Recent D-Wave Quantum (QBTS) Stock Market Performance: A Detailed Look

Table of Contents

Recent QBTS Stock Price Trends

Short-Term Fluctuations

Analyzing the recent daily, weekly, and monthly price movements of QBTS reveals a degree of volatility typical of a growth stock in a nascent industry. Price swings are often substantial, driven by various factors including news announcements, market sentiment, and overall technology sector performance. Trading volume can also be highly variable, reflecting the speculative nature of investment in quantum computing technology.

- Example 1: A significant price increase following the announcement of a major partnership with a large corporation.

- Example 2: A price drop after a competitor revealed a new product launch.

- Correlation with broader market trends: QBTS stock often mirrors the performance of the broader tech sector and the NASDAQ Composite, indicating sensitivity to overall market sentiment and economic conditions. Periods of increased market uncertainty often lead to increased volatility in QBTS's share price. This is typical for high-growth, high-risk stocks. Charting QBTS's price against the NASDAQ will provide a clear visual of this correlation.

Long-Term Performance Analysis

A longer-term analysis (e.g., six months, one year) of QBTS stock performance reveals a more nuanced picture. While exhibiting volatility, the overall trajectory may reflect a positive growth trend, although subject to market fluctuations. Comparing its performance to relevant benchmarks, such as other tech stocks specializing in emerging technologies, will give a clearer perspective on its relative success.

- Key milestones: Successful product launches, strategic partnerships, and significant funding rounds have generally had a positive effect on the long-term performance.

- Overall growth trajectory: The overall growth trajectory reflects the potential and challenges of the quantum computing market. While the future holds immense promise, near-term profitability and market acceptance remain key determinants of long-term growth.

- Investor sentiment: Sustained positive investor sentiment hinges on D-Wave’s continued technological advancements, successful product commercialization, and demonstration of a clear path to profitability.

Factors Influencing QBTS Stock Price

Company Performance and News

D-Wave's technological advancements, new product releases, successful partnerships, and securing significant contracts directly influence its stock price. Progress in quantum annealing technology, the core of D-Wave's offerings, is closely scrutinized by investors.

- Positive news: Successful product deployments, collaborations with industry leaders, and announcements of significant government or private sector contracts can drive price increases.

- Negative news: Technological setbacks, delays in product launches, or loss of key personnel may negatively impact the QBTS share price. Competition from other players in the quantum computing space is also an important factor.

Market Sentiment and Investor Expectations

Investor sentiment towards both quantum computing as a whole and D-Wave Quantum specifically plays a crucial role in shaping QBTS's share price. Market speculation, driven by media coverage, industry reports, and analyst ratings, significantly influences investor confidence.

- Analyst ratings: Positive ratings from reputable investment firms tend to boost investor confidence and push the share price upward, while negative ratings can have the opposite effect.

- Media coverage: Positive media coverage of D-Wave's technological breakthroughs and market potential can increase investor interest and raise the stock price.

- Industry reports: Favorable projections for the growth of the quantum computing market generally boost the share price of companies like D-Wave.

Macroeconomic Factors

Broader economic conditions and market trends, such as interest rates, inflation levels, and overall market volatility, impact QBTS's valuation. Investors react to changes in the overall economic outlook, often shifting their risk appetite accordingly.

- Economic outlook: Periods of economic uncertainty often lead to investors moving away from higher-risk investments, like QBTS, potentially causing a price decline.

- Inflationary pressure: High inflation can reduce investor confidence, impacting the valuations of growth stocks, including QBTS.

- Market volatility: Increased market volatility often causes price swings in speculative stocks like QBTS, making them more susceptible to market downturns.

Investment Considerations for QBTS

Risk Assessment

Investing in QBTS, a relatively new and volatile technology stock, carries significant risk. It's crucial to understand that this is a high-risk investment with the potential for both high reward and high loss.

- Technological challenges: The development of quantum computing technology is complex and faces significant challenges. Delays or setbacks could negatively impact QBTS’s stock price.

- Competition: The quantum computing field is highly competitive. The emergence of new players or technological breakthroughs by competitors could significantly impact D-Wave's market share and profitability.

- Market adoption rate: The success of QBTS depends on the rate of market adoption of quantum computing technology. Slower than anticipated adoption could hinder growth and profitability.

Potential Returns and Growth Outlook

Despite the risks, the potential returns for long-term investors in the quantum computing sector are substantial. D-Wave's market share and future valuation depend on its ability to capitalize on the growing demand for quantum computing solutions.

- Long-term growth potential: The long-term growth potential of the quantum computing market is enormous, with applications spanning various industries. D-Wave aims to secure a significant portion of this market.

- Future market share: D-Wave’s success in securing a large market share will be a key driver of its future valuation and stock price.

- Industry disruption: Quantum computing has the potential to disrupt numerous industries. D-Wave’s positioning to benefit from this disruption will be critical for its future stock performance.

Conclusion

This article provided an in-depth analysis of the recent D-Wave Quantum (QBTS) stock market performance, examining various factors influencing its price fluctuations and offering insights for investors. The analysis covered short-term and long-term trends, key drivers of stock price movement, and the associated risks and rewards. Understanding the complexities of investing in QBTS stock requires continuous monitoring of both market trends and company developments in the quantum computing space.

Call to Action: Understanding the recent performance of D-Wave Quantum (QBTS) stock requires continuous monitoring of market trends and company developments. Stay informed on future developments in the quantum computing market to make well-informed investment decisions related to D-Wave Quantum (QBTS) and other quantum computing stocks. Conduct thorough research before investing and consult with a financial advisor. Remember that investing in QBTS is a high-risk, high-reward endeavor.

