Rental Market Sell-Off Fears Amidst Planned Affordable Rent Protection Reductions

Table of Contents

Impact of Affordable Rent Protection Reductions on Landlords

Planned reductions in affordable rent protection directly impact landlords' profitability. While the intention might be to stimulate the market, the reality is a complex interplay of economic forces. Landlords face a potential squeeze on their income, coupled with rising costs.

- Reduced Rental Income: With rent control measures loosened or removed, landlords might struggle to maintain previous income levels, especially in competitive markets. This is particularly true if they are obligated to maintain existing properties to meet standards.

- Increased Costs: Maintenance, property taxes, and insurance premiums continue to rise, eating into already reduced rental income. Landlords may find themselves operating at a loss or with significantly reduced profit margins.

- Increased Risk of Tenant Disputes: Relaxing rent protection can lead to increased friction between landlords and tenants, escalating into costly legal battles. This is made worse by the possibility of increased tenant turnover due to affordability issues.

- Higher Vacancy Rates: Significant rent increases driven by reduced affordable rent protection may result in higher vacancy rates as tenants struggle to afford the increased costs. This directly impacts a landlord's revenue stream.

- Potential for Increased Insurance Premiums: Increased risk associated with higher tenant turnover and potential for disputes might drive up insurance premiums for landlords, further impacting their profitability.

The Potential for a Rental Market Sell-Off

The economic incentives suggest a real possibility of a widespread rental market sell-off. Decreased rental income directly impacts investor confidence. If the return on investment (ROI) from rental properties falls below expectations, many investors might opt to sell, especially in the face of more attractive investment opportunities. This could trigger a domino effect, impacting various segments of the market—from single-family homes to large apartment complexes.

- Lower Return on Investment (ROI): Reduced rental income and increasing costs translate into lower ROI, making rental properties less appealing.

- Increased Competition from Other Investment Options: Investors might shift their capital towards more profitable ventures, further accelerating the sell-off.

- Fear of Losing Money: The uncertainty surrounding future rental income, coupled with the risk of increased tenant disputes, could lead to panic selling.

- Potential for a Flood of Properties Hitting the Market: A sudden influx of properties for sale could depress prices, creating a vicious cycle that further erodes investor confidence.

Consequences of a Rental Market Sell-Off

A significant rental market sell-off would have severe consequences, particularly for tenants. The immediate impact would be increased rental prices and a dramatic reduction in available housing options, potentially leading to a housing crisis. The ripple effects could destabilize local economies and communities.

- Increased Homelessness: Reduced affordability will disproportionately impact vulnerable populations, leading to a rise in homelessness.

- Strain on Social Services: Increased demand for social services, such as homeless shelters and food banks, will place further strain on already overstretched resources.

- Potential for Economic Instability: Reduced consumer spending power due to increased rental costs can trigger a slowdown in local economic activity.

- Reduced Housing Affordability Across the Board: The decreased supply and increased demand will cause a general upward pressure on rental prices, affecting even those who were previously comfortably housed.

Government and Policy Responses

Government intervention is crucial to mitigating the potential negative impacts of reduced rent protection. Several policy options could help balance the interests of landlords and tenants. However, the effectiveness of these policies will depend on their design and implementation.

- Government Subsidies for Affordable Housing: Direct financial assistance for the construction and maintenance of affordable housing units could alleviate the pressure on the rental market.

- Tax Incentives for Landlords Who Maintain Affordable Rent: Incentivizing landlords to keep rents affordable through tax breaks could encourage responsible property management.

- Increased Funding for Tenant Assistance Programs: Expanding programs that provide financial aid to tenants struggling to afford rent is critical.

- Strengthening Tenant Protections Beyond Rent Control: While rent control has its limitations, exploring alternative tenant protection mechanisms is essential, such as stricter eviction regulations and improved tenant screening processes.

Conclusion: Navigating the Uncertainties of the Rental Market

The planned reductions in affordable rent protection pose a significant threat, potentially triggering a widespread rental market sell-off with devastating consequences for both landlords and tenants. Understanding the potential impacts – from reduced profitability for landlords to increased homelessness and economic instability – is critical. We must consider a balanced approach. While stimulating the rental market is important, it should not come at the cost of jeopardizing housing affordability and social stability. To mitigate risks in the rental market, staying informed about policy changes regarding affordable rent protection is vital. By actively engaging in discussions and advocating for responsible policies, we can work towards navigating the affordable rent protection crisis and creating a more stable and equitable housing market. Understanding the rental market sell-off is crucial for mitigating risks and ensuring a more secure future for all.

