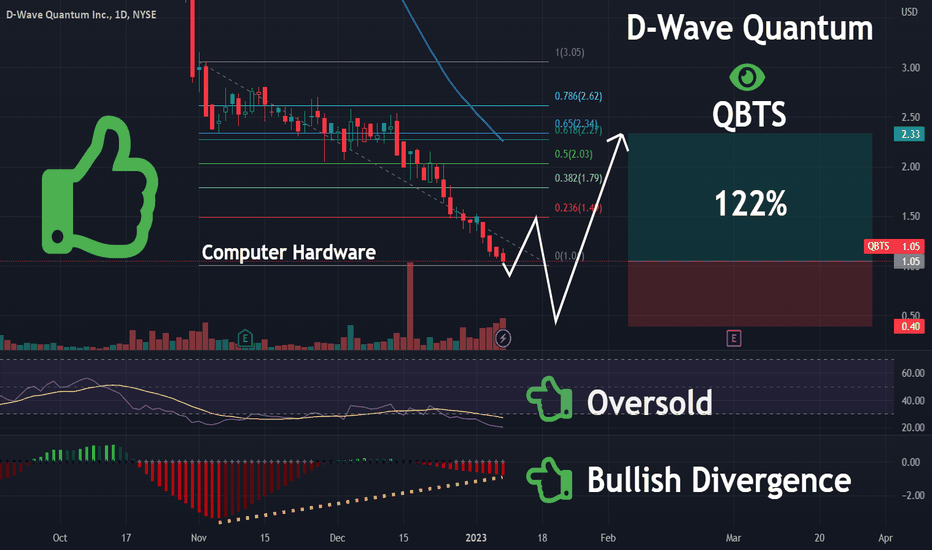

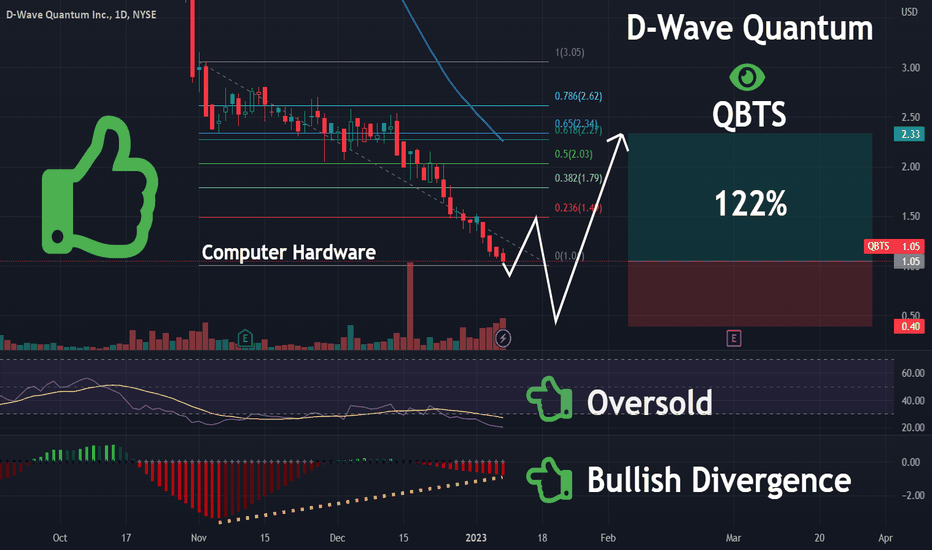

QBTS Stock's Upcoming Earnings: What To Expect

Table of Contents

Analyzing QBTS's Past Performance

Understanding QBTS's historical performance is crucial for predicting future outcomes. Analyzing QBTS's financial statements, including revenue growth, earnings per share (EPS), and other key metrics, provides a strong foundation for informed speculation. We'll examine the QBTS stock chart and consider the company's financial history to identify recurring trends and potential anomalies. Let's delve into the key aspects of QBTS's historical performance:

-

Examination of year-over-year revenue growth: Consistent year-over-year revenue growth indicates a healthy and expanding business. Analyzing the rate of this growth will reveal QBTS's potential for sustained success. Significant fluctuations in revenue should be examined closely to understand underlying causes. Access to QBTS's historical financial statements will allow for a deep dive into these figures.

-

Analysis of EPS trends and profitability margins: Tracking EPS trends is essential for understanding QBTS's profitability. A consistent increase in EPS suggests strong financial health, while a decline may indicate underlying issues. Examining profitability margins (gross and operating) provides insight into the efficiency of the company's operations and its ability to manage costs.

