PwC's Decision To Close Operations In Nine African Countries

Table of Contents

The Nine Affected African Countries and the Scale of PwC's Withdrawal

PwC's withdrawal impacts nine African nations, although the specific list hasn't been publicly released in its entirety by PwC itself. The scale of this closure is significant, affecting thousands of employees and countless clients across various sectors. The services offered by PwC in these countries encompassed a broad range, including auditing, consulting (both management and financial advisory), tax advisory, and assurance services. The exact number of employees affected remains undisclosed, making precise quantification challenging. However, reports suggest significant job losses, particularly in larger offices.

- Bullet Point Example: PwC's withdrawal from [Country A], for instance, reportedly resulted in the loss of over [Number] jobs, significantly impacting the local economy.

- Bullet Point Example: The impact is likely to be most acutely felt in [Country B] due to PwC's large market share in [specific service area] and the concentration of clients within the [specific industry] sector.

- Bullet Point Example: The closure represents a loss of considerable expertise and experience in areas critical to economic development.

Reasons Behind PwC's Decision to Close Operations in Africa

While PwC hasn't provided an exhaustive public explanation, several factors likely contributed to this decision. The official statements allude to challenging market conditions and a strategic restructuring aimed at improving profitability and focusing resources on higher-growth areas. However, several underlying factors are worth considering:

- Bullet Point Example: Reduced profitability in certain African markets, likely due to economic headwinds and intense competition, appears to be a crucial factor.

- Bullet Point Example: Increased competition from both local accounting firms and other global players like Deloitte, EY, and KPMG is another significant driver.

- Bullet Point Example: Regulatory changes and shifting economic policies in some of the affected countries could also have influenced PwC’s decision to reduce its footprint.

The Impact of PwC's Closure on the African Business Landscape

PwC's departure will have far-reaching consequences for the African business landscape. The immediate impact includes job losses, potentially hindering economic growth in affected countries. The loss of PwC's expertise will be keenly felt, particularly in sectors reliant on sophisticated professional services.

- Bullet Point Example: Small and medium-sized enterprises (SMEs), often lacking in-house expertise, will face greater difficulties accessing high-quality auditing, tax, and consulting services.

- Bullet Point Example: Larger corporations may experience disruptions to their operations, especially those reliant on PwC for complex financial reporting and regulatory compliance.

- Bullet Point Example: Foreign investors may view PwC's withdrawal as a sign of uncertainty, potentially impacting future investment flows into the affected regions.

Future Implications and Potential Alternatives for Businesses in Affected Countries

In the wake of PwC's exit, businesses in the affected countries must adapt and find alternative providers of professional services. The remaining Big Four firms (Deloitte, EY, and KPMG) are likely to experience increased demand, potentially leading to greater competition amongst themselves. Local firms will also see opportunities for expansion.

- Bullet Point Example: Companies might seek services from Deloitte, EY, and KPMG, leading to a surge in their workload and potentially higher prices.

- Bullet Point Example: Local firms with specialized expertise in specific sectors are well-positioned to attract clients formerly serviced by PwC, spurring growth and development.

- Bullet Point Example: The situation might encourage a greater focus on developing local talent and strengthening domestic professional services capacity.

Conclusion

PwC's decision to close operations in nine African countries marks a significant event with potentially profound consequences. The reasons behind this move are complex, encompassing challenging market conditions, intense competition, and strategic restructuring. The impact on the African business landscape is substantial, affecting job markets, access to crucial services, and investor confidence. Understanding PwC's decision to close operations in these nine African countries is crucial for navigating the evolving business landscape. It's essential to stay informed about subsequent developments and monitor the effects on individual countries and industries as they unfold. Further research into the specific impacts on each affected nation is strongly recommended.

