Riot Platforms (NASDAQ: RIOT): 52-Week Low And Future Outlook

Table of Contents

Analyzing Riot Platforms' Recent Performance and the 52-Week Low

Riot Platforms' current 52-week low reflects a confluence of factors impacting the Bitcoin mining sector as a whole. Let's break down the key contributors:

Impact of the Bear Market

The cryptocurrency market experienced a significant downturn in 2022 and into 2023, significantly impacting Bitcoin's price. This bear market had a direct and substantial effect on Riot Platforms' stock price and profitability.

- Decreased Bitcoin price: The price of Bitcoin, the primary product of Riot's mining operations, plummeted, directly reducing the value of its mined Bitcoin holdings and overall revenue.

- Reduced mining profitability: Lower Bitcoin prices coupled with relatively stable operational costs resulted in decreased profitability for Riot Platforms and the entire Bitcoin mining industry.

- Negative investor sentiment: The general bearish sentiment in the crypto market led to decreased investor confidence and a sell-off in mining stocks like RIOT.

For example, if Bitcoin's price dropped by 50%, Riot's revenue would likely decrease proportionally, impacting its profitability and stock valuation. Specific data on Riot's revenue decline during this period should be referenced from official company reports.

Rising Energy Costs and Their Influence

Increased energy costs significantly affect the profitability of Bitcoin mining operations, including Riot Platforms. The cost of electricity is a major expense, and fluctuations in energy prices can dramatically alter a miner's profit margins.

- Electricity price fluctuations: Volatile energy prices, particularly in regions with high electricity consumption like those where Riot operates, directly impact operational expenses.

- Hedging strategies: Riot Platforms, like other miners, employs various strategies to mitigate risks associated with energy price volatility, such as negotiating fixed-price contracts. The effectiveness of these strategies is a key factor influencing profitability.

- Impact on mining efficiency: High energy costs necessitate increased efficiency in mining operations to maintain profitability. This often involves upgrading hardware and optimizing operational processes.

Data on Riot's energy cost per kWh and comparisons to previous years are crucial for assessing the impact of these price fluctuations on its financial performance.

Operational Efficiency and Hashrate

Riot Platforms' operational efficiency and hashrate (a measure of its computing power) are crucial indicators of its future performance. Improvements in these areas can offset the negative impacts of lower Bitcoin prices and higher energy costs.

- New mining facility developments: The expansion of mining facilities increases Riot's overall mining capacity and its hashrate, potentially improving profitability.

- Technological upgrades: Investing in more energy-efficient mining equipment and employing advanced mining techniques enhance operational efficiency.

- Hashrate growth: A growing hashrate signifies increased mining capacity and potential for higher Bitcoin production.

Comparing Riot's hashrate to its competitors and examining its efficiency metrics will provide a clearer picture of its operational performance and competitive standing within the Bitcoin mining sector.

Factors Potentially Influencing Riot Platforms' Future Outlook

While the present situation presents challenges, several factors could positively influence Riot Platforms' future outlook.

Bitcoin Price Projections and Their Impact

The future price of Bitcoin is the most significant factor influencing Riot Platforms' profitability. Any substantial price increase would dramatically improve its financial position.

- Bitcoin price predictions from analysts: Analyzing various price predictions from reputable analysts helps assess the potential range of Bitcoin's future price.

- Potential catalysts for price increase: Events like increased institutional adoption, regulatory clarity, and technological advancements could drive Bitcoin price appreciation.

- Impact on revenue: A higher Bitcoin price directly translates to higher revenue for Riot Platforms, leading to improved profitability and stock valuation.

Data on various price prediction ranges and historical Bitcoin price volatility is essential to understanding the potential impact on Riot's financial performance.

Expansion Plans and Future Mining Capacity

Riot Platforms' plans for future expansion and increased mining capacity are critical factors affecting its long-term growth prospects.