Featured Posts

-

Housing Corporation Authority Warns Rent Freeze Endangers Tenant Well Being

May 28, 2025

Housing Corporation Authority Warns Rent Freeze Endangers Tenant Well Being

May 28, 2025 -

Prix Choc Samsung Galaxy S25 Ultra 256 Go 256 Go 1196 50 E

May 28, 2025

Prix Choc Samsung Galaxy S25 Ultra 256 Go 256 Go 1196 50 E

May 28, 2025 -

Ou Trouver Le Samsung Galaxy S25 512 Go Au Meilleur Prix Bon Plan 929 99 E

May 28, 2025

Ou Trouver Le Samsung Galaxy S25 512 Go Au Meilleur Prix Bon Plan 929 99 E

May 28, 2025 -

Updated Player Ratings In Nba 2 K25s Final Pre Playoff Update

May 28, 2025

Updated Player Ratings In Nba 2 K25s Final Pre Playoff Update

May 28, 2025 -

Pop Star Lorde Makes Surprise Guest Appearance At Fan Organized Event

May 28, 2025

Pop Star Lorde Makes Surprise Guest Appearance At Fan Organized Event

May 28, 2025

Latest Posts

-

Barry Diller Claims Popeyes Filming Was A Cocaine Fueled Mess

May 30, 2025

Barry Diller Claims Popeyes Filming Was A Cocaine Fueled Mess

May 30, 2025 -

Hugh Jackman And Deborra Lee Furness A Look Back At Their Relationship After Separation

May 30, 2025

Hugh Jackman And Deborra Lee Furness A Look Back At Their Relationship After Separation

May 30, 2025 -

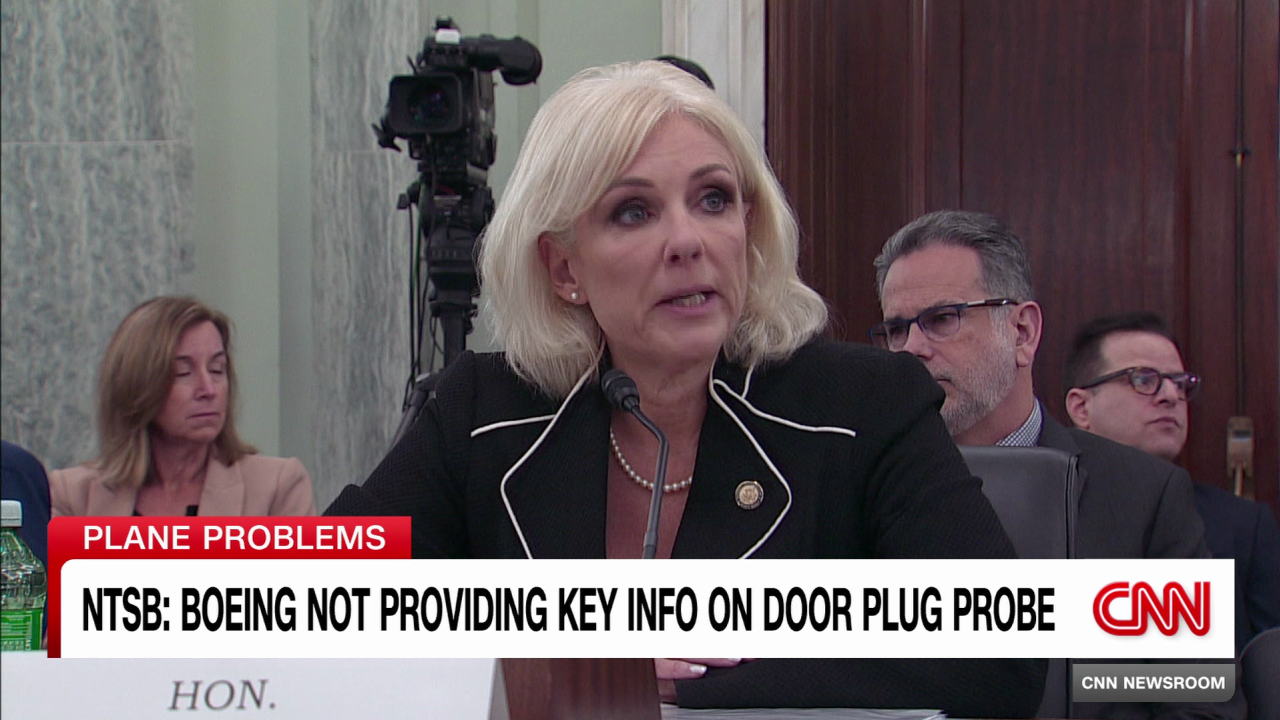

What Happens When Air Traffic Control Fails Pete Munteans Cnn Experiment

May 30, 2025

What Happens When Air Traffic Control Fails Pete Munteans Cnn Experiment

May 30, 2025 -

Baylor University Mourns Football Player Alex Foster City Imposes Curfew Following Shooting

May 30, 2025

Baylor University Mourns Football Player Alex Foster City Imposes Curfew Following Shooting

May 30, 2025 -

Deborra Lee Furness Reflects On Marriage Breakdown With Hugh Jackman

May 30, 2025

Deborra Lee Furness Reflects On Marriage Breakdown With Hugh Jackman

May 30, 2025