Riot Platforms (RIOT) Stock Analysis: Current Trends And Future Outlook

Table of Contents

Current Market Position of Riot Platforms (RIOT)

Mining Capacity and Hashrate

Riot Platforms' success hinges on its Bitcoin mining capacity and hashrate. The company's hashrate, a measure of its computing power dedicated to mining Bitcoin, directly influences its ability to earn Bitcoin rewards. As of [Insert most recent data available], Riot boasts a hashrate of [Insert current hashrate] PH/s, placing it among the [Insert ranking] largest Bitcoin miners globally.

- Comparison to other major Bitcoin miners: Riot competes with companies like Marathon Digital Holdings and Core Scientific, constantly striving to increase its hashrate and market share.

- Recent capacity expansions: Riot has recently expanded its mining operations by [Insert details about recent expansions, e.g., adding X number of mining rigs].

- Planned expansions: Future expansion plans include [Insert details about planned expansions, including locations and timelines]. This aggressive expansion strategy aims to solidify Riot's position in the Bitcoin mining landscape. These plans directly impact Riot Platforms mining operations and its ability to capitalize on Bitcoin’s price.

Financial Performance and Revenue

Analyzing Riot's financial statements reveals key insights into its operational efficiency and profitability. Recent quarterly and annual reports showcase [Insert details about recent financial performance, e.g., revenue growth, profitability, and operational efficiency].

- Key financial metrics (revenue, net income, operating margin): [Insert data points for key metrics, referencing the source of the data]. Analyzing trends in these metrics reveals the company's financial health and growth trajectory.

- Analysis of trends: [Provide analysis of trends observed in the financial data, highlighting positive and negative aspects].

- Comparison to previous periods: Comparing current performance to previous periods helps identify growth patterns and potential challenges. The correlation between Bitcoin mining profitability and RIOT financial statements is critical to understanding the company's overall performance.

Regulatory Landscape and Environmental Concerns

The regulatory environment significantly impacts Bitcoin mining operations. Governments worldwide are increasingly scrutinizing the environmental impact of Bitcoin mining and enacting regulations to address concerns.

- Regulatory changes affecting Bitcoin mining: [Discuss relevant regulatory changes, such as those related to energy consumption or carbon emissions]. These regulations directly influence the operational costs and profitability of Riot Platforms.

- Riot's environmental initiatives (e.g., renewable energy usage): Riot is actively pursuing sustainable mining practices, including [Insert details about Riot's environmental initiatives, such as renewable energy usage]. This commitment is crucial for navigating the evolving regulatory landscape and maintaining a positive public image.

- Potential future regulations: [Discuss potential future regulations and their potential impact on Riot Platforms]. Understanding the regulatory landscape is essential for accurately assessing the risks and opportunities associated with investing in Riot Platforms (RIOT) stock.

Future Outlook and Growth Potential for Riot Platforms (RIOT)

Expansion Plans and Technological Advancements

Riot Platforms' future growth relies heavily on its expansion plans and its adoption of technological advancements in Bitcoin mining hardware.

- Planned mining facility expansions: Further expansions are planned to increase mining capacity, enabling Riot to generate more Bitcoin and increase its revenue.

- New generation mining equipment adoption: Investing in next-generation mining hardware enhances efficiency and reduces operational costs.

- Technological innovations in Bitcoin mining: Staying ahead of the curve in technological advancements is crucial for maintaining a competitive edge. These technological innovations directly impact Riot Platforms expansion plans and overall profitability.

