Republican Resistance: Obstacles To Trump's Tax Plan

Table of Contents

Fiscal Conservatism vs. Tax Cuts

The Republican party isn't a monolith. While unified in their general support for lower taxes, significant disagreements emerged regarding the specifics of Trump's proposed tax cuts. This internal friction became a major obstacle to the plan's smooth passage.

Concerns about the National Debt

- Increased national debt: The plan's projected increase in the national debt was a major source of contention. Many fiscally conservative Republicans voiced serious concerns about the long-term economic consequences of such a large deficit.

- Long-term fiscal sustainability worries: Critics argued that the tax cuts were unsustainable and would place an undue burden on future generations. The lack of corresponding spending cuts fueled these concerns.

- Potential impact on future budgets: The plan's impact on future budget negotiations and the ability of the government to fund essential programs was a significant point of debate.

- Criticism from fiscally conservative Republicans: Prominent figures like Senator Mike Lee and Congressman Paul Ryan expressed reservations, highlighting the internal divisions within the party.

The core concern revolved around the principle of fiscal responsibility. Many Republicans, deeply rooted in conservative principles, viewed the tax plan as fiscally irresponsible, potentially jeopardizing the nation's long-term economic health. They argued for a more measured approach, emphasizing the need for spending restraint alongside tax cuts. This clash between the desire for tax cuts and the need for fiscal responsibility created a major obstacle to the plan's swift implementation.

Targeted Tax Cuts vs. Broad-Based Reductions

- Debate over benefiting corporations versus individuals: Significant disagreement arose over whether the tax cuts should primarily benefit corporations or individuals. Some argued that corporate tax cuts would stimulate economic growth, while others prioritized tax relief for individuals.

- Disagreements over the level of tax cuts for different income brackets: The plan's proposed tax cuts varied across different income levels, leading to internal disagreements about their distribution. Some Republicans favored more significant cuts for higher-income earners, while others advocated for greater benefits for lower and middle-income families.

- Internal party struggles over the allocation of tax benefits: These disagreements exposed deep divisions within the party, with different factions vying for influence and pushing for their preferred version of the tax plan. This internal power struggle significantly delayed the legislative process.

The battle over targeted versus broad-based tax cuts exposed the diverse interests and priorities within the Republican party. Different factions championed the interests of specific constituencies, leading to protracted negotiations and compromises that significantly altered the original plan.

Ideological Differences within the Republican Party

The Republican party encompasses a broad range of ideologies, from fiscal conservatives to libertarians. These differing viewpoints created internal friction and hampered the progress of Trump's tax plan.

The Role of Libertarians and Conservatives

- Differing views on the size and scope of government: Libertarian-leaning Republicans favored minimal government intervention, raising concerns about the plan's potential to increase government spending.

- Debate on the role of tax policy in economic growth: Conservatives and libertarians differed on the effectiveness of tax cuts in stimulating economic growth, with some questioning the plan's long-term economic impact.

- Tension between libertarian principles and the plan's potential for government intervention: The plan's various provisions, despite aiming for lower taxes, also contained elements that some libertarians viewed as excessive government intervention.

The ideological battleground within the Republican party significantly influenced the shape and passage of the tax plan. The tension between differing views on the role of government in the economy caused considerable debate and delays.

Factional Politics and Power Struggles

- Internal power dynamics within the party: The Republican party is not a unified bloc; various factions and competing interests existed within its ranks. This internal struggle played a major role in shaping the tax plan.

- Competing interests among Republican lawmakers: Different lawmakers championed the interests of various constituents, leading to negotiations and compromises that sometimes diluted the original goals of the plan.

- Influence of lobbyists and special interest groups: Lobbyists and special interest groups exerted significant influence on the legislative process, adding further complexity to the already fragmented Republican caucus.

- Backroom deals and compromises: The final version of the tax plan involved numerous compromises and backroom deals, reflecting the intense internal power struggles within the Republican party.

The intricate interplay of internal party politics substantially impacted the final form of the tax plan. The compromises made to secure passage often deviated from the initial proposal and reflected the conflicting interests and priorities within the party.

Public Opinion and Political Fallout

Public perception and the potential electoral consequences significantly influenced the Republican party's approach to Trump's tax plan.

Public Perception of the Tax Plan

- Polling data reflecting public opinion on the plan: Public opinion polls revealed a mixed response to the tax plan, with significant segments of the population expressing skepticism or disapproval.

