Retail Sales Surge: Is A Bank Of Canada Rate Cut Off The Table?

Table of Contents

The Unexpected Retail Sales Boom

Statistics Canada recently reported a significant jump in retail sales for [insert month and year], exceeding expectations by [insert percentage]. This unexpected surge in consumer spending represents a robust performance for the Canadian economy, raising questions about the necessity of a Bank of Canada rate cut.

Factors Contributing to the Surge

Several factors contributed to this surprising retail sales boom:

-

Increased Consumer Confidence: Following [mention recent positive economic news, e.g., strong job market, easing supply chain issues], consumer confidence has risen, leading to increased discretionary spending. Canadians feel more secure about their financial situation, resulting in higher retail purchases.

-

Pent-Up Demand: Pandemic restrictions suppressed consumer spending for an extended period. The lifting of these restrictions unleashed pent-up demand, with consumers eager to purchase goods and services delayed during lockdowns.

-

Government Stimulus Programs: While some stimulus programs have ended, the lingering effects of previous initiatives may still be contributing to increased consumer spending.

-

Strong Employment Numbers: Low unemployment rates and robust job creation have boosted disposable income, fueling consumer spending across various retail sectors.

-

Specific examples of retail growth:

- Auto sales experienced a [percentage]% increase.

- Furniture and home improvement stores saw a [percentage]% rise in sales.

- Electronics retailers reported a [percentage]% jump in revenue.

-

Temporary Factors: It's important to note that some of this growth might be temporary, driven by factors such as seasonal spending or one-time purchases related to pent-up demand. The sustainability of this retail boom requires further analysis.

The Bank of Canada's Current Stance on Interest Rates

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. Its current monetary policy focuses on controlling inflation, which has been a significant concern in recent months. The BoC's recent statements and press releases indicate a careful approach to interest rate adjustments, weighing the risks of inflation against the potential for economic slowdown.

Inflationary Pressures

Canada's inflation rate currently stands at [insert current inflation rate]%, remaining above the BoC's target range. The strong retail sales data adds another layer of complexity to the inflation picture. Increased consumer spending could fuel further price increases, making it harder for the BoC to achieve its inflation targets.

-

Contributing factors to inflation:

- Supply chain disruptions continue to impact the cost of goods.

- Energy prices remain elevated, influencing overall inflation.

- Increased demand, driven by factors mentioned above, can also contribute to inflationary pressures.

-

Impact of retail sales surge on inflation: The surge in retail sales could potentially exacerbate inflationary pressures, requiring the BoC to maintain or even increase interest rates to cool down the economy. Conversely, a temporary surge might not significantly alter the BoC's long-term strategy.

Analyzing the Implications for a Rate Cut

The strong retail sales figures present a dilemma for the Bank of Canada. The arguments for and against a rate cut are compelling and complex.

Arguments Against a Rate Cut

-

Persistent Inflation: High inflation rates argue against a rate cut, as lowering interest rates could further fuel price increases.

-

Risk of Overheating the Economy: Robust retail sales suggest a strong economy, potentially bordering on overheating. A rate cut could risk exacerbating this.

-

Potential Negative Consequences: Prematurely cutting interest rates could lead to uncontrolled inflation and long-term economic instability.

-

Supporting economic indicators: [Cite specific economic data, e.g., capacity utilization rates, wage growth].

Arguments For a Rate Cut

-

Potential for Economic Slowdown: While current data shows strength, there are concerns about future economic growth, potentially warranting a preemptive rate cut.

-

Global Economic Uncertainties: Global economic headwinds could impact the Canadian economy, making a rate cut a prudent measure to mitigate potential shocks.

-

Preventing a Sharp Downturn: A proactive rate cut could help prevent a more severe economic downturn in the future.

-

Supporting economic indicators: [Cite specific economic data, e.g., leading economic indicators, consumer sentiment].

Alternative Scenarios and Market Predictions

Several scenarios are possible regarding the Bank of Canada's next move. Some economists predict a pause in rate changes, while others anticipate either a rate cut or a further increase. Market predictions vary widely, with some financial institutions forecasting a rate cut by [date], while others expect rates to remain unchanged or even increase.

- Forecasts from reputable institutions: [Mention specific forecasts from institutions like RBC Economics, TD Economics, etc.].

Conclusion

The strong retail sales data presents a complex challenge for the Bank of Canada. The decision regarding a Bank of Canada rate cut remains uncertain, balancing the need to control inflation with the potential for an economic slowdown. The interplay between robust consumer spending, inflation, and global economic factors will significantly influence the BoC's future interest rate decisions. The situation remains fluid, and further analysis is needed to fully understand the implications of this retail sales surge. To stay informed about future developments regarding Bank of Canada interest rate decisions and the impact of interest rates on the Canadian economy, subscribe to our updates or follow reputable financial news sources for the latest Canadian retail sales forecast and analysis.