- New facility announcements: Announcements regarding new mining facilities and expansions indicate the company's commitment to growth and increased Bitcoin production.

- Geographic diversification strategies: Diversifying mining operations geographically can mitigate risks associated with regional energy price fluctuations or regulatory changes.

- Long-term growth plans: Riot's long-term strategic plans for expansion and technological advancements offer insights into its growth trajectory.

Data on projected hashrate increases and timelines for facility expansions provide concrete evidence of Riot's expansion efforts.

Regulatory Landscape and its Potential Influence

The regulatory environment surrounding cryptocurrency mining significantly impacts Riot Platforms' operations and future prospects.

- US regulatory developments: The evolving regulatory landscape in the US, concerning both cryptocurrency and environmental regulations, will influence Riot's operational costs and investment decisions.

- Environmental concerns: Growing concerns about the environmental impact of Bitcoin mining may lead to stricter regulations impacting energy consumption and potentially operational costs.

- Potential policy changes: Changes in regulatory policies, both domestically and internationally, can affect the profitability and viability of Bitcoin mining operations.

Assessing the Risk and Reward of Investing in Riot Platforms at its 52-Week Low

Investing in Riot Platforms at its 52-week low presents both significant risks and potential rewards.

Risk Factors

- Volatility in the crypto market: The cryptocurrency market is inherently volatile, and Bitcoin's price can experience sharp fluctuations, impacting Riot's profitability and stock price.

- Energy price fluctuations: High and volatile energy costs can significantly reduce Riot's profit margins, making it vulnerable to economic downturns.

- Regulatory uncertainty: Changes in regulatory policies could negatively impact Riot's operations and profitability.

Reward Potential

- Significant returns if the Bitcoin price rises: A substantial increase in Bitcoin's price would significantly boost Riot Platforms' profitability and stock value, potentially leading to substantial returns for investors.

- Successful expansion of mining operations: Successful execution of Riot's expansion plans would increase its mining capacity and hashrate, enhancing its long-term growth prospects.

Conclusion: Is Riot Platforms (NASDAQ: RIOT) a Buy at its 52-Week Low?

Riot Platforms' current 52-week low presents a complex investment scenario with significant risks and potential rewards. While the bear market, rising energy costs, and regulatory uncertainty pose substantial challenges, the potential for Bitcoin price appreciation and Riot's expansion plans offer a counterbalance. The ultimate decision rests on individual risk tolerance and a thorough understanding of the factors discussed in this article. Therefore, before investing in Riot Platforms (NASDAQ: RIOT) or any cryptocurrency-related asset, conduct your own thorough due diligence and carefully consider your risk tolerance. Remember, investing in RIOT stock requires careful consideration of the inherent volatility of the cryptocurrency market.

