Retail Sales Slump: Could The Bank Of Canada Reverse Course On Rates?

Table of Contents

The Severity of the Retail Sales Slump

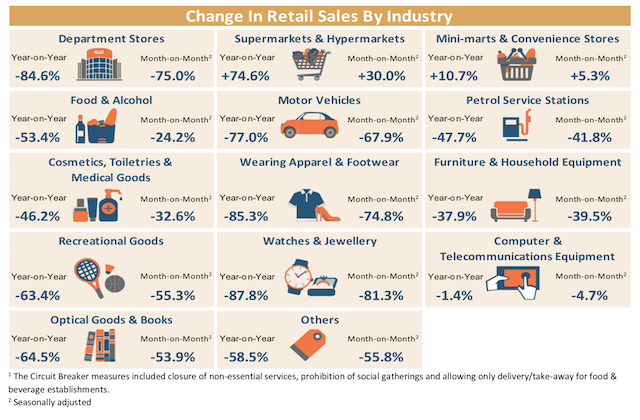

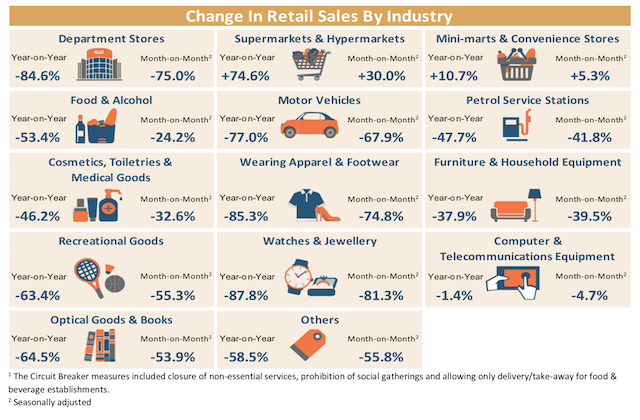

Recent data paints a concerning picture. Retail sales experienced a significant downturn in the last quarter, falling by X% (replace X with actual data). This decline isn't uniform across all sectors. The hardest-hit areas include durable goods (e.g., furniture, appliances) which are particularly sensitive to interest rate changes, and even non-durable goods are feeling the pressure. Several factors contribute to this worrying trend:

- Soaring Inflation: Persistent high inflation continues to erode purchasing power, forcing consumers to cut back on spending.

- High Interest Rates: The Bank of Canada's interest rate increases, while intended to curb inflation, have simultaneously increased borrowing costs, making it more expensive for consumers to finance purchases.

- Diminished Consumer Confidence: The combination of inflation and higher interest rates has significantly dampened consumer confidence, leading to a reluctance to spend.

- Global Economic Slowdown: The global economic climate is also impacting the Canadian economy, adding further pressure to already strained consumer spending.

This confluence of factors has resulted in a significant drop in sales of various product categories. For example, sales of new vehicles have fallen by Y% (replace Y with actual data), while sales in the clothing sector experienced a Z% decrease (replace Z with actual data). The consumer confidence index is currently at its lowest point in [time period], underscoring the gravity of the situation.

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada has been actively combating inflation through a series of interest rate hikes. Their rationale centers on bringing inflation down to their target rate of [percentage]. However, the recent retail sales slump suggests their strategy may be having unintended consequences. The Bank’s key actions include:

- Interest rate hikes of [percentage] in [time period].

- Current inflation rate at [percentage], exceeding the target rate.

The Bank of Canada utilizes various tools to influence the economy. Interest rate adjustments are their primary mechanism, with increases aiming to slow down spending and reduce inflationary pressure. Other tools, such as quantitative easing, could be employed if the situation warrants a more expansive approach.

The Link Between Retail Sales and Interest Rates

Consumer spending is the engine of economic growth, and interest rates play a crucial role in influencing this spending. Higher interest rates directly impact consumer borrowing costs, making it more expensive to finance large purchases like homes, cars, and appliances. This leads to decreased consumer demand and, consequently, a slowdown in retail sales. Conversely, lower interest rates can stimulate borrowing and spending, boosting economic activity. The relationship between interest rates and retail sales is often inverse; as interest rates rise, retail sales tend to fall, and vice-versa. Visual aids, such as charts and graphs illustrating this correlation over time, would strengthen this point.

