QNB Corp At The March 6th Virtual Banking Investor Conference

Table of Contents

QNB Corp's Financial Performance and Outlook

QNB Corp's financial results for the period leading up to the March 6th conference painted a positive picture. The company demonstrated strong financial health, marked by robust revenue growth and impressive profitability. These positive QNB financial results showcased the bank's resilience and strategic prowess within a sometimes challenging banking sector outlook. Key financial highlights were presented, offering investors a clear understanding of the company's performance.

-

Key financial highlights: A significant percentage increase in net income year-over-year was reported, alongside strong revenue growth fueled by strategic investments and expansion into new markets. Assets under management also experienced healthy growth.

-

Drivers of performance: Loan growth across various sectors, coupled with smart investment returns, were identified as primary drivers of QNB's exceptional performance. The efficient management of operational costs also contributed significantly to increased profitability.

-

Management's outlook: QNB's management expressed confidence in the future, projecting continued growth and profitability driven by strategic initiatives and expansion plans. They highlighted opportunities within both domestic and international markets.

-

Risk factors and challenges: While the outlook was largely positive, QNB management also acknowledged certain risks and challenges, including potential economic downturns and increased competition within the financial services industry. However, they outlined proactive measures to mitigate these risks.

Strategic Initiatives and Growth Strategies

The March 6th conference served as a platform for QNB Corp to outline its ambitious strategic initiatives and growth strategies. A key focus was the bank's commitment to digital transformation and its investments in fintech, paving the way for enhanced customer experiences and operational efficiency. These initiatives, combined with aggressive expansion plans, position QNB for significant future growth.

-

Key strategic priorities: Digital transformation, strategic partnerships, and international expansion emerged as key priorities, aimed at solidifying QNB’s position as a leading banking institution.

-

New products and services: Several innovative products and services were detailed, focused on enhancing customer accessibility and offering tailored financial solutions. The integration of advanced banking technology was a prominent aspect of these announcements.

-

Expansion plans: QNB's expansion plans involve exploring new geographic markets and tapping into previously underserved customer segments. This demonstrates a commitment to diversification and long-term growth.

-

Partnerships and collaborations: Several key partnerships and collaborations were highlighted, aiming to leverage external expertise and broaden QNB's reach and service offerings.

Q&A Session Highlights and Investor Sentiment

The Q&A session following QNB Corp's presentation provided valuable insights into investor sentiment and concerns. Analysts and investors raised questions regarding several key aspects of QNB's business, including the bank’s risk management strategy and future growth projections. Management provided comprehensive and reassuring responses.

-

Key questions addressed: Questions focused on the sustainability of the growth trajectory, the potential impact of global economic uncertainty, and the bank's response to increasing competition.

-

Management responses: QNB's management directly addressed these concerns, emphasizing the bank's strong capital position, diversified portfolio, and effective risk management practices.

-

Market reaction: The market reacted positively to QNB Corp's presentation, with the stock price experiencing a moderate increase in the days following the conference. Several analysts upgraded their ratings for QNB's stock, reflecting increased confidence.

-

Investor sentiment: Overall, the investor sentiment towards QNB Corp following the conference was largely positive, reflecting confidence in the bank's financial strength and future growth prospects.

Conclusion

QNB Corp's presentation at the March 6th virtual banking investor conference highlighted its strong financial performance, ambitious strategic initiatives, and positive outlook. The company’s focus on digital transformation, international expansion, and strategic partnerships positions it well for sustained growth. The positive market reaction and investor sentiment following the conference further underscore QNB Corp's strong position within the banking sector. The presented financial results, combined with the unveiled strategic plans, make QNB Corp a compelling investment opportunity. Learn more about QNB Corp's future growth prospects and investment opportunities by visiting their investor relations website today. Stay informed about future QNB Corp announcements and events to capitalize on potential investment opportunities within the dynamic banking sector.