Featured Posts

-

Tory Infighting Chairmans Clash With Reform Uk Exposes Deep Divisions

May 03, 2025

Tory Infighting Chairmans Clash With Reform Uk Exposes Deep Divisions

May 03, 2025 -

Poppys Legacy A Familys Moving Tribute To A Devoted Manchester United Fan

May 03, 2025

Poppys Legacy A Familys Moving Tribute To A Devoted Manchester United Fan

May 03, 2025 -

White House Cocaine Investigation Concludes Secret Service Report

May 03, 2025

White House Cocaine Investigation Concludes Secret Service Report

May 03, 2025 -

Abu Jinapor Npps 2024 Election Defeat A Difficult Reality

May 03, 2025

Abu Jinapor Npps 2024 Election Defeat A Difficult Reality

May 03, 2025 -

Sfynt Astwl Alhryt Tterd Lhjwm Israyyly Ksr Alhsar En Ghzt

May 03, 2025

Sfynt Astwl Alhryt Tterd Lhjwm Israyyly Ksr Alhsar En Ghzt

May 03, 2025

Latest Posts

-

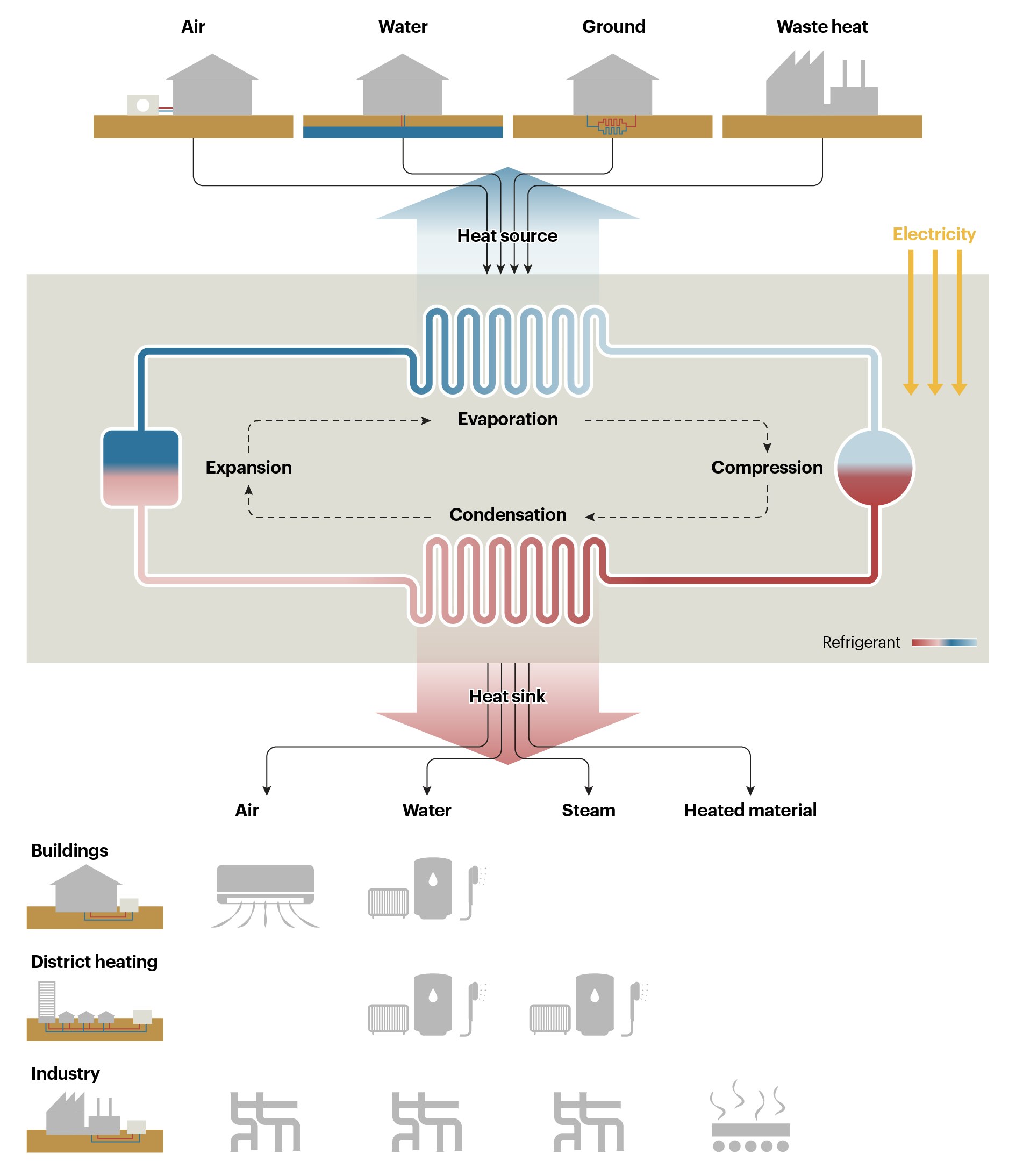

Innomotics Eneco And Johnson Controls Launch Of Europes Largest Heat Pump System