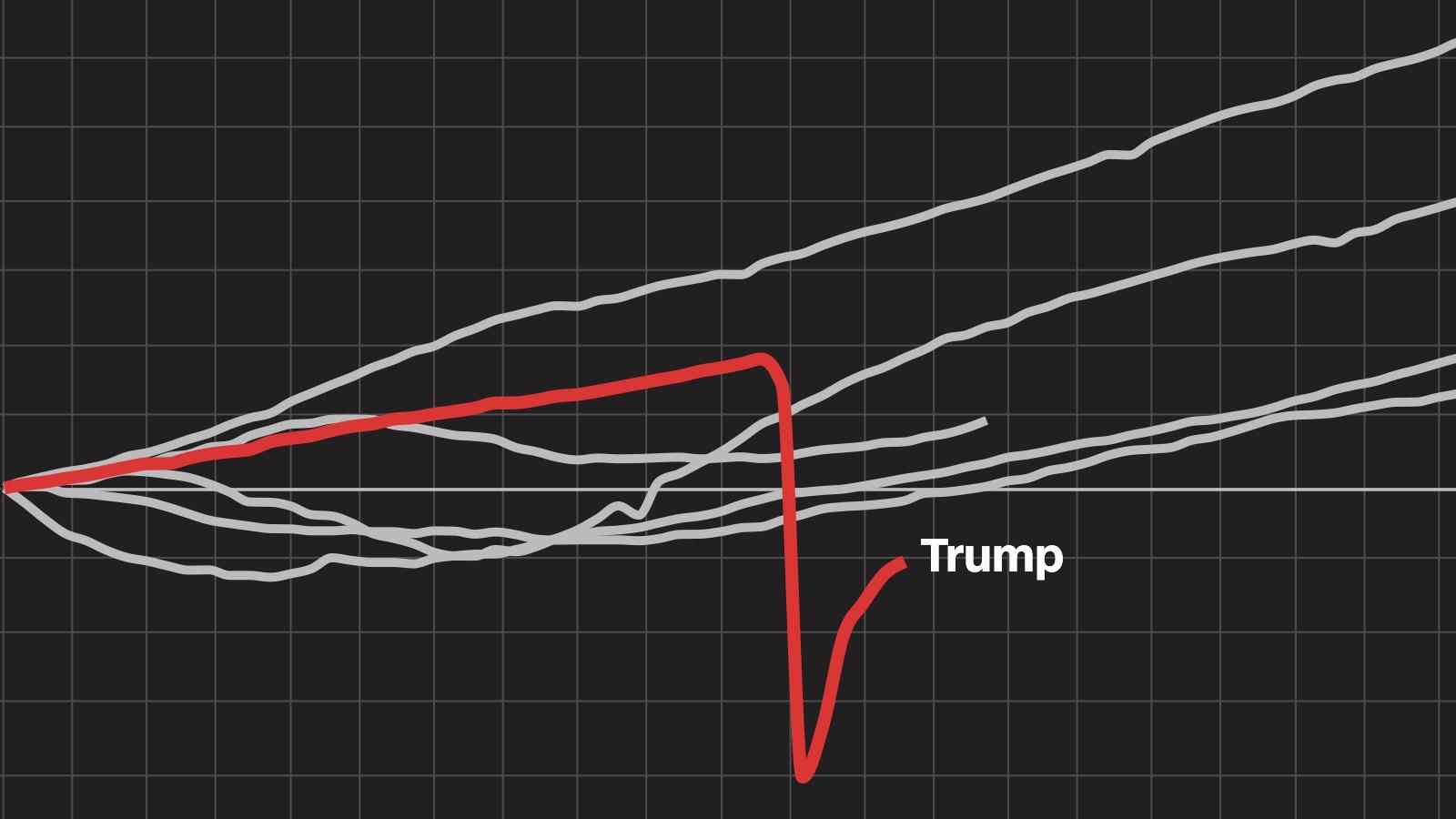

Bitcoin Price Volatility and its Impact

The price of Bitcoin is the most significant factor influencing Riot Platforms' profitability and stock price.

- Correlation between Bitcoin price and RIOT stock price: [Discuss the strong correlation between Bitcoin price and RIOT stock price].

- Strategies for mitigating price volatility risks: Riot employs strategies to mitigate the risks associated with Bitcoin price volatility, such as [Insert examples of risk mitigation strategies].

- Potential scenarios for Bitcoin price movement: Analyzing different scenarios for Bitcoin price movement provides insight into Riot's potential future performance. The impact of Bitcoin price prediction on RIOT stock price forecast is a key factor for investors.

Competition and Market Share

The Bitcoin mining industry is competitive, with several major players vying for market share.

- Key competitors: Riot faces competition from [List key competitors].

- Competitive advantages of Riot Platforms: Riot's competitive advantages include [List Riot's competitive advantages, e.g., low-cost energy, efficient operations, strategic partnerships].

- Market share analysis: [Analyze Riot's current market share and its potential for growth]. Maintaining and growing market share is crucial for Riot Platforms competitive advantage in the long term.

Conclusion

Investing in Riot Platforms (RIOT) stock presents both significant opportunities and considerable risks. The company's success is closely tied to Bitcoin's price, regulatory changes, and technological advancements in Bitcoin mining. While expansion plans and a focus on sustainable practices offer potential for growth, the inherent volatility of the cryptocurrency market remains a crucial factor. Thorough research and a careful consideration of current trends and future outlooks are essential before investing in RIOT. Before making any investment decisions regarding Riot Platforms (RIOT) stock, conduct your own thorough due diligence and consider consulting a financial advisor to create a sound RIOT stock investment strategy.

Featured Posts

-

Sydney Harbour And Beyond Understanding The Rise Of Chinese Maritime Activity

May 03, 2025

Sydney Harbour And Beyond Understanding The Rise Of Chinese Maritime Activity

May 03, 2025 -

X 300 5 6 9

May 03, 2025

X 300 5 6 9

May 03, 2025 -

The Influence Of Tariffs On Brookfields Manufacturing Plans In The Us

May 03, 2025

The Influence Of Tariffs On Brookfields Manufacturing Plans In The Us

May 03, 2025 -

Analyzing The Biden Presidency Its Impact On The Us Economy

May 03, 2025

Analyzing The Biden Presidency Its Impact On The Us Economy

May 03, 2025 -

Un Echange Muscle Sardou Reproche A Macron

May 03, 2025

Un Echange Muscle Sardou Reproche A Macron

May 03, 2025

Latest Posts

-

Au Roeulx Eneco Lance Son Important Parc De Batteries

May 04, 2025

Au Roeulx Eneco Lance Son Important Parc De Batteries

May 04, 2025 -

Eneco Inaugure A Au Roeulx Le Plus Grand Parc De Batteries De Belgique

May 04, 2025

Eneco Inaugure A Au Roeulx Le Plus Grand Parc De Batteries De Belgique

May 04, 2025 -

Testing Dynamic Pricing Dutch Utilities And Solar Energy Peak Production

May 04, 2025

Testing Dynamic Pricing Dutch Utilities And Solar Energy Peak Production

May 04, 2025 -

Dutch Energy Providers Explore Dynamic Tariff Models Based On Solar Production

May 04, 2025

Dutch Energy Providers Explore Dynamic Tariff Models Based On Solar Production

May 04, 2025 -

Lower Electricity Tariffs Dutch Utilities Test Solar Peak Pricing

May 04, 2025

Lower Electricity Tariffs Dutch Utilities Test Solar Peak Pricing

May 04, 2025