Featured Posts

-

The Future Of George Russell At Mercedes More Hints From Toto Wolff

May 26, 2025

The Future Of George Russell At Mercedes More Hints From Toto Wolff

May 26, 2025 -

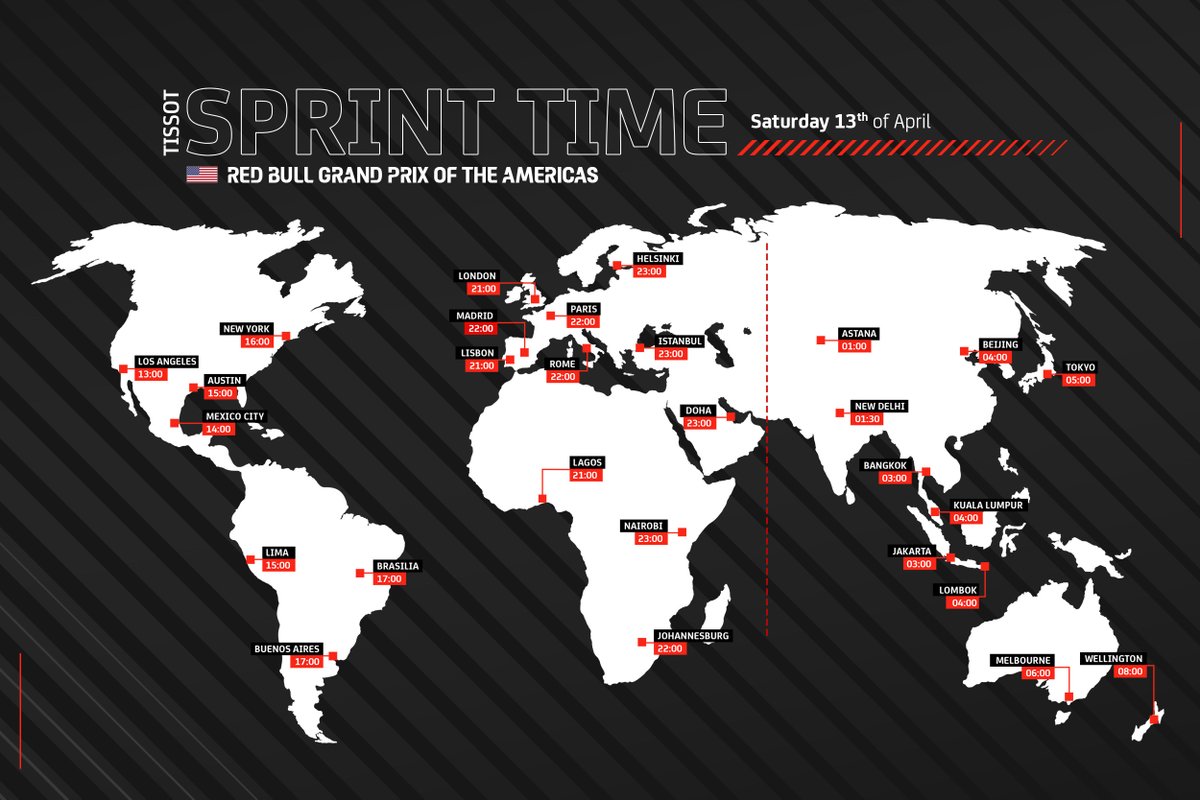

Jadwal Siaran Langsung Moto Gp Inggris Sprint Race Trans7 Alex Rins Dan Insiden Marquez

May 26, 2025

Jadwal Siaran Langsung Moto Gp Inggris Sprint Race Trans7 Alex Rins Dan Insiden Marquez

May 26, 2025 -

Kiefer Sutherland Casting News Fans React To The Latest Reports

May 26, 2025

Kiefer Sutherland Casting News Fans React To The Latest Reports

May 26, 2025 -

Jadwal Moto Gp Argentina 2025 Trans7 Semua Seri Balapan

May 26, 2025

Jadwal Moto Gp Argentina 2025 Trans7 Semua Seri Balapan

May 26, 2025 -

Jadwal Moto Gp Inggris 2025 Balapan Pekan Ini

May 26, 2025

Jadwal Moto Gp Inggris 2025 Balapan Pekan Ini

May 26, 2025

Latest Posts

-

Jennifer Lopez To Host The 2025 American Music Awards

May 27, 2025

Jennifer Lopez To Host The 2025 American Music Awards

May 27, 2025 -

Jennifer Lopezs American Music Awards Hosting Gig In Las Vegas Announced

May 27, 2025

Jennifer Lopezs American Music Awards Hosting Gig In Las Vegas Announced

May 27, 2025 -

Jennifer Lopez To Host 2025 American Music Awards On Cbs

May 27, 2025

Jennifer Lopez To Host 2025 American Music Awards On Cbs

May 27, 2025 -

Las Vegas To Host American Music Awards With Jennifer Lopez As Host

May 27, 2025

Las Vegas To Host American Music Awards With Jennifer Lopez As Host

May 27, 2025 -

American Music Awards 2024 Jennifer Lopez Confirmed As Host In Las Vegas

May 27, 2025

American Music Awards 2024 Jennifer Lopez Confirmed As Host In Las Vegas

May 27, 2025