Retailers' Warning: The Short-lived Impact Of Tariff Reductions On Prices

Table of Contents

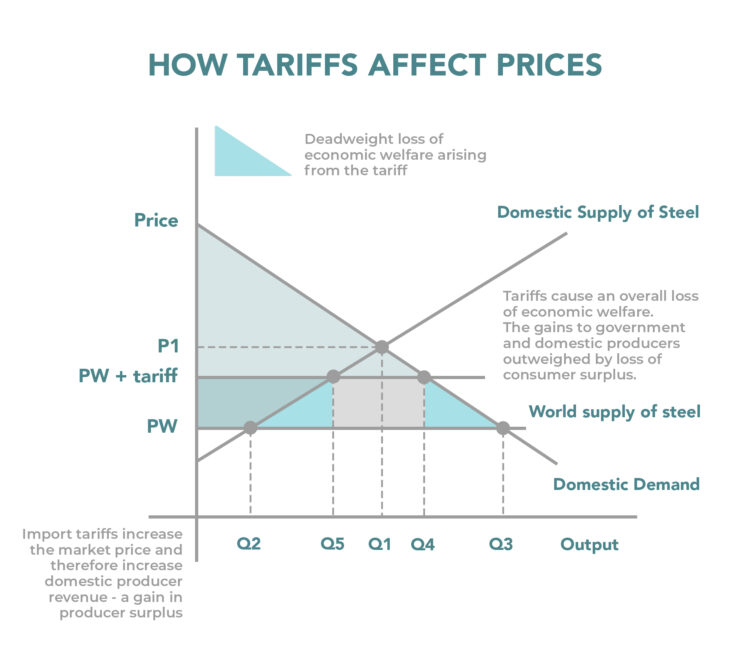

Factors Limiting the Sustained Impact of Tariff Reductions on Retail Prices

While decreased tariffs theoretically lower import costs, several obstacles prevent these savings from consistently translating into lower prices for consumers.

Supply Chain Dynamics and Bottlenecks

Existing supply chain disruptions significantly dampen the positive effects of tariff reductions. Port congestion, shipping delays, and a shortage of containers continue to plague global trade. These issues lead to increased shipping costs and longer lead times, often outweighing any savings achieved through lower tariffs.

- Increased Shipping Costs: The cost of transporting goods remains exceptionally high, absorbing a large portion of the tariff savings.

- Port Congestion: Delays at major ports lead to increased storage fees and potential spoilage of goods, driving up prices.

- Container Shortages: The ongoing lack of available shipping containers adds to the overall cost of transportation.

These supply chain bottlenecks effectively negate the intended price reductions stemming from tariff reductions, leaving retailers with little room to maneuver on pricing. The impact on import prices remains significant, regardless of tariff adjustments.

Increased Input Costs and Inflation

Even with reduced tariffs, rising inflation and increased input costs severely limit the potential for lower retail prices. The cost of raw materials, labor, and energy continues to climb, eating into any savings from lower tariffs.

- Rising Energy Prices: Increased fuel costs directly impact transportation expenses, impacting both import and domestic pricing.

- Increased Labor Costs: Wage inflation contributes to higher manufacturing and distribution costs, affecting final retail prices.

- Raw Material Shortages: Global shortages of key raw materials lead to price increases, independently of tariffs.

The combined effect of these inflationary pressures often outweighs the benefits of tariff reductions, making it challenging for retailers to pass on savings to consumers. The impact of inflation on input costs is a major hurdle to sustained price reductions.

Retailer Profit Margins and Pricing Strategies

Retailers, aiming to maintain profit margins in a competitive marketplace, may not always fully pass on the benefits of tariff reductions to consumers. Pricing strategies often prioritize profit maximization, even if it means only partially reflecting tariff reductions in retail prices.

- Maintaining Profit Margins: Retailers might absorb a portion of the tariff savings to maintain their profitability, especially during periods of economic uncertainty.

- Competitive Pricing: The competitive landscape plays a significant role. Retailers may choose to maintain competitive pricing rather than drastically reduce prices based solely on tariff changes.

- Price Elasticity: Retailers also consider how consumers will react to price changes and what they're willing to pay.

Understanding retailer margins and pricing strategies is crucial to grasping the limitations of tariff reductions in influencing consumer prices.

The Long-Term Implications: A Shifting Landscape for Retail

The short-lived impact of tariff reductions forces retailers to adopt more proactive and flexible strategies.

Strategic Adjustments by Retailers

Facing fluctuating tariffs and global market instability, retailers are increasingly focusing on diversification and risk mitigation.

- Diversification of Suppliers: Retailers are actively seeking alternative suppliers in different countries to reduce reliance on single sources.

- Nearshoring and Reshoring: Businesses are exploring options to bring manufacturing closer to home to reduce dependence on global supply chains.

- Improved Inventory Management: Effective inventory management techniques help mitigate the impact of supply chain disruptions and price fluctuations.

These sourcing strategies, aimed at strengthening global supply chains and mitigating risk, are becoming crucial for long-term business sustainability.

The Consumer's Perspective: Perceived Value vs. Actual Savings

Consumers often fail to fully grasp the intricate interplay of factors influencing retail prices. The disconnect between tariff reductions and actual price changes at the shelf often leads to dissatisfaction.

- Lack of Price Transparency: Consumers may not fully understand the complex cost structure of products and the impact of various factors on pricing.

- Perceived Value: Consumers focus on the perceived value of the product, and this is not always directly related to the reduction in tariffs.

- Expectation Management: Unrealistic expectations about immediate price drops following tariff reductions lead to consumer disappointment.

Conclusion: Understanding the Reality of Tariff Reductions on Retail Prices

In conclusion, while tariff reductions offer a theoretical opportunity to lower retail prices, their actual impact is often limited by supply chain bottlenecks, inflationary pressures, and retailer pricing strategies. Understanding the short-lived impact of tariff reductions requires acknowledging the complex interplay between global trade, domestic economics, and corporate decision-making.

To navigate the complexities of tariff reductions and retail pricing, retailers need to adopt transparent pricing practices, and consumers should focus on understanding the factors that genuinely impact the price of goods. Analyze the true cost savings from tariff reductions, considering the entire supply chain and economic context. The long-term implications for both retailers and consumers require a more nuanced understanding of global economics than simply focusing on tariff levels alone.

Featured Posts

-

Waarom Nu Gratis The New York Times Lezen Via Uw Nrc Abonnement

May 01, 2025

Waarom Nu Gratis The New York Times Lezen Via Uw Nrc Abonnement

May 01, 2025 -

Zakharova Pozdravila Ovechkina S Rekordom V N Kh L

May 01, 2025

Zakharova Pozdravila Ovechkina S Rekordom V N Kh L

May 01, 2025 -

Russias Spring Offensive Warmer Weather A Potential Game Changer

May 01, 2025

Russias Spring Offensive Warmer Weather A Potential Game Changer

May 01, 2025 -

Nigeria Railway Corporation Warri Itakpe Train Service Back In Operation

May 01, 2025

Nigeria Railway Corporation Warri Itakpe Train Service Back In Operation

May 01, 2025 -

Michael Sheens Journey Wealth Relationships And A Hollywood Farewell

May 01, 2025

Michael Sheens Journey Wealth Relationships And A Hollywood Farewell

May 01, 2025