Republican Revolt: Will Trump's Tax Plan Face Defeat?

Table of Contents

Internal Divisions Within the Republican Party

The Republican party is far from unified on Trump's tax plan. Deep divisions exist between different factions, creating significant hurdles to passage.

The Conservative Wing's Concerns

Fiscal conservatives harbor deep concerns about the plan's long-term fiscal implications. They argue that the proposed tax cuts, while potentially stimulating short-term growth, will dramatically increase the national debt and jeopardize long-term economic stability.

- Specific Objections: Many conservatives point to the lack of sufficient spending cuts to offset the revenue loss from the tax cuts, citing this as fiscally irresponsible. Prominent figures like Senator [insert name of a conservative Republican senator] have publicly voiced their concerns about the plan's unsustainable nature.

- Projected Debt Increase: The Congressional Budget Office (CBO) projects a significant increase in the national debt over the next decade if the plan is enacted. These projections, often cited by conservative critics, fuel their opposition. [Insert relevant statistic about projected debt increase].

Moderate Republicans' Hesitations

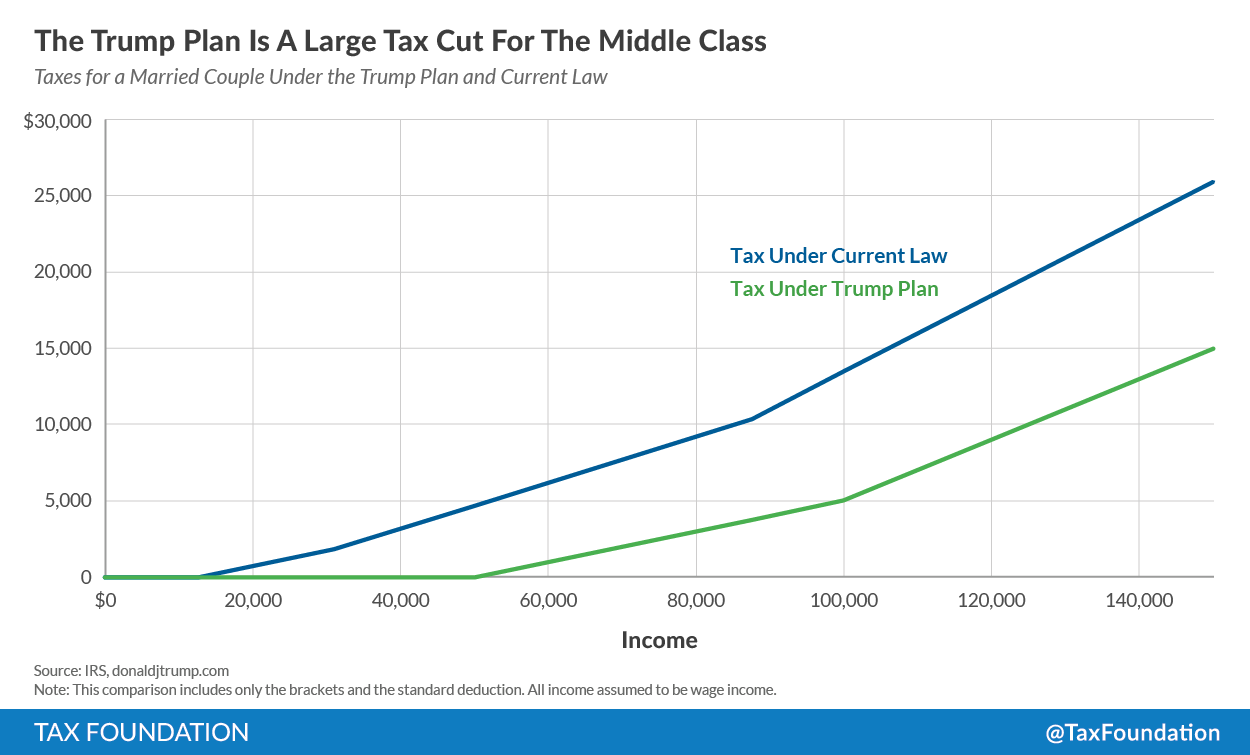

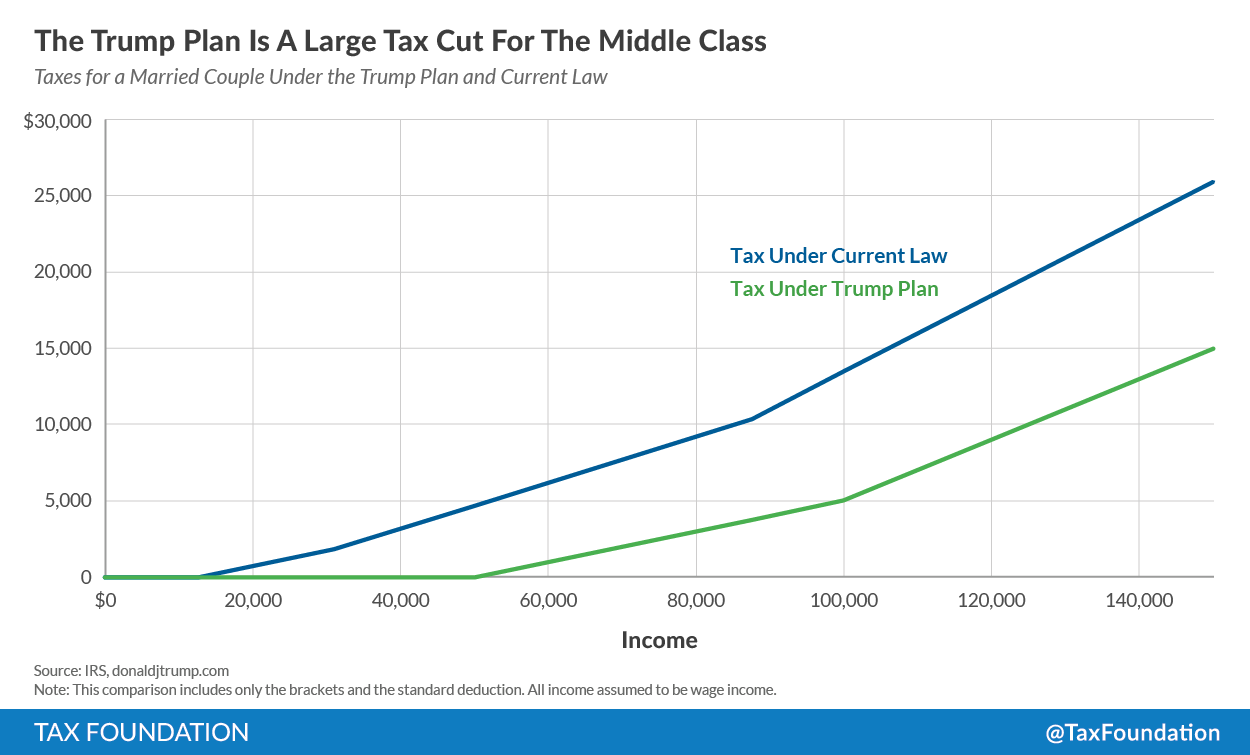

Even moderate Republicans express hesitation, finding certain aspects of the plan too extreme or insufficiently beneficial for the middle class. They worry about the disproportionate benefits accruing to the wealthy, while the middle class receives relatively smaller tax breaks.

- Opposition to Specific Proposals: The proposed elimination of certain deductions and the potential for increased tax burdens on some middle-class families are key areas of concern for moderate Republicans. [Insert specific examples of proposals facing opposition].