Featured Posts

-

Penny Stock Bbai Potential For Growth And Considerations For Investors

May 20, 2025

Penny Stock Bbai Potential For Growth And Considerations For Investors

May 20, 2025 -

Benjamin Kaellman Huuhkajien Uusi Maalintekijae

May 20, 2025

Benjamin Kaellman Huuhkajien Uusi Maalintekijae

May 20, 2025 -

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025

D Wave Quantum Qbts Stock Explaining The Thursday Price Drop

May 20, 2025 -

Endless Night Agatha Christie Novel To Become Bbc Tv Series

May 20, 2025

Endless Night Agatha Christie Novel To Become Bbc Tv Series

May 20, 2025 -

Arsenal And Liverpools Transfer Battle Key Details On Premier League Targets Release Clause

May 20, 2025

Arsenal And Liverpools Transfer Battle Key Details On Premier League Targets Release Clause

May 20, 2025

Latest Posts

-

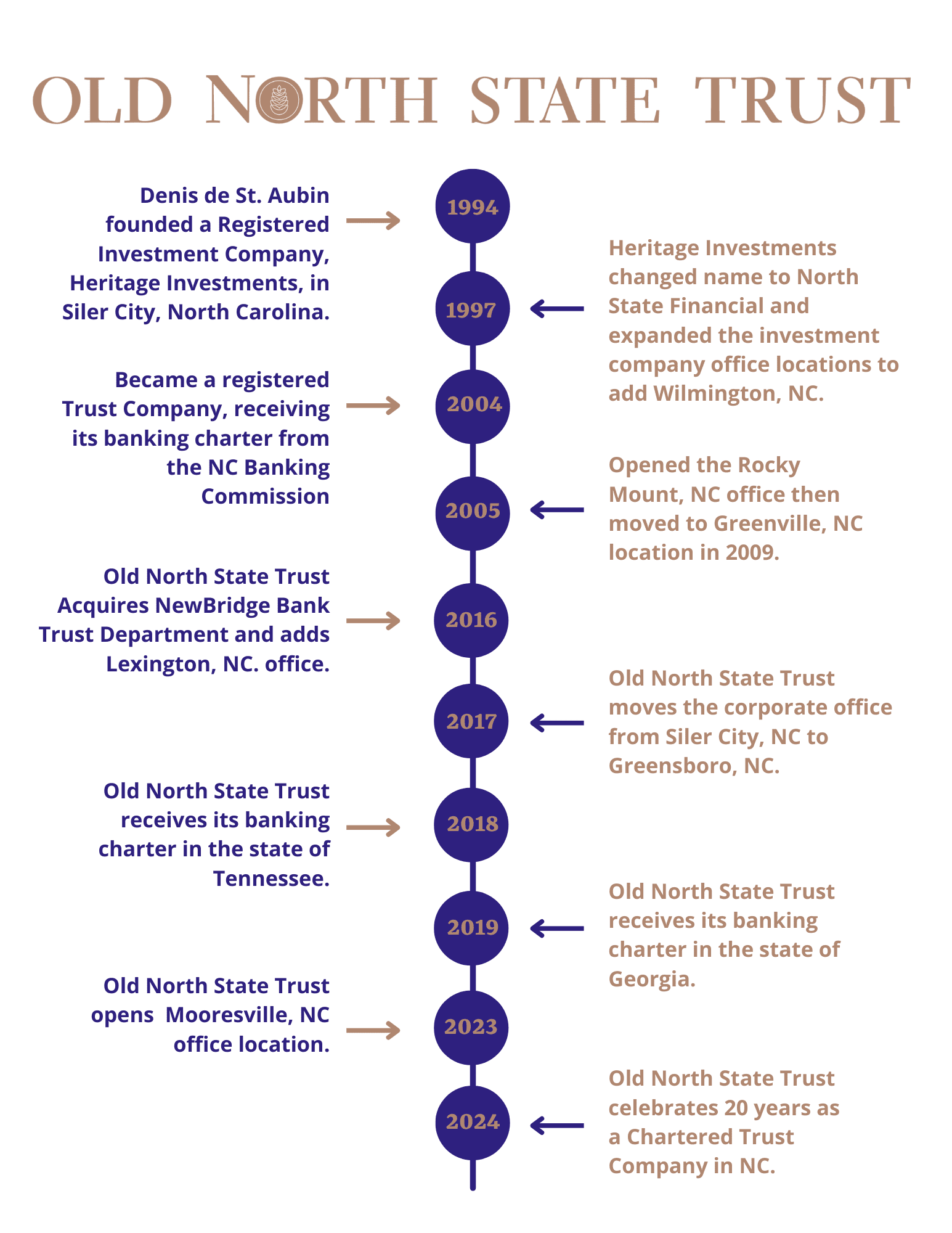

Old North State News And Analysis For May 9 2025

May 20, 2025

Old North State News And Analysis For May 9 2025

May 20, 2025 -

The Old North State Report A Look Back At May 9 2025

May 20, 2025

The Old North State Report A Look Back At May 9 2025

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025 -

Old North State Report A Summary Of May 9 2025 Events

May 20, 2025

Old North State Report A Summary Of May 9 2025 Events

May 20, 2025 -

Mnaqsht Tqryry Dywan Almhasbt Alnwab Ytkhdhwn Mwqfa Bshan Almkhalfat 2022 W 2023

May 20, 2025

Mnaqsht Tqryry Dywan Almhasbt Alnwab Ytkhdhwn Mwqfa Bshan Almkhalfat 2022 W 2023

May 20, 2025