Resilient Investments Boost China Life's Profits

Table of Contents

China Life's Strategic Investment Portfolio

China Life's remarkable financial performance is directly linked to its strategically diversified investment portfolio. The company employs a sophisticated asset allocation strategy, carefully balancing risk and return across various asset classes. This careful diversification has been instrumental in mitigating losses during periods of market volatility and maximizing gains during periods of growth. Key components of its investment strategy include:

-

Diversification across Asset Classes: China Life's portfolio isn't concentrated in a single sector; instead, it strategically allocates its assets across fixed income instruments (government bonds, corporate bonds), equities (both domestic and international), and alternative investments (real estate, infrastructure projects). A sample allocation might look like this (hypothetical figures for illustrative purposes):

- Fixed Income: 40%

- Equities: 40%

- Alternative Investments: 20%

-

Active Risk Management: The company actively manages risk within each asset class. This involves employing sophisticated risk models, stress testing portfolios against various market scenarios, and implementing rigorous due diligence processes before making any investments.

-

Successful Investments: China Life has demonstrated a keen ability to identify and capitalize on high-growth opportunities. Successful investments in specific sectors have significantly contributed to overall profitability. For example, investments in specific infrastructure projects aligned with government initiatives have yielded significant returns.

The Role of Economic Resilience in China Life's Success

China Life's success is intrinsically linked to the resilience of the Chinese economy. While navigating the complexities of the Chinese market, including fluctuating interest rates and regulatory changes, China Life has consistently demonstrated an ability to adapt its investment strategy to capitalize on opportunities presented by sustained economic growth.

-

Impact of Economic Policies: China Life has adeptly responded to government policies aimed at stimulating economic growth, such as infrastructure investments and initiatives focused on technological advancement. These policies have created favorable conditions for investments in specific sectors.

-

Adapting to Changing Conditions: The company’s agility in adjusting its investment strategy in response to shifts in economic conditions, such as managing inflation and interest rate adjustments, has proven crucial. This proactive approach to risk management has ensured consistent performance.

-

Favorable Economic Events: The company has benefited from positive macroeconomic factors such as sustained GDP growth and increasing consumer spending, creating a fertile ground for profitable investments.

Strong Performance in Key Investment Sectors

China Life’s impressive returns are reflected in its strong performance across several key investment sectors:

-

Real Estate: Investments in strategically located commercial and residential properties have yielded substantial returns, fueled by ongoing urbanization and robust demand in key Chinese cities.

-

Infrastructure: China Life's participation in large-scale infrastructure projects, aligned with the government's ambitious development plans, has resulted in consistent and substantial returns. This includes investments in transportation, energy, and communication infrastructure.

-

Technology: Recognizing the potential of the booming technology sector, China Life has strategically invested in high-growth technology companies, capturing significant returns from this rapidly expanding market.

-

High-Yield Bonds: China Life has also strategically utilized high-yield bonds to enhance overall portfolio returns, while maintaining a careful approach to risk management within this sector.

Future Outlook for China Life's Investments

China Life's future investment strategy will focus on maintaining its diversification, continuing to explore new opportunities, and adapting to the evolving economic landscape.

-

Future Investment Areas: The company is expected to further expand its investments in renewable energy, technology, and other sectors aligned with China's long-term sustainable development goals. A shift towards greater ESG (Environmental, Social, and Governance) investing is also anticipated.

-

Challenges: Potential challenges include navigating geopolitical uncertainties, managing regulatory changes, and adapting to potential shifts in macroeconomic conditions.

-

Long-Term Vision: China Life's long-term vision centers on sustained, profitable growth, achieved through a robust investment strategy, proactive risk management, and a keen understanding of the Chinese market's dynamics.

Conclusion

China Life's remarkable profit growth underscores the success of its resilient investment strategy. Its diversified portfolio, coupled with its adept navigation of the Chinese economic landscape and strategic investments in key growth sectors, has yielded impressive results. By actively managing risk and adapting to changing conditions, China Life has demonstrated a winning formula for long-term success in a dynamic market. Learn more about how resilient investments are driving growth in the Chinese insurance sector by visiting China Life's investor relations page [insert link here]. Invest wisely by understanding China Life's successful investment strategies.

