Recent Bitcoin Rebound: Opportunities And Risks For Investors

Table of Contents

Factors Contributing to the Bitcoin Rebound

Several key factors have contributed to the recent Bitcoin rebound, creating a complex interplay of influences shaping the cryptocurrency's price. Understanding these factors is crucial for assessing the sustainability of this upward trend and making informed investment decisions.

Increased Institutional Adoption

Growing acceptance by major financial institutions is bolstering Bitcoin's credibility and driving demand. This institutional interest signals a shift towards broader market acceptance and legitimization of Bitcoin as an asset class.

- Examples of institutional investment: MicroStrategy's significant Bitcoin holdings, Tesla's previous Bitcoin investment (though later partially sold), and the growing interest from other publicly traded companies.

- Impact of ETF applications: The ongoing applications for Bitcoin exchange-traded funds (ETFs) in various jurisdictions could significantly increase accessibility and liquidity, further boosting demand.

- Increasing regulatory clarity: While regulatory landscapes remain diverse globally, increasing clarity in some jurisdictions is reducing uncertainty and encouraging institutional involvement. This reduces some of the inherent risk associated with Bitcoin investment.

The psychological effect of institutional investment is substantial. Large-scale purchases by established players lend credibility and encourage further investment, creating a positive feedback loop that can fuel price increases.

Macroeconomic Factors

Global economic uncertainty and inflation are pushing investors towards alternative assets like Bitcoin, seeking diversification and potential inflation hedging.

- Inflation hedging potential: Bitcoin's limited supply of 21 million coins is often cited as a reason why it could act as a hedge against inflation, similar to gold. However, its price volatility makes this a debated point.

- Impact of rising interest rates: Rising interest rates generally impact the value of risk assets. However, Bitcoin's performance isn't always directly correlated with traditional market trends, offering a degree of independence.

- The role of Bitcoin as a safe haven asset: While some view Bitcoin as a safe haven during times of economic turmoil, its high volatility challenges this classification. Its behavior during periods of global uncertainty is still under ongoing analysis.

The correlation between Bitcoin price and traditional markets is complex and not always consistent. While some periods show a negative correlation (Bitcoin rising while stocks fall), others demonstrate positive correlation. This lack of consistent correlation makes Bitcoin an attractive diversifier for some investors.

Technological Advancements

Network upgrades and developments in the Bitcoin ecosystem are enhancing its functionality and appeal, making it a more efficient and user-friendly system.

- The Lightning Network: This second-layer scaling solution significantly improves transaction speeds and reduces fees, addressing one of Bitcoin's earlier limitations.

- Taproot upgrade: This upgrade enhances privacy, scalability, and smart contract capabilities, opening doors for more complex applications on the Bitcoin network.

- Other relevant improvements: Ongoing development and improvements in wallet security, mining efficiency, and overall network stability continue to strengthen Bitcoin's infrastructure.

These technological advancements increase scalability, security, and usability, leading to greater adoption and potential for future growth.

Opportunities Presented by the Bitcoin Rebound

The recent Bitcoin rebound presents several exciting opportunities for investors, but it's crucial to approach them with a balanced perspective and a comprehensive understanding of the risks involved.

Potential for High Returns

A successful Bitcoin rebound can lead to substantial profits for early investors, though past performance is never a guarantee of future results.

- Potential ROI scenarios: Historical data shows periods of significant price appreciation, but also periods of dramatic decline. It is essential to avoid overly optimistic projections based solely on past performance.

- "Buy the dip" strategy: This strategy involves purchasing Bitcoin during periods of price decline, anticipating a future rebound. However, timing the market accurately is extremely difficult, and significant losses are possible.

Diversification Benefits

Bitcoin can offer diversification benefits to an investment portfolio by reducing overall risk due to its low correlation with traditional assets.

- Bitcoin's low correlation with traditional assets: This low correlation can help cushion the impact of market downturns in stocks or bonds.

- Importance of asset allocation: Proper asset allocation is key. Bitcoin should be considered as only one component of a diversified portfolio, not a sole investment.

Risks Associated with the Bitcoin Rebound

Despite the potential for significant returns, several risks are inherent to Bitcoin investment, demanding careful consideration and risk management.