- Potential Compromises: Negotiations are underway to address these concerns. Possible compromises include targeted tax relief for the middle class or modifications to the corporate tax rate. However, reaching a consensus remains a challenge.

The Role of Lobbying and Special Interests

Lobbying groups and special interests are heavily involved in the debate, exerting significant influence on both sides. Their actions further complicate the already fraught political situation.

- Key Lobbying Groups: Powerful industry lobbies, like the [insert name of a relevant industry lobby] are actively pushing for specific provisions beneficial to their members. Conversely, groups advocating for social programs and fiscal responsibility are lobbying against aspects of the plan they deem detrimental to the public interest.

- Financial Implications: The plan's potential impact on various sectors and industries is enormous, creating a complex web of interests that are intensely lobbying for their preferred outcome. For instance, the proposed changes to corporate tax rates will significantly affect large corporations, while changes to individual tax brackets will impact families and individuals in different ways.

Economic Implications of a Potential Defeat

The failure of Trump's tax plan would have profound economic consequences, impacting the stock market, economic growth, and political stability.

Impact on the Stock Market

Defeat could trigger significant volatility in the stock market. Investors, anticipating lower economic growth and potentially decreased corporate profitability, might react negatively.

- Expert Opinions: Many financial analysts predict a market correction if the plan fails. [Insert quotes from financial experts about the potential market reaction].

