Responding To Trade Tensions: China's Approach To Bank Lending And Interest Rates

Table of Contents

The Impact of Trade Tensions on China's Economy

The US-China trade war, characterized by escalating tariffs and trade restrictions, inflicted considerable damage on China's economy. These trade tensions created a ripple effect, triggering negative consequences across various sectors.

- Reduced export demand from the US and other countries: Tariffs imposed by the US significantly reduced the demand for Chinese goods, impacting export-oriented industries and causing job losses. This decreased export revenue placed pressure on economic growth.

- Increased uncertainty for businesses investing in China: The unpredictable nature of trade disputes created uncertainty among both domestic and foreign investors, leading to a slowdown in investment and hindering long-term economic planning. This uncertainty affected foreign direct investment (FDI) flows into China.

- Potential for slower economic growth: The combined effects of reduced exports and investment dampened economic growth, forcing China to adjust its economic forecasts and implement countermeasures. GDP growth slowed considerably during this period.

- Pressure on the RMB exchange rate: The trade war and associated economic slowdown created downward pressure on the Renminbi (RMB) exchange rate, potentially leading to currency volatility and impacting import costs. The PBOC had to intervene to stabilize the RMB.

China's Monetary Policy Response

Faced with these challenges, the People's Bank of China (PBOC), China's central bank, implemented a series of monetary policy adjustments to mitigate the negative impacts of trade tensions. These actions aimed to stimulate the economy while maintaining financial stability.

- Interest Rate Adjustments: The PBOC implemented several cuts in interest rates, including benchmark lending rates and reserve requirement ratios (RRR). Lowering interest rates made borrowing cheaper for businesses and consumers, encouraging investment and consumption to boost economic activity. This aimed to offset the decline in export demand.

- Targeted Lending: Recognizing the disproportionate impact on SMEs, the PBOC introduced targeted lending programs, channeling credit to sectors heavily impacted by trade disputes. These programs prioritized access to credit for SMEs, helping them weather the economic storm.

- Liquidity Injections: The PBOC injected significant liquidity into the banking system through various mechanisms, ensuring banks had sufficient funds to lend and preventing a credit crunch. This prevented a liquidity crisis and supported lending activity.

- RMB Exchange Rate Management: The PBOC actively managed the RMB exchange rate, intervening in the foreign exchange market to prevent excessive volatility and maintain a stable currency. This aimed to prevent further economic uncertainty caused by currency fluctuations.

Balancing Growth and Financial Stability

China's response to trade tensions presented a significant challenge: balancing the need for economic growth with maintaining financial stability. The risk of excessive credit growth leading to asset bubbles and financial instability was a major concern.

- The risk of excessive credit growth leading to financial instability: While stimulating lending was crucial, the PBOC had to carefully manage the level of credit growth to avoid creating systemic risks.

- The need to support struggling businesses without exacerbating systemic risks: Providing support to SMEs was vital, but it needed to be done in a targeted and controlled manner to avoid excessive risk-taking by banks.

- The complex interplay between monetary policy, fiscal policy, and trade policy: A coordinated approach across all three policy areas was crucial to ensure effectiveness. The government needed to combine monetary easing with fiscal measures to stimulate the economy.

Effectiveness of China's Approach

Evaluating the effectiveness of China's response requires a nuanced assessment. While the monetary policy adjustments did stimulate lending and investment, the overall impact on economic growth was varied.

- Evidence of increased lending and investment: Data shows an increase in lending and investment following the implementation of the monetary policy changes, indicating a positive response to the stimulus measures.

- Analysis of economic growth indicators (GDP, industrial production, etc.): While growth slowed, it did not collapse, suggesting the measures prevented a more severe downturn. However, the growth rate still fell below the government's targets.

- Assessment of the effectiveness of targeted lending programs in supporting SMEs: The effectiveness of targeted programs varied depending on the specific implementation and the responsiveness of banks to the new lending requirements.

- Discussion of any unintended consequences of the policy response: Potential unintended consequences included increased debt levels and the potential for future financial instability.

Conclusion

China's response to trade tensions through strategic adjustments to bank lending and interest rates has been a central component of its broader economic strategy. The PBOC's actions, including interest rate cuts, targeted lending, liquidity injections, and RMB exchange rate management, aimed to mitigate the negative impacts of the trade war. However, balancing economic growth with maintaining financial stability remained a significant challenge, highlighting the complexities of navigating global trade disputes. Further research is needed to fully understand the long-term effects of these policies and their impact on the Chinese economy. Continued monitoring of these policies and their impact is crucial for understanding the future of global trade dynamics. Learn more about the complexities of China's response to trade tensions and its impact on bank lending and interest rates by [link to related resources/further research].

Featured Posts

-

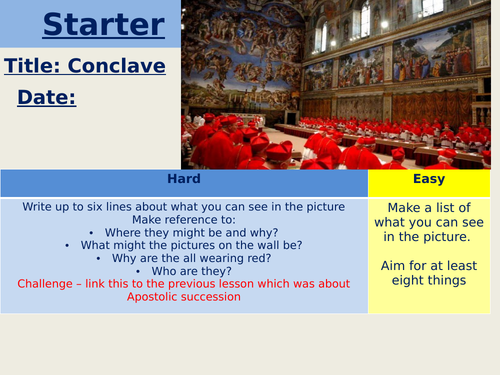

The Conclave Begins Electing The Next Pope

May 08, 2025

The Conclave Begins Electing The Next Pope

May 08, 2025 -

Piotr Zielinski Inter Milan Starlet Facing Extended Absence With Calf Injury

May 08, 2025

Piotr Zielinski Inter Milan Starlet Facing Extended Absence With Calf Injury

May 08, 2025 -

Finding A Veteran Replacement For Taj Gibson On The Hornets

May 08, 2025

Finding A Veteran Replacement For Taj Gibson On The Hornets

May 08, 2025 -

Empate Entre Liga De Quito Y Flamengo En La Copa Libertadores

May 08, 2025

Empate Entre Liga De Quito Y Flamengo En La Copa Libertadores

May 08, 2025 -

Arsenals Arteta Faces Setback Dembele Injury Update

May 08, 2025

Arsenals Arteta Faces Setback Dembele Injury Update

May 08, 2025