Featured Posts

-

Internal Investigation Leads To Pw C Us Partner Severance Of Brokerage Relationships

Apr 29, 2025

Internal Investigation Leads To Pw C Us Partner Severance Of Brokerage Relationships

Apr 29, 2025 -

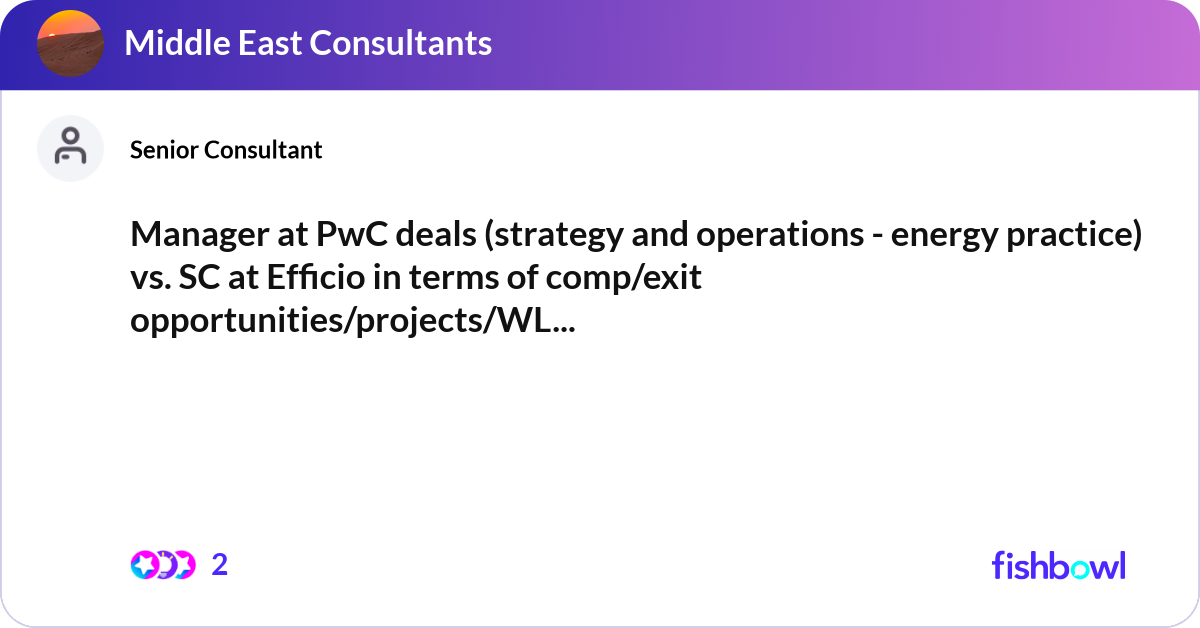

Alterya Joins Chainalysis A Strategic Move In Blockchain And Ai

Apr 29, 2025

Alterya Joins Chainalysis A Strategic Move In Blockchain And Ai

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025 -

Legendas F1 Technologia Hogyan Forradalmasitja Ezt A Porsche T

Apr 29, 2025

Legendas F1 Technologia Hogyan Forradalmasitja Ezt A Porsche T

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets A Complete Guide

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets A Complete Guide

Apr 29, 2025

Latest Posts

-

Sveti Valentin Iva Ekimova I Kontsertt Na Dscherya Y

Apr 29, 2025

Sveti Valentin Iva Ekimova I Kontsertt Na Dscherya Y

Apr 29, 2025 -

Aktualno Prof Iva Khristova Za Gripnata Epidemiya

Apr 29, 2025

Aktualno Prof Iva Khristova Za Gripnata Epidemiya

Apr 29, 2025 -

Prof Iva Khristova Za Gripa Nyama Vtora Vlna

Apr 29, 2025

Prof Iva Khristova Za Gripa Nyama Vtora Vlna

Apr 29, 2025 -

Gripna Vlna Ofitsialno Sobschenie Ot Prof Iva Khristova

Apr 29, 2025

Gripna Vlna Ofitsialno Sobschenie Ot Prof Iva Khristova

Apr 29, 2025 -

Ekspertno Mnenie Prof Iva Khristova Za Gripnata Vlna

Apr 29, 2025

Ekspertno Mnenie Prof Iva Khristova Za Gripnata Vlna

Apr 29, 2025