Record High For DAX? Frankfurt Equities Show Strong Opening

Table of Contents

Main Points:

2.1 DAX Performance and Key Drivers:

Analyzing the DAX's Rise:

The DAX index experienced a significant surge, climbing by X% in early trading. This represents a substantial increase compared to its previous high of Y points reached on [Date], and a notable improvement over its recent performance, which had seen [brief description of recent performance]. Several prominent DAX companies contributed significantly to this rise. For example, [Company A] saw its stock price increase by Z%, driven by [reason for increase], while [Company B] benefited from [reason for increase]. This positive momentum across key players demonstrates the underlying strength of the German economy.

- Data visualization: [Insert chart or graph illustrating the DAX's growth].

- Key Contributors: [List top 3-5 companies and their percentage gains].

- Keywords: DAX index, Frankfurt Stock Exchange, German equities, stock market performance, DAX 40

Impact of Global Economic Factors:

The DAX's strong performance isn't isolated; it's intertwined with global economic trends. Favorable interest rate adjustments by the European Central Bank (ECB) and signs of easing inflation across the Eurozone have instilled confidence in investors. Furthermore, relatively stable geopolitical conditions, compared to recent periods of uncertainty, have reduced risk aversion among investors. The resilience of the Eurozone economy, despite ongoing global challenges, plays a significant role in bolstering German business confidence and fueling this bullish trend.

- Interest Rate Impact: Lower interest rates stimulate borrowing and investment.

- Inflation Concerns: Easing inflation reduces pressure on businesses and consumers.

- Geopolitical Stability: A less volatile global political landscape boosts investor confidence.

- Keywords: Global economy, interest rates, inflation, Eurozone, geopolitical risk, ECB

Sector-Specific Performance:

The DAX's rise isn't uniform across all sectors. The automotive sector has seen particularly strong performance, fueled by increased demand for electric vehicles and a positive outlook for global car sales. The technology sector, while showing some growth, has displayed more modest gains compared to the automotive sector. The financial services sector, meanwhile, has benefited from improved market conditions and increased investor activity.

- Automotive Sector: [Explain the drivers of growth in the automotive sector].

- Technology Sector: [Discuss the factors influencing the technology sector's performance].

- Financial Services Sector: [Analyze the trends impacting the financial services sector].

- Keywords: Automotive sector, technology stocks, financial services, DAX sectors, electric vehicles

2.2 Investor Sentiment and Market Predictions:

Investor Confidence and Market Outlook:

Investor sentiment towards the DAX remains largely positive. Recent investment trends indicate a strong appetite for German equities, fueled by the positive economic outlook and the belief that the DAX has further upside potential. Analysts from [Reputable Financial Institution] predict further growth for the DAX in the coming months, citing [reasons for prediction]. This optimistic outlook is further supported by increased foreign investment flowing into the German market.

- Investment Trends: [Mention specific investment strategies and their impact].

- Expert Opinions: [Quote relevant experts and their forecasts].

- Keywords: Investor sentiment, market predictions, stock market forecast, DAX outlook, German equity market

Potential Risks and Challenges:

While the outlook is positive, potential risks exist. A global economic slowdown, particularly in key export markets, could significantly impact German businesses and dampen the DAX's growth. Unforeseen political instability, either domestically or internationally, also poses a threat. Moreover, unexpected market corrections, although considered unlikely given the current climate, cannot be entirely ruled out. A balanced perspective is crucial; while the potential for a DAX record high is strong, acknowledging these challenges provides a realistic assessment.

- Economic Slowdown Risk: The impact of a potential global recession on German exports.

- Geopolitical Uncertainty: Potential disruptions caused by global instability.

- Market Correction Potential: The possibility of a sudden and sharp market decline.

- Keywords: Market risk, economic slowdown, political uncertainty, market correction, DAX volatility

Conclusion: DAX Record High – What's Next?

The strong opening of the Frankfurt Stock Exchange and the potential for a DAX record high are driven by a confluence of factors, including positive global economic indicators, favorable investor sentiment, and strong performance across several key sectors. While significant potential exists, it's essential to remain aware of potential risks. To stay updated on the DAX and its future performance, monitor the DAX index regularly, follow reputable financial news outlets, and consult financial advisors for expert guidance on investing in the DAX and German equities. Learn more about investing in the DAX and navigating the complexities of the German equity market by [link to relevant resource or subscription]. Stay informed and make informed decisions about your investments in this dynamic market.

Featured Posts

-

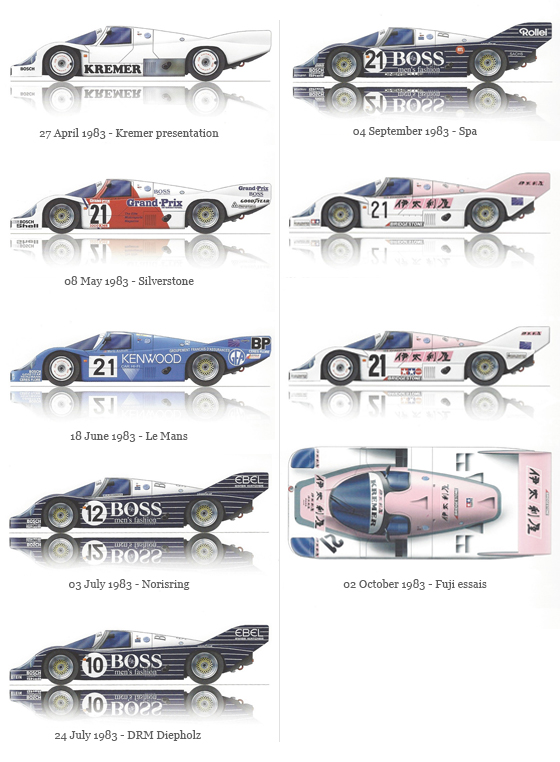

Porsche 956 Nin Tavan Sergisi Teknik Aciklamalar

May 25, 2025

Porsche 956 Nin Tavan Sergisi Teknik Aciklamalar

May 25, 2025 -

Your Escape To The Country Awaits Choosing The Right Location

May 25, 2025

Your Escape To The Country Awaits Choosing The Right Location

May 25, 2025 -

Full Glastonbury 2025 Lineup Olivia Rodrigo The 1975 Among Confirmed Acts

May 25, 2025

Full Glastonbury 2025 Lineup Olivia Rodrigo The 1975 Among Confirmed Acts

May 25, 2025 -

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025 -

Sejarah Produksi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Sejarah Produksi Porsche 356 Di Zuffenhausen Jerman

May 25, 2025

Latest Posts

-

Major Bangladesh Showcase In The Netherlands 1 500 Visitors Projected

May 25, 2025

Major Bangladesh Showcase In The Netherlands 1 500 Visitors Projected

May 25, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Visitors Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Visitors Expected

May 25, 2025 -

L Impact De Mathieu Avanzi Sur L Enseignement Et L Usage Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur L Enseignement Et L Usage Du Francais

May 25, 2025 -

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue D Enseignement

May 25, 2025

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue D Enseignement

May 25, 2025 -

Mathieu Avanzi L Evolution Du Francais Au Dela Des Salles De Classe

May 25, 2025

Mathieu Avanzi L Evolution Du Francais Au Dela Des Salles De Classe

May 25, 2025