Resilient Investments Boost China Life's Profit

Table of Contents

Strategic Asset Allocation Drives Profitability

China Life's success is fundamentally rooted in its sophisticated and diversified asset allocation strategy. The company avoids placing all its eggs in one basket, instead opting for a carefully balanced diversified portfolio spanning multiple asset classes. This approach mitigates risk and capitalizes on diverse market opportunities. Their strategic approach includes:

-

Diversification across asset classes: A significant portion of their portfolio is invested in high-quality bonds, offering stability and predictable returns. Simultaneously, strategic investments in equities, particularly in sectors demonstrating strong growth potential, contribute to higher returns. Real estate investments, judiciously selected and managed, also play a crucial role in the overall portfolio strength.

-

Sector-Specific Success: China Life has demonstrated astute sector selection, with noteworthy gains in technology companies driving innovation and infrastructure projects fueling the nation's development. These choices reflect a deep understanding of long-term economic trends and emerging opportunities.

-

Geographic Diversification: China Life’s investment portfolio isn't confined to domestic markets. Strategic international investments, carefully selected to complement their domestic holdings, provide further diversification and reduce exposure to localized economic shocks. This global outlook is key to their risk mitigation efforts.

-

Quantifiable Success: The effectiveness of this strategy is evident in impressive figures. China Life has reported a [Insert specific data on ROI or portfolio growth, e.g., "20% year-on-year increase in investment income" or "a 15% growth in the overall investment portfolio"]. These results underscore the power of a well-executed diversified portfolio and sophisticated asset allocation strategy.

Adaptability to Market Volatility

The current economic landscape is anything but static. China Life's remarkable performance stems not only from its strategic planning but also from its ability to adapt swiftly and effectively to market volatility. Their responsiveness to changing market conditions has been a critical factor in their resilience.

-

Navigating Challenges: The company effectively navigated the complexities of the US-China trade war and various regulatory changes by proactively adjusting their investment strategy, demonstrating agility and foresight.

-

Portfolio Adjustments: In response to specific market events, China Life has shown a capacity to rebalance its portfolio, shifting allocations to capitalize on emerging opportunities and mitigate potential losses. For example, [Insert specific example of portfolio adjustment and its positive outcome].

-

Risk Management Tools: The company utilizes sophisticated risk management tools, including hedging strategies and derivatives, to proactively manage potential downsides. This proactive approach helps safeguard their portfolio against unexpected market fluctuations.

-

Expert Investment Team: Underlying China Life's adaptability is the expertise of their seasoned investment management team. Their deep market knowledge and ability to anticipate shifts allow the company to make timely and effective adjustments to their investment strategy. This expertise is a crucial component of their success in navigating market volatility.

The Role of Long-Term Investment Horizons

Unlike many investment firms focused on short-term gains, China Life's commitment to long-term investment is a cornerstone of its success. This patient approach allows them to weather short-term market fluctuations and capitalize on long-term growth opportunities.

-

Resilience to Short-Term Fluctuations: A long-term perspective significantly reduces susceptibility to the short-term ups and downs inherent in any market. This steady approach minimizes the impact of market corrections and allows for sustained growth.

-

Capitalizing on Long-Term Growth: By focusing on sustainable growth, China Life can identify and invest in assets with strong long-term potential, generating substantial returns over time.

-

Improved Risk-Adjusted Returns: While short-term, high-risk strategies may yield occasional large profits, they also expose investors to significant losses. China Life's patient capital approach delivers superior risk-adjusted returns over the long term.

Technological Innovation in Investment Management

China Life recognizes the transformative potential of technology in investment management. The company embraces Fintech and leverages AI in finance and data-driven investment strategies to enhance its processes and improve investment outcomes.

-

Advanced Risk Assessment: AI-powered tools allow for more accurate and efficient risk assessment, enabling more informed investment decisions and improving risk management capabilities.

-

Efficient Portfolio Management: Technological advancements streamline portfolio management, leading to increased efficiency and reduced operational costs.

-

Enhanced Due Diligence: The use of big data analytics allows for more comprehensive due diligence, reducing fraud and enhancing investment security.

