Restructuring Fuji Media: The Impact Of Dalton's Alliance With Murakami's Fund

Table of Contents

Dalton's Strategic Objectives in the Fuji Media Restructuring

Dalton's investment in Fuji Media is likely driven by a multifaceted strategic vision. Their motivations likely include:

- Increased Market Share: Gaining a foothold in the Japanese media market, potentially challenging existing dominant players. This acquisition could lead to significant growth in viewership and market dominance.

- Access to Valuable Assets: Fuji Media boasts extensive content libraries, including iconic shows and a robust distribution network. Accessing these assets provides Dalton with immediate leverage in the media industry.

- Synergies and Portfolio Expansion: Integrating Fuji Media into Dalton's existing portfolio could create valuable synergies, streamlining operations and maximizing profitability across their holdings.

- Cost Reduction and Efficiency Improvements: Dalton might aim to streamline Fuji Media's operations, identifying areas for cost reduction while maintaining or enhancing quality. This will directly affect the future of Restructuring Fuji Media.

- High Expected Return on Investment: Dalton undoubtedly expects a substantial return on their investment, likely through a combination of increased revenue, cost savings, and asset appreciation.

However, integrating with Fuji Media's established structure presents challenges. Cultural differences, internal resistance to change, and navigating complex Japanese business practices will be key hurdles Dalton must overcome during the Restructuring Fuji Media process.

Murakami's Fund's Role and Investment Strategy

Murakami's fund is known for its astute investment strategy, focusing on undervalued assets and often employing an activist approach. Their involvement in the Restructuring Fuji Media process adds another layer of complexity and potential for significant change. Key aspects of their strategy include:

- Focus on Undervalued Assets: Murakami's fund likely identified Fuji Media as an undervalued asset with significant untapped potential. Their investment strategy often centers on identifying and realizing this potential.

- Activist Investment Approach: Their past investments suggest a proactive role in shaping corporate strategy, potentially influencing editorial decisions and operational changes.

- Media and Entertainment Expertise: Their portfolio likely includes other media companies, providing them with valuable insights and experience relevant to the Restructuring Fuji Media initiative.

- Long-Term Value Creation: Murakami's fund typically takes a long-term perspective, aiming to create sustainable value rather than focusing on short-term gains.

The alignment between Dalton's and Murakami's goals is crucial. While their objectives might broadly overlap in terms of maximizing Fuji Media's value, potential conflicts regarding the speed and nature of the restructuring process, particularly concerning minority shareholders' interests, cannot be ruled out.

The Impact on Fuji Media's Content and Operations

The Restructuring Fuji Media process is expected to significantly impact the company's operations and content. Potential changes include:

- Changes in Editorial Direction: A shift in programming, news coverage, and overall editorial tone could result from the new management's vision.

- Impact on Talent and Staff: Restructuring may lead to staff reductions, reassignments, or the recruitment of new talent aligned with the new strategic direction.

- Technological Upgrades and Investments: Dalton and Murakami's fund might invest heavily in modernizing Fuji Media's technology infrastructure, enhancing content creation and distribution.

- Rebranding or Marketing Strategies: A complete rebranding effort, or a refined marketing strategy, is likely to accompany the restructuring.

- Expansion into New Media Platforms: The restructuring could involve expanding Fuji Media's presence on digital platforms and streaming services.

Market Reaction and Future Outlook for Fuji Media

The market's response to the Dalton-Murakami alliance has been mixed. We have seen:

- Stock Price Fluctuations: Initial reactions have likely been speculative, with stock prices fluctuating based on investor sentiment and predictions of the restructuring's outcome.

- Analyst Ratings and Predictions: Financial analysts offer varying assessments of the alliance's potential, highlighting both the opportunities and risks.

- Competitor Reactions: Rival media companies are likely monitoring the situation closely, assessing its impact on the competitive landscape.

- Potential for Mergers and Acquisitions: The restructuring could trigger further mergers and acquisitions within the Japanese media industry.

The long-term implications for Fuji Media's competitiveness depend significantly on the effectiveness of the restructuring process. Successful integration and strategic execution can lead to a revitalized Fuji Media, better positioned for the future. Failure, however, could result in declining market share and diminished profitability.

Conclusion

The Restructuring Fuji Media, driven by the strategic partnership between Dalton and Murakami's fund, represents a pivotal moment in the company's history. The potential impact on Fuji Media's content, operations, and market position is considerable. The success of this restructuring hinges on navigating the challenges of integration, aligning the objectives of the investors, and responding effectively to market dynamics. The coming months and years will be crucial in determining whether this restructuring leads to a revitalized and thriving Fuji Media or a more uncertain future. Stay tuned for further updates on the Restructuring Fuji Media process and its long-term consequences for the Japanese media landscape.

