Riot Platforms, Inc.: Early Warning Report And Irrevocable Proxy Waiver Press Release

Table of Contents

Decoding the Early Warning Report

An early warning report, as mandated by securities regulations, signals a significant change in ownership of a publicly traded company's shares. For Riot Platforms, Inc., this report triggered heightened scrutiny and market reaction.

What is an Early Warning Report?

An early warning report, also known as a Schedule 13D filing in the United States, is a disclosure required when an individual or entity acquires a certain percentage (typically 5%) or more of a company's outstanding shares. This requirement ensures transparency and allows the market to react to potentially significant changes in ownership and control. For Riot Platforms, Inc., the report highlighted a substantial shift in its shareholder landscape.

Key Information Disclosed

The specific details revealed in Riot Platforms, Inc.'s early warning report would typically include:

- The identity of the acquirer: The report would name the individual or entity that acquired the significant stake.

- The percentage of shares acquired: The precise percentage of Riot Platforms, Inc.'s outstanding shares acquired would be clearly stated.

- The acquirer's intentions: This section outlines the acquirer's plans for the acquired shares – are they looking for a long-term investment, a short-term trade, or seeking to influence corporate strategy?

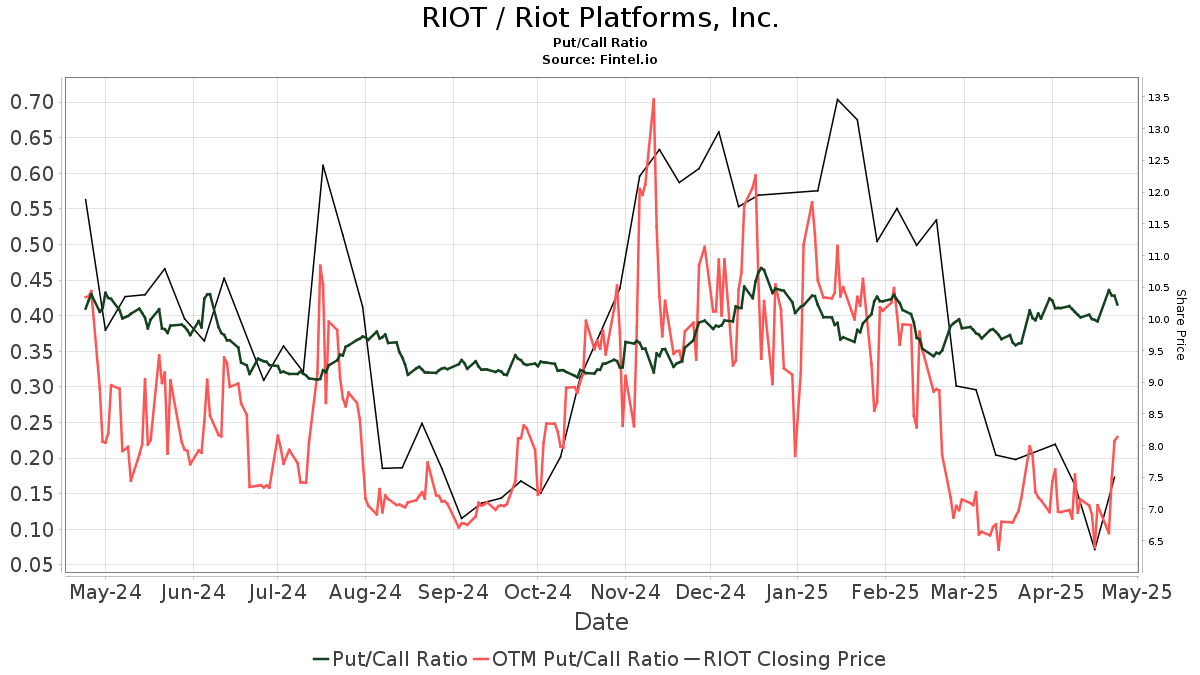