- Historical Precedents: Historical examples of failed tax legislation or major policy reversals offer insights into potential market reactions, although each situation is unique.

Effects on Economic Growth

Economists offer conflicting views on the plan’s impact on growth. While supporters claim it would boost growth, critics argue it would be negligible or even negative.

- Economic Models and Projections: Different economic models predict varying effects on GDP growth. [Insert statistics and projections from reputable economic institutions].

- Job Creation and Investment: The plan's failure could negatively impact job creation and investment, as businesses might postpone expansion plans in the absence of anticipated tax benefits.

Increased Political Polarization

A defeat would almost certainly exacerbate the already intense political polarization within the Republican party and beyond.

- Impact on Future Legislation: The failure would further erode trust and cooperation within Congress, hindering the passage of other crucial legislation.

- Implications for the 2024 Elections: The outcome will significantly impact the 2024 elections, potentially influencing voter turnout and the Republican party’s electoral prospects.

Potential Pathways Forward

Despite the current impasse, several pathways could resolve the situation.

Compromise and Negotiation

Negotiations and compromises are still possible. Moderates may push for revisions that address concerns about the national debt and provide greater benefits for the middle class.

- Possible Areas of Compromise: Potential compromises might involve scaling back some tax cuts, adding targeted relief for specific demographics, or including provisions to offset the revenue loss through other means.

- Concessions: Different factions will need to make concessions to reach an agreement. The willingness of both sides to compromise will be crucial in determining the ultimate fate of the plan.

Alternative Legislative Strategies

If the original plan fails, Republicans might pursue alternative legislative strategies.

- Smaller, More Targeted Tax Cuts: Smaller, more targeted tax cuts focusing on specific sectors or demographics might be considered as a less ambitious alternative.

- Phased Implementation: A phased implementation of the tax cuts, with some provisions taking effect later, could be another compromise approach.

Implications for the 2024 Elections

The tax plan's success or failure will undoubtedly impact the 2024 elections.

- Voter Turnout: The outcome will influence voter turnout and shape the political discourse leading up to the elections.

- Presidential Race: The debate's outcome will significantly impact the presidential race, potentially affecting candidate strategies and public opinion.

Conclusion

The Republican revolt over Trump's tax plan exposes deep divisions within the party and highlights the potentially far-reaching consequences of its failure. The uncertainty surrounding its future underscores the significant stakes involved. Will compromise prevail, or will the plan's defeat lead to significant economic and political fallout? Stay informed about developments in this crucial political battle and engage in thoughtful discussions about the implications of Trump's tax plan debate, the Republican tax plan fallout, and the future of the Republican tax agenda. The future of the Republican party may well depend on it.

Featured Posts

-

Is A Fifth Champions League Place For The Premier League Now Inevitable

Apr 29, 2025

Is A Fifth Champions League Place For The Premier League Now Inevitable

Apr 29, 2025 -

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025 -

New Willie Nelson Album Celebrating 92 Years With 77 Albums

Apr 29, 2025

New Willie Nelson Album Celebrating 92 Years With 77 Albums

Apr 29, 2025 -

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025

Parole Hearing Approaches For Ohio Doctor Convicted Of Wifes Murder 36 Years Ago

Apr 29, 2025 -

Arizona Speedboat Competition Daredevil Attempt Ends In Air

Apr 29, 2025

Arizona Speedboat Competition Daredevil Attempt Ends In Air

Apr 29, 2025

Latest Posts

-

Brazil Bound Justin Herbert And The Chargers Open 2025 Season In Rio

Apr 29, 2025

Brazil Bound Justin Herbert And The Chargers Open 2025 Season In Rio

Apr 29, 2025 -

Monte Carlo Masters 2025 Tabilo Stuns Djokovic In Straight Sets

Apr 29, 2025

Monte Carlo Masters 2025 Tabilo Stuns Djokovic In Straight Sets

Apr 29, 2025 -

Is A Fifth Champions League Place For The Premier League Now Inevitable

Apr 29, 2025

Is A Fifth Champions League Place For The Premier League Now Inevitable

Apr 29, 2025 -

Como Lograr La Garantia De Gol Segun Alberto Ardila Olivares

Apr 29, 2025

Como Lograr La Garantia De Gol Segun Alberto Ardila Olivares

Apr 29, 2025 -

Diamond Johnson From Norfolk State To Minnesota Lynx Wnba Camp

Apr 29, 2025

Diamond Johnson From Norfolk State To Minnesota Lynx Wnba Camp

Apr 29, 2025