Real Estate Update: 65 Hudson's Bay Leases Draw Buyer Interest

Table of Contents

Prime Location and High-Demand Area

The strategic location of 65 Hudson's Bay Company properties is a primary driver of buyer interest. These properties are typically situated in desirable neighborhoods known for their high foot traffic, excellent visibility, and proximity to key transportation hubs. This combination creates an ideal environment for various businesses, boosting their potential for success.

- High foot traffic areas: These locations see a constant flow of pedestrians, providing excellent exposure for retail businesses and increasing the potential customer base.

- Excellent visibility for retail businesses: Prominent locations with large storefront windows ensure high visibility, attracting potential customers and building brand awareness.

- Accessibility via public transport and major roadways: Easy access via public transportation and major roadways ensures convenient access for both employees and customers.

- Nearby amenities that enhance desirability: The proximity to restaurants, entertainment venues, and other amenities adds to the overall attractiveness of the location, increasing its desirability for businesses and their employees. This creates a vibrant and bustling environment.

Attractive Lease Terms and Conditions

Beyond location, the attractive lease terms and conditions offered for 65 Hudson's Bay Company properties are another significant draw for potential buyers. The terms are designed to be competitive and flexible, appealing to a broad range of businesses.

- Competitive rental rates compared to market averages: The rental rates are often below market average, making these leases a cost-effective option for businesses.

- Flexible lease terms accommodating various business needs: The lease agreements offer flexibility in terms of lease length and other conditions, catering to diverse business requirements.

- Options for lease extensions or renewals: The possibility of extending or renewing leases provides businesses with security and long-term planning opportunities.

- Potential for rent increases aligned with market growth: Rent increases are often structured to align with market growth, ensuring that landlords receive a fair return on their investment while maintaining tenant affordability.

Potential for Redevelopment and Value Appreciation

Many 65 Hudson's Bay Company properties present significant potential for redevelopment and value appreciation. The adaptable nature of these spaces allows for creative repurposing to meet evolving market demands.

- Opportunities for adaptive reuse to meet changing market demands: The existing structures can be renovated and repurposed to suit various business models, maximizing their potential and value.

- Potential for increased rental income through renovations: Strategic renovations can significantly increase the rental income generated by the property.

- Long-term appreciation in property value based on location and improvements: Investing in improvements and strategically managing the properties can lead to substantial long-term appreciation in property value, driven by the prime location and the quality of the renovations.

Diverse Buyer Profile and Investment Strategies

The interest in 65 Hudson's Bay Company leases stems from a diverse pool of buyers employing various investment strategies. This indicates a strong market demand and confidence in the long-term value of these properties.

- Retail investors seeking high-return opportunities: Individual investors see these properties as a chance for high returns due to their prime location and potential for appreciation.

- Commercial developers planning renovations and expansions: Developers are attracted by the opportunity to renovate and expand the properties, increasing their value and rental income.

- Real estate investment trusts (REITs) diversifying their portfolios: REITs utilize these properties to diversify their portfolios, reducing risk and maximizing returns.

- Private equity firms investing in commercial real estate: Private equity firms are increasingly seeking opportunities in commercial real estate, and 65 Hudson's Bay Company leases present an attractive investment option.

Market Analysis and Future Predictions

Analyzing recent sales in the area shows a strong upward trend in property values. This suggests a positive outlook for future rental rates, based on the high demand and limited supply of these prime properties.

- Analysis of recent sales in the area to establish market value: Recent sales data supports the conclusion that these properties are undervalued in the market, presenting a compelling investment opportunity.

- Predictions for future rental rates based on market demand: Based on current market trends, rental rates are projected to continue to increase over the next few years.

- Discussion of potential risks and opportunities: While potential risks exist in any real estate investment, thorough due diligence can mitigate these risks and maximize the opportunities.

- Long-term forecast for the value appreciation of 65 Hudson's Bay Company properties: The long-term outlook for these properties is positive, projecting continued value appreciation due to strong market demand and limited supply.

Due Diligence and Investment Considerations

Before investing in any property, including 65 Hudson's Bay Company leases, thorough due diligence is crucial. This process will help investors make informed decisions and minimize potential risks.

- Importance of a professional property appraisal: An independent appraisal provides an objective assessment of the property's value, guiding investment decisions.

