PwC Scandal: Global Accounting Firm Shrinks Its International Footprint

Table of Contents

The Nature and Impact of the PwC Scandal

The PwC scandal encompasses a range of serious issues, including data breaches, conflicts of interest, and regulatory violations across various jurisdictions. The controversies have resulted in substantial reputational damage, impacting client trust and leading to significant financial losses. The scale of the negative publicity has been immense, leading to a loss of confidence not only in PwC itself but also in the wider accounting profession. The scandal’s impact can be quantified in several ways: significant financial losses through fines and legal settlements, a noticeable increase in client churn as businesses seek alternative auditing firms, and a general erosion of PwC's brand image. Keywords associated with this section include "PwC controversies," "reputational damage," "regulatory fines," and "client churn."

Specific Examples of PwC's Misconduct

Several specific instances of misconduct have contributed to the overall scandal:

- [Specific Example 1, with source citation]: (e.g., "A data breach in [Region] led to the exposure of sensitive client information, resulting in a substantial fine from [Regulatory Body]." Source: [News Article Link])

- [Specific Example 2, with source citation]: (e.g., "Conflicts of interest were identified in the auditing of [Company Name] in [Country], leading to investigations by [Regulatory Body]." Source: [News Article Link])

- [Specific Example 3, with source citation]: (e.g., "Regulatory violations related to [Specific Violation] in [Region] resulted in a significant penalty for PwC." Source: [News Article Link])

PwC's Response: Retrenchment and Restructuring

In response to the escalating crisis and the resulting reputational damage, PwC has initiated a significant restructuring process involving a marked reduction in its international presence. This strategic retreat is characterized by office closures, staff layoffs, and the divestment of certain business units deemed non-core or less profitable. This restructuring reflects a proactive attempt to mitigate further losses and restore some level of stability. The geographical areas most affected by this downsizing vary, with certain regions experiencing more substantial reductions than others. Keywords used in this section include "PwC restructuring," "office closures," "staff layoffs," "strategic retreat," and "business unit divestment."

Geographic Analysis of Footprint Reduction

The impact of PwC's restructuring has been felt globally, although not uniformly. Specific examples include:

- [Region 1]: (e.g., "PwC reduced its workforce in [Region 1] by X%, closing Y offices." Source: [PwC press release or news article])

- [Region 2]: (e.g., "Significant staff reductions and office closures were reported in [Region 2], impacting Z number of employees." Source: [News article])

- [Region 3]: (e.g., "Divestment of the [Business Unit] division in [Region 3] signifies a strategic shift for the firm." Source: [Financial News Source])

This geographical analysis highlights the widespread nature of PwC's strategic retreat in response to the scandal.

Long-Term Implications for PwC and the Accounting Industry

The PwC scandal has undeniably had long-term implications for the firm's brand and market share. The loss of client trust and damaged reputation will likely take years to rebuild. Beyond PwC, the scandal has shaken investor confidence in the accounting industry as a whole, raising concerns about ethical standards and regulatory effectiveness. This could lead to stricter regulatory reforms and increased scrutiny of accounting practices globally. Keywords for this section include "market share decline," "investor confidence," "regulatory reform," and "industry reputation."

Competitor Analysis and Market Shifts

The difficulties faced by PwC have created opportunities for its competitors. Other major accounting firms are likely to benefit from client defections and increased demand for their services. This has led to noticeable shifts in the global accounting market landscape, with a potential realignment of market share among the leading players. The long-term consequences of this shift remain to be seen but are certain to reshape the competitive dynamics of the global accounting industry.

Conclusion: The Future of PwC and the Need for Accountability in Global Accounting

The PwC scandal and its resultant shrinking international footprint serve as a stark reminder of the importance of ethical conduct and transparency within the global accounting profession. The scandal's repercussions are far-reaching, impacting not only PwC's market position but also the overall trust in the industry. The need for greater accountability and robust regulatory oversight is undeniable. The future of PwC will depend on its ability to regain trust and implement comprehensive reforms to prevent similar incidents from occurring. Stay updated on the ongoing repercussions of the PwC scandal and its impact on the future of global accounting firms. Follow our updates for the latest developments and analysis of the PwC international footprint.

Featured Posts

-

Hagia Sophia Exploring The Legacy Of A Byzantine Masterpiece

Apr 29, 2025

Hagia Sophia Exploring The Legacy Of A Byzantine Masterpiece

Apr 29, 2025 -

Pw C Global Retreat A Dozen Countries Exit Amidst Scandal Concerns

Apr 29, 2025

Pw C Global Retreat A Dozen Countries Exit Amidst Scandal Concerns

Apr 29, 2025 -

Georgia Law Enforcement Officer Killed Another Injured In Shooting

Apr 29, 2025

Georgia Law Enforcement Officer Killed Another Injured In Shooting

Apr 29, 2025 -

From Bathroom Reads To Broadcast Ais Role In Podcast Creation From Repetitive Texts

Apr 29, 2025

From Bathroom Reads To Broadcast Ais Role In Podcast Creation From Repetitive Texts

Apr 29, 2025 -

Louisville Storm Debris Removal How To Submit Your Pickup Request

Apr 29, 2025

Louisville Storm Debris Removal How To Submit Your Pickup Request

Apr 29, 2025

Latest Posts

-

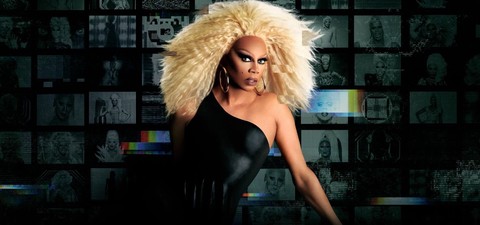

Ru Pauls Drag Race Season 17 Episode 11 Unleashing The Ducks

Apr 29, 2025

Ru Pauls Drag Race Season 17 Episode 11 Unleashing The Ducks

Apr 29, 2025 -

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 29, 2025

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 8 For Free

Apr 29, 2025 -

Stream Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Online

Apr 29, 2025

Stream Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Online

Apr 29, 2025 -

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 6 For Free

Apr 29, 2025

Where To Watch Untucked Ru Pauls Drag Race Season 17 Episode 6 For Free

Apr 29, 2025 -

Ru Pauls Drag Race The Charles Barkley Connection That Shocked Fans

Apr 29, 2025

Ru Pauls Drag Race The Charles Barkley Connection That Shocked Fans

Apr 29, 2025