Featured Posts

-

How To Choose Plants For Your Living Fence

May 29, 2025

How To Choose Plants For Your Living Fence

May 29, 2025 -

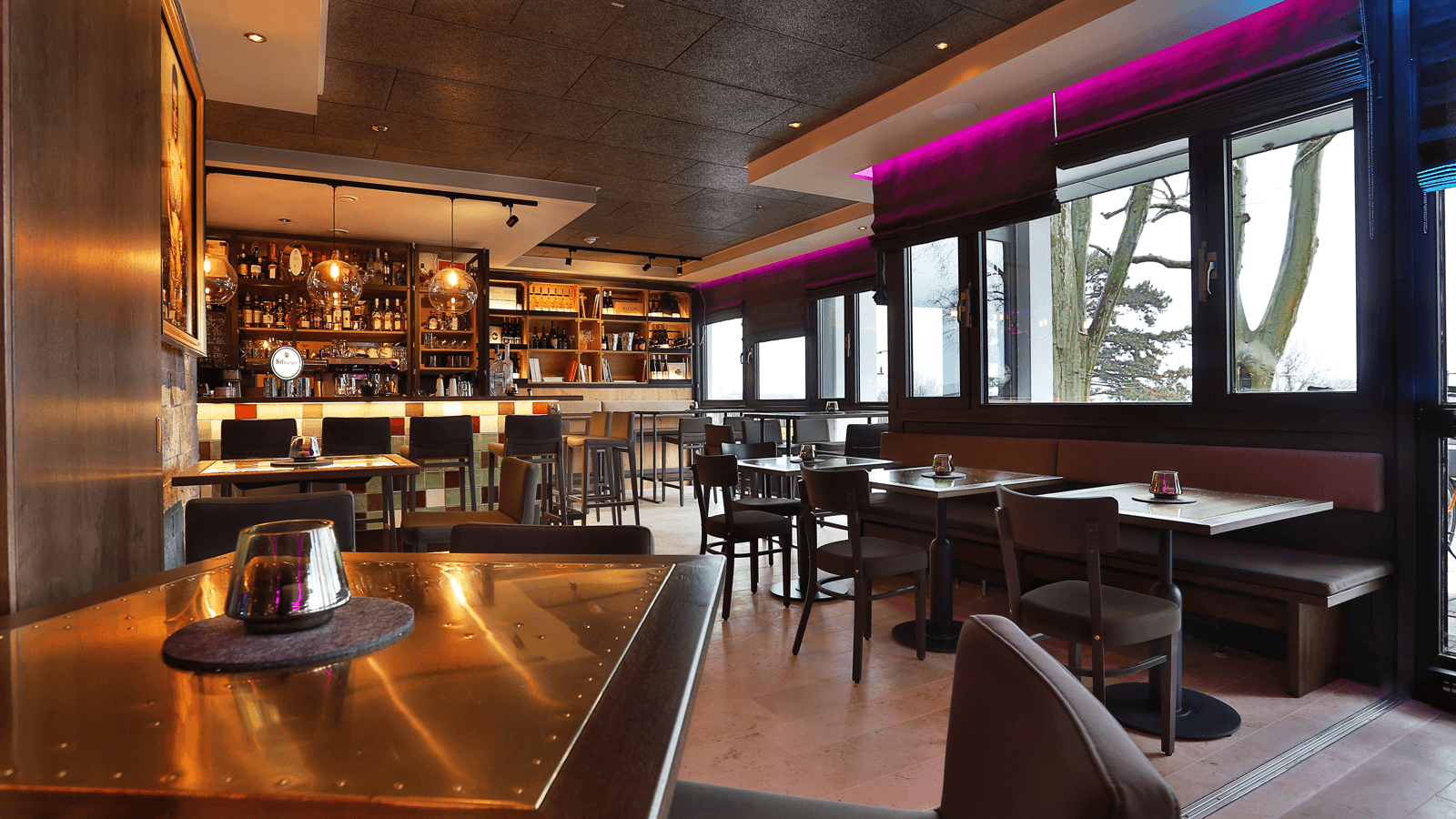

Eroeffnung Karl Weinbar Neue Weinbar An Der Venloer Strasse

May 29, 2025

Eroeffnung Karl Weinbar Neue Weinbar An Der Venloer Strasse

May 29, 2025 -

Opoznienia I Podwyzka Kosztow Flagowej Inwestycji Pcc

May 29, 2025

Opoznienia I Podwyzka Kosztow Flagowej Inwestycji Pcc

May 29, 2025 -

Pokemon Tcg Pockets 6 Month Anniversary Special Missions And Rayquaza Ex Event

May 29, 2025

Pokemon Tcg Pockets 6 Month Anniversary Special Missions And Rayquaza Ex Event

May 29, 2025 -

S Sh A I Velika Britaniya Uklali Torgovelnu Ugodu Scho Tse Oznachaye Dlya Biznesu

May 29, 2025

S Sh A I Velika Britaniya Uklali Torgovelnu Ugodu Scho Tse Oznachaye Dlya Biznesu

May 29, 2025