May 04, 2025

Innomotics Eneco And Johnson Controls Launch Of Europes Largest Heat Pump System

May 04, 2025 -

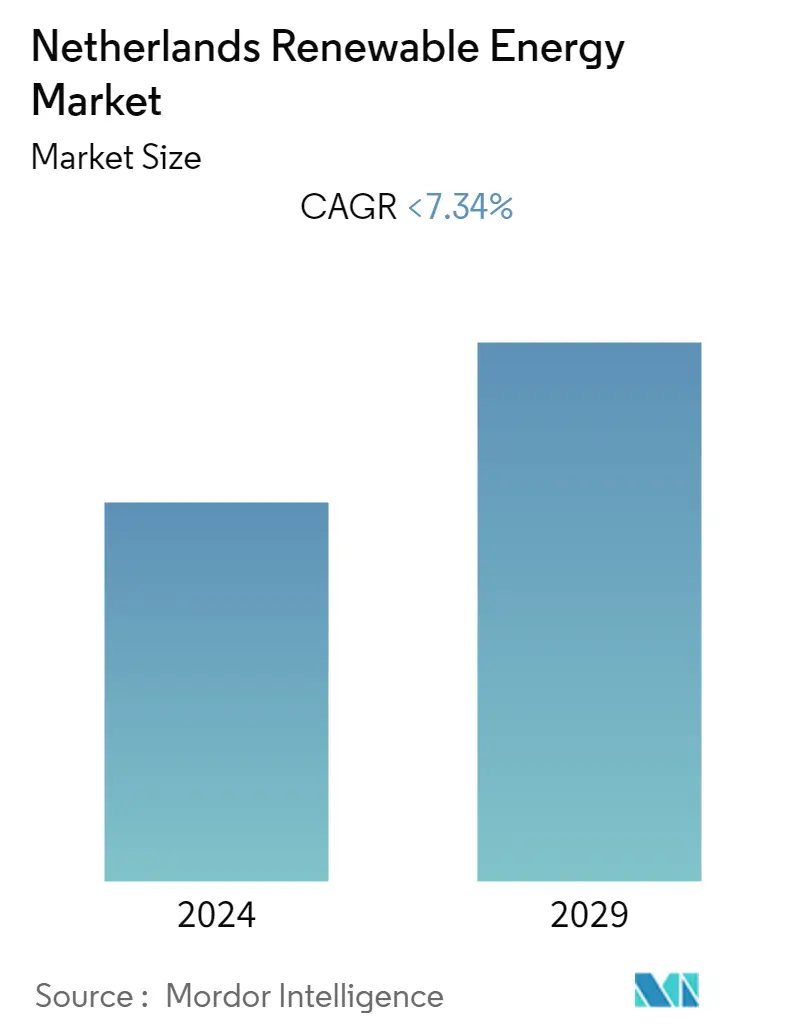

Netherlands Renewable Energy Push Utrechts Giant Heat Pump

May 04, 2025

Netherlands Renewable Energy Push Utrechts Giant Heat Pump

May 04, 2025 -

Utrechts Wastewater Plant Unveils Groundbreaking Heat Pump Technology

May 04, 2025

Utrechts Wastewater Plant Unveils Groundbreaking Heat Pump Technology

May 04, 2025 -

Parc De Batteries D Eneco A Au Roeulx Une Inauguration Importante Pour L Energie Verte En Belgique

May 04, 2025

Parc De Batteries D Eneco A Au Roeulx Une Inauguration Importante Pour L Energie Verte En Belgique

May 04, 2025 -

Le Nouveau Parc De Batteries D Eneco A Au Roeulx Un Projet Majeur Pour La Belgique

May 04, 2025

Le Nouveau Parc De Batteries D Eneco A Au Roeulx Un Projet Majeur Pour La Belgique

May 04, 2025