Reduce Your Student Loan Burden: A Financial Planner's Perspective

Table of Contents

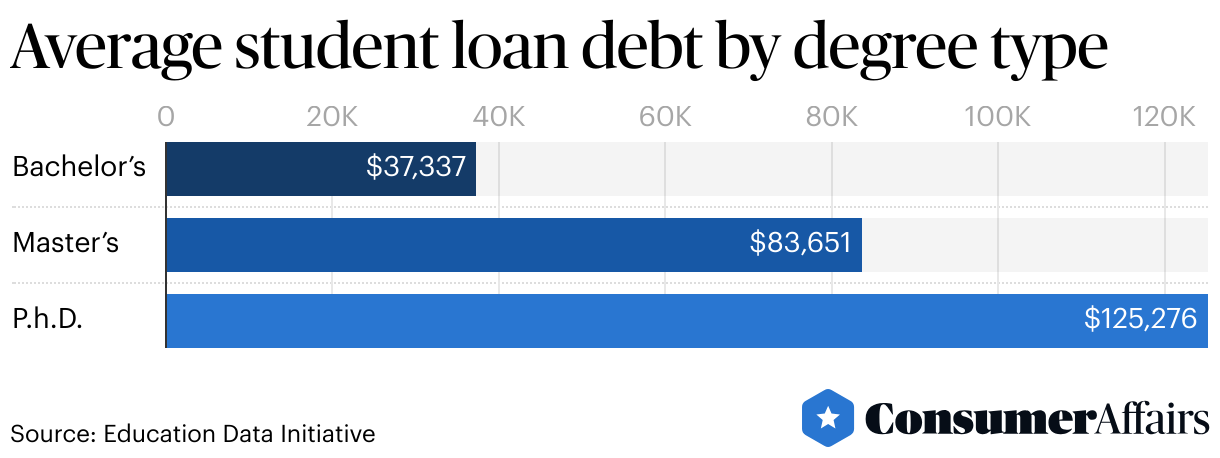

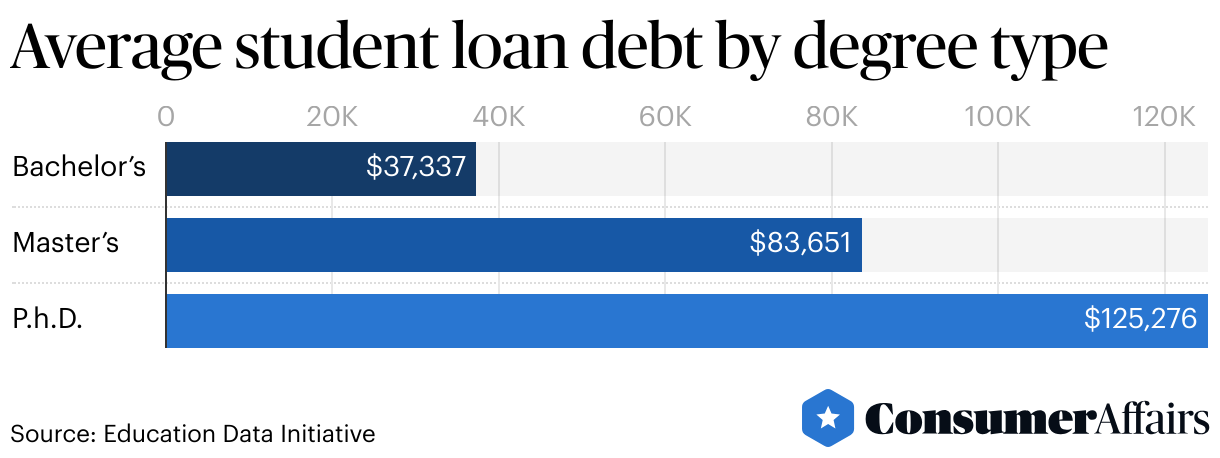

Understanding Your Student Loan Debt

Before you can tackle your student loan burden, you need a clear understanding of what you're dealing with. This involves identifying the types of loans you have and their associated interest rates.

Identify Loan Types and Interest Rates

Understanding the specifics of your loans is crucial for effective repayment planning. Different loan types have different terms and conditions, impacting your overall repayment strategy.

- Federal Loans: These loans are offered by the U.S. government and typically come with more borrower protections and repayment options than private loans. Examples include subsidized and unsubsidized Stafford Loans, Perkins Loans, and Federal PLUS Loans.

- Private Loans: These loans are offered by banks, credit unions, and other private lenders. They often have higher interest rates and fewer repayment options than federal loans.