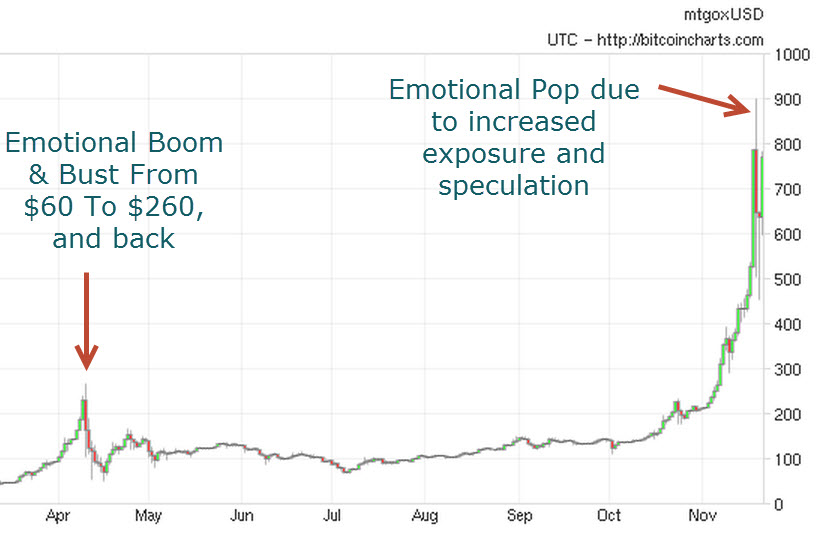

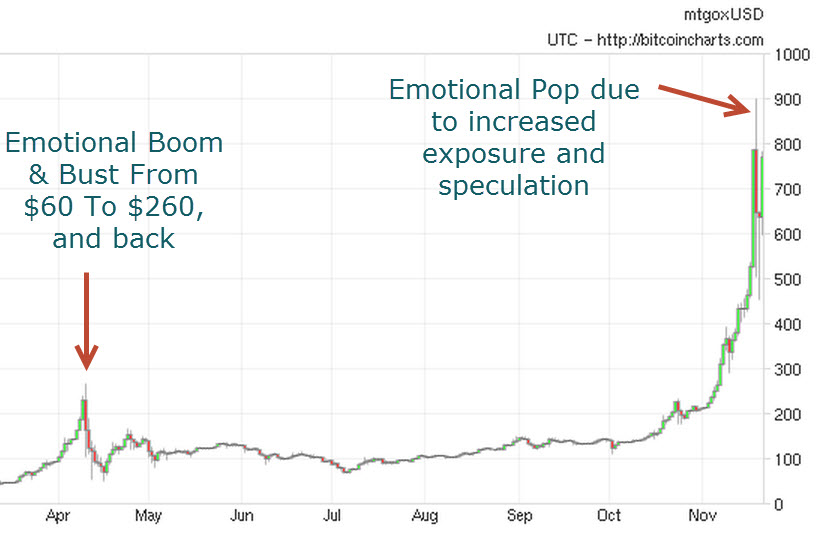

Volatility and Price Fluctuations

Bitcoin is known for its extreme price volatility, posing significant risk to investors. Sudden and substantial price swings can result in substantial losses.

- Examples of historical price swings: Bitcoin's history is marked by dramatic price fluctuations, both upwards and downwards. These fluctuations underscore the inherent risk.

- Psychological factors influencing volatility: Market sentiment, news events, and regulatory changes significantly impact Bitcoin's price, contributing to its volatility. Risk tolerance is a crucial factor to consider.

Regulatory Uncertainty

Changing regulations globally can significantly impact the Bitcoin market. Government actions and policies can dramatically influence Bitcoin's price and accessibility.

- Different regulatory approaches: Different countries are taking different approaches to regulating cryptocurrencies, creating a varied and often uncertain landscape.

- Potential for government crackdowns: The risk of government intervention remains a real concern that can lead to price drops and restricted access to Bitcoin.

Security Risks

Investors must be aware of the security risks associated with holding and trading Bitcoin, including hacking, scams, and the loss of private keys.

- Risks like hacking, scams, and loss of private keys: These risks can result in the complete loss of invested funds.

- Importance of secure storage: Employing secure storage methods, like hardware wallets, and following best practices are crucial for mitigating security risks.

Conclusion

The recent Bitcoin rebound offers both significant opportunities and considerable risks. While the potential for high returns is undeniable, investors must carefully weigh the inherent volatility and regulatory uncertainties. Thorough research, diversified investment strategies, and a clear understanding of risk management are crucial for navigating this dynamic market. Before investing in a Bitcoin rebound, thoroughly assess your risk tolerance and conduct thorough research. Don't miss out on the potential of the current Bitcoin rebound – but remember to approach it with caution and a well-defined investment strategy.

Featured Posts

-

Gear Up For Celtics Glory Fanatics Offers The Ultimate Collection For Nba Finals Fans

May 08, 2025

Gear Up For Celtics Glory Fanatics Offers The Ultimate Collection For Nba Finals Fans

May 08, 2025 -

Psg Nantes Maci Sonuc Ve Detaylar

May 08, 2025

Psg Nantes Maci Sonuc Ve Detaylar

May 08, 2025 -

Jayson Tatums Performance Colin Cowherds Continued Assessment

May 08, 2025

Jayson Tatums Performance Colin Cowherds Continued Assessment

May 08, 2025 -

Pro Shares Launches Xrp Etfs No Spot Market But Price Impact

May 08, 2025

Pro Shares Launches Xrp Etfs No Spot Market But Price Impact

May 08, 2025 -

Nuggets Players Response To Russell Westbrook Trade Rumors

May 08, 2025

Nuggets Players Response To Russell Westbrook Trade Rumors

May 08, 2025