Riot Platforms Stock Near 52-Week Low: What's Happening?

Table of Contents

Factors Contributing to Riot Platforms' Stock Price Decline

Several interconnected factors have contributed to the recent decline in Riot Platforms stock price, pushing it dangerously close to its 52-week low.

The Crypto Winter's Impact

The ongoing bear market in cryptocurrencies has significantly impacted Riot Platforms' performance. The reduced value of Bitcoin, the primary asset mined by Riot, directly translates into lower revenue and profitability. There's a strong correlation between Bitcoin's price and Riot Platforms' stock performance; when Bitcoin falls, so does Riot's stock.

- Reduced Bitcoin mining profitability: Lower Bitcoin prices mean miners receive less for each Bitcoin mined, squeezing profit margins.

- Lower Bitcoin price = lower revenue: Riot's revenue is directly tied to the amount of Bitcoin mined and its market value.

- Investor sentiment negatively impacted: The bear market has created a general sense of pessimism in the cryptocurrency market, leading to decreased investor confidence in Bitcoin mining stocks like Riot Platforms.

Increased Competition in the Bitcoin Mining Sector

The Bitcoin mining sector is becoming increasingly competitive. The number of companies vying for a piece of the Bitcoin mining pie has grown substantially, leading to increased competition for hash rate—the computational power used to mine Bitcoin. This competition intensifies the pressure on Riot Platforms' market share and profitability.

- Increased mining difficulty: As more miners join the network, the difficulty of mining Bitcoin increases, requiring more energy and resources to generate the same amount of Bitcoin.

- Competition for energy resources: Bitcoin mining is energy-intensive, creating competition for affordable and reliable energy sources amongst mining companies.

- Price wars among miners: In a competitive landscape, some miners might engage in price wars, potentially impacting overall profitability for the industry, including Riot Platforms.

Energy Costs and Regulatory Concerns

Fluctuating energy prices and regulatory concerns pose significant challenges for Riot Platforms. High energy costs directly impact the profitability of Bitcoin mining, while regulatory uncertainty can deter investment and hinder operations.

- Rising electricity prices: Electricity is a major operational expense for Bitcoin miners, and increases in energy prices can significantly reduce profit margins.

- Environmental regulations: Growing concerns about the environmental impact of Bitcoin mining are leading to stricter regulations in some regions, potentially increasing operational costs and limiting expansion opportunities.

- Government policies on cryptocurrency mining: Government policies and regulations regarding cryptocurrency mining can significantly influence the operations and profitability of companies like Riot Platforms.

Analyzing Riot Platforms' Financial Performance

Understanding Riot Platforms' financial performance is crucial to assessing its current situation and future prospects.

Recent Financial Reports and Key Metrics

Analyzing Riot Platforms' recent financial reports reveals key insights into its performance. Examining key performance indicators (KPIs) such as revenue, profitability, and production metrics is essential for gauging its financial health. Comparing these metrics to previous quarters and years helps identify trends and potential areas of concern.

- Revenue growth (or decline): Analyzing revenue trends reveals the impact of Bitcoin price fluctuations and operational efficiency.

- Mining profitability margins: Examining profit margins indicates the effectiveness of Riot Platforms' mining operations and cost management strategies.

- Hash rate performance: Tracking hash rate demonstrates Riot's mining capacity and competitiveness within the market.

Debt Levels and Capital Structure

Riot Platforms' debt levels and capital structure play a vital role in its financial stability. High debt levels can increase financial risk, while a strong capital structure can enhance resilience during challenging market conditions.

- Total debt: The total amount of debt held by Riot Platforms impacts its financial flexibility and ability to weather economic downturns.

- Debt-to-equity ratio: This ratio indicates the proportion of Riot's financing that comes from debt versus equity, providing insights into its financial leverage.

- Credit rating: Credit ratings from agencies like Moody's or S&P offer an independent assessment of Riot Platforms' creditworthiness and financial risk.

Future Outlook and Potential for Recovery

While the current situation is challenging, there's potential for Riot Platforms to recover and regain investor confidence.

Bitcoin's Potential for Growth

The future price of Bitcoin will significantly impact Riot Platforms' prospects. A bullish Bitcoin market could dramatically improve Riot's profitability and stock price.

- Potential Bitcoin price increase scenarios: Analyzing various market scenarios and their potential impact on Bitcoin's price is crucial for assessing Riot's future performance.

- Impact on mining profitability: A rise in Bitcoin's price directly translates into increased profitability for Bitcoin miners like Riot Platforms.

- Investor sentiment shift: A sustained increase in Bitcoin's price could significantly improve investor sentiment towards Bitcoin mining stocks.