Featured Posts

-

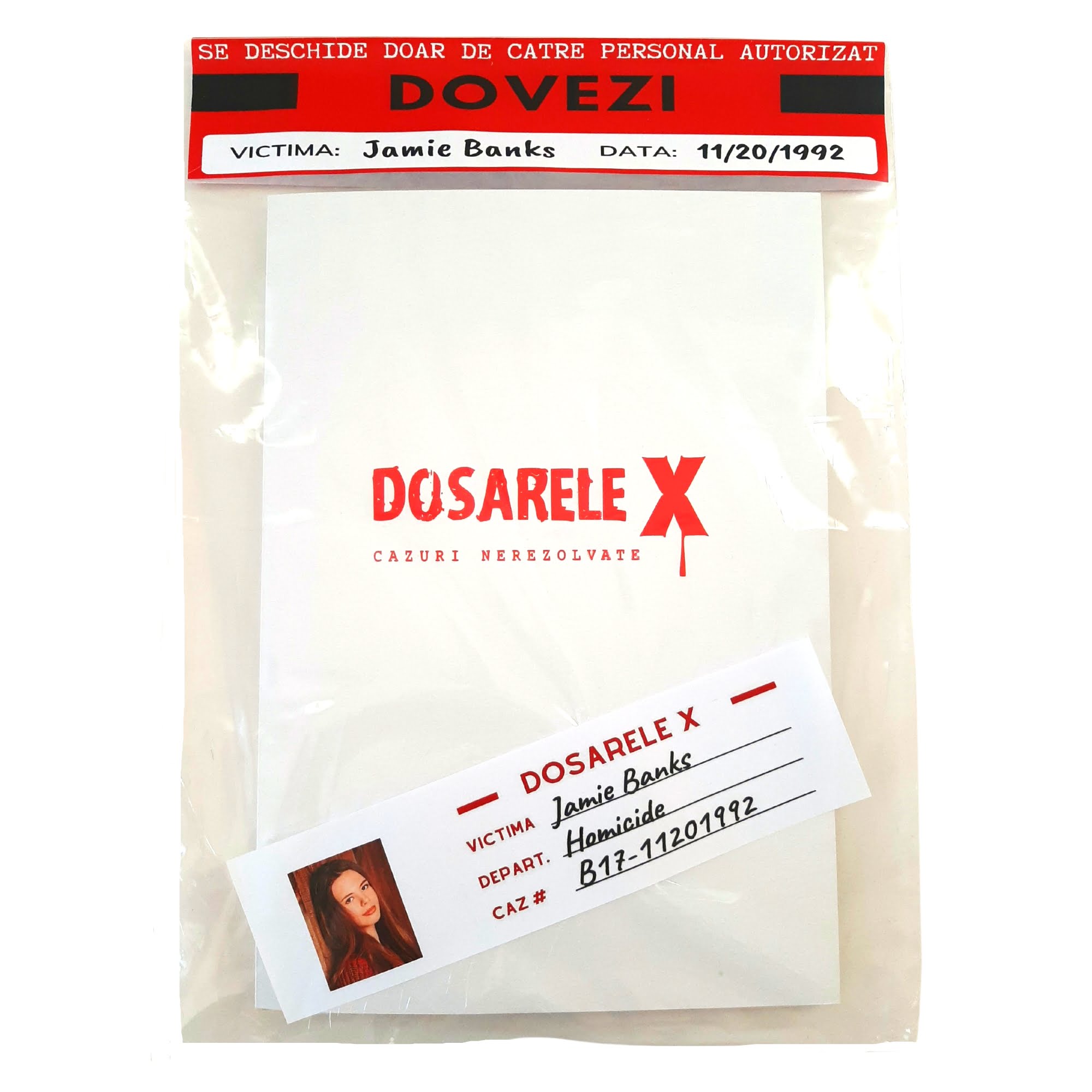

Dosarele X O Redeschidere Posibila Viata Libera Galati

Apr 30, 2025

Dosarele X O Redeschidere Posibila Viata Libera Galati

Apr 30, 2025 -

Ben Afflecks New Film Features Gillian Anderson In A Thrilling Shootout

Apr 30, 2025

Ben Afflecks New Film Features Gillian Anderson In A Thrilling Shootout

Apr 30, 2025 -

Reduire La Mortalite Routiere L Efficacite Des Glissieres De Securite

Apr 30, 2025

Reduire La Mortalite Routiere L Efficacite Des Glissieres De Securite

Apr 30, 2025 -

Appello Processo Becciu Data D Inizio E Dichiarazione Dell Imputato

Apr 30, 2025

Appello Processo Becciu Data D Inizio E Dichiarazione Dell Imputato

Apr 30, 2025 -

Document Amf Mercialys 2025 E1022016 Publication Du 25 Fevrier 2025

Apr 30, 2025

Document Amf Mercialys 2025 E1022016 Publication Du 25 Fevrier 2025

Apr 30, 2025