Retail Sales Growth: A Shift In Bank Of Canada's Rate Hike Outlook

Table of Contents

Recent Retail Sales Growth Trends in Canada

Analyzing the latest data releases from Statistics Canada paints a dynamic picture of the Canadian retail landscape. Understanding these trends is crucial for comprehending the Bank of Canada's policy decisions.

Analyzing the Latest Data Releases from Statistics Canada

- July 2024: A 1.0% increase in retail sales, exceeding expectations.

- June 2024: A 0.5% increase, demonstrating sustained, albeit moderating, growth.

- Strongest performing sectors: Motor vehicle and parts dealers, followed by furniture and home furnishings.

- Weakest performing sectors: Clothing and accessories, reflecting potential shifts in consumer priorities.

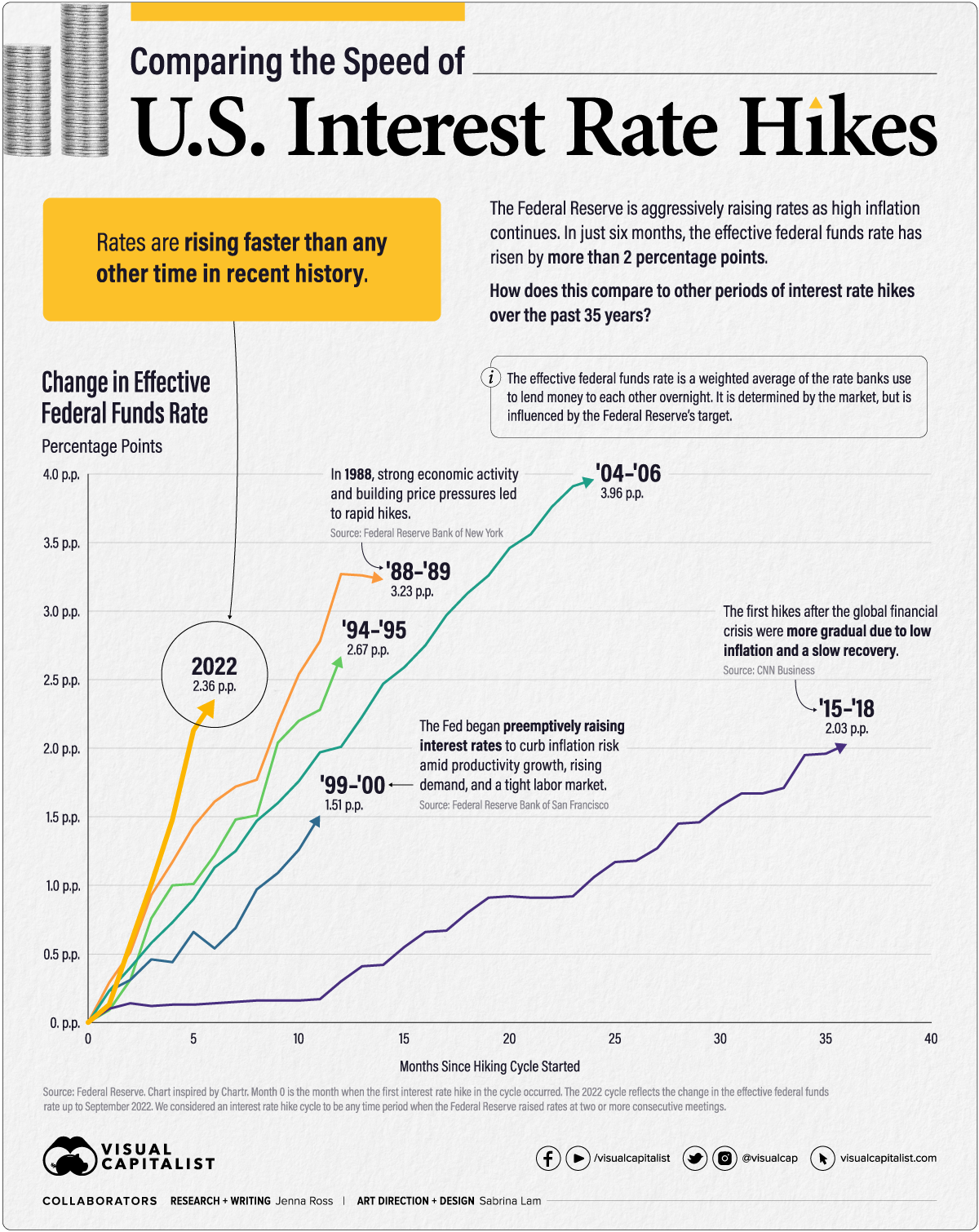

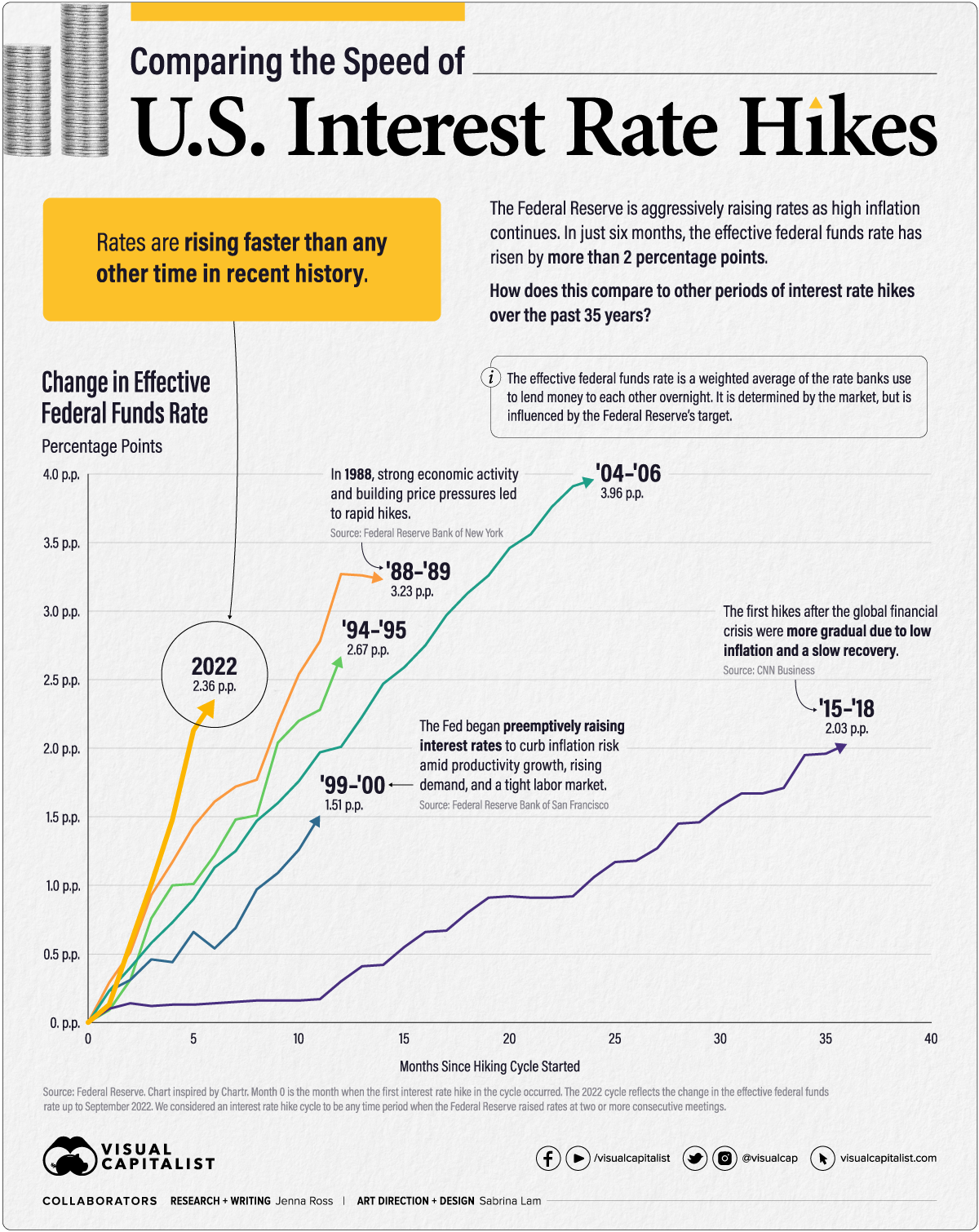

Several factors contribute to this growth: increased consumer confidence, pent-up demand following the pandemic, and sustained government support programs in specific sectors. However, persistent inflation continues to exert pressure on consumer budgets, creating a complex interplay of economic forces. (See Figure 1: Canadian Retail Sales Growth - 2023-2024)

The Bank of Canada's Mandate and Inflation Targets

The Bank of Canada's primary mandate is to maintain price stability and foster sustainable economic growth. To achieve this, the Bank sets an inflation target, currently 2%. Retail sales data provides valuable insights into consumer spending patterns, which, in turn, influence inflationary pressures.

Understanding the Bank of Canada's Role in Managing Inflation

- The Bank uses interest rate adjustments as its primary tool for managing inflation.

- Strong retail sales growth, indicating robust consumer demand, can contribute to inflationary pressures.

- Conversely, weak retail sales might signal a slowing economy and reduced inflationary risks.

