RBC Earnings Fall Short Of Expectations: Impact Of Potential Loan Defaults

Table of Contents

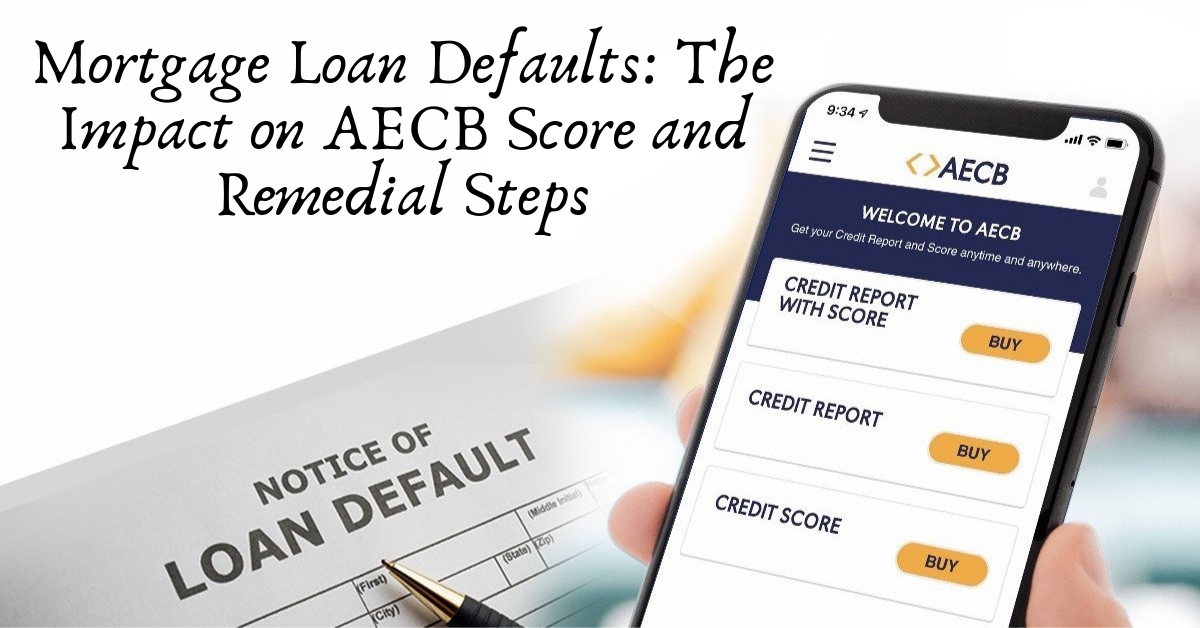

Economic Headwinds and Rising Interest Rates

The current economic climate is characterized by significant uncertainty. Inflation remains stubbornly high, fueling interest rate hikes by central banks globally, including the Bank of Canada. These "interest rate hikes" are designed to curb inflation but inadvertently increase borrowing costs for consumers and businesses, significantly impacting loan repayments and increasing the risk of defaults. Recessionary fears are also prevalent, adding to the economic uncertainty and potentially exacerbating the problem.

- Increased borrowing costs for consumers and businesses: Higher interest rates translate directly into increased monthly payments for mortgages, loans, and credit lines, straining household and corporate budgets.

- Strain on household budgets leading to potential mortgage defaults: Many Canadians are already facing affordability challenges, and rising interest rates further squeeze their budgets, increasing the likelihood of mortgage defaults.

- Higher debt servicing costs for companies, increasing default probability: Businesses with significant debt loads face higher interest expenses, reducing their profitability and potentially leading to loan defaults.

Sectors Most Vulnerable to Loan Defaults

Certain sectors are inherently more susceptible to loan defaults given the current economic conditions. A detailed "sectoral analysis" reveals the following high-risk areas:

- Commercial real estate: Higher vacancy rates in office buildings and retail spaces, driven partly by remote work trends and shifts in consumer behavior, are increasing the financial strain on commercial real estate developers and owners, making them more vulnerable to loan defaults.

- Energy sector: Fluctuating oil prices and global energy market volatility create uncertainty for energy companies, increasing their credit risk and the probability of loan defaults.

- Retail: The retail sector faces challenges from changing consumer spending habits, increased competition, and supply chain disruptions, all contributing to higher default risk amongst retail businesses burdened by debt. These factors contribute to the overall "credit risk" within the sector.

RBC's Response to Rising Loan Defaults

RBC is proactively addressing the rising risk of loan defaults through several key strategies focused on "risk management" and "loss mitigation." These include:

- Increased scrutiny of loan applications: RBC is likely implementing stricter lending criteria to reduce the acceptance of high-risk loans.

- Higher capital reserves to absorb potential losses: Building "credit provisioning" to cover potential loan losses is a crucial step in safeguarding financial stability.

- Initiatives to support struggling borrowers: Offering flexible repayment options or debt restructuring programs can help mitigate defaults and maintain positive customer relationships. This proactive approach to "loss mitigation" can lessen the financial impact on RBC.

Impact on RBC's Future Financial Performance and Investor Confidence

The potential increase in loan defaults poses a significant threat to RBC's future financial performance and investor confidence. This could manifest in several ways:

- Potential decrease in net income: Higher loan losses will directly impact RBC's profitability, reducing its "net income."

- Impact on dividend payouts: Reduced profitability could lead to a decrease or suspension of dividend payouts to shareholders.

- Effect on RBC's credit rating: A substantial increase in loan defaults could negatively affect RBC's credit rating, increasing its borrowing costs and potentially impacting investor sentiment. The resulting effect on the "stock price" will be a critical indicator of investor confidence.

Conclusion: Analyzing RBC Earnings and the Threat of Loan Defaults

RBC's lower-than-expected earnings highlight the significant impact of potential loan defaults, particularly within vulnerable sectors like commercial real estate, energy, and retail. The current economic headwinds, including rising interest rates and recessionary fears, are exacerbating the situation. While RBC is implementing measures to mitigate the risk, close monitoring of the situation is crucial. The potential for further loan defaults and their implications for RBC's profitability, investor confidence, and the broader Canadian economy cannot be understated. To stay informed about RBC's financial performance and the evolving landscape of "loan default risk," follow reputable financial news sources and consider subscribing to our newsletter for regular updates on "RBC earnings forecast" and "financial market analysis." Understanding the implications of potential loan defaults on RBC and the broader financial landscape is paramount.

Featured Posts

-

Lower Than Expected Earnings For Rbc A Look At The Souring Loan Portfolio

May 31, 2025

Lower Than Expected Earnings For Rbc A Look At The Souring Loan Portfolio

May 31, 2025 -

Receta De Lasana De Calabacin De Pablo Ojeda La Version Mas Vale Tarde

May 31, 2025

Receta De Lasana De Calabacin De Pablo Ojeda La Version Mas Vale Tarde

May 31, 2025 -

Sanofi Etend Son Expertise En Immunologie Grace A Dren Bio

May 31, 2025

Sanofi Etend Son Expertise En Immunologie Grace A Dren Bio

May 31, 2025 -

Solve The Nyt Mini Crossword Hints For March 31 2025

May 31, 2025

Solve The Nyt Mini Crossword Hints For March 31 2025

May 31, 2025 -

Essential Item To Save Money At Glastonbury Festival Veterans Advice

May 31, 2025

Essential Item To Save Money At Glastonbury Festival Veterans Advice

May 31, 2025