Featured Posts

-

Xrp Price Surge Ripple Sec Case Update And Etf Potential

May 01, 2025

Xrp Price Surge Ripple Sec Case Update And Etf Potential

May 01, 2025 -

Tbs Klinieken Overvol Wachttijden Langer Dan Een Jaar

May 01, 2025

Tbs Klinieken Overvol Wachttijden Langer Dan Een Jaar

May 01, 2025 -

Maikel Garcias Homer Witt Jr S Rbi Double Power Royals Past Guardians

May 01, 2025

Maikel Garcias Homer Witt Jr S Rbi Double Power Royals Past Guardians

May 01, 2025 -

Eagles White House Celebration Hurts Absence And Trumps Tush Push Controversy

May 01, 2025

Eagles White House Celebration Hurts Absence And Trumps Tush Push Controversy

May 01, 2025 -

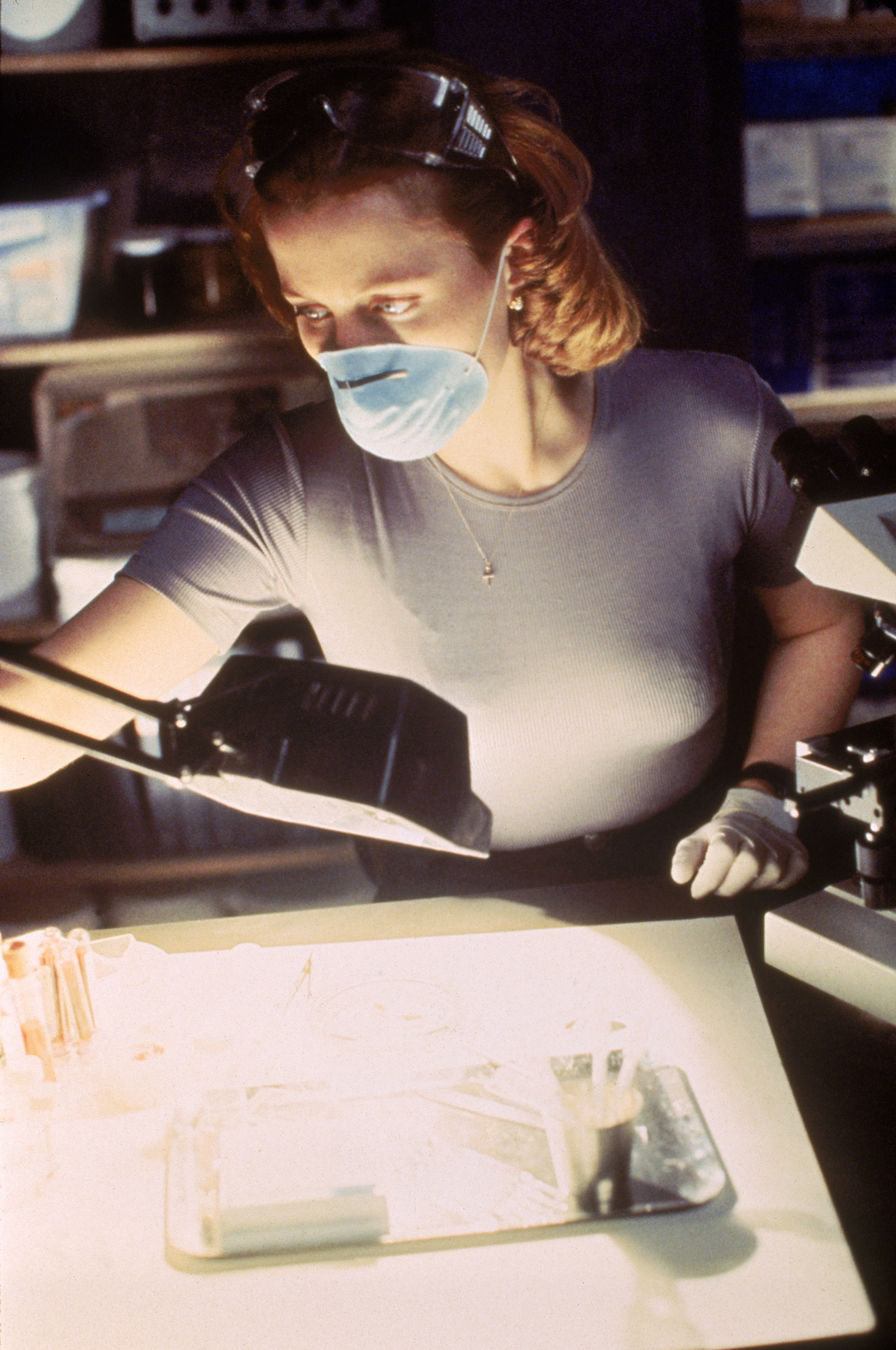

Gillian Anderson Faces Fears In Upcoming X Files Project

May 01, 2025

Gillian Anderson Faces Fears In Upcoming X Files Project

May 01, 2025