Record-Breaking Whistleblower Settlement: Credit Suisse Pays $150 Million

Table of Contents

The Allegations: What Led to the Record-Breaking Settlement?

The $150 million whistleblower settlement stems from serious allegations of financial fraud and regulatory violations against Credit Suisse. The SEC investigation uncovered evidence suggesting systemic failures in the bank's anti-money laundering (AML) and know your customer (KYC) programs. These failures allowed for potentially illicit financial activities to occur, raising concerns about the bank's overall corporate governance and risk management.

-

Specific Allegations: The allegations involved facilitating money laundering schemes, failing to adequately report suspicious activity, and potentially aiding and abetting clients in tax evasion. The exact details remain partially confidential due to the nature of the settlement and the ongoing need to protect the identity of the whistleblower.

-

The Whistleblower's Role: A crucial element of this case is the pivotal role played by a whistleblower who bravely came forward with information about the bank’s unethical and potentially illegal activities. This individual provided critical evidence that fueled the SEC investigation and ultimately led to the settlement. Their actions highlight the vital role of internal reporting mechanisms and the importance of protecting whistleblowers.

-

SEC Investigation Findings: The SEC investigation confirmed significant weaknesses within Credit Suisse's compliance infrastructure. It highlighted a pattern of non-compliance with established regulations and a failure to adequately address known risks. The investigation underscored a systemic lack of oversight and internal controls, ultimately paving the way for the record-breaking settlement.

-

Severity of Violations: The severity of the violations is emphasized by the substantial financial penalty levied against Credit Suisse. The case sends a clear message that such behavior will not be tolerated and will result in significant consequences for institutions and individuals involved.

The $150 Million Settlement: A Deep Dive into the Financial Implications

The $150 million settlement represents a substantial financial blow to Credit Suisse. It's one of the largest whistleblower settlements in history, highlighting the significant cost of non-compliance.

-

Settlement Distribution: While the exact breakdown remains undisclosed, the settlement likely covers a combination of financial penalties imposed by the SEC, restitution to victims who suffered financial losses due to Credit Suisse's actions, and possibly other related costs.

-

Financial Impact on Credit Suisse: The $150 million settlement significantly impacts Credit Suisse's profitability, potentially affecting its financial statements and impacting shareholder confidence. The reputational damage further compounds the financial consequences.

-

Legal Implications and Future Liabilities: The settlement does not necessarily absolve Credit Suisse from all potential future liabilities. Further investigations could uncover additional wrongdoing, leading to additional penalties or lawsuits.

-

Precedent Set: This record-breaking settlement sets a significant precedent, signaling the SEC's unwavering commitment to pursuing financial fraud and holding institutions accountable for failing to maintain robust compliance programs.

-

Cost of Compliance: The settlement also highlights the substantial cost of compliance and the financial burden placed on organizations that fail to proactively invest in robust risk management and anti-money laundering programs. This incident emphasizes that the long-term costs of non-compliance far outweigh the investment required to create and maintain effective compliance frameworks.

The Whistleblower's Role: Protecting the Integrity of the Financial System

The actions of the whistleblower in this case are critical. Without their courage and commitment to reporting wrongdoing, the fraudulent activities might have continued undetected.

-

Significance of the Whistleblower's Actions: The whistleblower's actions were instrumental in uncovering and exposing widespread misconduct within Credit Suisse. They played a vital role in bringing the illegal activities to light and helping to hold the bank accountable.

-

SEC Whistleblower Program Protections: The SEC whistleblower program provides crucial protections to individuals who report potential financial fraud, ensuring confidentiality and safeguarding them from retaliation. The substantial reward demonstrates the value placed on such whistleblowers.

-

Whistleblower's Potential Financial Reward: While the exact amount is not publicly known, whistleblowers are often eligible for significant financial rewards under the SEC's whistleblower program, ranging from 10% to 30% of the monetary sanctions collected. This incentivizes others to come forward with information about corporate wrongdoing.

-

Maintaining Integrity of Financial Markets: Whistleblowers are essential for maintaining the integrity of the financial system. By reporting misconduct, they safeguard investors, protect the public interest, and ensure fair and transparent markets.

-

Implications for Future Whistleblowing: This case underscores the importance of strong whistleblower protection laws and encourages more individuals to come forward with information about potential financial fraud, knowing they will be protected.

The Broader Implications: Impact on the Financial Industry and Compliance Efforts

The Credit Suisse settlement has far-reaching implications for the financial industry and its commitment to compliance.

-

Impact on Credit Suisse's Reputation: The settlement severely damages Credit Suisse's reputation, potentially affecting its ability to attract and retain clients, impacting its ability to secure new business partnerships, and eroding shareholder trust.

-

Influence on Regulatory Oversight: The case will likely intensify regulatory scrutiny of financial institutions and push regulators to enhance oversight, strengthen enforcement mechanisms, and demand improved compliance programs.

-

Implications for Other Financial Institutions: This case serves as a stark warning to other financial institutions about the potential consequences of failing to prioritize compliance and robust risk management. It necessitates a thorough review of their own AML and KYC programs.

-

Importance of Robust AML and KYC Procedures: The case underscores the critical importance of implementing robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to prevent financial crimes. These procedures are essential for detecting and reporting suspicious activity.

-

Improved Corporate Governance and Risk Management: The settlement highlights the need for improved corporate governance and risk management strategies, emphasizing the necessity for independent oversight, strong internal controls, and a culture of compliance.

Conclusion

The $150 million whistleblower settlement against Credit Suisse stands as a powerful testament to the importance of robust regulatory oversight and the crucial role whistleblowers play in exposing financial wrongdoing. This landmark case underscores the severe consequences of corporate misconduct and the significant financial penalties imposed on institutions found violating laws and regulations. The settlement’s impact reverberates throughout the financial industry, pushing institutions to strengthen compliance programs and prioritize ethical business practices. The sheer scale of the settlement emphasizes the critical need for stringent anti-money laundering measures and transparent corporate governance.

Call to Action: Stay informed on the latest developments in whistleblower settlements and corporate accountability. Learn more about the SEC whistleblower program and how you can report potential financial fraud. Understand your rights as a whistleblower and the potential for significant rewards in exposing corporate wrongdoing. Learn more about [link to relevant resource on whistleblower protection or SEC website].

Featured Posts

-

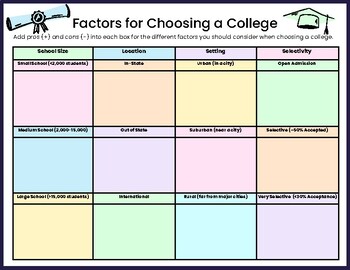

Choosing A College Town Why Consider City Name In Michigan

May 10, 2025

Choosing A College Town Why Consider City Name In Michigan

May 10, 2025 -

Womans Racist Attack Results In Mans Death Investigation Ongoing

May 10, 2025

Womans Racist Attack Results In Mans Death Investigation Ongoing

May 10, 2025 -

Uk Tightens Visa Rules Implications For Pakistani Students And Asylum Applications

May 10, 2025

Uk Tightens Visa Rules Implications For Pakistani Students And Asylum Applications

May 10, 2025 -

Presidential Politics 2025 Examining The Trump Administrations Day 109 May 8th

May 10, 2025

Presidential Politics 2025 Examining The Trump Administrations Day 109 May 8th

May 10, 2025 -

Chinas Canola Supply Chain Adapting After The Canada Break

May 10, 2025

Chinas Canola Supply Chain Adapting After The Canada Break

May 10, 2025