Recordati: Tariff Volatility Drives M&A Strategy In Italy

Table of Contents

Recordati, a leading specialist pharmaceutical company, holds a strong position in the Italian market and across Europe. Its focus on specialized therapeutic areas makes it particularly susceptible to shifts in tariff policies. Therefore, understanding how tariff volatility influences Recordati's M&A strategy is crucial to grasping the dynamics of the Italian pharmaceutical industry. This analysis will demonstrate that tariff volatility is a primary driver shaping Recordati's acquisition decisions and overall growth strategy.

The Impact of Tariff Volatility on the Italian Pharmaceutical Market

Tariff fluctuations significantly impact the Italian pharmaceutical market, creating a challenging environment for companies like Recordati. These fluctuations directly affect pricing, profitability, and overall competitiveness. The regulatory landscape in Italy, already complex, is further complicated by the unpredictable nature of tariffs. This uncertainty forces companies to adopt proactive strategies to safeguard their market position and financial stability.

- Increased uncertainty in revenue projections: Fluctuating tariffs make it difficult to accurately forecast revenue, hindering long-term planning and investment decisions.

- Pressure on profit margins: Changes in tariffs can directly impact profit margins, forcing companies to adjust their pricing strategies or absorb losses.

- Need for strategic partnerships and acquisitions to mitigate risk: M&A activity becomes a critical tool for diversification and risk mitigation in such an unstable environment.

- Examples of specific tariffs impacting the Italian pharmaceutical sector: Specific examples of tariffs affecting import/export pricing of raw materials or finished goods, and their impact on Italian pharmaceutical companies could be explored here (requires specific data).

Recordati's M&A Strategy as a Response to Tariff Volatility

Recordati's M&A activity demonstrates a clear correlation with periods of tariff instability. The company has actively utilized acquisitions to counter the negative impacts of tariff volatility. Their approach to identifying targets involves a thorough assessment of the potential for diversification, technological advancements, and market expansion, all crucial elements in navigating tariff uncertainties. Post-acquisition integration is meticulously planned to ensure a smooth transition and maximize synergies.

- Examples of successful acquisitions driven by tariff considerations: Specific examples of Recordati's past acquisitions should be included here, highlighting how these deals helped the company mitigate tariff-related risks.

- Specific strategies employed to offset tariff impacts through M&A: Detailing specific strategies, such as acquiring companies with diversified product portfolios or geographic reach, would strengthen this section.

- Analysis of the types of companies Recordati targets (e.g., size, specialization): Identifying patterns in the types of companies Recordati acquires (e.g., smaller companies in niche markets) would add valuable insight.

Diversification and Risk Mitigation through M&A

Recordati leverages M&A to diversify its product portfolio and geographic reach, reducing dependence on specific markets vulnerable to tariff changes. This strategy minimizes the impact of any single tariff fluctuation on the company's overall financial performance. Furthermore, acquisitions provide access to new technologies and intellectual property, strengthening Recordati's competitive position and future-proofing its business against external shocks.

- Examples of diversification strategies implemented through acquisitions: Illustrating how acquisitions have broadened Recordati's product lines and market presence would strengthen this point.

- Analysis of how diversification reduces the impact of tariff volatility: A quantitative or qualitative analysis of the diversification effect on reducing tariff-related risks would be beneficial.

- Discussion of the importance of intellectual property acquisition in a volatile market: Highlighting the strategic importance of acquiring intellectual property rights to ensure long-term growth and competitiveness.

Future Outlook for Recordati's M&A Strategy in Italy

Predicting future tariff trends is challenging, yet analyzing potential scenarios is crucial for informing Recordati's future M&A strategy. The company will likely continue to prioritize acquisitions that enhance diversification, secure access to innovative technologies, and solidify its position in less tariff-sensitive markets. However, increased competition and regulatory changes could present challenges.

- Predictions on future tariff trends: This section requires informed speculation about potential future tariff policies and their impact on the pharmaceutical sector.

- Potential areas of focus for future acquisitions: Identifying potential areas where Recordati might focus future acquisitions based on market trends and strategic goals.

- Assessment of the competitive landscape and its influence on M&A: Analyzing the competitive dynamics within the Italian pharmaceutical market and how this might influence Recordati's future M&A activity.

Conclusion: Recordati and the Future of M&A in a Volatile Italian Market

In conclusion, Recordati: Tariff Volatility Drives M&A Strategy in Italy is undeniably linked. Recordati's proactive M&A approach demonstrates a strategic response to the challenges posed by tariff instability. Mergers and acquisitions are proving to be an essential tool for navigating the unpredictable nature of the Italian pharmaceutical market. By diversifying its portfolio and geographical reach, Recordati is effectively mitigating risk and securing its long-term growth. To stay informed about Recordati's continued strategic maneuvering in response to Recordati: Tariff Volatility Drives M&A Strategy in Italy, continue following industry news and analysis.