Arguments For and Against a Rate Reversal

The current economic climate presents a complex dilemma for the Bank of Canada. Arguments for a rate reversal center on the weakening economy and the concerning decline in retail sales. The risk of a recession is a significant concern. Conversely, arguments against a reversal highlight the persistent inflation and the potential for a rate cut to reignite inflationary pressures.

- Arguments for reversal: Reduced consumer spending, risk of recession, falling inflation (if applicable).

- Arguments against reversal: Persistent core inflation, potential for increased inflation, risk of losing credibility in managing inflation.

Economists and financial analysts hold differing views, reflecting the uncertainty surrounding the optimal course of action. Some argue that maintaining current rates risks a deeper recession, while others warn against prematurely loosening monetary policy and exacerbating inflationary pressures.

Potential Economic Consequences of a Rate Reversal (or Lack Thereof)

A decision to reverse course on interest rates carries significant implications. A rate reversal could stimulate consumer spending and boost economic growth but might also reignite inflationary pressures. Maintaining the current tight monetary policy, on the other hand, risks deepening the retail sales slump and potentially triggering a recession, although it could ultimately better control inflation in the long run. The impact on the housing market, employment levels, and various sectors of the economy will vary depending on the chosen path. A comprehensive analysis of different scenarios is necessary to fully understand the potential consequences.

Conclusion: Retail Sales Slump and the Future of Bank of Canada Interest Rates

The current retail sales slump presents a significant challenge for the Canadian economy, forcing the Bank of Canada to carefully weigh the risks and benefits of its monetary policy. The connection between the slump and interest rates is undeniable, making a rate reversal a viable, yet risky, option. The potential consequences of both maintaining current rates and reversing course are significant, highlighting the complexities of navigating this economic downturn. It is crucial to stay informed about the Bank of Canada's forthcoming decisions and their impact on the retail sales slump and the Canadian economy as a whole. Regularly check the Bank of Canada's website and reputable financial news sources for the latest updates and analysis. The future trajectory of interest rates will have significant repercussions, underscoring the need for continuous monitoring of this crucial aspect of the Canadian economy.

Featured Posts

-

The Pete Rose Pardon Debate Analyzing Trumps Potential Decision And Its Impact On Mlb

Apr 29, 2025

The Pete Rose Pardon Debate Analyzing Trumps Potential Decision And Its Impact On Mlb

Apr 29, 2025 -

Identifying Promising Business Locations A Map Of The Countrys Growth Areas

Apr 29, 2025

Identifying Promising Business Locations A Map Of The Countrys Growth Areas

Apr 29, 2025 -

Eleven Years After The Louisville Tornado A Communitys Resilience

Apr 29, 2025

Eleven Years After The Louisville Tornado A Communitys Resilience

Apr 29, 2025 -

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025

Trumps Potential Pardon For Pete Rose A Look At The Mlb Betting Ban

Apr 29, 2025 -

Country Legend Willie Nelson Releases 77th Solo Album

Apr 29, 2025

Country Legend Willie Nelson Releases 77th Solo Album

Apr 29, 2025

Latest Posts

-

Family And Friends Appeal For Information On Missing Paralympian Sam Ruddock

Apr 29, 2025

Family And Friends Appeal For Information On Missing Paralympian Sam Ruddock

Apr 29, 2025 -

British Paralympian Sam Ruddock Reported Missing In Las Vegas What We Know

Apr 29, 2025

British Paralympian Sam Ruddock Reported Missing In Las Vegas What We Know

Apr 29, 2025 -

Concern Grows For Missing British Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025

Concern Grows For Missing British Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian Sam Ruddock

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian Sam Ruddock

Apr 29, 2025 -

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025

British Paralympian Sam Ruddock Missing In Las Vegas Urgent Search Underway

Apr 29, 2025