- Media coverage and its influence on public perception: Media coverage played a crucial role in shaping public opinion, highlighting both the potential benefits and drawbacks of the plan.

- Potential electoral consequences of the plan's success or failure: Republican lawmakers were acutely aware of the potential electoral impact of the plan, and this awareness influenced their actions.

Public opinion acted as a significant constraint on the Republican party, forcing them to consider the political ramifications of their decisions.

The Impact on the 2018 Midterm Elections

- Relationship between the tax plan and election outcomes: The tax plan's passage and its perceived impact on the economy influenced voter sentiment and contributed to the Republican party's significant losses in the 2018 midterm elections.

- The role of public dissatisfaction in shaping election results: Public dissatisfaction with the plan, or at least its perceived lack of benefit to the average citizen, played a role in the Democratic wave that swept the country in 2018.

- Impact of the plan on voter turnout: The tax plan also likely impacted voter turnout in the 2018 midterms, as the lack of positive public perception could have discouraged some Republicans from voting.

The 2018 midterm elections served as a crucial referendum on Trump's tax plan, highlighting the political risks associated with controversial fiscal policies.

Conclusion

The Republican resistance to Trump's tax plan underscores the complex internal dynamics within the party. Disagreements over fiscal conservatism, ideological differences, and concerns about public perception created significant hurdles, ultimately shaping the final legislation. Understanding this Republican Resistance to Trump's Tax Plan is crucial for analyzing the broader political landscape and predicting the future of fiscal policy. Further research into the specific compromises and the long-term effects of this plan remains vital to a complete understanding of its impact. Analyzing the various aspects of the Republican Resistance to Trump's Tax Plan provides invaluable insight into the complexities of American politics and the challenges of enacting major legislative changes.

Featured Posts

-

New Music Willie Nelsons Oh What A Beautiful World Album Details And Rodney Crowell Collaboration

Apr 29, 2025

New Music Willie Nelsons Oh What A Beautiful World Album Details And Rodney Crowell Collaboration

Apr 29, 2025 -

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025 -

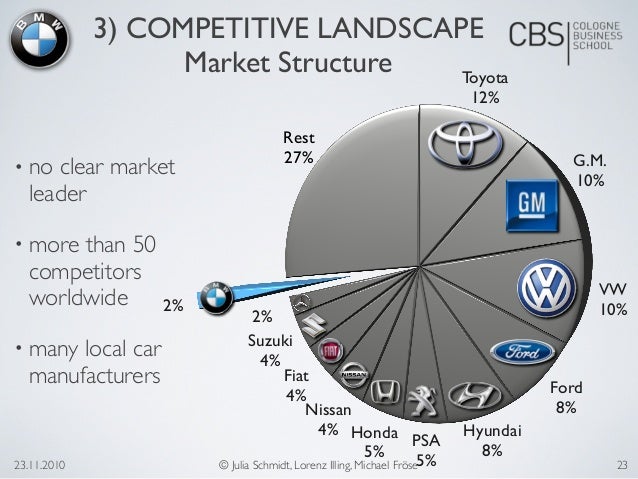

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

Apr 29, 2025

Chinas Impact On Bmw And Porsche Sales Market Analysis And Future Outlook

Apr 29, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 29, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

Apr 29, 2025 -

The China Factor Assessing The Challenges Faced By Premium Auto Brands

Apr 29, 2025

The China Factor Assessing The Challenges Faced By Premium Auto Brands

Apr 29, 2025

Latest Posts

-

New Willie Nelson Album Celebrating 92 Years With 77 Albums

Apr 29, 2025

New Willie Nelson Album Celebrating 92 Years With 77 Albums

Apr 29, 2025 -

Willie Nelson Pays Tribute To Longtime Roadie In Touching Documentary

Apr 29, 2025

Willie Nelson Pays Tribute To Longtime Roadie In Touching Documentary

Apr 29, 2025 -

Country Legend Willie Nelson Releases 77th Solo Album

Apr 29, 2025

Country Legend Willie Nelson Releases 77th Solo Album

Apr 29, 2025 -

New Music Willie Nelsons 77th Solo Album Out Now

Apr 29, 2025

New Music Willie Nelsons 77th Solo Album Out Now

Apr 29, 2025 -

New Documentary Showcases Willie Nelsons Respect For His Roadie

Apr 29, 2025

New Documentary Showcases Willie Nelsons Respect For His Roadie

Apr 29, 2025