Featured Posts

-

Targets Changing Stance On Diversity Equity And Inclusion

Apr 30, 2025

Targets Changing Stance On Diversity Equity And Inclusion

Apr 30, 2025 -

8xmille Nuove Date Per Il Processo Al Fratello Di Angelo Becciu

Apr 30, 2025

8xmille Nuove Date Per Il Processo Al Fratello Di Angelo Becciu

Apr 30, 2025 -

Nhan Dien Cong Ty Da Cap Tra Hinh Huong Dan Dau Tu An Toan

Apr 30, 2025

Nhan Dien Cong Ty Da Cap Tra Hinh Huong Dan Dau Tu An Toan

Apr 30, 2025 -

Airbnb Domestic Searches Surge 20 As Canadians Shun Us Travel

Apr 30, 2025

Airbnb Domestic Searches Surge 20 As Canadians Shun Us Travel

Apr 30, 2025 -

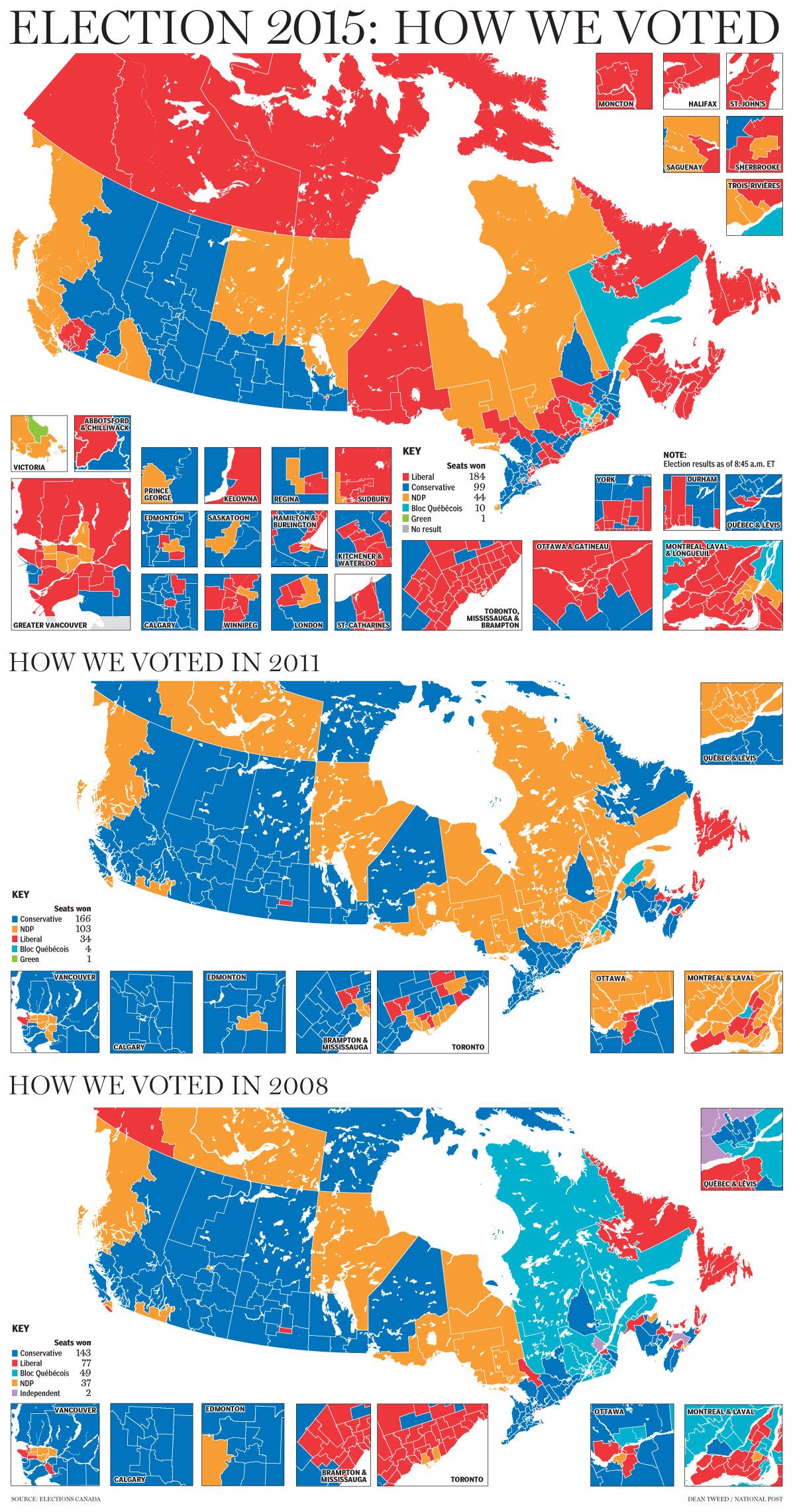

Canadian Election Results Poilievres Unexpected Defeat

Apr 30, 2025

Canadian Election Results Poilievres Unexpected Defeat

Apr 30, 2025