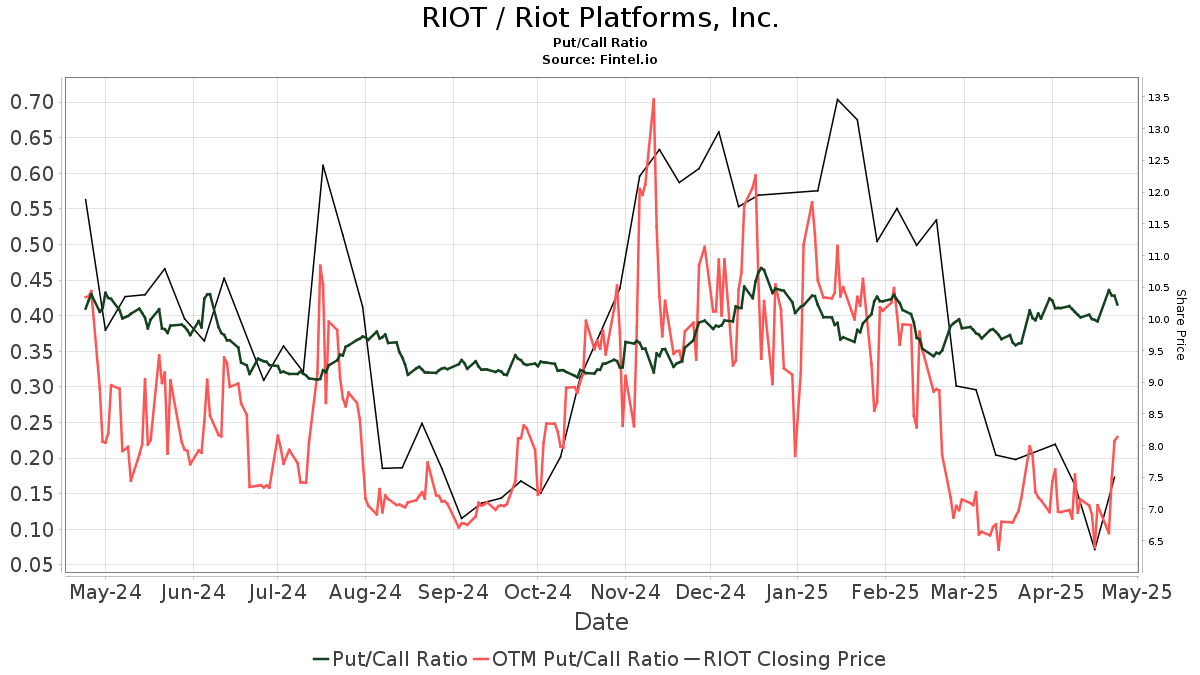

Market Impact Analysis

The release of the early warning report immediately impacts the market's perception of Riot Platforms, Inc. Several factors influence the impact:

- The identity and reputation of the acquirer: A well-respected institutional investor might have a positive impact, while a less-known entity could lead to uncertainty.

- The stated intentions of the acquirer: Aggressive intentions might cause concern, while a passive investment strategy could be seen favorably.

- The overall market sentiment: Prevailing market conditions also significantly influence the stock price reaction.

Regulatory Compliance

Riot Platforms, Inc.'s timely filing of the early warning report demonstrates compliance with securities regulations. Failure to comply could result in significant penalties and legal repercussions. The company's adherence to these rules showcases its commitment to transparency and investor relations.

Analyzing the Irrevocable Proxy Waiver

Simultaneously with the early warning report, Riot Platforms, Inc. issued an irrevocable proxy waiver. This is another crucial aspect requiring detailed analysis.

Understanding Proxy Waivers

A proxy waiver allows a shareholder to transfer their voting rights to another party. An irrevocable proxy waiver means the shareholder relinquishes their voting rights permanently, or for a specific period, usually tied to a particular shareholder meeting.