-

Assessment of debt levels and cash flow: Analyzing QBTS's debt levels and cash flow provides critical information about its financial stability. High debt levels can indicate increased risk, while strong cash flow suggests financial strength and the ability to handle future challenges. These aspects greatly influence a QBTS stock price prediction.

-

Comparison to industry benchmarks and competitors: QBTS's performance must also be analyzed relative to its competitors within the industry. Benchmarking against similar companies provides valuable context and helps assess QBTS's competitive positioning and potential for future growth. Comparing QBTS's revenue growth, profitability, and market share against industry averages highlights its strengths and weaknesses.

Assessing Current Market Conditions and Their Impact on QBTS

The overall economic climate significantly influences investor sentiment and QBTS stock valuation. Current market trends, including interest rates, inflation, and geopolitical events, all contribute to the overall investment environment. We will assess how these broader market conditions can specifically affect QBTS's performance and influence investor expectations.

-

Analysis of the overall market's health: A strong market generally benefits most stocks, including QBTS. Conversely, a bear market will often lead to decreased investor confidence and reduced stock prices. Understanding the current market's overall health is vital.

-

Discussion of prevailing interest rates and their impact: Interest rates significantly affect borrowing costs for companies. Higher rates can make expansion more expensive for QBTS, potentially impacting future growth and impacting QBTS earnings.

-

Review of recent news and developments affecting the QBTS industry: Recent industry news, regulatory changes, and technological advancements will impact QBTS's future prospects. Staying updated on industry-specific news is crucial.

-

Evaluation of competitor performance and market share: The performance of QBTS's competitors directly impacts its position in the market. A competitor’s innovative product or aggressive pricing strategy could potentially hurt QBTS's market share and influence its QBTS stock price prediction.

Key Factors to Watch in the Upcoming QBTS Earnings Report

The upcoming QBTS earnings report will contain several key performance indicators (KPIs) that investors should scrutinize closely to assess the company’s performance and future outlook. Careful analysis of these factors will allow for a more accurate QBTS stock forecast.

-

Focus on revenue growth rate compared to previous quarters: A significant increase or decrease in revenue growth compared to previous quarters requires detailed analysis to understand the underlying reasons. This will inform expectations for future QBTS earnings.

-

Analysis of the company's explanation for any variance in EPS: Any unexpected changes in EPS should be carefully examined, along with management's explanation for those changes. This is crucial in assessing the company's future financial health.

-

Scrutiny of any changes in operating margins or expenses: Changes in operating margins or expenses can reveal important information about the efficiency of the company's operations and its ability to manage costs. These factors will influence future QBTS earnings guidance.

-

Assessment of the company's projections for the next quarter and year: The company’s forward-looking statements, particularly revenue projections and earnings guidance, are crucial for investors in making informed decisions. These projections form the basis of many QBTS stock price predictions.

Strategies for Investing in QBTS Stock Based on Earnings

The upcoming earnings report will inform various investment strategies. This section provides general guidance, emphasizing the importance of careful consideration and risk management, rather than providing explicit financial advice. Remember, diversification is key for any investment portfolio.

-

Strategies for investors expecting positive earnings results: Positive earnings results could signal an opportunity to buy or hold QBTS stock, depending on your individual investment strategy and risk tolerance.

-

Strategies for investors anticipating negative or mixed results: Negative or mixed results may lead to a sell-off or a decision to wait and see. The decision depends on your individual investment goals and the overall market conditions.

-

Importance of setting stop-loss orders to manage risk: Stop-loss orders help limit potential losses in your QBTS investment if the price falls below a predetermined level.

-

Emphasis on diversifying investment portfolios: Diversifying across multiple assets reduces the overall risk of your investment portfolio, minimizing the impact of any single stock's underperformance.

Conclusion

This analysis provides a framework for understanding the upcoming QBTS earnings report. By examining past performance, current market conditions, and key factors within the report, investors can make more informed decisions about their QBTS investment. Remember to always conduct your own thorough research and seek advice from qualified financial professionals before making any investment decisions.

Call to Action: Stay informed about the upcoming QBTS earnings announcement and continue to monitor QBTS stock performance for optimal investment strategies. Learn more about QBTS stock and effective investment strategies to maximize your returns. Understanding QBTS financial results is key to making informed decisions about your QBTS investment.