- The Bank carefully analyzes various economic indicators, including retail sales, employment data, and inflation rates, to make informed decisions about interest rate adjustments. The relationship between consumer spending, as reflected in retail sales data, and inflation is complex and not always directly proportional. A rise in consumer spending can fuel inflation, prompting the Bank of Canada to increase interest rates to cool down the economy and curb price increases.

The Impact of Retail Sales Growth on Rate Hike Decisions

The Bank of Canada’s response to retail sales data significantly influences its decision-making process regarding rate hikes.

How Strong Retail Sales Influence Rate Hikes

Strong retail sales data, indicative of a robust economy and potentially rising inflation, increases the likelihood of the Bank of Canada raising interest rates. This monetary policy tightening aims to curb consumer spending and reduce inflationary pressures. However, aggressive rate hikes also carry the risk of triggering an economic slowdown or even a recession, negatively impacting consumer spending and employment. The Bank must carefully balance the need to control inflation with the risk of stifling economic growth.

How Weak Retail Sales Influence Rate Hikes

Conversely, weak retail sales data suggests a slowing economy and potentially reduced inflationary pressures. This could lead the Bank of Canada to pause or slow down its rate hike cycle. A prolonged period of weak retail sales could raise concerns about recessionary risks and the potential for job losses. In such a scenario, the Bank might prioritize supporting economic activity over solely focusing on inflation control.

Alternative Perspectives and Expert Opinions

Economists and financial analysts offer diverse viewpoints on the relationship between retail sales growth and the Bank of Canada's rate hike strategy. Some argue that strong retail sales are a clear indicator of inflationary pressures and necessitate rate hikes, while others emphasize the importance of considering other economic factors before making such decisions. This divergence in perspectives highlights the complexity of economic forecasting and the challenges faced by policymakers.

Conclusion: Retail Sales Growth and the Future of Bank of Canada Rate Hikes

In conclusion, retail sales growth plays a crucial role in shaping the Bank of Canada's approach to interest rate hikes. Strong retail sales data can signal increased inflationary pressure, prompting rate increases to cool down the economy. Conversely, weak data might lead to a pause or slowdown in the rate hike cycle. The Bank carefully weighs various economic indicators, including retail sales data, to make informed decisions about monetary policy. The future path of interest rates hinges on the evolving trend in retail sales and other key economic indicators. To make informed financial decisions, it's vital to monitor retail sales growth and follow Bank of Canada announcements closely. Stay informed about interest rate changes and their potential impact on your financial well-being.

Featured Posts

-

Singer Gwen Stefanis Support For Christianity A Source Of Outrage For Some

May 27, 2025

Singer Gwen Stefanis Support For Christianity A Source Of Outrage For Some

May 27, 2025 -

Andrey Sibiga Unian Rol Germanii V Spasenii Ukrainskikh Zhizney

May 27, 2025

Andrey Sibiga Unian Rol Germanii V Spasenii Ukrainskikh Zhizney

May 27, 2025 -

Randall And Elliot Stablers Bond Deepens In Law And Order Organized Crime Season 5 A Preview

May 27, 2025

Randall And Elliot Stablers Bond Deepens In Law And Order Organized Crime Season 5 A Preview

May 27, 2025 -

Analyzing Atlantas Extensive Cctv System Facts And Figures

May 27, 2025

Analyzing Atlantas Extensive Cctv System Facts And Figures

May 27, 2025 -

Sine Maceio Oportunidades De Emprego E Como Se Candidatar

May 27, 2025

Sine Maceio Oportunidades De Emprego E Como Se Candidatar

May 27, 2025

Latest Posts

-

Oi Kalyteres Tileoptikes Metadoseis Tis Kyriakis 4 And 5 Maioy

May 30, 2025

Oi Kalyteres Tileoptikes Metadoseis Tis Kyriakis 4 And 5 Maioy

May 30, 2025 -

Poy Na Deite Tis Tileoptikes Metadoseis Toy Pasxa Olokliromenos Odigos E Thessalia Gr

May 30, 2025

Poy Na Deite Tis Tileoptikes Metadoseis Toy Pasxa Olokliromenos Odigos E Thessalia Gr

May 30, 2025 -

Programma Tileoptikon Metadoseon Kyriakis 4 5

May 30, 2025

Programma Tileoptikon Metadoseon Kyriakis 4 5

May 30, 2025 -

Pasxalines Tileoptikes Metadoseis E Thessalia Gr Odigos Programmatos

May 30, 2025

Pasxalines Tileoptikes Metadoseis E Thessalia Gr Odigos Programmatos

May 30, 2025 -

Tileoptiko Programma Savvatoy 5 4 Ti Na Deite

May 30, 2025

Tileoptiko Programma Savvatoy 5 4 Ti Na Deite

May 30, 2025