Riot Platforms' Strategic Initiatives

Riot Platforms' ability to adapt and implement effective strategies will be key to its future success. This includes enhancing operational efficiency, exploring new technologies, and managing risks effectively.

- Expansion plans: Riot's expansion plans, including acquiring new mining facilities or upgrading existing ones, can significantly increase its mining capacity and market share.

- Energy efficiency improvements: Implementing energy-efficient technologies can help reduce operational costs and enhance profitability.

- New technology adoption: Adopting advanced mining technologies can increase efficiency and competitiveness within the Bitcoin mining sector.

Conclusion

The decline in Riot Platforms stock, nearing its 52-week low, is a result of several interconnected factors including the crypto winter's impact on Bitcoin's price, increased competition within the Bitcoin mining sector, rising energy costs, and regulatory uncertainty. Analyzing Riot Platforms' financial performance, including its debt levels and key metrics, is vital for understanding its current situation. While challenges remain, the potential for Bitcoin price growth and Riot Platforms' strategic initiatives offer some hope for future recovery. While the current situation surrounding Riot Platforms stock near its 52-week low presents challenges, understanding the underlying factors and monitoring future developments is crucial for informed investment decisions. Stay updated on Riot Platforms stock and the broader cryptocurrency market for a comprehensive understanding of its potential future trajectory.

Featured Posts

-

Poleodomiki Diafthora Mia Analysi Kai Dromoi Gia Tin Anasygkrotisi Toy Kratoys

May 03, 2025

Poleodomiki Diafthora Mia Analysi Kai Dromoi Gia Tin Anasygkrotisi Toy Kratoys

May 03, 2025 -

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi

May 03, 2025

Reactions Des Partis Algeriens Pt Ffs Rcd Jil Jadid A La Reforme De La Loi

May 03, 2025 -

Report Play Station Showcase To Announce New Ps 5 Games Soon

May 03, 2025

Report Play Station Showcase To Announce New Ps 5 Games Soon

May 03, 2025 -

Addressing Stock Market Valuation Concerns Insights From Bof A

May 03, 2025

Addressing Stock Market Valuation Concerns Insights From Bof A

May 03, 2025 -

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 03, 2025

Fortnite Update V34 30 Sabrina Carpenter Collaboration Gameplay Changes And Downtime

May 03, 2025

Latest Posts

-

Lion Storage Completes Financing For 1 4 G Wh Battery Energy Storage System In The Netherlands

May 04, 2025

Lion Storage Completes Financing For 1 4 G Wh Battery Energy Storage System In The Netherlands

May 04, 2025 -

Sustainable Rail Transport The Rise Of Wind Powered Trains

May 04, 2025

Sustainable Rail Transport The Rise Of Wind Powered Trains

May 04, 2025 -

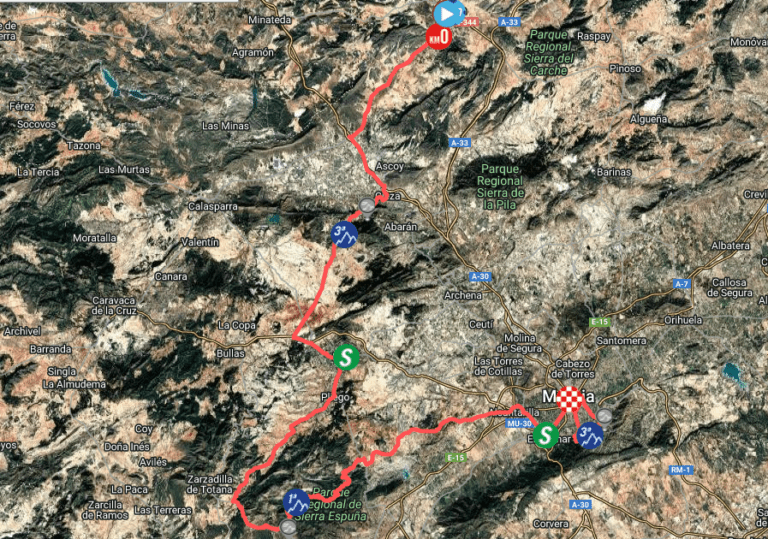

Triunfo De Fabio Christen En La 45 Vuelta A Murcia

May 04, 2025

Triunfo De Fabio Christen En La 45 Vuelta A Murcia

May 04, 2025 -

Why The Cost Of Offshore Wind Power Is Pushing Energy Companies Away

May 04, 2025

Why The Cost Of Offshore Wind Power Is Pushing Energy Companies Away

May 04, 2025 -

Green Trains Exploring The Potential Of Wind Power For Railways

May 04, 2025

Green Trains Exploring The Potential Of Wind Power For Railways

May 04, 2025