- Fixed Interest Rates: Your monthly payment remains the same throughout the loan term.

- Variable Interest Rates: Your monthly payment can fluctuate based on market interest rates. This can lead to unpredictable monthly payments.

It’s vital to check your loan statements regularly to confirm your interest rates and repayment terms. Any discrepancies should be reported immediately to the lender.

Create a Detailed Loan Inventory

Consolidating your loan information into a single, organized document will simplify your repayment strategy and allow you to see the bigger picture of your student loan debt.

- Use a Spreadsheet: Create a spreadsheet listing each loan, including the lender, loan balance, interest rate (fixed or variable), minimum monthly payment, and due date.

- Utilize Budgeting Apps: Many budgeting apps offer features to track loans, providing a centralized view of your debt. Mint, YNAB (You Need A Budget), and Personal Capital are popular options.

- Keep Loan Documents: Store all loan documents (promissory notes, interest rate disclosures, etc.) in a safe and accessible place, either physically or digitally.

Strategies to Reduce Your Student Loan Burden

Once you understand your student loan debt, you can start implementing strategies to reduce your burden. Several options exist, each with its own advantages and disadvantages.

Explore Repayment Plans

Several federal student loan repayment plans can help you manage your monthly payments:

- Standard Repayment: Fixed monthly payments over 10 years.

- Graduated Repayment: Payments start low and gradually increase over time.

- Extended Repayment: Payments are spread over a longer period (up to 25 years), resulting in lower monthly payments but higher total interest paid.

- Income-Driven Repayment (IDR) Plans: Your monthly payment is based on your income and family size. These plans may lead to loan forgiveness after 20-25 years, depending on the plan and your income.

Choosing the right repayment plan depends on your individual financial situation and goals. Consider your income, expenses, and long-term financial objectives when making your decision.

Consider Loan Refinancing

Refinancing your student loans could lower your interest rate and monthly payments. However, it's crucial to weigh the pros and cons carefully.

- Lower Interest Rates: Refinancing can potentially save you thousands of dollars in interest over the life of your loan.

- Simplified Payments: If you have multiple loans, refinancing can consolidate them into a single loan with one monthly payment.

- Credit Score Requirements: You'll typically need a good credit score to qualify for refinancing at a favorable interest rate.

- Loss of Federal Benefits: Refinancing federal loans into private loans might mean losing access to federal loan forgiveness programs and other benefits.

Carefully compare offers from multiple lenders before making a decision.

Make Extra Payments

Even small extra payments can significantly reduce the total interest paid and shorten the repayment period.

- Automate Payments: Set up automatic payments to ensure you consistently make your minimum payments on time.

- Round Up Payments: Round up your monthly payment to the nearest $50 or $100.

- Allocate Bonuses and Tax Refunds: Use any extra money you receive to make extra principal payments on your loans.

For example, an extra $100 per month on a $20,000 loan with a 5% interest rate can save you thousands of dollars in interest and pay off the loan years earlier.

Negotiate with Your Lenders

In some cases, you might be able to negotiate lower interest rates or more favorable repayment terms with your lenders.

- Gather Supporting Documentation: Gather information about your financial situation, such as your income, expenses, and credit report.

- Present Your Case: Explain your situation to your lender in a professional and polite manner, outlining why you believe a modification is warranted.

- Maintain Communication: Maintain open and consistent communication with your lender throughout the negotiation process.

This approach is particularly useful for those experiencing financial hardship.

Long-Term Financial Planning with Student Loan Debt

Managing student loan debt shouldn't prevent you from planning for your long-term financial future.

Budget Effectively

Creating a realistic budget that accounts for your student loan payments is crucial for successful financial management.

- Use the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Track Expenses: Use budgeting apps or spreadsheets to monitor your spending habits and identify areas for potential savings.

- Prioritize Essential Expenses: Focus on paying for necessities (housing, food, transportation, etc.) while minimizing non-essential spending.

Careful budgeting ensures you can comfortably manage your student loan payments and still save for the future.

Build Good Credit

A strong credit score is essential for securing favorable loan terms and other financial opportunities in the future.

- Pay Bills on Time: Always pay your bills on time to avoid late payment fees and negative impacts on your credit score.

- Maintain Low Credit Utilization: Keep your credit card balances low compared to your available credit limit.

- Diversify Credit: Maintain a mix of credit accounts (credit cards, loans, etc.) to demonstrate responsible credit management.

A healthy credit score will open up more options for future financial endeavors.

Save and Invest Wisely

Even with student loan debt, it's essential to start saving and investing for the future.

- Automate Savings: Set up automatic transfers from your checking account to your savings account.