Featured Posts

-

The Kite Runner And Nigeria A Comparative Study Of Moral Dilemmas

May 20, 2025

The Kite Runner And Nigeria A Comparative Study Of Moral Dilemmas

May 20, 2025 -

Giakoymakis I Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025

Giakoymakis I Kroyz Azoyl Ston Teliko Toy Champions League

May 20, 2025 -

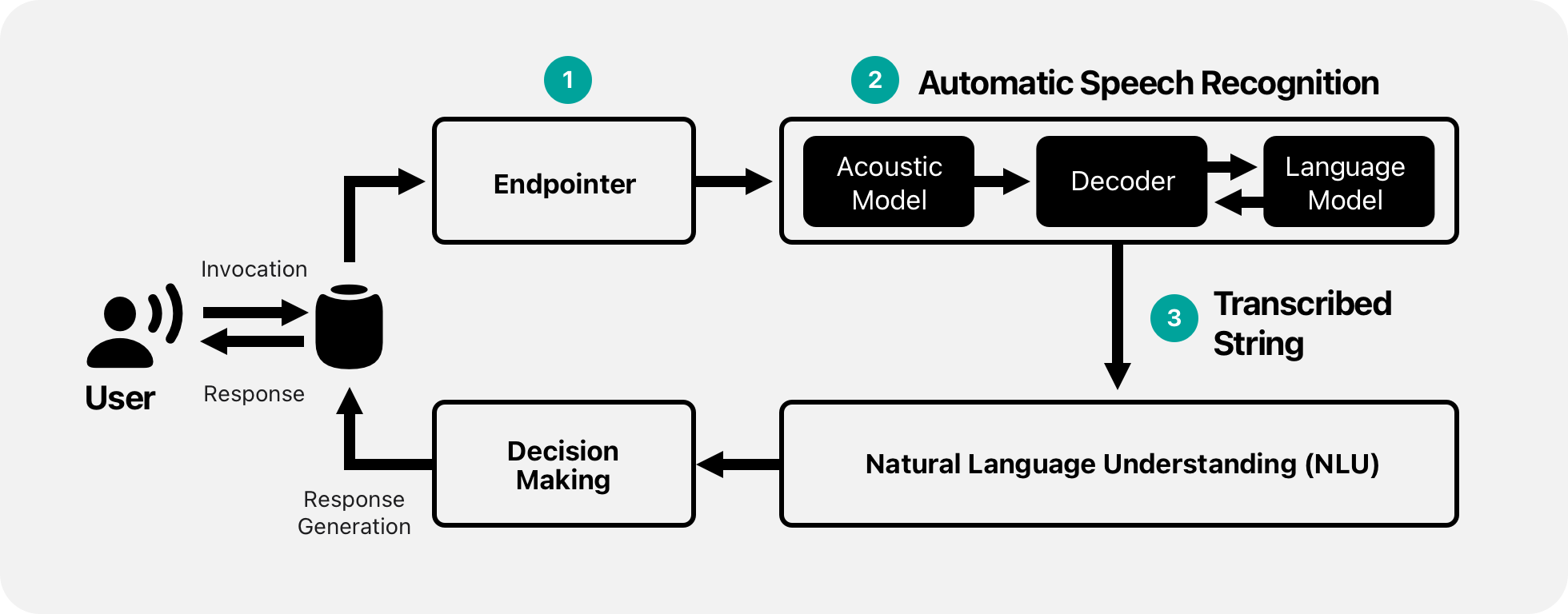

Hmrcs New Voice Recognition System Faster Call Handling

May 20, 2025

Hmrcs New Voice Recognition System Faster Call Handling

May 20, 2025 -

Ivoire Tech Forum 2025 Un Evenement Majeur Pour Le Numerique En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 Un Evenement Majeur Pour Le Numerique En Cote D Ivoire

May 20, 2025 -

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025

Latest Posts

-

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025 -

Gangsta Granny Activities To Enhance Reading Comprehension

May 20, 2025

Gangsta Granny Activities To Enhance Reading Comprehension

May 20, 2025 -

A Hitch In The Plans Matt Lucas And David Walliams Cliff Richard Musical

May 20, 2025

A Hitch In The Plans Matt Lucas And David Walliams Cliff Richard Musical

May 20, 2025 -

A Parents Guide To Discussing Gangsta Granny With Children

May 20, 2025

A Parents Guide To Discussing Gangsta Granny With Children

May 20, 2025 -

The Cliff Richard Musical Lucas And Walliams Encounter A Problem

May 20, 2025

The Cliff Richard Musical Lucas And Walliams Encounter A Problem

May 20, 2025