Your Diagnosis And Next Steps

Apr 29, 2025 -

February 20 2025 A Happy Day

Apr 29, 2025

February 20 2025 A Happy Day

Apr 29, 2025 -

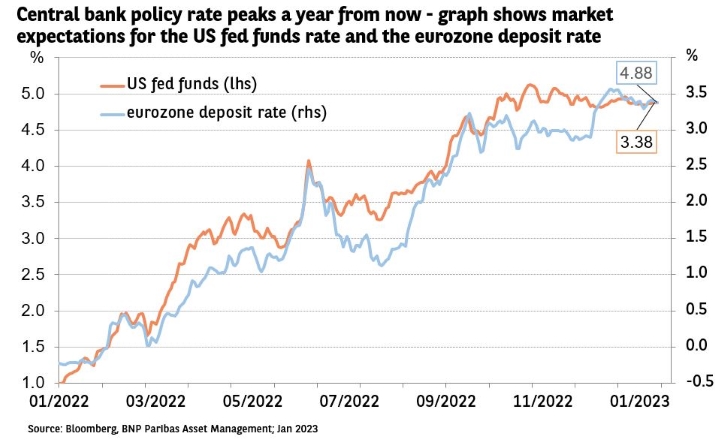

Canadas Monetary Policy Rosenbergs Concerns And Predictions

Apr 29, 2025

Canadas Monetary Policy Rosenbergs Concerns And Predictions

Apr 29, 2025 -

The Culture Departments Canoe Awakening Event Highlights And Photos

Apr 29, 2025

The Culture Departments Canoe Awakening Event Highlights And Photos

Apr 29, 2025

Latest Posts

-

Ru Pauls Drag Race Live Milestone 1 000th Show Broadcast Live

Apr 30, 2025

Ru Pauls Drag Race Live Milestone 1 000th Show Broadcast Live

Apr 30, 2025 -

Ru Pauls Drag Race Live 1 000 Shows Celebrated With Special Live Broadcast

Apr 30, 2025

Ru Pauls Drag Race Live 1 000 Shows Celebrated With Special Live Broadcast

Apr 30, 2025 -

Ru Pauls Drag Race Live Celebrates 1 000th Show With Live Broadcast

Apr 30, 2025

Ru Pauls Drag Race Live Celebrates 1 000th Show With Live Broadcast

Apr 30, 2025 -

Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Online Guide To Legal Streaming

Apr 30, 2025

Untucked Ru Pauls Drag Race Season 17 Episode 8 Free Online Guide To Legal Streaming

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 9 Analyzing The Design Challenge

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 9 Analyzing The Design Challenge

Apr 30, 2025