- Thorough review of lease agreements and terms: Carefully reviewing the lease agreements ensures a clear understanding of all terms and conditions, preventing future disputes.

- Assessment of potential risks and liabilities: Identifying and evaluating potential risks and liabilities helps investors prepare for unforeseen circumstances.

- Seeking advice from experienced real estate professionals: Consulting with experienced real estate professionals ensures access to valuable expertise and guidance.

Conclusion

The significant buyer interest in 65 Hudson's Bay Company leases reflects a confluence of positive factors, including prime location, attractive lease terms, and significant redevelopment potential. Investors should conduct thorough due diligence, carefully considering market trends and potential risks before making any decisions. The future for these properties looks promising, representing a valuable opportunity for those seeking investment in a dynamic and thriving real estate sector. For more information on available 65 Hudson's Bay leases and other prime commercial real estate opportunities, contact [Contact Information/Link to relevant site]. Don't miss out on this exciting opportunity to invest in prime 65 Hudson's Bay Company real estate.

Featured Posts

-

Tyler Herro And The Cavaliers Shine At Nba All Star Weekend

Apr 24, 2025

Tyler Herro And The Cavaliers Shine At Nba All Star Weekend

Apr 24, 2025 -

Trump Administration And Harvard Negotiation Opens After Major Lawsuit

Apr 24, 2025

Trump Administration And Harvard Negotiation Opens After Major Lawsuit

Apr 24, 2025 -

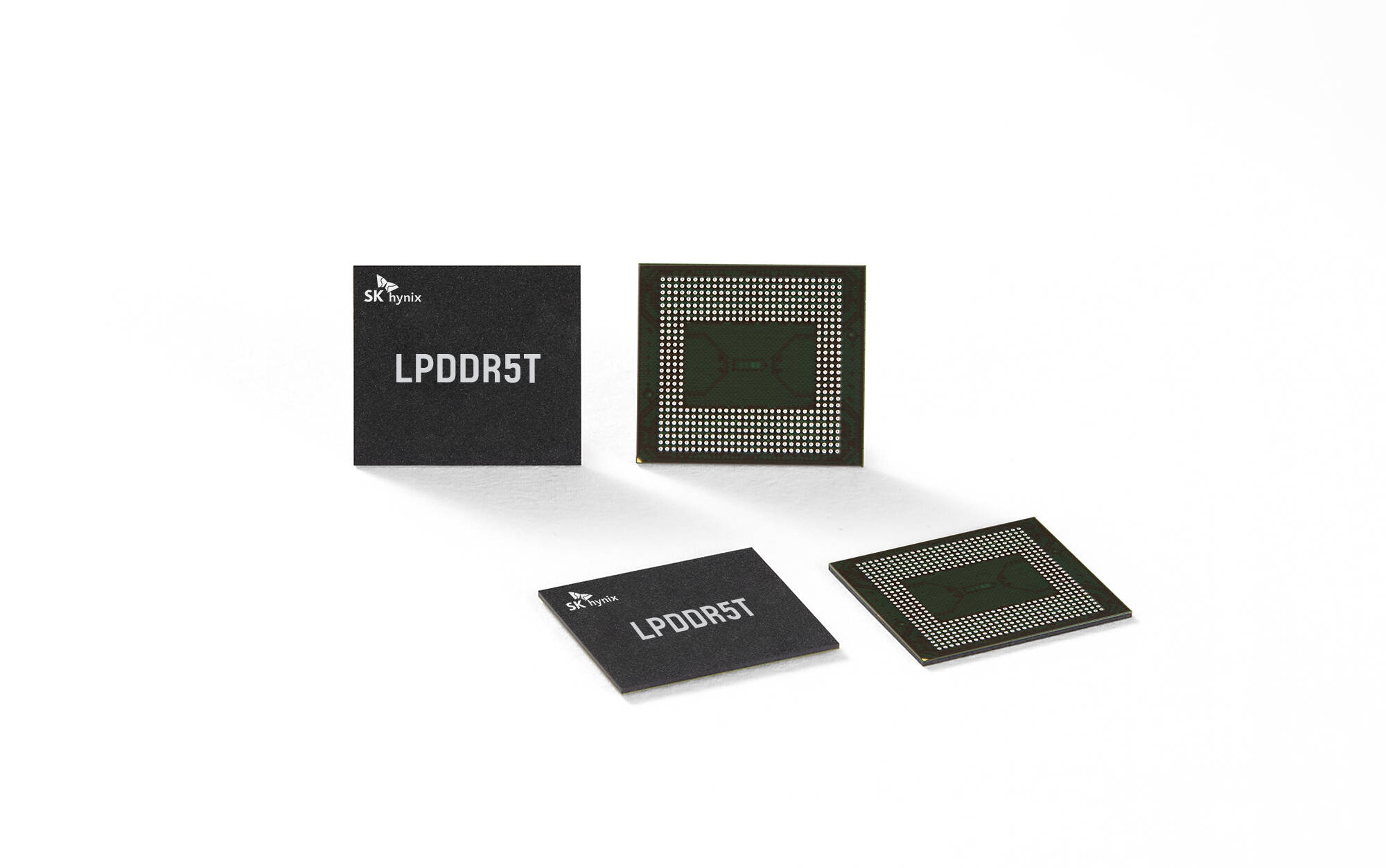

Sk Hynix Surpasses Samsung As Leading Dram Manufacturer The Ai Factor

Apr 24, 2025

Sk Hynix Surpasses Samsung As Leading Dram Manufacturer The Ai Factor

Apr 24, 2025 -

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Son Jetts Birthday

Apr 24, 2025 -

Pope Francis A Divided Church In A Globalized World

Apr 24, 2025

Pope Francis A Divided Church In A Globalized World

Apr 24, 2025

Latest Posts

-

The Vma Simulcast On Cbs A Turning Point For Music Television

May 12, 2025

The Vma Simulcast On Cbs A Turning Point For Music Television

May 12, 2025 -

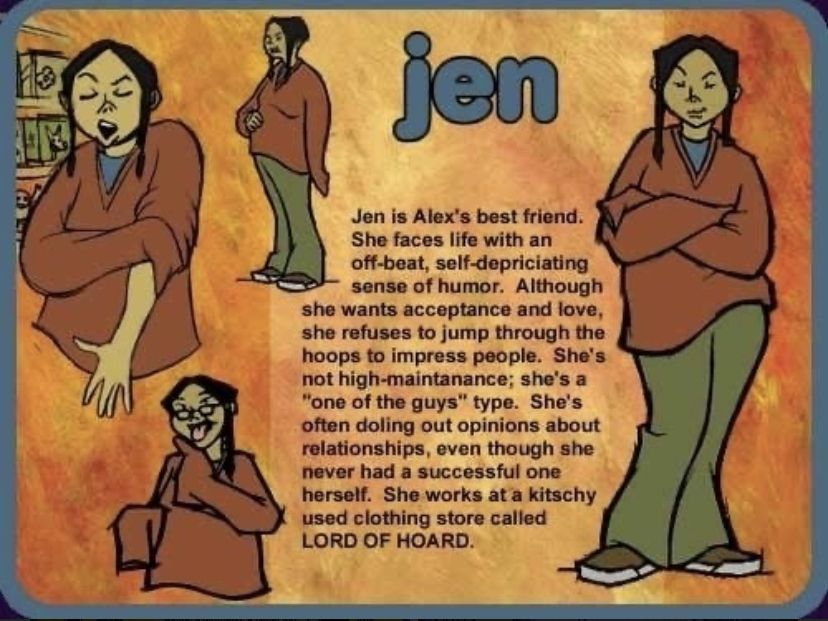

Alex Winters Lost Mtv Years The Sketch Comedy That Preceded Freaked

May 12, 2025

Alex Winters Lost Mtv Years The Sketch Comedy That Preceded Freaked

May 12, 2025 -

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Share Happy News

May 12, 2025

Pregnancy Announcement Mackenzie Mc Kee And Khesanio Hall Share Happy News

May 12, 2025 -

Mtv Vs Cbs Analyzing The Impact Of The Vma Simulcast

May 12, 2025

Mtv Vs Cbs Analyzing The Impact Of The Vma Simulcast

May 12, 2025 -

Uncovering Alex Winters Early Comedy Career His Mtv Sketch Shows

May 12, 2025

Uncovering Alex Winters Early Comedy Career His Mtv Sketch Shows

May 12, 2025