Conclusion: Resilient Investments: The Key to China Life's Success

China Life's impressive profit surge is a direct result of its well-defined and effectively implemented resilient investment strategies. The company's success is a powerful example of how a diversified portfolio, adaptability to market volatility, a long-term investment horizon, and the effective integration of technology can drive significant and sustainable profitability, even during challenging economic times. Learn from China Life's success and build your own resilient investment portfolio today! Explore robust investment strategies and discover the secrets behind China Life's investment success.

Featured Posts

-

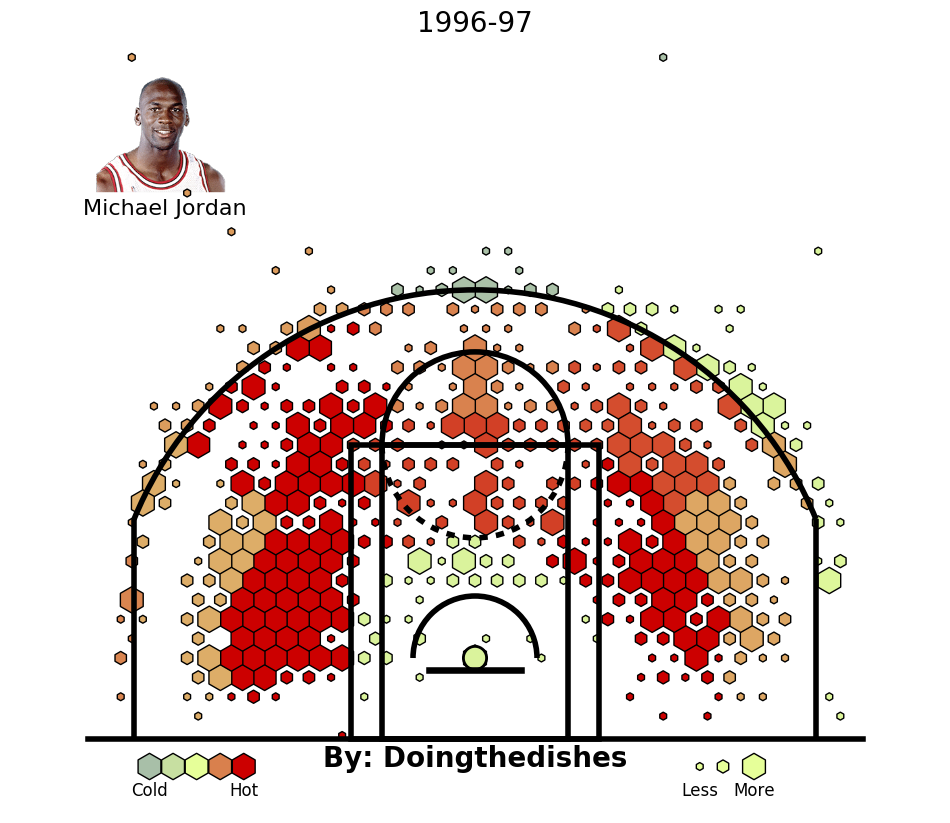

Essential Michael Jordan Fast Facts For Fans

Apr 30, 2025

Essential Michael Jordan Fast Facts For Fans

Apr 30, 2025 -

Eurovision 2025 United Kingdoms Confirmed Entry Announced

Apr 30, 2025

Eurovision 2025 United Kingdoms Confirmed Entry Announced

Apr 30, 2025 -

Kareena Kapoor On Aging Embracing Lines Cosmetic Surgery Struggles

Apr 30, 2025

Kareena Kapoor On Aging Embracing Lines Cosmetic Surgery Struggles

Apr 30, 2025 -

Trtyb Hdafy Aldwry Alinjlyzy Almmtaz Bed Hdf Haland Alywm

Apr 30, 2025

Trtyb Hdafy Aldwry Alinjlyzy Almmtaz Bed Hdf Haland Alywm

Apr 30, 2025 -

Anche Il Vaticano Condanna Becciu Risarcimento Per Gli Accusatori

Apr 30, 2025

Anche Il Vaticano Condanna Becciu Risarcimento Per Gli Accusatori

Apr 30, 2025