- Prioritize Emergency Fund: Build an emergency fund to cover unexpected expenses, providing a financial safety net.

- Invest for Retirement: Start contributing to a retirement account, even if it's a small amount, to benefit from the power of compounding.

Consistent saving and investing will help you build wealth over time, securing your financial future despite the initial burden of student loan debt.

Conclusion

Reducing your student loan burden requires a proactive and strategic approach. By understanding your loans, exploring various repayment options, and implementing effective financial planning strategies, you can significantly lessen the weight of your student loan debt. Remember to regularly review your progress, adapt your strategies as needed, and seek professional financial advice if necessary. Don't let student loan debt define your future – take control and actively work towards reducing your student loan burden today!

Featured Posts

-

All Conference Track Athletes A Complete Roundup

May 17, 2025

All Conference Track Athletes A Complete Roundup

May 17, 2025 -

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025

El Esquema Ponzi De Koriun Inversiones Una Explicacion Detallada

May 17, 2025 -

Moto Racing News Gncc Mx Sx Flat Track And Enduro Events

May 17, 2025

Moto Racing News Gncc Mx Sx Flat Track And Enduro Events

May 17, 2025 -

Pga Championship Struggles For Golfing Elite In First Round

May 17, 2025

Pga Championship Struggles For Golfing Elite In First Round

May 17, 2025 -

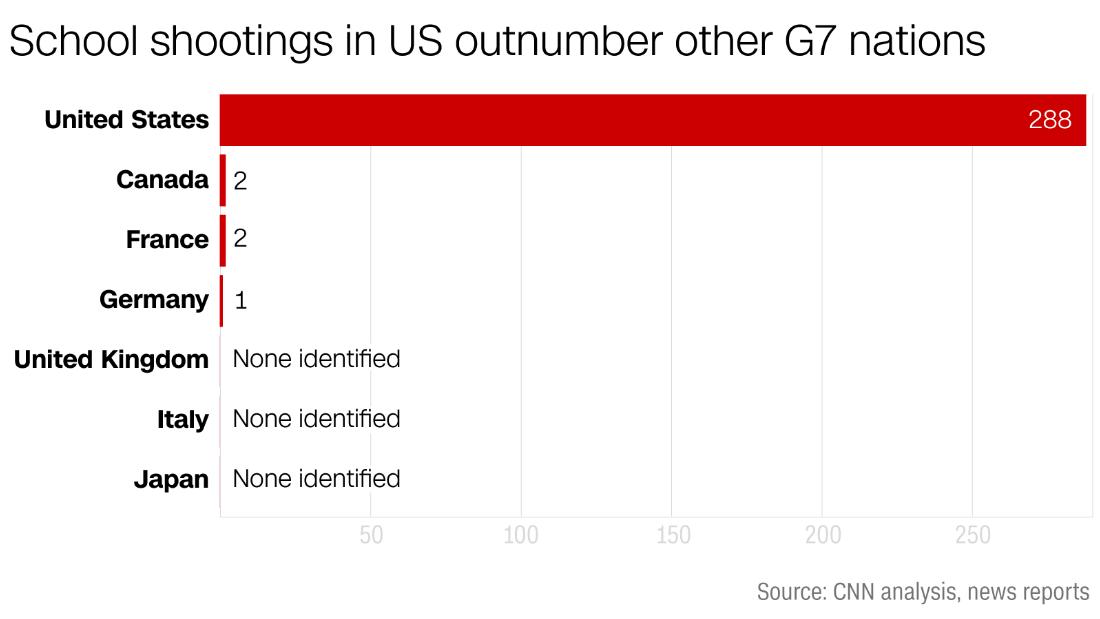

Florida School Shootings Lockdown Procedures And Generational Impact

May 17, 2025

Florida School Shootings Lockdown Procedures And Generational Impact

May 17, 2025

Latest Posts

-

Fortnite Item Shop Feature Update Easier Item Browsing

May 17, 2025

Fortnite Item Shop Feature Update Easier Item Browsing

May 17, 2025 -

Helpful New Feature Added To The Fortnite Item Shop

May 17, 2025

Helpful New Feature Added To The Fortnite Item Shop

May 17, 2025 -

Fortnite Item Shop Enhanced Functionality For Players

May 17, 2025

Fortnite Item Shop Enhanced Functionality For Players

May 17, 2025 -

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025

Improved Fortnite Item Shop Navigation With New Feature

May 17, 2025 -

New Fortnite Item Shop Feature Makes Purchasing Easier

May 17, 2025

New Fortnite Item Shop Feature Makes Purchasing Easier

May 17, 2025