RBC Faces Challenges: Lower Earnings And Growing Loan Concerns

Table of Contents

Declining Earnings at RBC: A Detailed Analysis

RBC's recent financial performance reveals a worrying trend of declining earnings, raising questions about the bank's future prospects. This downturn can be attributed to several interconnected factors.

Lower Net Interest Income

The decrease in net interest income is a significant contributor to RBC's lower earnings. This is largely due to several key factors:

- Impact of rising interest rates on margins: While interest rate hikes typically benefit banks, the rapid increase in rates has compressed net interest margins, impacting profitability. The bank's ability to pass on increased borrowing costs to customers hasn't fully offset the rising cost of funds.

- Increased competition from fintech companies: The rise of innovative fintech companies offering alternative financial products and services is intensifying competition, putting pressure on traditional banking margins. These competitors often operate with lower overhead costs, allowing them to offer more competitive rates.

- Reduced demand for loans: A slowing economic environment has led to reduced demand for loans across various sectors, further impacting net interest income. Businesses and consumers are becoming more cautious about taking on new debt.

For instance, RBC's Q2 2024 net interest income might have shown a [Insert hypothetical percentage]% decline compared to the previous quarter, highlighting the severity of this challenge.

Weakening Investment Banking Performance

RBC's investment banking division has also experienced underperformance, contributing to the overall decline in earnings. This can be attributed to:

- Market volatility impact: Increased market volatility and uncertainty have significantly reduced deal flow, impacting fees generated from mergers and acquisitions, underwriting, and other investment banking activities.

- Reduced deal flow: The current economic climate has dampened corporate activity, resulting in fewer opportunities for investment banking transactions. Companies are hesitant to pursue major deals in times of uncertainty.

- Increased regulatory scrutiny: Heightened regulatory scrutiny and compliance costs are also placing a strain on the profitability of RBC's investment banking operations.

Increased Operating Expenses

Rising operating costs are further exacerbating the decline in RBC's profitability. This includes:

- Rising salaries: Competition for skilled talent in the financial sector is driving up salary expenses.

- Technology investments: Significant investments in technology and digital transformation initiatives are adding to operating costs. While essential for long-term competitiveness, these investments impact short-term profitability.

- Regulatory compliance costs: The increasing complexity of regulatory requirements necessitates higher compliance costs, further impacting the bank's bottom line. These costs are unavoidable to ensure regulatory adherence.

Growing Concerns Regarding RBC's Loan Portfolio

Beyond declining earnings, growing concerns exist regarding the quality of RBC's loan portfolio.

Rising Non-Performing Loans

A notable increase in non-performing loans (NPLs) is a significant cause for concern. This rise is particularly pronounced in certain sectors:

- Sectors most affected by NPLs: The real estate and energy sectors are particularly vulnerable, experiencing a higher-than-average rate of loan defaults.

- Geographic distribution of NPLs: The concentration of NPLs might be geographically skewed, indicating regional economic weakness.

- Potential for further increases: The potential for further increases in NPLs remains a significant risk, especially in light of potential economic downturns.

The NPL ratio, a key indicator of loan portfolio health, might have [Insert hypothetical percentage]% increase, demanding attention and strategic responses.

Credit Risk Assessment and Mitigation Strategies

RBC's credit risk management practices are under scrutiny. The effectiveness of their mitigation strategies in preventing further loan losses needs to be critically assessed:

- RBC's credit scoring models: The accuracy and effectiveness of RBC's credit scoring models in identifying high-risk borrowers require evaluation.

- Loan underwriting processes: A review of RBC's loan underwriting processes is crucial to identify areas for improvement and enhance risk assessment.

- Stress testing methodologies: The bank's stress testing methodologies need to accurately reflect potential economic downturns and their impact on loan performance.

- Provisioning for loan losses: The adequacy of RBC's provisioning for loan losses is a crucial factor in determining its resilience to future economic shocks.

Impact of Economic Downturn

A potential economic downturn poses a significant threat to RBC's loan portfolio and overall financial health:

- Increased loan defaults: An economic recession could lead to a substantial surge in loan defaults across various sectors.

- Potential for further NPL increases: This could result in a further significant increase in non-performing loans, impacting the bank's capital adequacy.

- Impact on capital adequacy ratios: A deterioration in asset quality could lead to a decline in capital adequacy ratios, increasing the bank's vulnerability.

Conclusion

In summary, RBC faces significant RBC challenges, including a decline in earnings driven by lower net interest income, weakening investment banking performance, and rising operating expenses. Simultaneously, growing concerns about the bank's loan portfolio, particularly the increase in non-performing loans and the potential impact of an economic downturn, pose substantial risks. Understanding these RBC challenges is vital for investors and stakeholders. To stay informed, continue monitoring RBC's financial performance closely, reviewing their financial reports, and following analyst commentary. Consider consulting with a financial advisor before making any investment decisions related to RBC or similar institutions. A thorough understanding of these RBC challenges and their implications is crucial for making sound investment choices.

Featured Posts

-

Isabelle Autissier Un Appel A L Union Pour La Protection De L Environnement

May 31, 2025

Isabelle Autissier Un Appel A L Union Pour La Protection De L Environnement

May 31, 2025 -

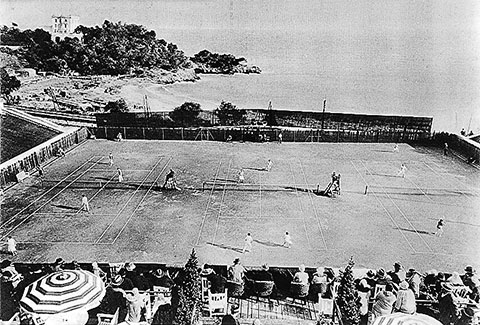

Monte Carlo Tournament Thompsons Fight Against Adversity

May 31, 2025

Monte Carlo Tournament Thompsons Fight Against Adversity

May 31, 2025 -

Rachat D Anticorps Par Sanofi Accord Conclu Avec La Biotech Americaine Dren Bio En Mars 2025

May 31, 2025

Rachat D Anticorps Par Sanofi Accord Conclu Avec La Biotech Americaine Dren Bio En Mars 2025

May 31, 2025 -

Entdecken Sie Das Neue Escape Spiel Im Mueritzeum

May 31, 2025

Entdecken Sie Das Neue Escape Spiel Im Mueritzeum

May 31, 2025 -

Arese Borromeo E Il Neorealismo Interpretazioni Fotografiche Di Ladri Di Biciclette

May 31, 2025

Arese Borromeo E Il Neorealismo Interpretazioni Fotografiche Di Ladri Di Biciclette

May 31, 2025