Riot Platforms, Inc.'s Specific Waiver

The specifics of Riot Platforms, Inc.'s irrevocable proxy waiver would detail:

- The shareholder granting the waiver: Which shareholder(s) relinquished their voting rights?

- The recipient of the voting rights: To whom were the voting rights transferred?

- The duration of the waiver: How long does this waiver remain effective?

Potential Implications

This waiver significantly alters the balance of power within Riot Platforms, Inc.’s shareholder structure. Potential implications include:

- Increased voting control for the recipient: The entity receiving the waiver gains significant influence over corporate decisions.

- Shifts in corporate strategy: The change in voting power might lead to adjustments in the company’s strategic direction.

- Impact on future mergers and acquisitions: Significant changes in ownership can dramatically influence potential M&A activity.

Legal and Ethical Considerations

The issuance of an irrevocable proxy waiver necessitates careful consideration of legal and ethical implications:

- Disclosure requirements: Full transparency concerning the waiver is legally mandated.

- Potential conflicts of interest: Any potential conflicts of interest must be disclosed and addressed.

- Fairness to all shareholders: The process must ensure equitable treatment of all stakeholders.

Investor Implications and Future Outlook

Navigating the implications of these two announcements requires careful analysis for investors.

Recommendations for Investors

Based on the information revealed, investors should:

- Conduct thorough due diligence: Carefully research the identity and intentions of the acquirer mentioned in the early warning report.

- Assess the long-term implications of the proxy waiver: Understand how the shift in voting power could impact the company's future.

- Diversify their portfolios: Avoid over-exposure to Riot Platforms, Inc. until the situation becomes clearer.

Potential Scenarios

Several scenarios could unfold for Riot Platforms, Inc.:

- Successful integration of new shareholder: A collaborative approach leading to positive growth.

- Increased scrutiny from regulators: Further investigation into the transactions.

- Significant changes in corporate strategy: A new direction for the company.

Risk Assessment

Investing in Riot Platforms, Inc. after these announcements carries both risks and opportunities:

- Increased volatility: Expect price fluctuations in the short term.

- Potential for significant gains: If the changes lead to positive developments.

- Potential for significant losses: If the changes have negative consequences.

Due Diligence

Thorough due diligence, including researching financial statements, analyzing market trends, and understanding regulatory compliance, is paramount before making any investment decisions.

Conclusion: Actionable Insights on Riot Platforms, Inc.'s Recent Announcements

The combined impact of the early warning report and the irrevocable proxy waiver represents a significant development for Riot Platforms, Inc. Investors must carefully analyze the disclosed information, assess the risks, and develop a well-informed investment strategy. Understanding the implications of these announcements is vital for making sound investment decisions. Staying informed about future developments concerning Riot Platforms, Inc., including further press releases and regulatory filings regarding the early warning report and irrevocable proxy waiver, is crucial. Consult with a financial advisor to tailor your investment approach to your specific risk tolerance and financial goals. Remember to conduct thorough research using reputable financial news sources before making any decisions related to Riot Platforms, Inc. Learn more by searching for "Riot Platforms, Inc. early warning report" and "Riot Platforms, Inc. irrevocable proxy waiver" online.

Featured Posts

-

Fortnite Never Before Seen Skins And Their Potential Return

May 02, 2025

Fortnite Never Before Seen Skins And Their Potential Return

May 02, 2025 -

Nws Tulsa Issues Warning Near Blizzard Conditions Developing

May 02, 2025

Nws Tulsa Issues Warning Near Blizzard Conditions Developing

May 02, 2025 -

Fortnite Community Furious Over Reversed Music

May 02, 2025

Fortnite Community Furious Over Reversed Music

May 02, 2025 -

Mini Cameras Chaveiro Guia Completo De Compra E Uso

May 02, 2025

Mini Cameras Chaveiro Guia Completo De Compra E Uso

May 02, 2025 -

From Crabbe To Harry Potter Actors Stunning Transformation

May 02, 2025

From Crabbe To Harry Potter Actors Stunning Transformation

May 02, 2025